Silver Forecast: $43.97 Support Meets Dollar Tension Ahead of U.S. Releases

Silver steadies at $43.97 as traders eye U.S. GDP, jobless claims, and PCE data. Dollar swings will decide XAG/USD’s next breakout...

Quick overview

- Silver is currently priced at $43.97 as traders await key U.S. economic data, including GDP and jobless claims.

- The dollar's stability at 97.46 will influence the next movements of XAG/USD, with potential breakouts or pullbacks.

- Despite recent weaker PMI numbers and a significant drop in the Richmond Fed index, silver's fundamentals remain strong due to growing industrial demand.

- Technical analysis shows silver is consolidating within a rising channel, with key resistance and support levels identified.

Silver steadies at $43.97 as traders eye U.S. GDP, jobless claims, and PCE data. Dollar swings will decide XAG/USD’s next breakout or pullback. The dollar is holding steady at 97.46 as we head into a big week of US data. Recent PMI numbers showed slower momentum—manufacturing 52.0 and services 53.9, the lowest since May—softer but still positive growth. The Richmond Fed index plummeted to -17, showing factory weakness.

This week’s focus is on GDP, unemployment claims, durable goods and the PCE index. Stronger growth and higher prices will lift real yields and the dollar, a headwind for silver. Weaker data will ease yield pressure and support the metal.

Why It Matters for Silver

Silver is tied to the dollar and real yields. When yields rise the opportunity cost of holding non-yielding assets increases and capping gains. When yields fall silver often benefits as investors seek havens.

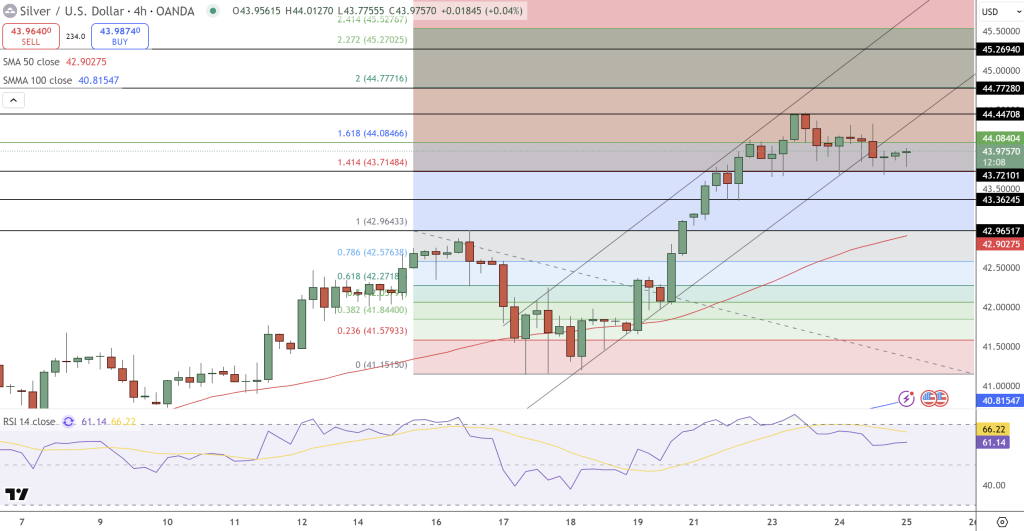

[[XAG/USD-graph]]

Beyond macro factors silver’s fundamentals are strong. Industrial demand is growing, driven by electrification, grid investment and solar panel production. Supply deficits have been in place for several years so dips are attractive for long term buyers even as short term moves are data dependent.

Technical Outlook for Silver (XAG/USD)

On the 4 hour chart silver is at $43.97 inside a rising channel. The RSI is 61 so momentum is cooling but still above 50. Price is consolidating around key Fibonacci levels $43.71 and $44.08.

- Above $44.08 could drive to $44.45 and $44.78 with stretch targets at $45.27.

- Rejection at resistance may pull back to $43.36 or $42.97.

- Below $42.90 would weaken trend support and expose $42.27-$41.58.

For now silver’s structure is positive. But with so much US data this week direction will depend on if the data lifts the dollar or adds to growth concerns.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account