Daily Crypto Signals: Ethereum Shows Resilience, XRP Confronts Descending Triangle Pattern

The cryptocurrency market experiences mixed signals as regulatory developments progress in the US and China considers yuan-backed stablecoin

Quick overview

- The cryptocurrency market is experiencing mixed signals due to regulatory developments in the US and China's consideration of yuan-backed stablecoins.

- Ethereum shows technical strength despite recent price volatility, with traders remaining confident in its recovery.

- XRP faces bearish indicators, suggesting a potential further downside as it confirms a descending triangle pattern.

- Network fundamentals for XRP are weakening, with a significant drop in active addresses and transaction counts since early 2025.

The cryptocurrency market experiences mixed signals as regulatory developments progress in the US and China considers yuan-backed stablecoins. Ethereum ETH/USD demonstrates technical strength despite recent price volatility, while XRP XRP/USD faces multiple bearish indicators suggesting further downside potential.

Crypto Market Developments

Big changes in rules and policies in various jurisdictions have had a big effect on the crypto world today. Senator Cynthia Lummis of the United States gave an optimistic timeframe for legislation on the structure of the crypto market. She said that the long-awaited bill might reach President Trump’s desk “before the end of the year.” Lummis spoke at the Wyoming Blockchain Symposium and said that Thanksgiving might be a turning moment. The House has already passed the Digital Asset Market Clarity (CLARITY) Act, and Republicans are pressing for the Senate to do the same.

China is allegedly thinking about allowing yuan-backed stablecoins for the first time to help people around the world use more currencies. This is a surprising change in policy. Reuters says that China’s State Council will look over a plan in late August that includes actions to stop the US from making advances with stablecoins and to make the yuan more widely used around the world. This is a huge change from China’s 2021 ban on cryptocurrencies, with Hong Kong and Shanghai being named as the first places to apply it. The Shanghai Cooperation Organization Summit in Tianjin from August 31 to September 1 is likely to focus a lot on policy talks.

As Bitcoin failed to rise above $113,000, retail traders’ mood changed substantially, according to Santiment. The analytics company says this is the lowest level of social media sentiment since June 22, when fears of conflict in the Middle East led to panic selling. But Santiment says this negative mood could be a chance for smart purchasers, since retail panic generally happens when the market hits a low.

Ethereum Traders Sure of Recovery

Ethereum is quite strong, even though it lost 15.1% in value over six days, which wiped out $817 million in leveraged holdings. After probing lower levels, the network found support about $4,070. Derivatives data shows that traders are still confident that ETH will recover. The annualized futures premium stayed over the neutral 5% level during the whole drop, which shows that institutions still have faith in the market even though the price went down.

The macroeconomic situation is still making investors nervous. US inflation is still above the Federal Reserve’s 2% objective, and there are mixed signals about economic growth. The Nasdaq Composite has gone down for two days in a row because people are worried about the value of AI stocks. Traders are also being careful because Federal Reserve Chair Jerome Powell will speak on Friday. Even with these problems, the Ethereum options market shows that there is equal demand for insurance against both price increases and decreases. The current 4% delta skew reading shows that people are not panicking but are instead neutral.

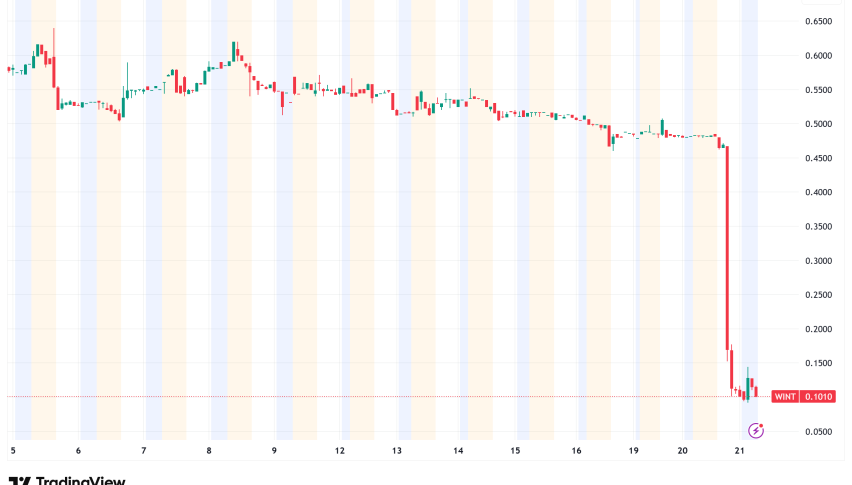

XRP Could See Further Downtrend

XRP is having a hard time right now. It’s trading 23% below its multi-year high of $3.66 and confirming a bearish descending triangle pattern on daily charts. This technical pattern predicts a possible 18% drop to $2.40, which is backed up by the fact that the price broke below the $2.95 support line on Tuesday. Technical indicators make the pessimistic prognosis even worse. The XRP/BTC pair’s RSI has been getting worse, going from overbought circumstances at 75 to 43 while prices made higher lows between July and August.

The negative thesis is supported by network fundamentals, as XRP Ledger activity has dropped a lot since its highs in early 2025. There were 608,000 active addresses every day in March, but now there are only about 33,000. Transaction counts have plunged 51% since June. The 90-day spot taker cumulative volume delta shows that there has been constant selling pressure since July 28. Negative readings mean that traders are still taking profits. More than 91% of the XRP supply is still lucrative at present levels, so if selling pressure keeps up, the price could go down even more.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account