Robotaxi Expansion Lifts Tesla Stock, Analysts Hike TSLA Target Above $500 Level

Although underlying risks and execution concerns indicate that the rally may yet face significant tests in the future, Tesla's most recent..

Quick overview

- Tesla's share price has surged nearly 9% this week, driven by optimism around its expanding robotaxi fleet in Austin.

- While the company's recent gains reflect renewed investor confidence, underlying risks and execution challenges remain significant.

- Analysts have turned more positive on Tesla's long-term potential, with price targets ranging widely, indicating differing opinions on the stock's future upside.

- Tesla's expansion into new markets, like India, signals ambition but also highlights the complexities and uncertainties of global growth.

Although underlying risks and execution concerns indicate that the rally may yet face significant tests in the future, Tesla’s most recent leap demonstrates growing trust in its autonomous ambition.

Rising Share Price Meets A Delicate Backdrop

Tesla shares extended their recovery on Wednesday as broader market sentiment improved, with the stock climbing close to 9% for the week. Optimism has been partly fueled by news that the company’s robotaxi fleet in Austin could double in the coming month, sparking renewed enthusiasm among investors eager to see autonomous mobility move from concept to reality. While the rally has been impressive, it arrives at a moment when risk appetite across markets remains fragile, and valuations in much of the technology sector are still under close scrutiny.

The bounce also follows a choppy period in which investors rotated away from high-growth names amid uncertainty around interest rates and slowing momentum across parts of the AI and EV landscape. Tesla’s latest gains therefore appear to combine renewed confidence in leadership with a broader relief rally in global equities, rather than reflecting a clear removal of all underlying risks.

Expanding Robotaxi Vision Raises Both Hopes And Questions

Elon Musk’s confirmation that Tesla intends to expand its robotaxi operations in Austin has once again placed autonomy at the center of the company’s long-term narrative. The service, which launched on a limited scale earlier this year, currently operates under controlled conditions and still relies on safety monitors inside the vehicles. Tesla has also secured an additional ride-hailing permit in Arizona, marking another step forward in its regional expansion strategy.

These developments point toward ambition and technological confidence. Yet they also highlight the regulatory and technical complexity involved in scaling fully autonomous services. Musk has previously spoken about rapid geographic expansion and the eventual removal of safety drivers, but such transitions require not only technical readiness, but also strong public trust and regulatory cooperation. Any delay or incident could quickly shift sentiment, reminding investors that autonomy carries both transformational potential and significant uncertainty.

Technical Strength Returns As Markets Stabilize

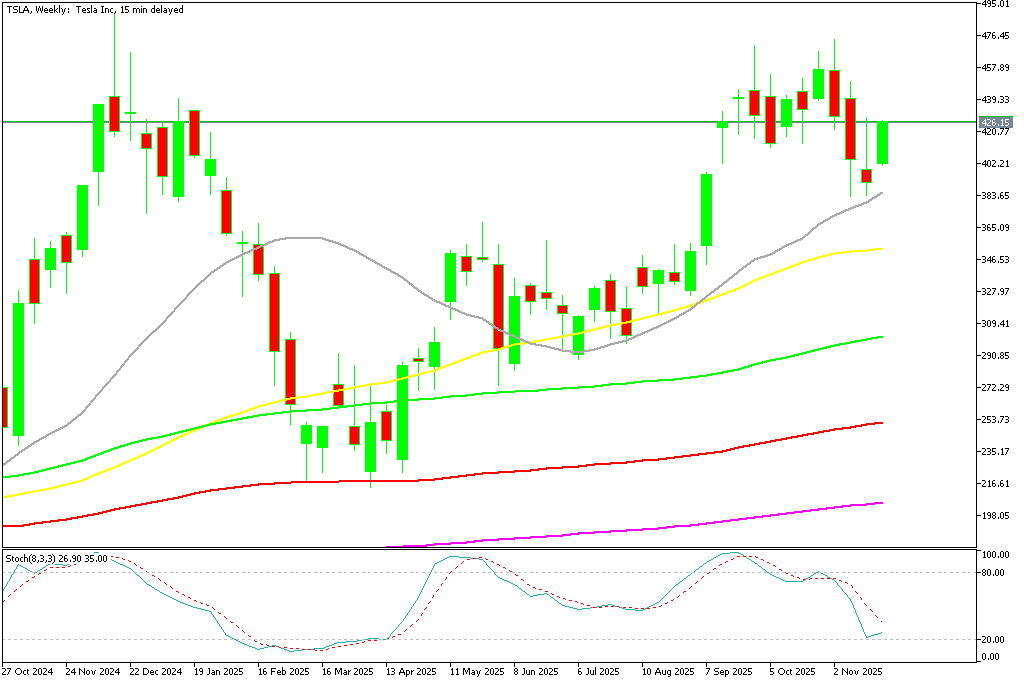

From a technical perspective, Tesla’s rebound has been notable. After a multi-week pullback, the stock found support near longer-term moving averages and reversed higher, gaining for several sessions in a row. A bounce of more than $40 from recent lows suggests that buyers were waiting for signs of stabilization before stepping back in.

TSLA Chart Weekly – Rebounding Off the 20 SMA

However, strong rebounds following sharp declines can sometimes reflect short-term positioning rather than a durable shift in long-term outlook. If broader markets stumble again or if expectations around rate cuts change, high-beta stocks like Tesla could quickly return to volatile conditions. The current recovery is therefore best viewed as encouraging, but still tentative within a wider and uncertain macro environment.

Analyst Optimism Builds Around Long-Term Potential

Wall Street sentiment has also turned more positive, with several analysts framing this period as a pivotal chapter for Tesla. With leadership questions around management compensation now settled, focus has moved back to innovation, particularly in Full Self-Driving development and future robotics integration. Some forecasts extend several years ahead, suggesting that autonomous ride-hailing could become a material revenue stream by the middle of the decade.

Several Wall Street analysts have recently updated their outlooks on Tesla, offering a wide range of proposed valuation levels. Over the past six months, a total of 23 analysts have published price targets for TSLA, resulting in a current median estimate of $435.00 per share.

Among the most notable updates, Vijay Rakesh of Mizuho set a target of $475.00 on November 25, 2025. Stephen Gengaro from Stifel followed with a $508.00 target on November 17, 2025. Daniel Ives of Wedbush delivered one of the more optimistic views, assigning a $600.00 target on November 7, 2025. John Murphy from BofA Securities placed his estimate at $471.00 on October 29, 2025, while Andres Sheppard of Cantor Fitzgerald issued a $510.00 target on October 27, 2025.

Together, these projections highlight both the renewed optimism around Tesla’s growth prospects and the considerable divergence of opinion regarding how much upside still remains in the stock.

Global Leadership Changes Signal Fresh Intent

Tesla’s recent leadership appointment in India has added another dimension to its international strategy. By placing an experienced executive at the helm of its efforts in one of the world’s fastest-growing EV markets, the company is signaling renewed intent to establish a meaningful presence there. India represents both an opportunity and a challenge, given regulatory complexity, price sensitivity, and evolving infrastructure.

Such moves support the narrative that Tesla is positioning itself for long-term global relevance. Still, success in new markets is rarely straightforward. Local competition, policy changes, and consumer dynamics can all influence outcomes, making this expansion an important but uncertain part of Tesla’s future equation.

Financial Signals Show Strength, But Costs Are Rising

Tesla’s most recent earnings report demonstrated resilience, with revenue growth and solid delivery numbers offering reassurance after a turbulent period. At the same time, increased spending on AI development, manufacturing upgrades, and future-focused projects has weighed on margins. This reflects a deliberate strategy to invest heavily in long-term capabilities, but it also means short-term profitability could remain under pressure.

Investors now face a balancing act: weighing present-day cost increases against the promise of future dominance in autonomy, energy storage, and advanced mobility. The outcome of that equation will largely depend on execution and timing.

Energy Storage And Regional Production Provide Stability

Beyond vehicles, Tesla’s energy division has quietly evolved into a critical growth driver. Record deployment figures and strong demand for storage solutions have helped diversify revenue streams and improve margin stability. Meanwhile, efficient production in China continues to support global output, even as some regions experience slower demand and intense competition.

These supporting pillars strengthen Tesla’s overall business model, yet they also tie the company to geopolitical, economic, and supply-chain risks that remain difficult to predict.

A Promising Path, But One That Requires Caution

Tesla’s recent share price surge reflects genuine progress, renewed confidence, and powerful long-term storytelling around autonomy and clean energy. Nonetheless, the journey ahead is not without obstacles. High expectations, capital intensity, regulatory hurdles, and evolving competition mean that volatility is likely to remain a constant companion.

For now, the rally is a reminder of Tesla’s enduring influence on market imagination — but also a signal that careful observation, rather than blind enthusiasm, remains the most sensible approach.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM