XRP Poised for Historic Milestone as First US Spot ETF Launch Expected Thursday

The cryptocurrency market is getting ready for a big moment as XRP looks like it will be the next digital asset to get spot ETF clearance in

Quick overview

- XRP is poised for a significant moment as it may become the next cryptocurrency to receive spot ETF approval in the US, with a potential launch as early as Thursday.

- Canary Capital's Form 8A filing with the SEC is the final step before the ETF can be traded, indicating growing institutional interest in direct XRP exposure.

- XRP is currently trading at $2.30, having experienced a 5.5% decline in the last 24 hours but a 10% increase over the past week, with key resistance levels identified at $2.45 and $2.50.

- The upcoming ETF launch could lead to increased volatility in XRP's price, as traders anticipate its impact on market dynamics and institutional adoption.

The cryptocurrency market is getting ready for a big moment as XRP XRP/USD looks like it will be the next digital asset to get spot ETF clearance in the US. Canary Capital filed Form 8A with the Securities and Exchange Commission on Monday night. This might lead to the launch of the first US-based exchange-traded fund that directly holds XRP tokens on Thursday.

As of this writing, XRP is trading at $2.30. It has down 5.5% in the last 24 hours, but it has gained 10% in the last seven days. The token reached a high of $2.58 before entering its current corrective phase. This is normal market behavior as traders try to figure out what the upcoming ETF approval would mean.

Canary Capital’s Spot XRP ETF: Regulatory Milestone Signals Broader Market Acceptance

Eric Balchunas, a senior ETF analyst at Bloomberg, said that the Form 8A filing, which is required before securities can be traded on exchanges, suggests that the launch is coming soon, possibly as soon as Wednesday or Thursday. The filing is the last step in the process. Crypto writer Eleanor Trent said that once Nasdaq confirms the listing at 5:30 PM ET on Wednesday, “the first XRP spot ETF will be set to launch Thursday at market open.”

The structure of Canary’s offering under the Securities Act of 1933 sets it apart from other XRP exchange-traded products. This allows investors to hold XRP directly instead than through offshore intermediaries. This direct exposure method could draw in institutional investors who want simple access to cryptocurrencies without having to deal with custody solutions or foreign companies.

Multiple XRP ETF Applications Create Competitive Landscape

Canary Capital is the first company to enter a field that is sure to be crowded. The Depository Trust and Clearing Corporation has a list of other spot XRP ETF applications that are still waiting for approval. Some of these applications are from big names in the industry, such as 21Shares, ProShares, Bitwise, Volatility Shares, REX-Osprey, CoinShares, Amplify, and Franklin Templeton. The fact that so many well-known financial institutions are applying for XRP shows that institutional confidence in XRP’s regulatory status is building after Ripple’s partial court success against the SEC.

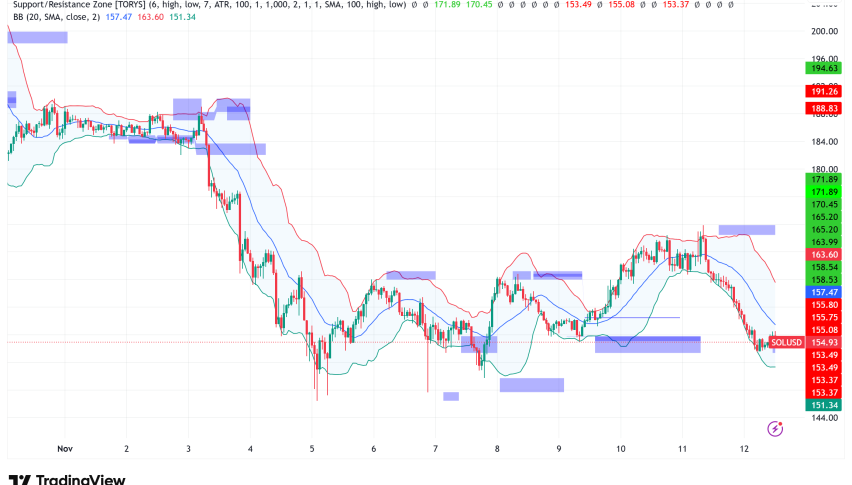

XRP/USD Technical Analysis: Consolidation Before Next Move

XRP is at a very important point in its technical development. The token’s latest drop from $2.58 has taken it to test support near the 100-hourly Simple Moving Average, which is approximately $2.40. There is now a short-term negative trend line with resistance at $2.44, which means that any attempts to recover will hit a wall right away.

The most important resistance levels have become clear at $2.45 and $2.50, with the latter being an important milestone. If XRP breaks above $2.50, it might quickly rise to $2.55 and maybe even $2.62. If the bullish trend continues, it might reach $2.68 and $2.75. However, this would only happen if there was a lot of purchasing pressure and encouraging news about ETFs.

On the other hand, there are still risks on the downside. Support is currently at $2.365 (the 61.8% Fibonacci retracement level) and is very important at $2.32. If the price drops below $2.32, it could go down further more to $2.25 and $2.20. If bearish momentum picks up, $2.12 could be a deeper support zone.

The technical indicators don’t all agree. The hourly MACD has moved into negative territory and is picking up speed going down. The Relative Strength Index has also dropped below the neutral 50 mark, which means that bullish sentiment is fading in the short term.

XRP Price Prediction: ETF Launch Could Catalyze Volatility

The combination of a technical correction and a fundamental catalyst makes for an interesting setup. When Bitcoin and Ethereum ETFs first came out, there were signs of “buy the rumor, sell the news” behavior. However, as institutional investors kept putting money into the market, prices went up.

It looks like XRP will test $2.50-$2.60 again if it stays above $2.32 and the ETF launch goes off without a hitch on Thursday. But traders should be ready for more volatility as the markets price in the new investment vehicle and how it can affect the supply of XRP and the paths that institutions choose to adopt it.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account