Zcash Surges Past $714: Privacy Coin Rally Gains Momentum Amid Technical Strength

Zcash (ZEC) is still going up, and at the time of writing, it is solidly above $714, which is a gain of almost 2% in the last 24 hours.

Quick overview

- Zcash (ZEC) is currently trading above $714, reflecting a nearly 2% gain in the last 24 hours and solidifying its position as the largest privacy coin by market cap.

- Technical indicators suggest strong bullish momentum for ZEC, with 'Strong Buy' signals on multiple timeframes and key support levels established around $600 and $700.

- Institutional interest is rising, highlighted by Cypherpunk Technologies' $100 million commitment to ZEC, which could further drive demand and price appreciation.

- Price predictions for ZEC vary widely, with conservative estimates suggesting a range of $620 to $1,047 by 2026, while more aggressive forecasts could see prices exceeding $2,300.

Zcash ZEC/USD is still going up, and at the time of writing, it is solidly above $714, which is a gain of almost 2% in the last 24 hours. As the biggest privacy coin by market capitalization, with a value of about $11.7 billion and a rank of 12th among all cryptocurrencies, the privacy-focused cryptocurrency has become the center of fierce debate within the crypto community.

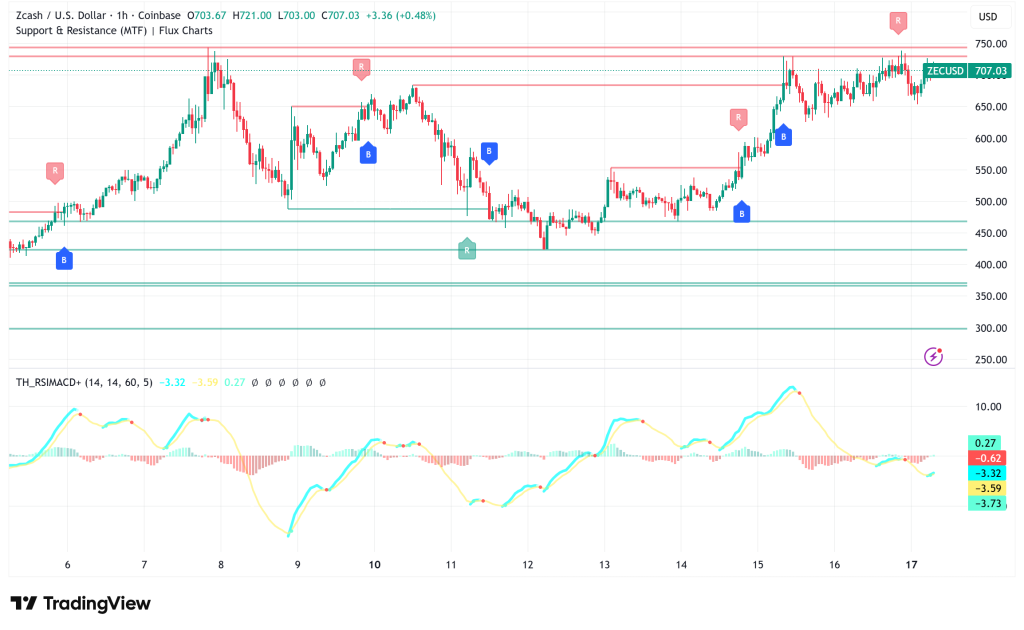

ZEC/USD Technical Analysis Points to Continued Bullish Momentum

Zcash’s current price action shows strong technical strength on a number of periods. According to several technical indicators, ZEC shows “Strong Buy” signals on the four-hour chart. The same positive mood can be seen on the daily and weekly charts. Technical analysts see the cryptocurrency trading well above its key moving averages, including as the 50-day, 100-day, and 200-day exponential moving averages (EMAs). This is a strong sign that the positive trend will continue.

The Relative Strength Index (RSI) is currently at 70.17, which means that ZEC is overbought, but it doesn’t mean that a reversal is about to happen. In the past, assets that are going up a lot can stay overbought for a long time. The Moving Average Convergence Divergence (MACD) indicator shows that things are moving in the right direction, but some analysts say they see early symptoms of cooling that could mean a short period of consolidation before the next leg up.

Key Support and Resistance Levels Shape Near-Term Outlook

There are important support levels at $600 and stronger support between $460 and $488. These zones are places where buyers have been quite active in the past and are predicted to protect price action during any pullbacks. After being tested successfully several times, the psychological $700 level has changed from being resistance to being support.

On the plus side, there seems to be immediate resistance at $740 to $750, which is the most recent intraday peak on Bitfinex. Analysts say that if momentum keeps going, a confirmed daily close above this level might start the next rally phase, with possible advances toward $800-$880. Some technical signals, such a falling flag breakout structure, suggest that even higher objectives could be possible if the market stays positive.

The Bollinger Bands are getting a lot wider, which means that the market is more volatile and moving in a strong direction. This growth usually happens with big price changes, which means that traders should be ready for big price changes in either direction.

Zcash’s Market Dynamics and Institutional Interest Drive Narrative

There have been many reasons for the amazing 1,500% rise since October, not just technical ones. The accumulation of institutions has sped up a lot, as shown by Cypherpunk Technologies (supported by the Winklevoss twins) announcing a $100 million treasury commitment to ZEC. The corporation presently has about 203,775 ZEC and wants to raise it to 5% of the overall supply, which might make it much harder to get cash.

Arthur Hayes, the former CEO of BitMEX, has said in public that Zcash is the second-largest liquid asset in his family office, Maelstrom, after Bitcoin. Hayes has said that ZEC might someday be worth 10–20% of Bitcoin’s market value. He points to the cryptocurrency’s privacy features and the fact that it may be undervalued compared to its technological possibilities.

There are now more than 30% of the total ZEC supply (around 4.9 million coins) in completely encrypted pools, which is the highest level of shielded transaction adoption ever. This is a 55% rise over the course of a month, which shows that people are really using it for more than just trading. The Zashi wallet’s impending release of better privacy capabilities, which will let people buy protected ZEC directly via NEAR Intent technology, could speed up this trend even more.

Zcash Price Predictions Range From Conservative to Aggressive

Short-term predictions say that ZEC might reach $877 by the middle of December 2025, which would be a 28% increase from where it is now. The monthly forecast is still very bullish, and technical models suggest that prices might rise by 6–7% a week, which could bring them toward $720–730 if the present mood stays the same.

Depending on the approach used, medium-term predictions for 2026 vary substantially. Conservative estimates put ZEC between $620 and $1,047, while more aggressive forecasts say prices might go above $2,300 if the privacy story keeps gaining popularity and institutional adoption speeds up. Analysts say that going above $880 would make it possible to test the $1,000 milestone, which is important for the mind.

But there are also bearish scenarios. Some technical analysts are worried about the RSI’s differences on daily charts. They think that if momentum fails, a double-top formation around $740 could lead to a decline toward $300-$370. The fact that there are a lot of leveraged bets, such a big short position on Hyperliquid that is currently losing over $22 million in floating losses, makes the situation more volatile.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM