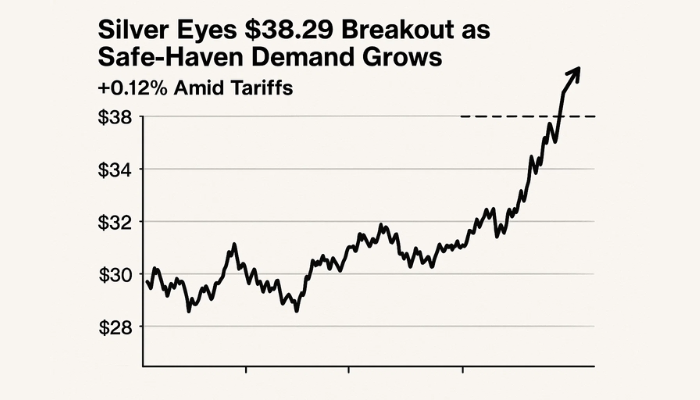

Silver Eyes $38.29 Breakout as Safe-Haven Demand Grows 0.12% Amid Tariffs

Silver (XAG/USD) rose 0.12% to $37.10 during Monday’s Asian session as safe-haven demand and bets on a U.S. Federal Reserve...

Quick overview

- Silver (XAG/USD) increased by 0.12% to $37.10 due to safe-haven demand and expectations of a U.S. Federal Reserve rate cut.

- The recent underwhelming Nonfarm Payrolls data and rising unemployment rate suggest a potential pivot to easing by the Fed, benefiting silver as a dual-purpose asset.

- Geopolitical uncertainty and new tariffs announced by President Trump are driving investors towards hard assets like silver, which is showing bullish technical patterns.

- A close above the key resistance level of $37.31 could signal a bullish breakout, with targets set at $37.74 and $38.29.

Silver (XAG/USD) rose 0.12% to $37.10 during Monday’s Asian session as safe-haven demand and bets on a U.S. Federal Reserve rate cut lifted the metal. Gold fell but silver maintained its upward momentum as investors hedged against renewed global trade tensions and weaker U.S. labor market data.

The move comes after underwhelming Nonfarm Payrolls (NFP) which showed only 73,000 jobs added in July – well below the 110,000 consensus forecast. The unemployment rate also rose to 4.2% – more evidence the Fed may pivot to easing later this year. That’s good for silver as a dual-purpose asset – valued for its industrial and monetary use.

Geopolitical uncertainty is driving risk aversion. U.S. President Trump’s announcement of new tariffs has sparked fears of another trade war cycle and traders are seeking safety in hard assets. Silver, often overlooked compared to gold, is benefiting from the spillover.

XAG/USD Technical Outlook: $37.31 Key Resistance Zone

From a technical perspective, silver is forming a short-term bullish structure. On the 2-hour chart, it bounced off the $36.22 support and is now testing the key descending trendline and the 50-SMA at $37.31.

The RSI is rising from oversold and has crossed 54 – a sign of recovering momentum. More importantly, a bullish divergence formed during the recent decline – a sign of reversal strength.

- Immediate resistance: $37.31 (SMA + trendline)

- Next targets: $37.74 and $38.29

- Key support: $36.67, then $36.21 if down

Price action is also showing bullish candlestick patterns – hammer and engulfing – indicating dip buying interest. This is a technical setup for a breakout.

Silver Trade Opportunity: Bullish Breakout in Play

For those watching closely, a close above $37.31 could confirm the breakout to $38.29. A stop below $36.67 keeps the risk low with a good reward.But a trendline rejection or a reversal candle (spinning top or inverted hammer) would be a warning. If momentum fades, silver could retest $36.67 or $36.21.

As rate cut speculation grows and tariff risks rise, silver may be set to outperform in the next few days – if it can clear resistance on volume.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account