Polyhedra Network’s ZKJ Token Crashes 83% Following Liquidity Crisis and Abnormal Trading Activity

The price of Polyhedra Network's native token ZKJ fell by 83% on June 15, going from almost $2.00 to $0.33 in just a few hours. The meltdown

Quick overview

- Polyhedra Network's ZKJ token plummeted 83% from nearly $2.00 to $0.33 due to abnormal on-chain transactions, resulting in a $500 million loss in market value.

- The depletion of the KOGE/USDT liquidity pool forced KOGE holders to convert to ZKJ, overwhelming the ZKJ/USDT pair and triggering a liquidation cascade.

- Investors are concerned about an upcoming unlock of 15.5 million ZKJ tokens on June 19, which could add significant sell pressure to an already weakened market.

- ZKJ's recovery hinges on restoring market confidence and implementing structural changes to prevent future liquidity issues, with potential price stabilization between $0.25 and $0.40 in the short term.

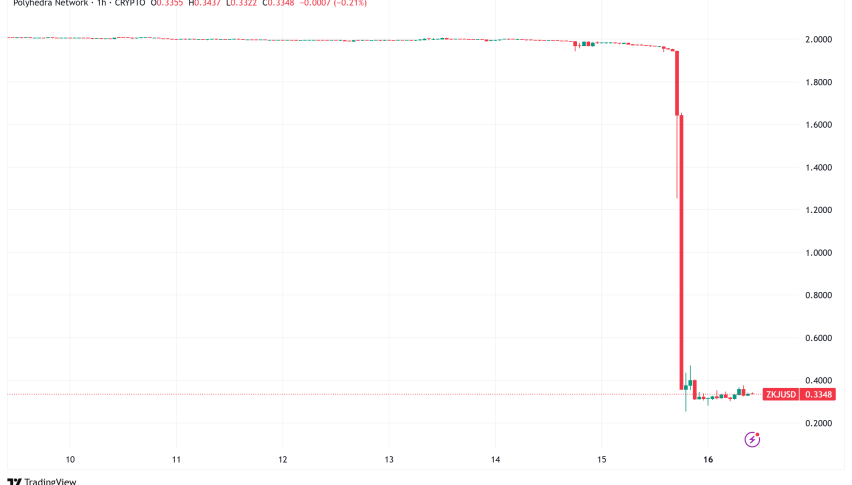

The price of Polyhedra Network’s native token ZKJ fell by 83% on June 15, going from almost $2.00 to $0.33 in just a few hours. The meltdown, which cost the company approximately $500 million in market value, was caused by what the company calls “abnormal on-chain transactions” involving the ZKJ/KOGE trading pair.

The KOGE/USDT liquidity pool was totally depleted, which forced anybody who held KOGE tokens to change them into ZKJ tokens through the KOGE/ZKJ pool, which was still working. The ZKJ/USDT pair was overwhelmed by this unexpected influx, which led to a cascade liquidation event that caused both tokens’ values to drop.

ZKJ/USD Technical Analysis: Support Levels and Market Structure Breakdown

From a technical point of view, ZKJ’s price action shows that all of the previous support structures have broken down. Before the crisis, the token had stayed pretty stable between $1.98 and $2.05 for more than 30 days. This made it look like there was a strong support base around the $2.00 level.

The first plunge saw ZKJ fall 60% to $0.76 in just 90 minutes, but it quickly rose back to $1.41. But this bounce didn’t last long; the token eventually settled around $0.33, which is an 83% drop from where it was before the crisis.

The Relative Strength Index (RSI) is probably at an all-time low, which is a sign that ZKJ is very oversold. At $0.33, the price is at an all-time low, and there are no support levels to help find possible recovery areas.

Binance Alpha Points Program Restructuring Adds Market Pressure

The situation has gotten worse because ZKJ and KOGE are connected in Binance’s Alpha Points ecosystem. The Alpha Points scheme, which rewards users for being active in the Binance Alpha ecosystem, gave both tokens a reason to exist. But this link produced severe liquidity dependencies that made the crash worse.

Analysis of the blockchain shows that a number of big wallets were actively cultivating Alpha Points before the crash. One wallet took out more than $3.7 million in KOGE and $530,000 in ZKJ, and two others sold about $5 million worth of KOGE and ZKJ, which Binance called a “liquidation cascade.”

Binance said it would make big adjustments to how it calculates Alpha Points in reaction to the situation, starting on June 17. Trading volume between Alpha tokens like ZKJ and KOGE will no longer be used to figure out Alpha Points. This is meant to lower systemic concentration concerns.

Upcoming ZKJ Token Unlock Threatens Further Downside Pressure

Investors are even more worried since 15.5 million ZKJ tokens are set to unlock on June 19. This might add almost $10 million in sell pressure to a market that is already weak. This is about 5.3% of the current circulating supply, and if market confidence is low, it might make prices go down much more.

This release is particularly bad timing because it comes at a time when investors’ faith in the enterprise has been badly undermined. In the past, big token unlocks during times of market stress have typically led to even lower token prices.

Polyhedra (ZKJ) Price Prediction and Recovery Outlook

ZKJ’s chances of recovery depend on a number of important things in the future. If Polyhedra successfully recovers market confidence through complete transparency measures and structural upgrades to stop such events from happening again, the token could bounce back to the $0.50-$0.70 region in a bullish scenario.

In the short term, though, the bearish case seems more likely. ZKJ could stay between $0.25 and $0.40 for a while because the token will soon be unlocked and investors are losing faith in it. If the fundamental liquidity management problems aren’t fixed, the coin could go considerably lower.

For Polyhedra to make a real comeback over $1.00, it would need to show big changes in how its tokenomics work, be very open about what happened, and put in place protections to stop similar liquidity problems from happening again. The company’s promise of a thorough post-mortem review will be very important in figuring out if investors can trust them again.

ZKJ is currently trading at $0.33. For investors who are willing to take risks, this could be a great chance to make money. For others, it could be a warning about how dangerous networked DeFi protocols can be. The token’s medium-term path will probably be set in the next 48 to 72 hours, especially around the token unlock on June 19.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account