Hirose Financial Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Hirose Financial Account

- Safety and Security

- Trading Platforms and Tools

- Deposits and Withdrawals

- Super Signal Package

- Affiliate Program

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Hirose Financial

- Employee Overview: Working for Hirose Financial

- Pros and Cons

- In Conclusion

Hirose Financial is a trusted and well-regulated Forex broker recognized for its competitive spreads and flexible leverage. The broker offers a straightforward trading environment with zero-commission accounts, responsive customer support, and reliable platforms, making it a solid choice for both new and experienced traders.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Overview

Hirose Financial stands out as a reliable Forex broker with a strong track record since 2004. Listed on the Tokyo Stock Exchange, it has earned the trust of over 600,000 traders worldwide. Transparent operations, top-tier regulation, competitive spreads, and award-winning customer satisfaction highlight its commitment to safe and client-focused trading.

Frequently Asked Questions

Why is Hirose Financial considered a safe Forex broker?

Hirose Financial is regulated by 🇯🇵 FSA, 🇬🇧 FCA, and 🇲🇾 LFSA, ensuring strict compliance with international standards. As a listed company on the Tokyo Stock Exchange, it adheres to transparent reporting and external audits. These measures provide traders with confidence in the broker’s financial integrity and operational safety.

What makes Hirose Financial’s trading conditions competitive?

Hirose Financial partners with 20 leading liquidity providers to offer consistently low spreads and competitive pricing. This strong network ensures reliable execution even during high market volatility. Combined with responsive multilingual customer support and a customer-first approach, traders benefit from a secure and efficient trading environment.

Our Insights

Hirose Financial is a globally recognized Forex broker with proven credibility and transparency. Backed by top-tier regulations, competitive spreads, and award-winning customer service, it delivers a dependable trading experience. Its long-standing history and social initiatives further underline its reputation as a broker that values both clients and communities.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Fees, Spreads, and Commissions

Industry watchers note that Hirose Financial offers competitive pricing for forex trading. They typically charge no commission on standard accounts, and spread rates start from around 0.8 pips on major pairs. In certain jurisdictions, they also provide ECN/RAW options with tighter spreads plus commission per lot.

| Account Type | Commission | Typical Spread (EUR/USD) | Notes |

| Standard | None | From ~ 0.8 pips | Spread includes broker markup |

| ECN / RAW (in select regions) | Per lot | From ~ 0.1 pips | Market spreads + commission |

| Withdrawal Fees | None | N/A | No fees charged by broker |

| Inactivity | None | N/A | No monthly inactivity charge |

Frequently Asked Questions

Does Hirose charge commissions on trades?

On most standard accounts, Hirose does not charge separate commissions; costs are built into the spreads. For ECN or RAW-style accounts in some regions, traders may pay a commission per lot in exchange for tighter spreads.

What are typical spreads with Hirose?

Spreads on major pairs like EUR/USD usually start at 0.8 pips under normal market conditions. In ECN/RAW accounts, spreads can fall as low as 0.1 pips (with a commission applied).

Our Insights

Hirose Financial’s fee structure balances clarity and competitiveness. Standard accounts avoid commission fees, and the option of ECN/RAW accounts gives active traders access to tighter spreads when desired. Overall, its approach fits both casual and higher-volume traders.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Minimum Deposit and Account Types

Observers note that Hirose Financial maintains a low entry barrier with a modest minimum deposit requirement. The typical starting deposit is around 20 USD, making it accessible for new traders. Multiple account types are available, allowing flexibility based on trading volume, preferred spread model, and access to additional features.

Frequently Asked Questions

What is the minimum deposit to open an account?

The minimum deposit for a standard trading account is approximately 20 USD. Some account types or promotional offers may require a higher deposit level, depending on the jurisdiction.

How many account types does Hirose offer?

Hirose provides multiple account types, including standard and ECN/RAW variants. The standard type has no commission and built-in spread markup, while the ECN/RAW type offers tighter spreads but charges per-lot commission in eligible regions.

Our Verdict

Hirose Financial’s minimum deposit policy keeps entry barriers low, inviting a broad range of traders. The variety in account types, spanning commission-free to commission-based, lets users pick the model best suited to their trading style and volume.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

How to Open a Hirose Financial Account

Opening a Hirose Financial account is straightforward and mostly online. You can register for a demo or apply for a live account, complete identity checks, and fund your account to start trading on desktop or mobile platforms.

1. Step 1: Visit the registration page

Click “Open Account” or “Sign Up” on Hirose Financial’s site and choose Demo or Live to begin.

2. Step 2: Complete the online form

Enter your personal details, country of residence, phone number, email, and create a secure password; answer the short trading experience questionnaire.

3. Step 3: Confirm your email

Open the verification email from Hirose and click the activation link to access your client area.

4. Step 4: Submit KYC documents

Upgrade to a live account and upload a valid government ID (passport or national ID) and recent proof of address to complete identity verification.

5. Step 5: Fund your account and choose a platform

Go to Money Management, select a deposit method (card, bank transfer, e-wallet), fund your account (minimums vary by region), then choose a platform (MT4, MT5, or proprietary) to begin trading.

Most steps are completed online; KYC review times vary by jurisdiction.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Safety and Security

Hirose Financial operates under a strong global regulatory framework that prioritizes transparency, fairness, and the protection of client funds. With oversight from top-tier authorities in 🇯🇵 Japan, 🇬🇧 the United Kingdom, and 🇲🇾 Malaysia, the broker offers a secure trading environment where both new and experienced traders can operate with confidence.

| Regulator | Country | License Number | Main Role |

| 🇯🇵 FSA Kinki Finance Bureau | Japan | #41 | Enforces transparency and client fund protection |

| 🇬🇧 FCA | United Kingdom | #540244 | Safeguards clients and ensures fair market practices |

| 🇲🇾 Labuan FSA | Malaysia | MB/15/0006 | Oversees international operations and enforces compliance |

| Independent Audits | N/A | Ongoing | Supports transparency and boosts client confidence |

Frequently Asked Questions

How does Hirose’s Japanese regulation protect clients?

Hirose is licensed by the 🇯🇵 Financial Services Agency (FSA) under the Kinki Finance Bureau (Registration #41). This license ensures strict compliance with Japan’s Financial Instruments and Exchange Act, including regular audits and robust client fund protections to maintain a secure and transparent trading environment.

What is the role of the FCA and Labuan FSA for Hirose clients?

The 🇬🇧 Financial Conduct Authority (FCA #540244) and 🇲🇾 Labuan Financial Services Authority (MB/15/0006) oversee Hirose’s international operations. Both regulators enforce high standards for fairness, fund safety, and transparency, offering clients in their jurisdictions secure and reliable access to Hirose’s services.

Our Insights

Hirose Financial’s compliance with multiple respected regulators demonstrates its commitment to client protection and operational transparency. By adhering to the rigorous standards set by the 🇯🇵 FSA, 🇬🇧 FCA, and 🇲🇾 Labuan FSA, the broker offers traders a trustworthy platform backed by strong financial oversight and consistent regulatory audits.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

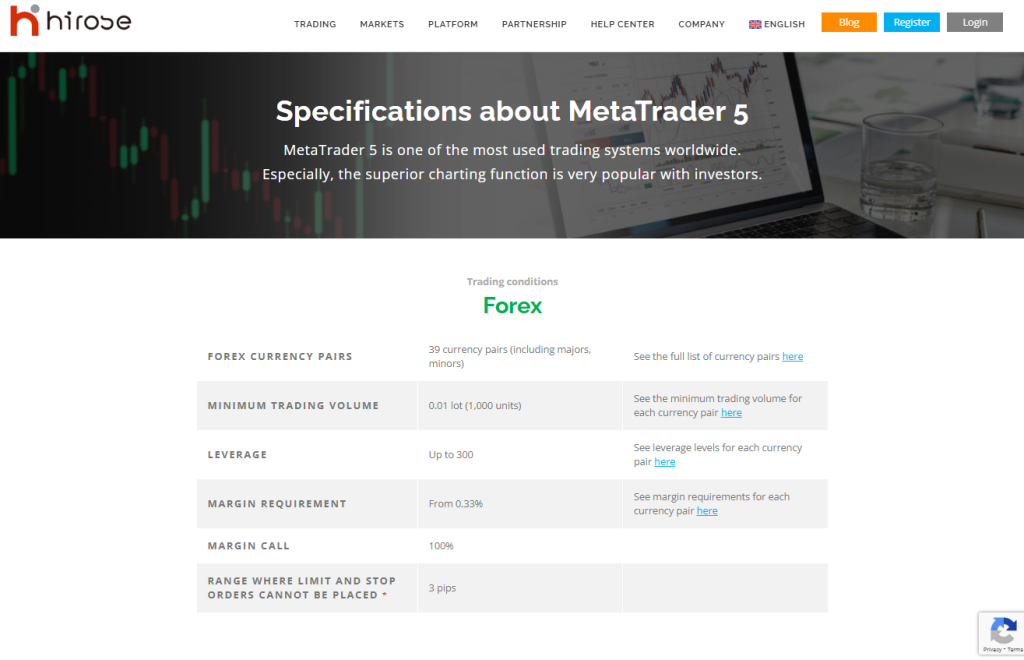

Trading Platforms and Tools

Hirose Financial delivers a robust trading experience on MetaTrader 5 (MT5), one of the most trusted platforms worldwide. Traders benefit from advanced charting tools, automated trading support, and diverse asset classes, including forex, CFDs, metals, and crypto, all under flexible leverage and transparent conditions for both beginners and seasoned investors.

| Asset Class | Pairs Available | Leverage | Margin Requirement |

| Forex | 39 pairs | Up to 300:1 | From 0.33% |

| CFDs | 9 pairs | Up to 500:1 | From 0.2% |

| Metals | 2 pairs | Up to 100:1 | From 1% |

| Crypto | BTC/USD | Up to 400:1 | From 0.25% |

Frequently Asked Questions

What makes Hirose’s MT5 attractive to traders?

Hirose’s MT5 platform combines powerful charting, automated trading, and one-click execution for speed. It supports multiple devices, offers competitive leverage across asset classes, and ensures transparency with features like hedging and no dealing desk execution, making it appealing for diverse trading strategies.

Can I use MT5 on mobile devices with Hirose?

Yes, MT5 is available on Android and iOS devices with stable performance. Traders can monitor markets, execute trades, receive alerts, and access reports directly on the go, making the platform convenient for active users who need flexibility and instant order execution.

Our Insights

Hirose Financial’s MT5 platform stands out for its versatility and user-friendly design. By supporting multiple devices, offering comprehensive reporting, and ensuring transparent NDD execution, it empowers traders with reliable tools to analyze markets, automate strategies, and manage trades efficiently across forex, CFDs, metals, and crypto assets.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

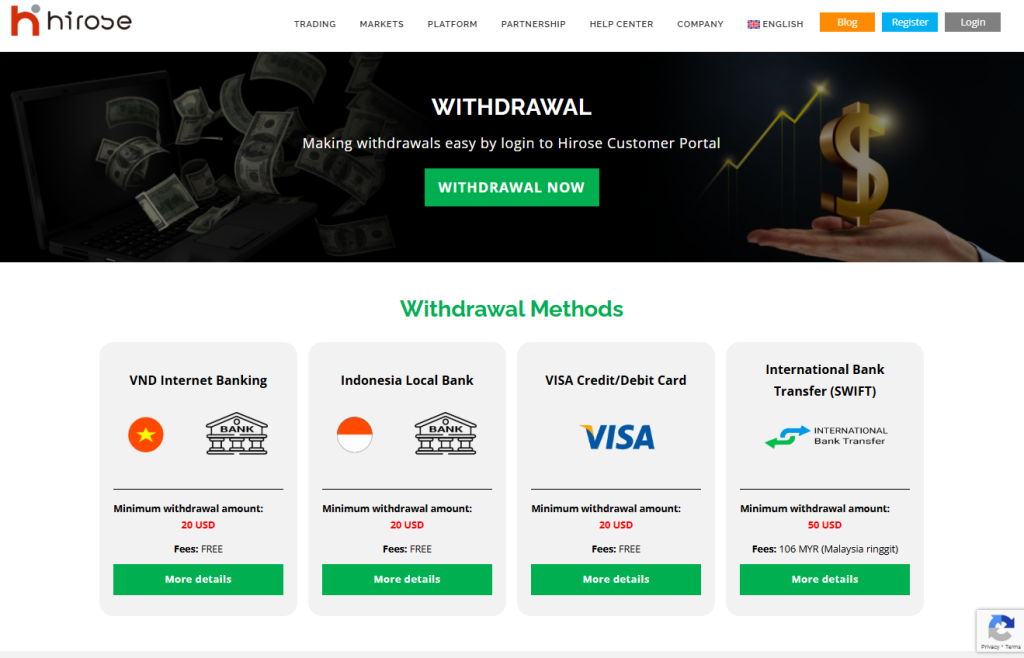

Deposits and Withdrawals

Hirose Financial offers a wide range of deposit and withdrawal options to make funding and accessing your trading account simple and efficient. With zero broker fees on most methods, fast processing, and strong security measures, traders benefit from a smooth and transparent experience that supports their trading journey.

| Method | Minimum Deposit | Approx Processing Time | Fees |

| VND Internet Banking Momo ZaloPay VietQR | 300,000 VND | Fast | Free |

| VISA Credit Debit Card | 20 USD | Fast | Free |

| International Bank Transfer (SWIFT) | 50 USD | On confirmation | Bank fees apply |

| Virtual Account | 300,000 IDR | Fast | Free |

| Local Bank (Mandiri, BRI) | 300,000 IDR | Fast | Free |

| OVO E-Wallet | 300,000 IDR | Fast | Free |

Frequently Asked Questions

Does Hirose charge fees for deposits?

Hirose does not charge additional fees for deposits. However, your bank or payment provider may apply their own charges, especially for international bank transfers. The broker ensures secure processing, but recommends checking with your bank for any extra costs.

Are withdrawals as fast and fee-free as deposits?

Withdrawals are usually quick and free of Hirose fees when using most methods. However, international bank transfers incur a fixed fee of 106 MYR. Additionally, banks may apply conversion or service fees depending on the withdrawal currency and region.

Our Insights

Hirose Financial’s deposit and withdrawal system is efficient, offering multiple local and international methods to suit traders’ needs. The absence of broker-imposed fees on most transactions keeps costs low, while transparency about third-party charges and smooth processing ensures reliable access to funds.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

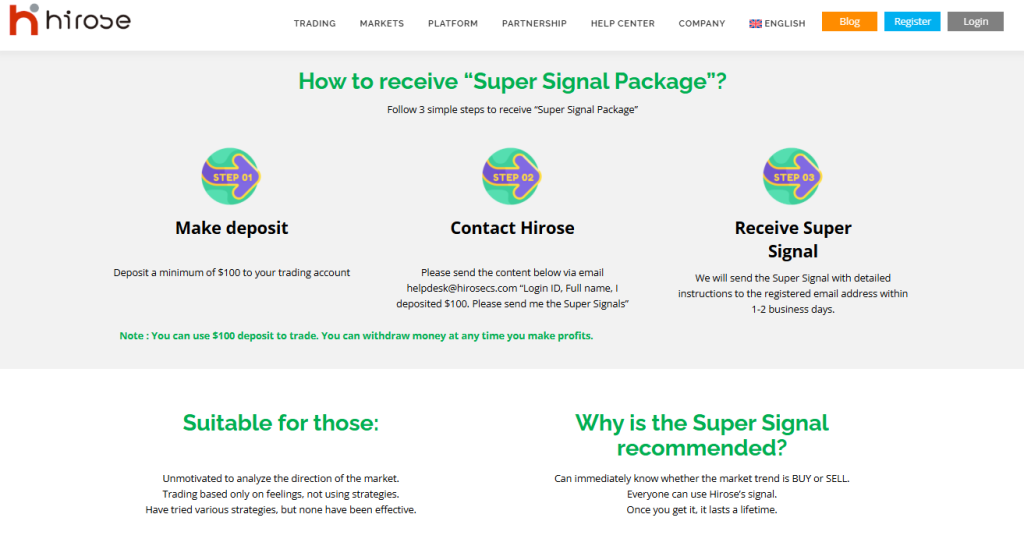

Super Signal Package

Hirose’s Super Signal Package offers traders an intuitive way to identify market trends without relying on complex analysis. By simply depositing $100, traders gain lifetime access to three powerful tools that highlight buy or sell opportunities, support and resistance levels, and overall market direction, enhancing decision-making and confidence.

| Feature | Requirement | Benefit | Delivery Time |

| Minimum Deposit | 100 USD | Unlocks Super Signal Package | 1-2 business days |

| Tools Included | Forecast 2 New Move T-Channel | Clear trend and resistance insights | Lifetime access |

| Suitable For | Beginners and emotional traders | Supports disciplined trading | Immediate usability |

| Withdrawal Flexibility | Profits can be withdrawn anytime | Keeps trading capital accessible | No restrictions |

Frequently Asked Questions

Who can benefit most from Hirose’s Super Signal Package?

This package is ideal for traders who struggle with consistent strategies or rely on instinctive decisions. By providing clear signals on market direction, it empowers both beginners and experienced traders to make more disciplined choices, thereby reducing emotional trading and increasing potential profitability.

How long does it take to receive the Super Signal Package after depositing?

After depositing a minimum of $100 and sending the required email with your login ID and details, Hirose typically delivers the Super Signal Package to your registered email within one to two business days. The tools come with detailed instructions for seamless integration into your trading platform.

Our Insights

Hirose’s Super Signal Package simplifies trading decisions by offering reliable, easy-to-understand tools. With a modest deposit, traders gain access to lifetime-use indicators that support disciplined strategies. Overall, it is a valuable solution for those seeking to improve market timing and reduce uncertainty in their trading approach.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Affiliate Program

Hirose’s Affiliate Program enables partners to earn unlimited commissions from referred clients’ trades. Supported by trusted FCA 🇲🇾LFSA and 🇯🇵FSA regulations, it offers daily payouts, transparent transactions, and multilingual support, making it a reliable choice for affiliates seeking long-term growth in the Forex industry.

| Feature | Benefit | Regulation | Payout System |

| Unlimited Payouts | Earn from client trades continuously | 🌏FCA 🇲🇾LFSA 🇯🇵FSA | Daily payouts |

| Competitive Trading Edge | Zero swap fees and low spreads | Transparent platform | No hidden charges |

| Payment Options | Visa, bank transfers, VND e-wallets | Secure transactions | Easy withdrawals |

| Affiliate Support | Multilingual professional assistance | Global Forex leader | User-friendly tools |

Frequently Asked Questions

How do I join the Hirose Affiliate Program?

You can join by registering for the program on the Hirose website. Once approved, you will receive a secure referral link to share with potential clients. Your earnings are calculated based on the trading activities of referred clients, and payouts are made daily.

How can affiliates monitor their performance and earnings?

Affiliates can access a dedicated dashboard to track referred clients, check rebates, review commission balances, and analyze detailed reporting features. This transparent system ensures affiliates stay informed about their performance and can plan strategies for increased earnings effectively.

Our Insights

Hirose’s Affiliate Program stands out for its daily payouts, regulatory backing, and strong customer support. It is ideal for individuals or businesses seeking a stable, transparent partnership in Forex promotion. This program combines competitive rewards with trustworthiness, fostering long-term affiliate success.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Customer Support

Hirose prioritizes customer care by offering a responsive support team ready to handle queries and provide expert assistance. Traders can conveniently access the Help Center for FAQs or reach out via email for more specific concerns, ensuring a smooth and reliable support experience.

Frequently Asked Questions

How can I contact Hirose for direct assistance?

You can contact Hirose by sending an email to [email protected]. Their support team responds promptly to address questions and provide guidance, ensuring clients receive timely and professional solutions to their trading concerns.

Where can I find answers to common questions before reaching out?

Hirose’s Help Center features a comprehensive list of frequently asked questions. This self-service option allows clients to quickly find answers to common issues, saving time and making it easier to resolve concerns without waiting for a response.

Our Insights

Hirose’s customer support system combines efficient direct communication with a practical Help Center for common inquiries. This approach ensures traders can access timely assistance and dependable guidance, strengthening trust and providing a more seamless trading experience.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Customer Reviews and Trust Scores

Hirose Financial generally receives positive marks from external reviewers, with particularly strong trust and regulation credentials. Most feedback highlights good regulatory oversight, solid safety of funds, and satisfaction with support – though some criticisms about spreads widening during volatile periods do appear.

| Metric | Rating/Notes |

| Trust Score | Around 90/100 |

| Regulation | Regulated in UK (FCA), Japan (FSA), Malaysia (LFSA) |

| Credit Rating | “BBB” long-term and “J-1” short-term by JCR (Japan Credit Rating Agency) |

| Customer Service Rating | Good responsiveness; multilingual 24/5 support cited in reviews |

| Trustpilot Rating (UK division) | Around 3.3/5 (limited number of reviews) |

In conclusion, Hirose Financial appears to enjoy high trust among brokers in its category, thanks to its regulatory licenses, credit ratings, and largely favourable customer feedback.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Discussions and Forums about Hirose Financial

In forums and broker review sites, discussions usually revolve around reliability, spreads during news, platform usability, and regulatory safety. Traders often compare it with other brokers regarding costs, transparency, and withdrawal ease.

| Topic | Common Views/ Opinions |

| Spreads during Economic News | Some reports of wide spread spikes around major announcements |

| Platform Instruments | Positive remarks for MetaTrader 4 and the proprietary LION Trader; but criticism that non-forex instruments are limited |

| Safety Regulation | Many users reassure each other of broker’s legitimacy because of strong regulation; some caution about verifying local entity |

| Withdrawal Support Process | Mostly smooth, though occasional complaints about delays in certain regions or during high-volume times |

To summarise, while user discussions praise many of Hirose Financial’s features, traders also warn to pay attention during news events (spread widening), check available instruments carefully, and test support in your region.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Employee Overview: Working for Hirose Financial

Insights from job review platforms suggest that Hirose Financial offers good opportunities for newer staff and has certain strengths, but also areas where improvements are often called for.

| Category | What Employees Say |

| Overall Rating | Around 3.5/5 in Malaysian site reviews |

| Salary Pay | Mixed: many say salary is average-to-good for the region; some feel it's low relative to workload |

| Work-Life Balance | Moderate: some balance, but under pressure especially during busy periods or when roles are not clearly defined |

| Management Communication | Often cited as weak in transparency; top down communication issues; some political influences claimed among management |

| Learning Environment | Good for early career; many mention opportunities to learn new skills, exposure to diverse tasks; but less opportunity for senior level innovation in certain locations |

Overall, working at Hirose Financial seems to be beneficial for those early in their career or looking to build broad experience. Yet, expectations for higher-level staffing or leadership roles may need to be managed carefully.

★★★★ | Minimum Deposit: $0 Regulated by: JFSA, FCA Crypto: No |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong regulatory oversight | Spreads can widen sharply during news/events |

| Competitive trading fees | Limited non-forex instruments |

| Good support responsiveness | Management & communication issues reported |

| Low barriers to entry / small minimum deposit | Role scope sometimes unclear / limited senior autonomy |

| Fast account opening / low hidden fees | Some delays or friction in withdrawals for certain users |

References:

In Conclusion

Hirose Financial has established a strong international presence with local offices and customer support in several key regions. This global reach allows the broker to provide dedicated services and localized assistance to traders across different markets.

- 🇯🇵 Japan

- 🇬🇧 United Kingdom

- 🇭🇰 Hong Kong

- 🇲🇾 Malaysia

- 🇻🇳 Vietnam

- 🇦🇮 Antigua and Barbuda

By maintaining offices and support teams in these countries, Hirose Financial ensures that clients have access to responsive customer service and localized expertise, reinforcing its reputation as a reliable global Forex broker.

Faq

Yes – it’s regulated by recognized authorities such as the FCA in the UK, FSA in Japan, and LFSA in Malaysia. It also holds a credit rating “BBB” from JCR, which helps confirm its financial and operational stability.

It is generally rated well. Multilingual support 24/5 via live chat, email, and phone is cited; response times are often praised.

Hirose keeps client funds segregated, operates under strong regulatory regimes, and discloses financial statements. These practices, along with its external credit ratings, add to its safety profile.

Yes – low minimum deposits, demo accounts, user-friendly platforms, and educational resources make it suitable for new traders. But beginners should be aware of risks like spread widening during high volatility.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Hirose Financial Account

- Safety and Security

- Trading Platforms and Tools

- Deposits and Withdrawals

- Super Signal Package

- Affiliate Program

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Hirose Financial

- Employee Overview: Working for Hirose Financial

- Pros and Cons

- In Conclusion