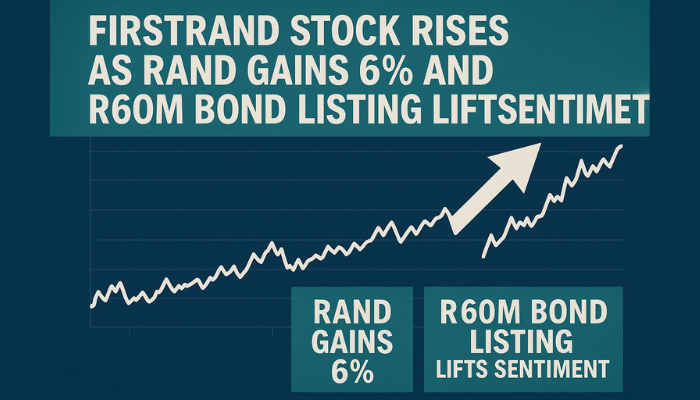

FirstRand Stock Rises as Rand Gains 6% and R60M Bond Listing Lifts Sentiment

FirstRand Ltd (JSE: FSR) rose 0.77% to 7,498 ZAC on Tuesday, building on recent gains as investor sentiment improves across South Africa’s.

Quick overview

- FirstRand Ltd's stock rose 0.77% to 7,498 ZAC, reflecting improved investor sentiment in South Africa's banking sector.

- The rand has appreciated over 6% against the US dollar this year, easing inflationary pressures on imported goods.

- Despite recent gains, the rand remains vulnerable to external shocks and domestic fiscal challenges, with a historical inflation gap affecting its long-term value.

- Technically, FirstRand's stock is showing tentative signs, with key support and resistance levels indicating a range-bound outlook unless it surpasses 7,620 ZAC.

FirstRand Ltd (JSE: FSR) rose 0.77% to 7,498 ZAC on Tuesday, building on recent gains as investor sentiment improves across South Africa’s banking sector. The up move comes as the rand continues its 2025 rebound and FirstRand is about to list R60 million in new bonds—more good news for the credit outlook.

The rand has gained over 6% year-to-date against the US dollar, currently trading at R17.57. While this is a big move, it’s still way off the fair value. Old Mutual’s chief economist Johann Els estimates the fair value at around R11.90 based on purchasing power parity.

The rand’s strength is easing inflationary pressure, particularly on imported goods like fuel, after years of low growth and high volatility. With GDP growth averaging just 1.1% over the past 15 years, this stability—albeit temporary—means better lending conditions and more market confidence for banks like FirstRand.

Rand Still Capped by Risks

Despite the recent tailwinds, the rand is still vulnerable to external shocks and domestic fiscal weakness. According to Els, the historical inflation gap between South Africa and the US is still driving long-term depreciation, while policy instability and low economic output is weighing on the rand’s global standing.

Els says the rand tends to overshoot in both directions, and short-term rallies are often followed by sharp reversals. “The rand is a barometer of global risk appetite and political trust in South Africa’s economy,” he said in a recent note.

Key Factors Holding Back the Rand:

- Inflation differential vs. USD

- Slow growth trajectory (1.1% average GDP growth)

- Fiscal uncertainty and political instability

FirstRand Technicals Look Tentative

From a technical perspective, FirstRand is looking tentative. The stock bounced from the 78.6% Fibonacci retracement level (7,304) and is now just below the 38.2% retracement at 7,536.

Price is at 7,498 ZAC, just above the 50-period SMA (7,445) which is acting as short-term support.The RSI is neutral at 49, neither bullish nor bearish. A break above 7,536 would be positive, with resistance at 7,620 and 7,755.

Levels to Watch:

- Support: 7,468, 7,445 (SMA), 7,400, 7,304

- Resistance: 7,536, 7,620, 7,755

Unless FirstRand gets back above 7,620 soon, it will be range bound short term. But with support in place and overall market sentiment improving, the bias is tentatively bullish.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account