Cypherpunk Technologies Expands ZEC Holdings with $29M Purchase as Zcash Eyes $600 Breakout

Nasdaq-listed Cypherpunk Technologies (CYPH) has shown that it is serious about the privacy sector by buying a lot of Zcash (ZEC) tokens for

Quick overview

- Cypherpunk Technologies has invested $29 million in Zcash (ZEC), indicating growing institutional trust in privacy-focused cryptocurrencies.

- Zcash has seen an impressive 800% increase in value over the past year, outperforming Bitcoin amid rising concerns about digital privacy.

- The token is currently testing a critical resistance level around $550, with potential for further gains if it breaks through.

- Analysts are divided on ZEC's future, with some predicting a rise to $1,000 while others caution about possible declines to $400.

Nasdaq-listed Cypherpunk Technologies (CYPH) has shown that it is serious about the privacy sector by buying a lot of Zcash ZEC/USD tokens for $29 million. This shows that more institutions are trusting cryptocurrencies that protect privacy. ZEC is now trading above $525, but it has dropped 2.5% in the last 24 hours as it tests a key technical resistance zone.

Zcash’s Institutional Accumulation Accelerates

Winklevoss Capital-backed digital asset treasury business bought 56,418 ZEC at an average price of $514 per token. This brought its total holdings to 290,062.67 ZEC, or about 1.76% of the token’s circulation supply. This deliberate accumulation is part of a big goal to get 5% of ZEC’s total supply, which will put the company at the head of the privacy cryptocurrency movement.

Will McEvoy, the CIO of Cypherpunk, remarked, “We are well positioned for a market that is repricing the societal importance of privacy.” This statement shows the company’s broader goal. The company, which changed its name from Leap Therapeutics to Leap Therapeutics in November, has seen its stock price rise by around 170% since then. It is now selling at around $1.18, which shows that investors are excited about digital assets that focus on privacy.

Privacy Coin Narrative Drives ZEC’s 800% Gains in a 2025

Zcash has been quite strong in 2025, rising more than 800% from about $58 a year ago to about $536. This is a lot better than Bitcoin, which has dropped about 5% over the same time. The privacy-focused blockchain, which started as a Bitcoin fork in 2016, uses zero-knowledge proofs to confirm transactions without giving away the sender, receiver, or transaction data. This feature is getting more attention as people become more worried about government surveillance and the loss of digital privacy.

Important people in the sector have noticed. Arthur Hayes, the former CEO of BitMEX, said on Monday that ZEC might be getting ready to climb toward $1,000. He said this was because Federal Reserve funding methods might make zero-knowledge technology more liquid. Other crypto experts agree with him that privacy tokens are becoming more important as AI technology and digital surveillance improve.

Alex Bornstein, the executive director of the Zcash Foundation, says that the asset’s rise is due to natural demand caused by growing concerns about government overreach. This means that the surge is based on real market concern rather than speculation.

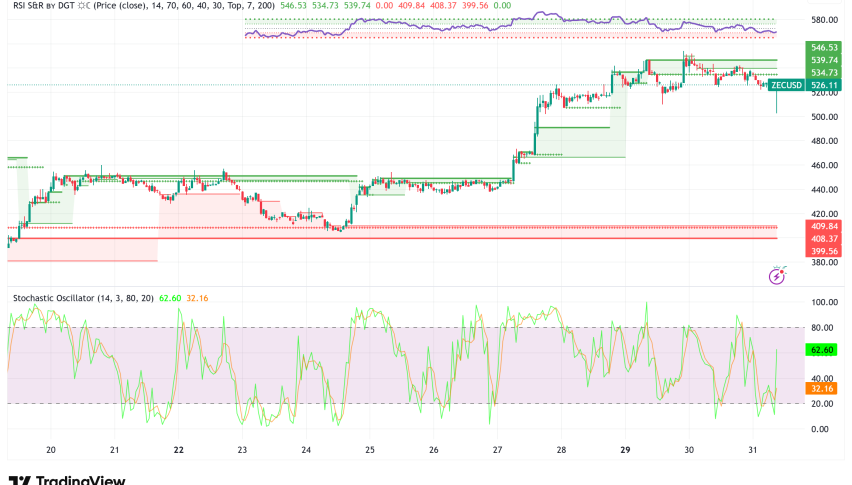

ZEC/USD Technical Analysis: Critical Resistance Test Ahead

From a technical point of view, ZEC is currently testing major resistance near $550 after bouncing off the support level of an ascending triangle pattern that has formed over the past few weeks. This bullish continuation pattern looks like accumulation and could mean more higher if resistance breaks.

If ZEC makes a clear move over $550, it will probably go up to $600, where it will face its next significant resistance zone at $616. If the momentum keeps up, the token might reach the $728 mark and then go for its all-time high. The Relative Strength Index is still above neutral, which shows that the market is still going up. However, the Stochastic Oscillator is now in overbought zone, which usually means that the market will consolidate or pull back in the short term.

But not all analysts are as hopeful. Eric Van Tassel said that a retreat to $400 is still feasible, especially if ZEC doesn’t break through the current resistance levels. If the lower edge of the ascending triangle breaks, bears might send prices down to the $375 support zone.

Zcash Price Outlook: Breakout or Breakdown?

The next several sessions will be very important for ZEC’s path. Bulls need to stay above $550 for a while to confirm breakout momentum. If they can’t break through this level, they might take profits and test lower support zones. Zcash seems to be in a good position to take advantage of macro tailwinds as institutional support grows and privacy concerns rise around the world. This is only true if technical resistance gives way to buying pressure.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM