Forex Signals Brief June 2: Markets Focus on ECB and BOC Rate Cuts, US NFP

This week brings a packed calendar of major economic events across key global economies, with central bank updates, inflation data, and...

Quick overview

- This week features significant economic events, including central bank updates and labor market reports, likely to impact forex volatility.

- The US Core PCE price index showed a 0.1% monthly increase, aligning with expectations, while personal income rose sharply by 0.8% in April.

- A notable trade balance improvement in April boosted GDP growth estimates from the Atlanta Fed, raising expectations from 2.2% to 3.8%.

- In the cryptocurrency market, Bitcoin surged over 6% to a new all-time high, reflecting its growing status as a store of value amid economic uncertainty.

This week brings a packed calendar of major economic events across key global economies, with central bank updates, inflation data, and labor market reports poised to drive forex volatility.

Economic Recap: Inflation and Spending Trends

The most closely watched data last week was the US Core PCE price index for April—widely considered the Federal Reserve’s preferred inflation gauge. It posted a month-over-month increase of 0.1%, aligning exactly with market expectations. On an annual basis, core PCE rose by 2.5%, also in line with projections. Notably, the year-over-year core PCE figure for March was revised upward from 2.6% to 2.7%, indicating a slightly stronger underlying inflation trend than previously thought.

The broader, headline PCE index climbed just 0.1% from the previous month and registered a 2.1% annual gain—slightly below the anticipated 2.2%—signaling a modest easing in overall price pressures. Prices for services, excluding energy, remained unchanged after a 0.2% rise the month before, and core PCE excluding food and energy also increased by a modest 0.1%.

Beyond inflation, personal income rose sharply in April, advancing 0.8%—well above the 0.3% forecast. This marked the second consecutive month of strong gains after a prior upward revision to March’s figure, now at 0.7%. Inflation-adjusted spending held steady, while nominal personal consumption rose just 0.1%, a notable slowdown from March’s 0.7% increase. These numbers suggest consumers are maintaining their purchasing power thanks to solid wage growth, even as spending begins to cool.

Trade Balance Reversal Supports Growth Outlook

April also brought a significant shift in trade dynamics. US goods exports jumped from $182.2 billion in March to $188.5 billion—a $6.3 billion gain. At the same time, imports dropped sharply, falling from $344.5 billion to $276.1 billion, a steep $68.4 billion decline. This dramatic improvement in the trade balance gave a strong boost to GDP expectations.

As a result, the Atlanta Fed’s GDPNow model revised its Q2 growth estimate significantly higher—from 2.2% to 3.8%. This sharp upward revision was primarily driven by the positive trade data, highlighting its outsized influence on near-term economic projections.

Consumer Sentiment, Politics, and Policy Talk

The University of Michigan’s consumer sentiment index held firm in May, coming in at 52.2. That was not only a match for April’s level but also a beat compared to both the preliminary May reading of 50.8 and the consensus forecast of 51.0. The stable reading suggests consumers are cautiously optimistic despite ongoing uncertainties in the economy and political landscape.

On the political front, President Trump reiterated his strong stance on tariffs and expressed satisfaction with a recent appeals court decision that upheld his trade measures. He also touched on ongoing fiscal policies, noting that budget cuts would proceed in a “surgical” manner, with long-term impacts expected to unfold gradually.

In tech and crypto commentary, Trump referred to Elon Musk’s commitment to Dogecoin as personal, calling it “his baby,” and confirmed that many team members involved would remain engaged in its development.

On foreign policy, Trump suggested a resolution in the Gaza conflict may soon be reached and that a diplomatic breakthrough with Iran could also be on the horizon.

This Week’s Forex Events

This week is packed with pivotal moments for forex traders. With multiple central bank rate decisions, inflation metrics, and labor market updates on tap, markets are bracing for a potentially volatile stretch. The combination of Powell’s remarks, the ECB’s expected rate cut, and Friday’s NFP will likely set the tone for currency pairs heading into mid-June. Traders should prepare for breakout moves across USD, EUR, CAD, CHF, and AUD pairs as macro forces come into sharper focus.

Monday:

- Switzerland Q1 GDP expected to rise to 0.4% (from 0.2%), indicating moderate growth.

- US ISM Manufacturing Prices projected at 49.3 (up from 48.7), signaling mild inflationary pressure.

- Fed Chair Jerome Powell speaks, with markets listening closely for policy clues amid rate cut speculation.

Tuesday:

- Swiss CPI (April) expected to increase by 0.2%, rebounding from 0.0% in March.

- US JOLTS Job Openings to provide insight into labor demand and potential wage pressure.

Wednesday:

- Australia Q1 GDP forecast to slow to 0.4% (from 0.6%), suggesting softer domestic momentum.

- Bank of Canada rate decision expected to cut rates to 2.50% (from 2.75%), signaling the start of policy easing.

- US ISM Services PMI (May) projected at 52.0 (up from 51.6), indicating modest expansion in the service sector.

Thursday:

- European Central Bank (ECB) expected to cut its Main Refinancing Rate to 2.15% (from 2.40%), marking a potential shift toward monetary easing.

- US Weekly Unemployment Claims to provide near-term labor market health check.

Friday:

- Canada Employment Change report due, offering a view on labor market trends north of the border.

- US Non-Farm Payrolls (NFP) report is the main event—expected to significantly influence USD direction and rate expectations.

Last week, markets were slower than what we’ve seen in recent months, with gold retreating as a result, the EUR/USD falling below 1.11, and stock markets continuing upward. The moves weren’t too big, but we opened 37 trading signals in total, finishing the week with 25 winning signals and 12 losing ones.

Gold Returns to $3,000

Gold prices have regained upward momentum, boosted by a shift in the Federal Reserve’s tone, ongoing geopolitical tensions, and broader market caution. After climbing near $3,200, gold briefly tested resistance at $3,500—a level not seen since April. Though it failed to establish a firm breakout beyond that point, sentiment among investors remains upbeat. Bullion continues to serve as a hedge against inflation and rising systemic risks, reaffirming its status as a core safe-haven asset

As geopolitical concerns eased, investors pivoted toward equities and risk-oriented instruments, taking advantage of the bullish tone that has gripped global stock markets in recent months.

This renewed optimism has pushed gold into a consolidation phase. Since the final week of April, the metal has been

Gold prices are back on the rise, driven by a shifting outlook from the Federal Reserve, persistent geopolitical tensions, and a cautious market environment. After rallying from near $3,200, the precious metal briefly tested the key resistance zone just above $3,500—levels not seen since April. Although a decisive breakout wasn’t achieved, investor sentiment toward bullion remains constructive. Gold continues to hold its status as a critical safe-haven asset, prized for its role in hedging against inflation and systemic risks that continue to cloud the global economic outlook.

Even with this positive sentiment, gold’s trajectory has not been straightforward. As fears around geopolitical flashpoints temporarily eased in early May, many investors shifted capital toward equities and other higher-risk assets, riding the wave of optimism that had lifted global stock markets. This rotation led gold into a consolidation phase. Since the last week of April, it has been trading in a tightening range—supported around $3,120 and capped below the $3,500 area. The narrowing price action has formed a visible triangle pattern on daily charts, typically a precursor to a breakout in either direction, depending on the next macro catalyst.

trading within a broad range, with support seen at $3,120 and resistance levels gradually falling so a triangle is forming in the daily chart, which points to a breakout soon.

Currency Markets Defy Rate Logic as Yen Weakens

In a notable development this week, the U.S. dollar rose against the Japanese yen—even as U.S. Treasury yields declined—defying the typical correlation between interest rates and the greenback. USD/JPY climbed from 143.40 to 144.31, a move some analysts attribute to capital flight from Japan and broader portfolio reallocations amid heightened global risk. This unusual dynamic highlights the growing complexity of today’s financial environment, where traditional currency relationships are increasingly influenced by shifting global capital flows and geopolitical repositioning.

USD/JPY – Daily Chart

Cryptocurrency Update

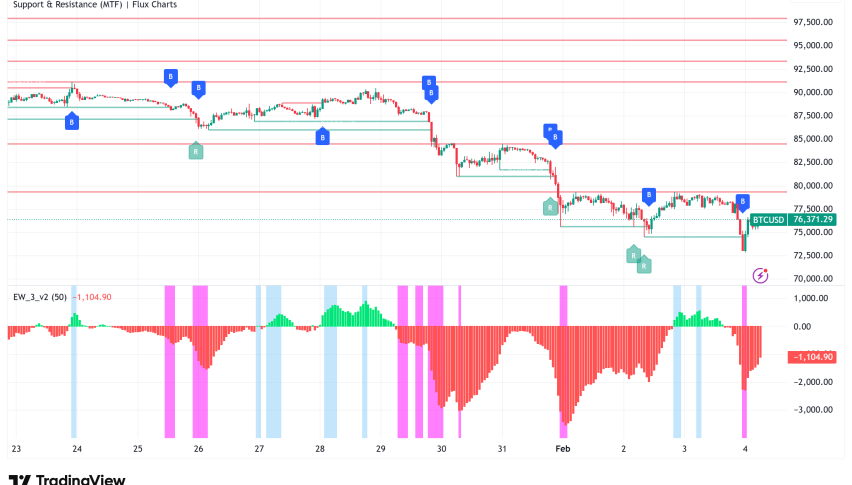

Bitcoin Sellers Tests the 20 SMA

Meanwhile, the standout performance this week came not from traditional assets, but from the digital space. Bitcoin surged over 6% to break above $110,000, setting a new all-time high. Its rally has been underpinned by growing anxiety over the U.S. fiscal outlook, record public debt levels, and a sense of unease around international tensions. Bitcoin’s sustained momentum reflects a growing perception that it is evolving into a viable store of value during times of macroeconomic instability.

BTC/USD – Weekly chart

Ethereum Tries Breaking Above MAs Again

Ethereum also staged a significant rally, jumping more than 20% from its April lows. This resurgence has been fueled by the successful launch of its latest upgrade, Pectra, which enhances staking functionality and improves wallet integration. These developments have drawn renewed interest from both institutional and retail investors, pushing Ether higher and breathing fresh life into the broader digital asset ecosystem.

ETH/USD – Weekly Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM