Forex Signals Sept 25: US GDP and Unemployment Claims, Lead to Costco, Blackberry Earnings

Today we have the Costco and Blackberry earnings, on top of the US GDP and Unemployment claims, but the day kicks off with the SNB rate...

Quick overview

- The U.S. dollar strengthened significantly today, particularly against the Japanese yen, amid positioning flows and optimism about economic growth.

- New U.S. home sales data showed mixed signals, with cautious builder sentiment raising questions about the sustainability of sales strength.

- Commodities diverged, with oil prices rising due to concerns over Russian energy infrastructure, while gold prices fell after reaching record highs.

- Equity markets retreated as investors took profits, particularly in the tech sector, with notable declines in Oracle and Micron.

Today we have the Costco and Blackberry earnings, on top of the US GDP and Unemployment claims, but the day kicks off with the SNB rate decision first.

Dollar Strength and FX Flows

The U.S. dollar strengthened significantly today, with the most notable move seen against the Japanese yen, where the pair surged by 125 pips. While the magnitude of the move was striking, it lacked a clear catalyst. Chair Powell’s comments yesterday were largely dovish, with only minor references to lingering inflation risks, making it difficult to attribute the dollar rally to monetary policy expectations. Fed funds futures did trim about 2.5 basis points of easing for the year ahead, but that adjustment alone hardly justifies the scale of the currency shift. Instead, the move appears more consistent with positioning flows and possibly a squeeze, supported by a broader sense of optimism about economic growth heading into next year.

Housing Data Sends Mixed Signals

New U.S. home sales data provided some support for the dollar, but the upbeat figures were met with caution. Builder sentiment surveys, which tend to be more timely, have not shown any comparable rebound in optimism. Moreover, rates did not fall during August, the survey period, which raises questions about the sustainability of the strength in sales. If the trend were to persist, however, it could mark a turning point for a sector of the economy that has been in a prolonged slump.

Commodities Diverge: Oil Up, Gold Down

Commodities traded in opposite directions today. Oil prices advanced, supported by concerns over potential new attacks on Russian energy infrastructure. In contrast, gold weakened, reversing much of the strength it had displayed earlier in 2025. This divergence highlights shifting investor positioning across safe-haven and risk-sensitive assets.

Equities Retreat on Tech Weakness

Equity markets slipped as investors took profits in some of the market’s strongest performers. Oracle led the pullback in big tech, while Micron fell 2.6% following its earnings report. The retreat underscored investor caution after a strong run in equities, particularly in high-flying technology names.

Data in Focus This Week

Central Bank in Focus: SNB Policy Decision

The Swiss National Bank will announce its policy decision on Thursday, with markets widely expecting rates to remain unchanged at 0.00%. Inflation in August was steady at 0.2% year-on-year, slightly above the SNB’s forecast but not high enough to force immediate action. Chairman Schlegel has made clear that the bar for negative rates remains high, though the option is not ruled out if conditions worsen. For now, the probability of a further cut is priced at just 5%, with attention shifting to December for possible guidance on policy direction.

U.S. Durable Goods Orders Outlook

Markets are also watching Thursday’s release of U.S. durable goods data. Expectations are for a modest contraction in both core durable goods (–0.2% vs prior +1.0%) and headline orders (–0.4% vs prior –2.8%). While the manufacturing sector has shown signs of stabilization in 2025, growth remains narrow, concentrated in technology-driven industries such as software and computing. Broader business sentiment remains subdued, with firms hesitant to commit to long-term capital investment amid ongoing policy uncertainty.

Key Earnings on Watch

With Costco representing the consumer discretionary space and BlackBerry offering a read on tech transformation, today’s earnings could provide valuable signals across very different sectors of the market.

Costco Wholesale (COST) – Q4 2025 Results

- Timing: After Market Close (AMC).

- EPS Estimate: $5.81.

- Costco’s quarterly update will provide insight into consumer spending resilience, membership growth, and margins in a still-pressured retail environment.

- Investors will watch closely for signals on holiday demand trends and inflation’s impact on food and discretionary categories.

BlackBerry (BB) – Q2 2026 Results

- Timing: Before Market Open (BMO).

- EPS Estimate: $0.01.

- Focus remains on the company’s pivot toward cybersecurity and IoT solutions as legacy handset revenues fade further.

- Investors will be looking for updates on enterprise security demand and traction in its automotive software division.

Last week, markets were quite volatile again, with gold soaring to $3,6065. EUR/USD continued the upward move toward 1.17.80, while main indices closed higher again. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

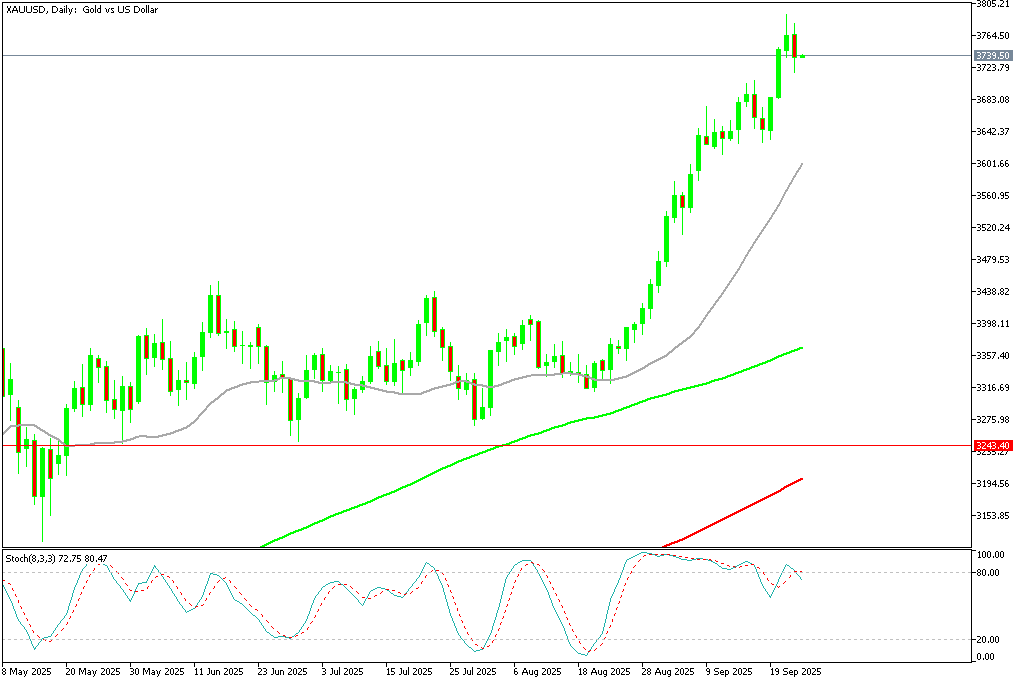

Gold Cools Off Before the Next Push Higher

Although demand for safe haven assets is still high, gold fell precipitously from record highs following the Fed’s most recent rate decrease as profit-taking was prompted by Powell’s cautious tone. Earlier this week, gold jumped beyond $3,700 and reached $3,707.42 following the Federal Reserve’s announcement of a 25 basis point rate decrease to 4.25%. But the impetus soon waned, and prices dropped back to $3,627, a $80 decline from the new all-time high. As traders locked in profits after the rally driven by dovish predictions, there was a sudden fall but buyers returned on Friday pushing the price $60 higher. Yesterday buyers continued to push and XAU reached another record high at $3,791 before retreating yesterday.

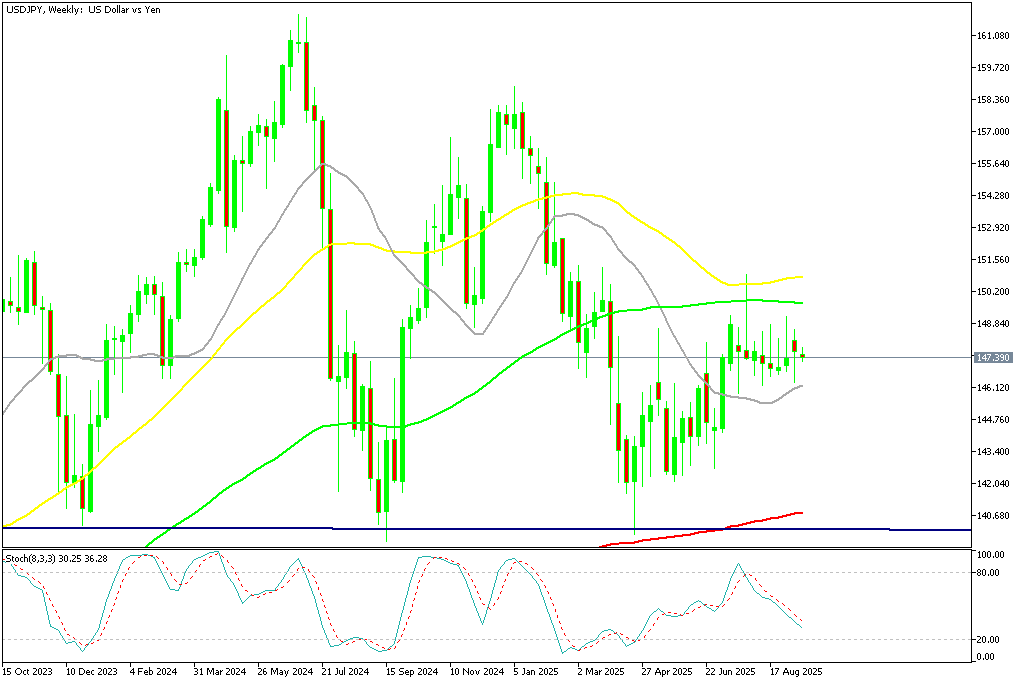

USD/JPY Continues Trading in the Range

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. The move underscored persistent volatility as traders weighed Japan’s intervention risks against evolving Fed expectations.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Returns Lower to the 100 SMA

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down to $113,000 before recovering above $116,000 last week, however sellers returned and sent BTC below $110,000, however we saw a rebound off the 20 weekly SMA (gray) but the price is returning down again.

BTC/USD – Weekly chart

Ethereum Heads to $4,o00 Again

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. However buying resumed and on Sunday ETH/USD printed another record at $4,941. However we saw a retreat toward $4,000 lows over the weekend.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM