Rock West Review

- Overview

- Fees, Spreads, and Commissions

- How Safe Are Your Funds with Rock-West?

- How Does Rock-West Handle Trade Execution and Strategy Restrictions?

- How Competitive Are Rock-West’s Trading Conditions?

- Account Types

- Opening a Rock-West Account

- What Is Rock-West’s MAM Account, and Who Is It For?

- Trading Platforms and Tools

- Markets You Can Trade

- When Can You Trade with Rock-West?

- What Margin and Leverage Does Rock-West Offer?

- How Do Deposits and Withdrawals Work at Rock-West?

- Rock-West Bonuses and Promotions

- Corporate Social Responsibility

- Does Rock-West Offer Educational Tools or Market Research?

- Can You Partner with Rock-West as an Affiliate or IB?

- Support and Service Quality

- Who Should Trade with Rock-West?

- Customer Reviews: What Are Traders Saying?

- Rock-West vs AvaTrade vs Tickmill - A Comparison

- In Conclusion

Rock-West operates as a forex and CFD broker under MAIV LIMITED. It provides access to forex, crypto, commodities, and indices via MetaTrader 5 and its in-house platform, requiring a minimum deposit of 50 USD.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Overview

Rock-West, regulated by the Seychelles FSA (SD044), offers MT5 and its own platform for trading forex, crypto, commodities, and indices. It provides up to 1:2000 leverage and uses an A-book model, delivering transparency uncommon for offshore brokers, but it still carries high-risk exposure.

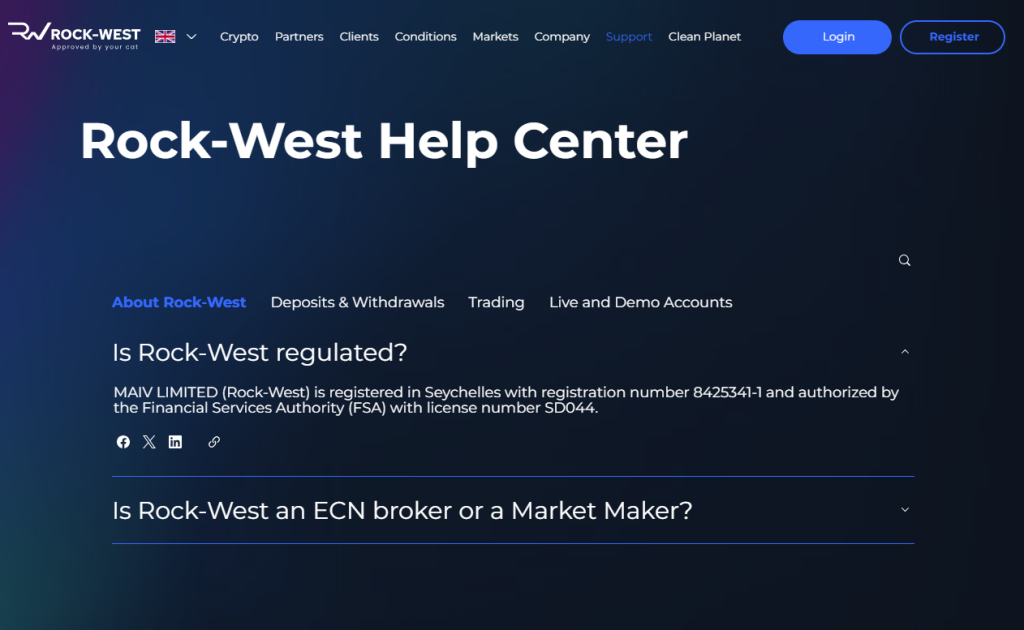

Frequently Asked Questions

Is Rock-West a regulated and legitimate broker?

Yes, the Seychelles Financial Services Authority regulates Rock-West under license SD044. While this oversight isn’t as strict as FCA or ASIC regulation, it surpasses being unregulated and shows the broker operates with some supervision, making it more trustworthy than many offshore peers.

What makes Rock-West different from other offshore brokers?

Rock-West uses an A-book model, avoids trading against clients, and passes orders directly to liquidity providers. It openly discloses its execution policy and bonus terms, setting itself apart from many offshore brokers that lack transparency in trade handling and client relations.

Our Insights

Rock-West operates as a regulated offshore broker, offering high leverage, transparent execution, and MT5 access. While it provides more openness than many peers, it lacks top-tier protection – traders should proceed cautiously and start with small investments.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Fees, Spreads, and Commissions

Rock-West applies a transparent fee model covering spreads, trading commissions, overnight swaps, and occasional inactivity fees. Your costs vary based on account type, instrument, and overnight positions. The broker waives deposit and withdrawal fees, though currency conversion may apply to non-USD accounts.

| Fee Type | Standard Account | Raw Account | Applies To |

| Spreads (EUR/USD) | Avg. 27 pips | Avg. 5 pips | All traders |

| Commission | None | $8 per round lot | Forex/CFDs (Raw only) |

| Crypto Fee | ~0.075% per trade | ~0.075% per trade | Crypto CFDs (all accounts) |

| Inactivity Fee | Up to $10/year (after 12 months idle) | Same | Both accounts |

Frequently Asked Questions

What’s the main difference between the Raw and Standard accounts for fees?

Raw accounts offer tighter spreads, ideal for scalping and high-frequency trading, but include a flat $8 commission per round lot. Standard accounts skip commissions entirely but come with wider spreads. Crypto trades involve percentage-based commissions regardless of the account type.

Are there any hidden or extra fees with Rock-West?

There are no hidden platform or withdrawal fees. However, swaps apply to overnight positions, and accounts inactive for 12 months may incur a $10 annual maintenance fee. Currency conversion charges also apply when trading or withdrawing in a different currency than your base account.

Our Insights

Rock-West provides a fee structure tailored to all trader types. Raw accounts offer low spreads ideal for high-volume trading, while Standard accounts cater to those preferring commission-free trading. Crypto traders should be aware that swap rates and transaction fees apply across all account types.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

How Safe Are Your Funds with Rock-West?

Rock-West holds a license from the Seychelles Financial Services Authority (FSA) under MAIV LIMITED (License: SD044), confirming its legitimacy. However, as an offshore broker, protections are limited, you won’t get client compensation schemes or strong local legal safeguards if issues arise.

What Protections are In Place?

Rock-West uses segregated client funds and an A-Book model to enhance transparency. Full KYC is required before funding or withdrawals. Clear policy documents explain what’s covered, offering more clarity than many offshore brokers.

What is Missing?

Unlike FCA or ASIC brokers, Rock-West offers no compensation if it collapses. Third-party risks from payment processors or liquidity partners may lead to losses, and disputes fall under Seychelles law, offering limited protection for international clients.

Frequently Asked Questions

Is Rock-West considered a safe broker to trust with your funds?

Rock-West is regulated and maintains some safety protocols, such as segregated client funds and full KYC. However, its offshore license means it lacks investor compensation, local legal protection, and secure fallback options common with higher-tier regulators. Risk remains, especially in the event of default or dispute.

What specific protections does Rock-West provide for client accounts?

Rock-West claims to use an A-book model with no dealing desk interference and enforces strict KYC procedures. Funds are separated from operational accounts. Clear policy documents outline terms and liabilities, but they also specify limitations, so users should read them carefully before depositing.

Our Insights

Rock-West provides basic protection and Seychelles FSA oversight, but lacks major safeguards like compensation schemes. While more transparent than many offshore brokers, it still carries notable risks traders should consider before committing.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

How Does Rock-West Handle Trade Execution and Strategy Restrictions?

Rock-West uses an A-Book execution model, routing trades to external liquidity providers rather than matching them in-house. This means the broker claims not to take the opposite side of your trades or influence outcomes. While stronger than many offshore peers, there’s no audit to verify consistent application.

Execution speed and spreads vary by account: Raw accounts provide tighter spreads and lower latency, while Standard accounts have wider spreads but include promotions and copy trading.

What strategies are allowed?

Most are. The broker explicitly supports:

- Scalping

- EA (automated) trading

- Hedging

- Copy trading (Standard account only)

- MAM trading (via MT5)

What’s restricted?

Trades flagged as bonus abuse, latency arbitrage, or churning may be blocked or disqualified from rewards. You’ll find this in their legal docs under “abusive practices.”

Frequently Asked Questions

Does Rock-West interfere with trades or run a dealing desk?

Rock-West claims to use an A-Book model, routing trades to liquidity providers without profiting from client losses. However, without an independent audit, there’s no way to confirm consistent application of this model.

Are trading strategies restricted at Rock-West?

Rock-West supports most strategies, including scalping, EAs, hedging, and copy trading. However, abusive tactics like bonus abuse or latency arbitrage may be restricted and excluded from promotions, as outlined in the broker’s legal terms.

Our Insights

Rock-West offers strong execution transparency for an offshore broker, with A-Book routing, advanced strategy support, and MT5 access. However, limited oversight and no third-party audits mean traders should test execution cautiously on a demo or small account first.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

How Competitive Are Rock-West’s Trading Conditions?

Rock-West’s trading conditions are competitive compared to other offshore brokers in its license category. You gain access to high-leverage trading, over 170 crypto CFDs, and two account types that cater to different trading styles.

Spreads and fees depend on the account you choose, but if you trade forex or metals with volume, the Raw account offers tighter costs than most offshore brokers.

- Forex spreads start from 0.0 pips on Raw (with commission) and 1.4 pips on Standard (no commission).

- Leverage reaches up to 1:2000 on Standard accounts, which is unusually high, even in the offshore space.

- Crypto access is broader than many competitors, and spreads tend to be more competitive than mainstream exchanges (from 1.5 pips on ETH and BTH).

Compared to other brokers regulated in Seychelles or similar jurisdictions, Rock-West’s mix of tight execution, leverage, and crypto availability places it near the top of its tier.

It doesn’t compete with Tier-1 regulated brokers in terms of safety, but in terms of tradable conditions, it holds its ground, especially on Raw.

| Feature | Raw Account | Standard Account | Crypto Access |

| Spreads | From 0.0 pips (+ commission) | From 1.4 pips (no commission) | 170+ crypto CFDs |

| Leverage | Up to 1:500 | Up to 1:2000 | Up to 1:20 |

| Best For | High-volume forex/metals | Casual and bonus traders | Crypto-focused traders |

Frequently Asked Questions

How tight are Rock-West’s spreads compared to other offshore brokers?

Rock-West’s Raw account features forex spreads from 0.0 pips plus commission, while the Standard account offers spreads from 1.4 pips with no commission. These competitive rates appeal especially to volume traders in forex and metals within similar offshore jurisdictions.

Does Rock-West offer advantages for crypto traders?

Yes. With over 170 crypto CFDs and spreads starting from 1.5 pips on major coins like ETH and BTC, Rock-West beats many offshore brokers and even mainstream exchanges on cost. Combined with MT5 support and leverage, it’s a solid choice for crypto-focused traders.

Our Insights

Rock-West offers competitive trading conditions among offshore brokers, with tight spreads, high leverage, and broad crypto CFD access appealing to experienced traders. However, absence of Tier-1 regulation means risk management and caution remain essential.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Account Types

Rock-West provides two active account types, Standard and Raw. Although a Classic account is listed, it’s not available at signup. Both accounts support forex, crypto, indices, commodities, and metals, with differing costs, leverage, and features based on your trading priorities.

Standard Account

This account is for lower-deposit traders, promotion-focused strategies, and anyone using copy trading. You’ll gain access to a comprehensive product list, featuring commission-free trading and wider spreads.

It suits newer traders, smaller accounts, or anyone taking advantage of bonus offers.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Raw Account

The Raw account is built for tighter trade costs and faster execution. It drops, spreads significantly, and replaces them with a flat commission.

This account is a better fit if you trade larger volumes, use scalping strategies, or employ EA/automated trading where spread size matters.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Other Account types available include:

Classic Account (On Request)

The Classic account is referenced on the Rock-West site and appears in crypto contract types and can be requested by contacting customer support or your account manager. Based on what’s listed, it seems to use fixed spreads and no commissions.

Swap-Free, Islamic Account (On Request)

Rock-West’s swap-free option is available only on Standard accounts and must be requested at sign-up or through support. It removes overnight interest to meet Islamic finance needs. No extra fees are disclosed, but it’s best to confirm.

Demo Account

Rock-West offers a demo account with $10,000 in virtual funds and access to all platforms, including crypto. Conditions closely match live trading, making it ideal for testing execution, spreads, and platform features before using real money.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Frequently Asked Questions

What is the main difference between the Standard and Raw accounts at Rock-West?

The Standard account is designed for entry-level traders, offering no commission, wider spreads, and bonus promotions. The Raw account targets volume traders, offering tighter spreads starting from 0.0 pips with a commission of $8 per round lot. Bonus offers and copy trading are limited to Standard only.

Does Rock-West offer swap-free or Islamic accounts?

Yes. Rock-West offers a swap-free option on Standard accounts only, which removes overnight interest (swaps) in line with Islamic finance principles. You must request this feature during sign-up or contact support. It’s not automatic and not available on Raw accounts.

Our Insights

Rock-West’s accounts cater to both beginners and active traders. The Standard account suits casual trading and promotions, while the Raw account is ideal for scalpers and high-frequency strategies. Despite limited Classic account availability, its platform support and flexibility make it a solid offshore choice.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Opening a Rock-West Account

You can open a Rock-West account online in a few steps. It doesn’t take long, but full KYC is required before you can fund or withdraw.

What’s the process?

- 1. Step 1: Register on the website using your name, email address, and country of residence.

- 2. Step 2: Verify your email to access the client area.

- 3. Step 3: Submit documents, including a Valid government-issued ID, and Proof of address (bank statement, utility bill, or similar). This applies to some EU countries.

- 4. Step 4: Wait for approval. This usually takes 1 – 2 minutes via Sumsub.

- 5. Step 5: Fund your account using a card, crypto, e-wallet, or local transfer.

- 6. Step 6: Start trading on MT5 or the Rock-West Trader app.

Is there a minimum deposit?

Yes, there is a Minimum deposit, Standard account – 50 USD, and for the Raw account – 250 USD. Your chosen account type will be locked in when you make your first deposit; there’s no toggle afterwards. If you want both account types, you’ll need to open a second profile under your main login.

Anything to watch out for?

The name on the payment method must match the name on your ID. Moreover, you can’t withdraw or claim bonuses without full KYC approval. If you upload partial or low-res documents, it’ll delay activation.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

What Is Rock-West’s MAM Account, and Who Is It For?

Rock-West offers a MAM (Multi-Account Manager) system via MT5 for professional traders managing multiple client accounts. Unlike copy trading, it allows full control over trade execution across accounts, making it ideal for fund managers, signal providers, and trading educators.

Who is it for?

The MAM platform is for Traders who manage capital from multiple investors, Strategy providers who prefer direct execution over follower-based systems, and Professionals who need to set individual risk levels per account.

How does it compare to Copy Trading

Copy trading lets users follow strategy leaders while retaining control of their accounts. In contrast, MAM gives the master account full control over client trades, making it ideal for professionals managing capital who need greater control and scalability. MT5 access and Rock-West approval are required.

Key Features

Rock-West’s MAM system uses one master account to manage multiple clients with adjustable risk settings. Available only on MetaTrader 5, it features real-time trade and commission tracking, customizable profit-share fees, and smooth client entry or exit without interrupting strategy execution.

| Feature | Description | Platform | Ideal For |

| Master Account Control | Single account manages multiple client accounts | MetaTrader 5 | Fund Managers Strategy Providers |

| Risk Allocation | Adjustable per client account | MetaTrader 5 | Professionals requiring control |

| Real-Time Tracking | Commissions and trade metrics monitored live | MetaTrader 5 | Trading Educators Capital Managers |

| Profit-Share Fees | Customizable by account manager | MetaTrader 5 | Fund Managers |

Frequently Asked Questions

Who benefits most from Rock-West’s MAM system?

The MAM account is ideal for traders managing capital from multiple investors, strategy providers preferring direct trade execution, and professionals needing customizable risk settings per client account for precise portfolio control.

How does MAM differ from copy trading at Rock-West?

Unlike copy trading, where users follow trades but retain account control, MAM centralizes trade execution via a master account across multiple client accounts, offering greater control and scalability for professional capital managers.

Our Insights

Rock-West’s MAM account is a robust solution for experienced traders managing multiple portfolios. Its integration with MT5 ensures seamless trade execution, customizable fees, and real-time performance monitoring, making it well-suited for professionals seeking enhanced control and operational efficiency.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Trading Platforms and Tools

Rock-West supports trading through MetaTrader 5 (MT5) and a proprietary platform, Rock-West Trader, available across devices. Each platform supports all asset classes offered by the broker, including forex, crypto, metals, indices, and commodities.

Both platforms allow one-click trading, use real-time pricing, and are compatible with any strategy that isn’t flagged as abusive by the broker (like latency arbitrage or bonus farming).

| Platform | Features | Best For | Copy Trading |

| MetaTrader 5 | Advanced charting EA MAM DOM | Pro users EA/scalpers | Standard only |

| Rock-West Trader | Mobile/web funding support | Beginners bonus/copy-focused users | Standard only |

MetaTrader 5 (MT5)

MT5 is available to all Rock-West users and supports both live and demo accounts. It includes standard features like:

- Full technical charting tools.

- Algorithmic and EA trading.

- Depth of market (DOM).

- Multi-asset access.

- Mobile and desktop versions.

- Support for MAM (Multi-Account Management) setups.

Rock-West’s MT5 stands out with over 170 crypto CFDs, a level of access few brokers offer. Crypto leverage goes up to 1:10, while forex can reach 1:2000, depending on the account. Raw accounts enjoy tighter spreads and faster execution; Standard accounts gain from built-in promotions.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Rock-West Trader (Web and Mobile)

Rock-West Trader is the broker’s platform, available through browsers and app stores. It includes full access to all tradeable markets and account types.

While it’s not trying to compete with MT5 on advanced indicators or EA integration, it focuses on simplified trade execution and account management.

Key tools include:

- Funding and withdrawal functions.

- Access to demo and live accounts.

- Copy trading integration.

- Account switching (between multiple live or demo profiles).

- In-app customer support.

The mobile app opens with a $10,000 demo account by default and doesn’t require funding or KYC to get started. You can explore the features and switch to live mode once you’ve been verified.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Copy Trading

Rock-West offers a built-in copy trading system that lets you follow and mirror the trades of experienced strategy providers. It’s available on the mobile app and MT5 platform (for Standard accounts only).

- Each strategy leader profile includes:

- Total and monthly return percentages.

- Account age and live performance stats.

- Number of followers.

- Profit-sharing fee (e.g., 40% of profit).

You can filter strategies by performance or risk and allocate funds directly from your live account, maintaining full control of your capital. Copy trading isn’t available on Raw accounts; a Standard account is required. Strategy providers must meet eligibility criteria and earn through performance-based fees.

Frequently Asked Questions

What platforms does Rock-West support, and who are they suited for?

Rock-West supports MetaTrader 5 (MT5) and its own Rock-West Trader platform. MT5 is ideal for advanced traders using EA, scalping, or MAM, while Rock-West Trader is better suited for beginners or copy traders looking for ease of use, account switching, and simplified tools.

Is copy trading available on all Rock-West accounts?

No, copy trading is only available on the Standard account. It allows you to follow top-performing strategy providers with performance stats and profit-sharing. Raw accounts do not support copy trading, so traders must use the Standard account to access this feature.

Our Insights

Rock-West offers a dual-platform setup with advanced MT5 and user-friendly Rock-West Trader. Featuring over 170 crypto CFDs, ultra-high leverage, and built-in copy trading, it provides one of the most flexible trading experiences among offshore brokers.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Markets You Can Trade

Rock-West gives traders access to all major asset classes, Forex, Crypto CFDs, Commodities, Indices, and Metals – across both Standard and Raw accounts. You don’t need to worry about account type or platform restrictions. While not all assets are listed publicly, verified users can view full specs in the client portal.

| Asset Class | Key Highlights | Leverage Limits | Account Notes |

| Forex | 30+ pairs Majors Minors Exotics | Up to 1:2000 (Standard) 1:1000 (Raw) | Available on all accounts |

| Crypto CFDs | 170+ tokens Divided by account type (m/s/r) | Up to 1:10 | CFDs only, No spot or perpetuals |

| Indices | Global indices incl. US100 GER30 UK100 JAP225 | Variable | No asset restrictions |

| Metals/Oil | Gold Silver Platinum Palladium Brent WTI NGAS | Up to 1:2000 (Gold/Silver) | Margins vary by account type |

Frequently Asked Questions

What asset classes are available at Rock-West, and do they differ by account?

All Rock-West clients, regardless of whether they choose the Standard or Raw account, get access to the same instruments. These include 30+ forex pairs, 170+ crypto CFDs, spot metals, major indices, and energy commodities. Availability doesn’t change across platforms or account types.

Does Rock-West offer real crypto or just CFDs?

Rock-West only offers crypto CFDs, not real spot tokens or perpetual contracts. You can speculate on price movements with leverage up to 1:10, but you do not own the underlying asset. Each crypto CFD type is linked to a specific account category (Standard, Raw, or Classic).

Our Insights

Rock-West offers an impressive range of instruments, especially in forex and crypto. With over 170 crypto CFDs and ultra-high leverage on forex and metals, it appeals to retail traders seeking variety and opportunity, though all trading is CFD-based, not spot.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

When Can You Trade with Rock-West?

Rock-West follows standard global trading sessions, but accessibility varies based on the asset class. While crypto is available 24/7, markets like forex, indices, and commodities observe regular hours. Traders can monitor and queue trades at any time, but execution is only possible during active sessions.

Trading Hours by Asset Class

| Asset Class | Session Hours (GMT) | Days | Notes |

| Forex | 22:00 Sun – 22:00 Fri | Monday to Friday | Continuous during open session |

| Crypto CFDs | 24/7 | All days, year-round | Swaps apply at 00:00 server time |

| Indices | Varies by index (e.g., US100: 01:00–23:15) | Monday to Friday | Maintenance breaks may apply |

| Commodities | Aligned with futures markets (e.g., Brent) | Monday to Friday | No trading on weekends |

Frequently Asked Questions

Are Rock-West platforms accessible 24/7 for all assets?

You can log in and manage your account 24/7, but not all markets are open all the time. Forex, indices, and commodities only trade during their respective market hours, while crypto CFDs remain available around the clock, even on weekends and public holidays.

What happens if I place a trade outside of trading hours?

Orders placed during inactive sessions will be held in the queue until the market reopens. This applies to forex, indices, and commodities. Crypto trades, however, are processed in real time 24/7, as there are no official closures for that asset class.

Our Insights

Rock-West offers flexible platform access with asset-specific market schedules. Crypto traders benefit from 24/7 access, while forex and indices follow traditional weekday cycles. Overall, the broker aligns with industry norms and provides clear session guidance within its platform.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

What Margin and Leverage Does Rock-West Offer?

Rock-West offers high leverage across all major asset classes. You’ll find up to 1:2000 on forex, 1:500 on indices, and 1:10 on crypto. The leverage available depends on both the instrument and your account type; Raw accounts have lower maximums than Standard.

Margin requirements are automatically calculated in the platform, and leverage is applied per trade. There’s no tiered leverage model or account-based scaling; what’s listed is what you get.

Leverage by Instrument Type

| Asset Class | Standard Account | Raw Account |

| Forex | Up to 1:2000 | Up to 1:1000 |

| Metals (XAU/USD) | Up to 1:2000 | Up to 1:400 |

| Indices | Up to 1:500 | Up to 1:500 |

| Energies | Up to 1:500 | Up to 1:500 |

| Crypto CFDs | Up to 1:10 | Up to 1:10 |

The Standard account is where you’ll find the highest leverage overall. It’s also the only one that allows for swap-free status (subject to approval). If you need the tightest spreads and lower trade costs, you’ll give up some leverage under the Raw setup.

Margin Call and Stop-Out Levels

- Margin Call: 50%

- Stop-Out Level: 30%

If your equity falls to the stop-out threshold, open trades are automatically closed to protect your account from incurring a negative balance. Margin calls are displayed in-platform, and you’ll get alerts as your available margin drops.

Crypto Margin Notes

All crypto trades are automatically limited to 1:10 leverage, except on BTC and ETH. This cap applies across altcoins and any other CFD categories. Margins on crypto are fixed and not customizable.

There’s no option to adjust leverage manually, and the settings are predefined based on the asset and account.

Frequently Asked Questions

What leverage can I expect on Rock-West accounts?

Leverage depends on your account and asset type: up to 1:2000 on forex (Standard account), 1:500 on indices, and a fixed 1:10 on most crypto CFDs. Raw accounts have lower maximum leverage but offer tighter spreads.

How does Rock-West handle margin calls and stop-out levels?

A margin call triggers at 50% equity, alerting you in-platform. If equity falls to 30%, stop-out closes open trades automatically to prevent negative balances and protect your capital.

Our Insights

Rock-West offers flexible margin and leverage options, with high leverage on forex and indices balanced by risk controls like margin calls and stop-outs. Crypto leverage is predefined to manage risk, supporting both aggressive and conservative trading styles.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

How Do Deposits and Withdrawals Work at Rock-West?

Rock-West provides practical funding methods like crypto wallets, local bank transfers, SEPA, cards, and agents. While the broker charges no internal fees, third-party costs apply. All transactions require verified identity, so payment details must match your registered information exactly.

Deposits and Withdrawals at a Glance

| Method | Region | Currency | Min. Deposit | Max. Deposit |

| Binance Pay | All countries | USDT | 20 USD | $30,000 per transaction |

| Direct Wallet | All countries | USDT | 20 USD | $10,000 per transaction |

| Visa/Mastercard | All countries (some limits may apply) | (Not specified) | 20 USD | $3,000 per transaction |

| SEPA Transfer | EU27 UK CH SM VA AD MC LI IS NO | EUR | 20 USD | No listed max |

| Local Bank | IN MY PH TH VN ID NG KE GH | Local currencies | 20 USD | $5,000–$17,000 (varies) |

| Local Payment Agents | ID TH NG MY | All currencies | 20 USD | No listed max |

What You Need to Know Before Depositing

Your payment method must match the name on file, third-party transfers are not allowed. Deposits aren’t active until they appear in your account, so pending funds won’t prevent margin calls. For crypto users, most deposits default to USDT, with conversions done before reaching your account.

Withdrawing Funds

Rock-West expects withdrawals to be made using the same payment method as deposits. You can’t change this midstream unless your original method doesn’t support withdrawals; even then, you can expect to undergo extra verification. They don’t list any internal withdrawal fees, but:

- Third-party fees are your responsibility.

- Any bounced or reversed transactions are on you.

If your documents don’t check out (or anything appears to be incorrect), your request will be either blocked or reversed and returned to your trading account.

Frequently Asked Questions

What funding methods are available at Rock-West?

Rock-West accepts crypto wallets, local bank transfers, SEPA payments, credit/debit cards, and payment agents. All deposit and withdrawal methods must be in the client’s verified name to comply with security policies and prevent fraud.

Are there any fees for deposits or withdrawals?

Rock-West does not charge internal fees for deposits or withdrawals. However, any third-party fees from banks, crypto networks, or payment processors are the client’s responsibility. Withdrawals must use the original deposit method unless additional verification is completed.

Our Insights

Rock-West offers a reliable and secure funding system with diverse payment options and no internal fees, prioritizing client protection through strict identity verification. Users should be aware of third-party fees and ensure their payment details match to avoid processing delays.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Rock-West Bonuses and Promotions

Rock-West provides multi-tiered bonus promotions exclusively for Standard account holders, including a 100% Eid al-Adha Deposit Bonus and a Copy Trading Achievement Bonus for strategy leaders. Raw account users and crypto trades are excluded from bonuses.

All offers come with clear terms to ensure fair use and prevent abuse.

| Bonus Type | Eligibility | Key Benefit | Validity/Conditions |

| Eid al-Adha Deposit Bonus | Standard accounts only | 100% bonus up to $10,000 | 90 days $2 per lot traded |

| Copy Trading Achievement | Strategy leaders only | Up to $5,000 funded equity | Withdrawable after milestones |

| Bonus Restrictions | Raw accounts excluded | No crypto trades count | No stacking anti-abuse rules |

Frequently Asked Questions

Who is eligible for Rock-West’s bonuses?

Bonuses are available only to Standard account holders. Raw account users cannot receive deposit bonuses, and crypto trades don’t count towards bonus volume or milestones, making these promotions tailored to more traditional trading activities.

What are the key terms of the Eid al-Adha Deposit Bonus?

The bonus offers up to $10,000 (100%) within 7 days of deposit, active for 90 days. Traders earn $2 per full lot traded on forex, metals, indices, and commodities. Early withdrawals recalculate the bonus, and crypto trades don’t contribute to bonus targets.

Our Insights

Rock-West’s bonus programs provide valuable incentives for Standard account traders, encouraging volume and strategy development. Clear restrictions and anti-abuse rules protect the broker and users alike, but Raw account holders and crypto traders should look elsewhere for promotions.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Corporate Social Responsibility

Rock-West actively supports environmental protection through its partnership with Clean Planet Seychelles, an NGO focused on plastic recycling, ocean cleanup, and education. By backing local sustainability efforts and waste management initiatives, Rock-West demonstrates genuine CSR beyond typical offshore broker practices.

| CSR Focus | Partner Organization | Key Activities | Impact Highlight |

| Environmental Protection | Clean Planet Seychelles | Plastic recycling beach cleanups | Real local sustainability impact |

| Corporate Support | Rock-West | Donations, waste reduction efforts | Transparent, genuine CSR action |

| Regional Importance | Seychelles | Addresses local waste challenges | Moves beyond superficial PR |

Frequently Asked Questions

What is Clean Planet Seychelles, and how does Rock-West support it?

Clean Planet is a Seychelles-based NGO dedicated to recycling, ocean and beach cleanups, and environmental education. Rock-West contributes through direct donations, ongoing support for waste reduction, and internal sustainability efforts.

Why is Rock-West’s CSR initiative significant?

Unlike generic eco-friendly claims, Rock-West’s partnership addresses real local environmental challenges in Seychelles, reflecting meaningful support for sustainable development in its operating region rather than superficial PR.

Our Insights

Rock-West’s CSR commitment stands out among offshore brokers by backing a tangible, impactful local environmental NGO. Their support for Clean Planet Seychelles highlights a responsible approach to corporate citizenship rooted in the community they serve.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Does Rock-West Offer Educational Tools or Market Research?

Rock-West doesn’t have a learning portal or formal education content. You won’t find an academy, video tutorials, or beginner guides available through the client area or public site.

Their educational offer is limited. The broker states that a Rock-West Academy is in development, but it hasn’t launched yet. Currently, there are no learning resources available for new traders.

Market Research and Analysis

Where Rock-West is active is in market coverage. Their internal team produces short-form analysis covering:

- Currency pairs

- Commodities

- Cryptocurrency

- Global macroeconomic events

Updates are shared through the platform and Telegram and focus on upcoming risks, chart setups, and short-term direction. These are aimed at active traders already familiar with technical and fundamental terms. Research content includes:

- Commentary on trend setups

- Suggested entry and exit levels

- Economic and policy impact breakdowns

You’ll also find a live economic calendar, including filters for region, impact level, and forecast figures. This is integrated into both the mobile app and the client area.

Frequently Asked Questions

Does Rock-West offer educational materials for beginners?

No, Rock-West does not currently provide educational content such as tutorials or guides. A dedicated Rock-West Academy is under development but not yet available to clients.

What market research does Rock-West provide?

Rock-West delivers concise analysis on currency pairs, commodities, crypto, and global macroeconomics. Updates include trend commentary, entry/exit suggestions, and economic event impacts, shared through their platform and Telegram.

Our Insights

While Rock-West lacks formal educational tools for new traders, its active market research and analysis offer valuable insights for experienced traders. The upcoming Rock-West Academy may expand educational support in the future.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Can You Partner with Rock-West as an Affiliate or IB?

Rock-West offers an Introducing Broker (IB) program. It’s aimed at traders, educators, influencers, copy providers, and fund managers who want to refer clients and earn commission based on deposits and trading volume.

There’s no mention of a standalone “affiliate” program. The partnership model is strictly IB-focused, meaning you’re expected to bring active traders, not just clicks.

How do you earn through the Rock-West IB program?

There are two commission structures:

Deposit-based referral payouts

- Earn $30+ per referral once the client deposits at least $1,000.

- High-value referrals (clients depositing over $50,000) can earn you up to $1,500 per person.

Lot-based trading commissions

Once your referrals start trading, you’ll earn per lot, depending on their account type and how much they’ve deposited:

| Tier | Deposits | Standard Account | Raw Account |

| Silver | Under $30,000 | $6.00 | $2.00 |

| Gold | $30K–$50K | $8.00 | $2.50 |

| Platinum | $50K+ | $10.00 | $3.00 |

| Custom | $100K+ | Custom rates | Custom rates |

You’re also eligible to earn from sub-IBs (referrals who become IBs themselves).

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

How are IB commissions paid?

- Payouts are processed daily. As soon as your referred clients trade, commissions are deposited into your IB wallet.

- Withdrawals are unrestricted. You can withdraw as often as you like, using your preferred method, as long as it complies with their name-matching rule.

What support does Rock-West provide IBs?

IBs get access to:

- A dedicated account manager for direct communication.

- Custom commission deals if you’re bringing high-volume referrals.

- Promotional material like banners, kits, and calculators.

- Earnings tracking tools are in the partner dashboard.

How do you sign up?

You’ll need to:

- Create a standard Rock-West account.

- Apply via the “Partnership” section or email [email protected].

- Share your unique referral link.

- Start onboarding your network.

Once your referrals deposit and begin trading, your IB earnings will start to build.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Support and Service Quality

Rock-West provides multiple direct channels for support, and their listed hours cover most of the active trading week.

Available Support Channels

You can reach support through live chat directly on the website. For client-specific issues or documents, there are separate inboxes: [email protected], [email protected], and [email protected].

- Phone: There’s also a direct line listed: +248 4 376 660.

- Ticket system: Available through the site for more structured queries.

Support is available daily from 08:00 to 22:00 (UTC+4), including holidays. That’s strong coverage across the five-day trading week, and it includes off-market hours when most traders sort out funding or platform issues.

What You Can Expect

Rock-West uses Sumsub for KYC and onboarding, ensuring thorough verification. They follow up if documents are missing and may require official certification in some regions. Sumsub’s partnership with legit brokers reflects well on Rock-West.

Withdrawals may undergo compliance checks if details don’t match, with notifications sent by email or platform. While response times aren’t specified, live chat and email support during business hours connect you with real people, not bots.

Team Structure

Ovsanna Sahakyan is listed as the Customer Support Team Lead, and support is framed as part of their strategic service model, not just a side offering. That aligns with their onboarding claims, partner handling, and the tight integration of support into the mobile app itself.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Who Should Trade with Rock-West?

Rock-West offers a setup catering to different traders’ needs, but how much you benefit depends on your trading style and priorities.

Beginner-friendly?

Sort of. The Standard Account requires a low $50 deposit, provides up to 2000:1 forex leverage, and supports copy trading. It suits smaller deposits and strategy testing, with swap-free options available. However, it lacks educational resources like webinars and structured tutorials.

Experienced traders?

Yes, especially if you value low execution costs and strategy freedom. The Raw Account offers tighter spreads from 0.0 pips, high leverage, and no strategy restrictions. Scalpers, algo traders, and high-volume traders gain flexibility.

Both the proprietary platform and MT5 support deep order customization and fast execution, with no bans on EAs or high-frequency trading, provided you follow abuse rules.

Traders with larger deposits or high-frequency styles benefit from:

- Lower spreads and competitive commission structures.

- Faster order processing across platforms.

- Daily payout programs for IBs or managers.

Copy traders and passive users can use the copy trading functionality on MT5 or via the mobile app. You gain access to live manager statistics and can automatically copy portfolios, which is particularly useful for hands-off traders.

Summary: Who does Rock-West fit best?

Rock-West is a better match for:

- Traders who need ultra-high leverage (1:2000 on forex).

- Experienced traders chasing low spread execution.

- Clients who want swap-free options.

- Users who prefer crypto-based funding or need multi-platform access.

- Managers or IBs looking to scale referrals and track commissions in real time.

- Traders who want copy-trading via MT5 and mobile.

It’s not ideal for:

- First-time traders who need structured education.

- US-based traders (service not available).

- Traders who want guaranteed fund protection beyond basic segregation.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Customer Reviews: What Are Traders Saying?

Most public reviews of Rock-West are positive, particularly praising support, withdrawals, and the app experience. However, the total number of verified reviews remains small, mostly found on Trustpilot and app stores. It’s not yet a broker with thousands of public ratings.

What traders like

Several Trustpilot users praise Rock-West for same-day or even same-hour payouts, especially via Binance Pay. Traders highlight fast support responses within minutes, mainly through live chat or Telegram rather than email.

On Google Play, positive reviews emphasize the Rock-West Trader app’s ease of use and smooth navigation.

Example from Trustpilot:

“I received my withdrawal within 20 minutes via Binance Pay. Customer service was helpful and responsive. Highly recommend!” – 5⭐⭐⭐⭐⭐ (Trustpilot, 2024)

Example from Google Play:

“Fast deposits and withdrawals. I’ve been using the copy trading feature, and so far, no issues.” – 4⭐⭐⭐⭐ (Play Store, 2024)

What’s missing

Sites like Forex Peace Army, Reddit, and broker-focused Telegram groups show little organic chatter so far. While the platform promotes copy trading, reviews have yet to offer detailed insights into long-term follower performance.

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

Rock-West vs AvaTrade vs Tickmill – A Comparison

★★★★★ | Minimum Deposit: $50 Regulated by: FSA Crypto: Yes |

In Conclusion

Rock-West provides high leverage, crypto funding, and fast trade execution through MT5 and its platform. The Raw account delivers low-cost trading, while the Standard account includes bonuses and copy trading.

Faq

No. Rock-West does not accept clients from the United States. This includes both residents and citizens, regardless of their current location.

No. Rock-West does not charge inactivity fees on any account type, regardless of how long your account remains unused.

Yes. Hedging is allowed on both Standard and Raw accounts. There are no stated restrictions.

Yes. Rock-West allows automated trading, including Expert Advisors (EAs), as long as they don’t violate the broker’s abuse policies.

No. All Rock-West accounts are held in USD. If you deposit in another currency, it’s converted automatically at the provider’s rate.

- Overview

- Fees, Spreads, and Commissions

- How Safe Are Your Funds with Rock-West?

- How Does Rock-West Handle Trade Execution and Strategy Restrictions?

- How Competitive Are Rock-West’s Trading Conditions?

- Account Types

- Opening a Rock-West Account

- What Is Rock-West’s MAM Account, and Who Is It For?

- Trading Platforms and Tools

- Markets You Can Trade

- When Can You Trade with Rock-West?

- What Margin and Leverage Does Rock-West Offer?

- How Do Deposits and Withdrawals Work at Rock-West?

- Rock-West Bonuses and Promotions

- Corporate Social Responsibility

- Does Rock-West Offer Educational Tools or Market Research?

- Can You Partner with Rock-West as an Affiliate or IB?

- Support and Service Quality

- Who Should Trade with Rock-West?

- Customer Reviews: What Are Traders Saying?

- Rock-West vs AvaTrade vs Tickmill - A Comparison

- In Conclusion