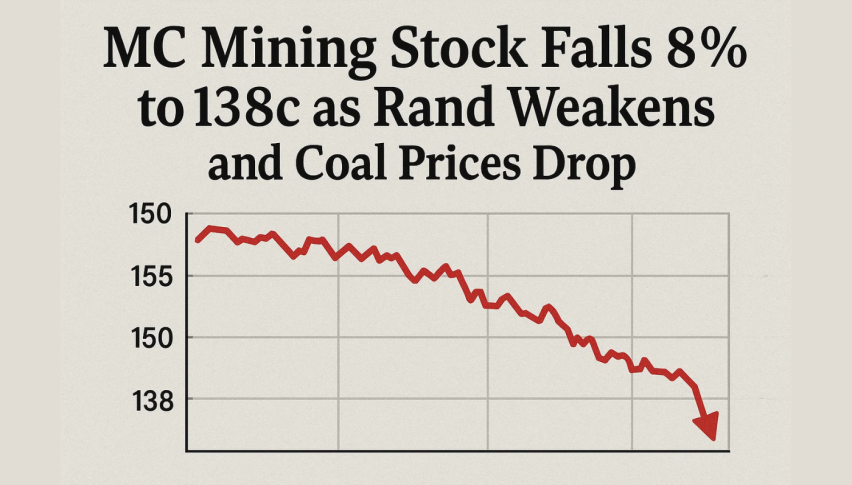

MC Mining Stock Falls 8% to 138c as Rand Weakens and Coal Prices Drop

MC Mining Ltd (JSE: MCZ) took a hit of 8% - dropping to 138c and a loss of 12c in value - because of the impact of weaker coal prices...

Quick overview

- MC Mining Ltd's share price dropped 8% to 138c due to weaker coal prices and a stronger U.S. dollar impacting investor sentiment.

- Operational challenges and reliance on coal exports have raised concerns about the company's profitability in the near term.

- The South African rand's weakness against the dollar is making commodities more expensive for international buyers, further affecting MC Mining's earnings.

- Gold prices have fallen, contributing to a negative sentiment in the resource sector, which has also influenced MC Mining's stock performance.

MC Mining Ltd (JSE: MCZ) took a hit of 8% – dropping to 138c and a loss of 12c in value – because of the impact of weaker coal prices and a stronger U.S. dollar on investor sentiment. The slide reflects concerns that the company might struggle to make a profit in the near-term due to its heavy reliance on coal exports and exposure to the ups and downs of commodity prices.

Operational challenges have just added to the pressure, with investors questioning the company’s ability to produce and keep costs under control at a time when coal prices are under pressure. This is particularly concerning for investors, because the Johannesburg Stock Exchange also mirrored this weakness with the Top 40 Index falling 2.5%, with major resource stocks that have a big influence on MC Mining’s performance leading the way down.

Rand Weakness Makes Buying More Expensive

The value of the South African rand has dropped even further against the dollar as global investor appetite for risk has faded, making commodities sold in South Africa more expensive for international buyers. This currency weakness is having a knock-on effect on resource linked stocks like MC Mining, and that’s because their earnings are so closely tied to the demand for exports.

Three key things are spooking the market:

- A stronger dollar: This is making it harder for South African producers to compete.

- FATF grey list uncertainty: This is keeping some foreign investors away.

- Negative commodity sentiment: A falling rand is just making things more volatile in the mining sector.

The weakness of the rand combined with falling coal demand has left MC Mining pretty vulnerable to having its profits eroded.

Gold Prices Fall Leaving Resource Sector Feeling The Pinch

Gold prices took a 4% tumble, reversing gains from record highs, as investors looked to take profits and rotate their money into the dollar. While MC Mining is in the coal business, its shares are often moving in line with the general mood of the mining sector, and the fall in gold prices didn’t help. It all contributed to MC Mining’s share price falling 8%.

This general softness in the sector has just reinforced the risk-averse way that investors have been behaving with resource linked shares, leading them to trim their exposure to those assets.

What The Price Chart Is Saying

Technically MC Mining’s price has been below its 20 and 50 day moving averages for a while now, which doesn’t look great for the share price. It’s still consolidating around the 134c level, which is a key horizontal support level in a descending triangle pattern.

If it breaks down below that level then we could see a slide down to 116c and 100c. On the other hand, a breakout above 152–159c and we might see a move back up to 168c and 198c.

Trade Ideas:

- Buy zone: 134c–138c

- Targets: 159c, 168c, 198c

- Stop Loss: below 129c

The RSI at 41 suggests the momentum is fading, but we’re not quite at the point of a reversal. Traders might want to wait for a bullish engulfing candle or a move above RSI 50 before calling the bottom. The next big move could give us a good idea of where MC Mining is headed in the coming quarter.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM