Bitcoin Holds $115K Support, Traders Eye Critical Weekly Close Ahead of Fed Decision

As the weekend trading session comes to an end, Bitcoin (BTC) is holding steady around the $115,000 mark. Traders are keeping a careful eye

Quick overview

- Bitcoin is currently stable around $115,000, following a strong performance that peaked at $116,800 on Friday.

- Technical analysis indicates critical support at $114,000, with potential resistance levels at $116,200 and $116,500.

- Institutional interest in Bitcoin is growing, with significant inflows into Bitcoin ETFs and a forecasted increase in allocations for 2025.

- The upcoming Federal Reserve interest rate decision could positively impact Bitcoin's price, with expectations of a rate drop.

As the weekend trading session comes to an end, Bitcoin BTC/USD is holding steady around the $115,000 mark. Traders are keeping a careful eye on price activity as we head into a big week for both cryptocurrency and traditional financial markets. The world’s biggest cryptocurrency has been quite strong, staying steady after hitting recent highs of $116,800 during Friday’s Wall Street session. This was its best performance since August 23.

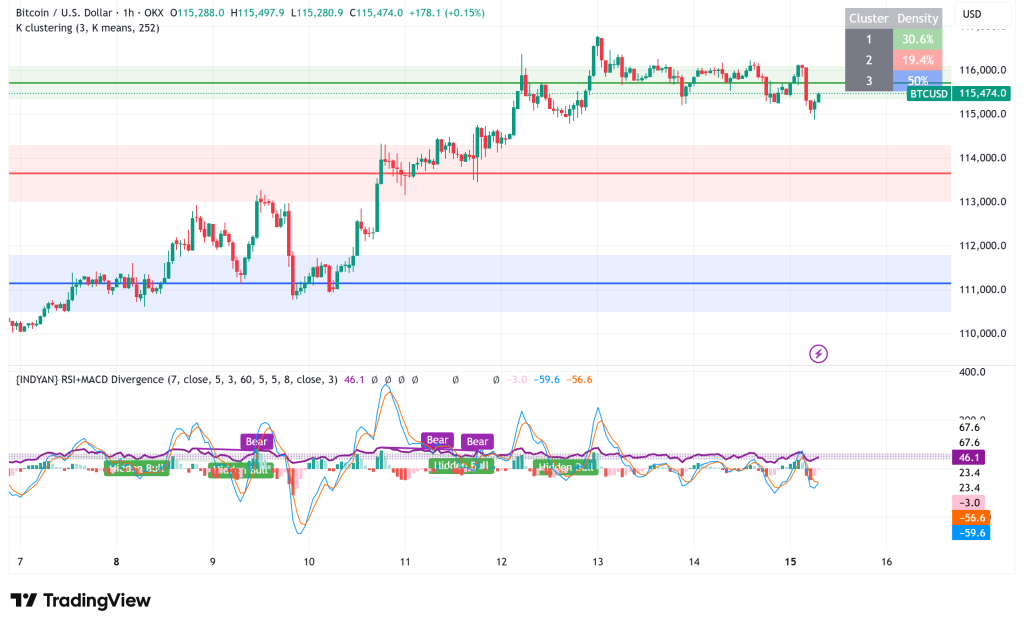

BTC/USD Technical Analysis Points to Critical Support Levels

Bitcoin is at a very important point from a technical point of view as it gets closer to the weekly closure. Rekt Capital, a well-known trader and analyst, said that a weekly close above $114,000 would mean that the digital asset’s bullish momentum would continue. This level is a major psychological barrier that could affect the short-term direction of Bitcoin.

The way prices are moving right now signals that they are in a cautious consolidation period. Trader Skew says there is “some pretty decent bid depth & liquidity just below $115K” on exchange order books. This observation shows that there is a lot of purchasing demand at these levels, which could stop any price drops from going further.

Technical indications show a variety of things. The hourly MACD is indicating less momentum in the bullish zone, and the RSI has dropped below the neutral 50 mark, which means there may be some pullback in the near future. Bitcoin is still trading close to the 100-hour simple moving average, though, which shows that there is support underneath.

$116,200 and $116,500 are important resistance levels to keep an eye on. If the price breaks above these levels, it might advance toward $117,500 and higher. On the downside, immediate support is at $114,900, and more significant support is at $113,750, which is the 50% Fibonacci retracement level from the most recent advance.

Institutional Momentum Building for Q4 Allocation Increases

Aside from technological issues, basic fundamentals are coming together to support Bitcoin’s medium-term prognosis. Jordi Visser, a Wall Street veteran and macro analyst, recently said that traditional financial institutions will greatly boost their Bitcoin holdings in the fourth quarter of 2024. This will lead to higher demand in 2025.

This interest from institutions is already showing up in ways that can be measured. In the last five trading days, US-based spot Bitcoin ETFs have had about $2.33 billion in net inflows. Since they started trading in January 2024, they have brought in a total of $56.79 billion. Also, publicly traded corporations now have over $117.03 billion worth of Bitcoin on their balance sheets. This is a big jump in how many businesses are using Bitcoin.

The institutional adoption argument is bolstered by survey data showing that 83% of institutional investors intend to augment their cryptocurrency allocations in 2025. Bitwise thinks that Bitcoin will bring in $120 billion by 2025 and even $300 billion by 2026.

Federal Reserve Decision Looms Large

The Federal Reserve’s decision on interest rates will be the most important thing that happens next week. All markets forecast at least a 0.25% rate drop. This relaxation of monetary policy could be good for risk assets like Bitcoin because lower interest rates usually push capital into investments that provide higher returns.

Mosaic Asset Company, a trading firm, said it was hopeful about the fourth quarter because of “improving leading indicators, ongoing loose financial conditions, and strong market breadth.” These are all signs that the economy will keep growing. In the past, these kinds of situations have helped risky assets, and they could help Bitcoin’s price go up.

Bitcoin Price Prediction and Market Outlook

Bitcoin looks like it might break out over $116,500 in the near future, based on the current technical setup and fundamental reasons. The first objectives are $117,500 and $118,500. If the $114,000 weekly closing level isn’t kept, though, it might lead to a deeper decline down $112,500 or lower.

Bitcoin’s price is likely to keep going up because of technical consolidation, more interest from institutions, and a monetary policy that supports it. Short-term volatility is still likely, but the medium-term prognosis seems good. Many analysts still forecast fresh all-time highs above the current cycle peak of $124,500.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM