Ethereum Holds Critical $3,100 Support as Staking Demand Surges to 30-Month Highs

Ethereum (ETH) is trading abovet $3,100 on January 20, 2026. It hasn't changed much after it fell 0.56% in the last 24 hours. The overall

Quick overview

- Ethereum is trading above $3,100 but has seen a slight decline of 0.56% in the last 24 hours due to selling pressure and technical resistance.

- Despite recent weakness, ETH has increased by 3.06% over the past week, indicating an underlying positive trend.

- Record staking demand and institutional accumulation through ETFs provide a bullish foundation for Ethereum, with significant amounts of ETH staked and positive inflows into spot ETFs.

- The price action suggests that holding the $3,100-$3,170 support zone is crucial for a potential rebound, while failure to maintain this level could lead to further declines.

Ethereum ETH/USD is trading abovet $3,100 on January 20, 2026. It hasn’t changed much after it fell 0.56% in the last 24 hours. The overall cryptocurrency market went up by a small amount (0.15%), but ETH has not done as well because of selling pressure in certain areas and rejection at important technical resistance levels. Even though it has been weak lately, the altcoin has gone up 3.06% in the last week, which means that the underlying positive trend is still there.

The latest price movement is happening in the middle of a perfect storm of opposing forces: institutional treasury sells putting pressure on prices, enormous staking demand showing long-term confidence, and important technical support levels being tested in real time.

Institutional Treasury Sale Adds Bearish Pressure

Foresight News says that institutional holder FG Nexus sold 2,500 ETH worth almost $8 million just a few hours ago, which added to selling pressure in the area. The company bought 50,770 ETH at an average price of $3,944 and still has 37,594 ETH in its treasury. When institutional investors make big sells like this, they typically set off algorithmic stop-losses and show that short-term confidence is dropping, especially when the market is less liquid.

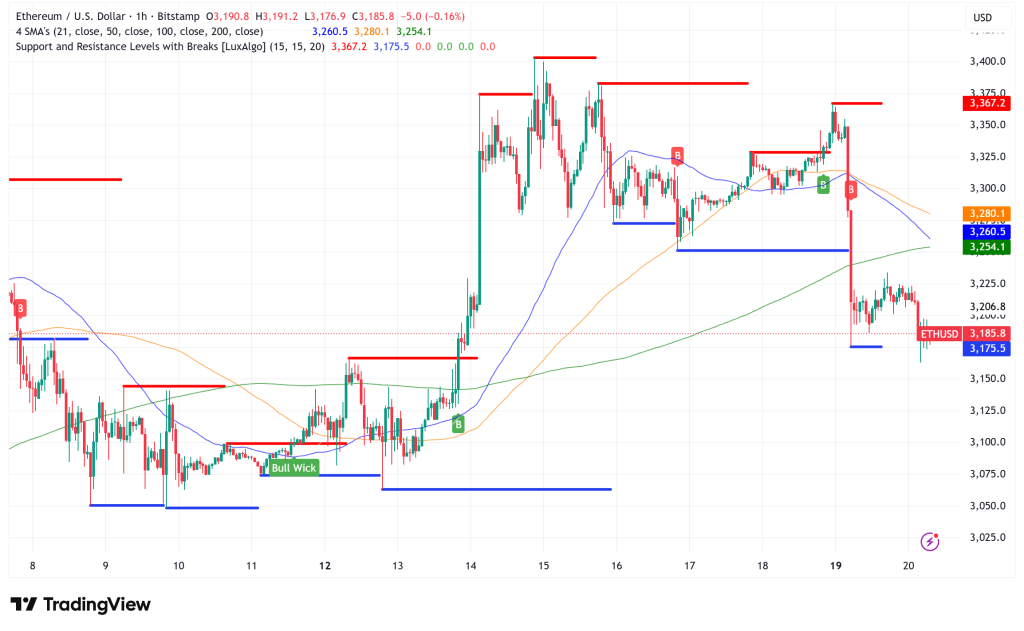

At the same time as this selling pressure, ETH failed to break over the $3,212 pivot point and the 200-day simple moving average (SMA) at $3,661. The Moving Average Convergence Divergence (MACD) histogram reading of +6.19 shows that the market is moving in a bullish direction. The Relative Strength Index (RSI) reading of 51.76 shows that the market is neutral, meaning it is neither overbought nor oversold.

Record ETH Staking Demand Provides Bullish Foundation

Ethereum’s staking fundamentals have reached amazing levels, even though the technical setup is negative. The validator entry line has grown to nearly 2.6 million ETH, which is worth $8.3 billion. This is the largest staking demand since July 2023. The wait time for new validators is now 44 days, which is what analyst Ted Pillows called “insane demand for staking ETH.”

The network’s supply-demand dynamics are getting a lot stronger now that there are 978,657 active validators and 29.76% of the entire ETH supply (around 36.1 million ETH) is staked. The validator exit queue has reduced to zero, which is probably more important because it removes a big source of possible selling pressure.

Leon Waidmann, a researcher at the Onchain Foundation, said that the last time the exit queue cleared was in July 2025. This was before a big rally that sent ETH to its all-time high of $4,950 on Coinbase in August 2025.

Institutional Accumulation Through ETFs Continues

Spot Ethereum ETFs have regained strength, with SoSoValue data showing that they saw positive inflows of $479 million over the past week. This comes after a short three-day period in early January when these funds lost $351 million.

According to Capriole Investments, the total amount of strategic reserves and ETFs held by everyone has gone up 10% from November 22, 2025, from 11.59 million ETH to 12.23 million ETH. These businesses and institutions now own 9.72% of all ETH, which is worth about $40.1 billion.

BitMine Immersion Technologies, which is led by Tom Lee and has the most Ethereum in its corporate treasury, is still doing a lot of staking. Last week, the company added 186,560 ETH (worth $625 million) to its staking address. This brought its overall staked value to 1.53 million ETH, which is 4% of all ETH staked on the Beacon Chain.

ETH/USD Technical Analysis: Critical Support Zone at $3,100-$3,170 Under Test

Based on Glassnode’s cost basis distribution statistics, almost 3.27 million ETH were bought at an average price of between $3,100 and $3,170. This created a strong support zone. This price level is the same as the 21-day SMA, which MN Capital founder Michael van de Poppe says is important for keeping bullish momentum going.

Tyrex, a crypto expert, says that Ethereum’s 4-hour chart displays patterns that are worrying. ETH has tried the same support region around $3,260 many times, and each time it does, the zone gets weaker. The expert says that if the price drops below $3,230, it might drop to the $3,209-$3,221 region, which would be a 3% reduction from where it is now.

Ethereum Price Prediction: Path Forward Depends on $3,100 Hold

Over the next several weeks, the technical and basic picture for Ethereum shows two different possibilities:

- Bullish Case: If ETH can hold the $3,100-$3,170 support zone, the combination of record staking demand, institutional accumulation, and robust ETF inflows might lead to a long-term rebound. If the price goes back over the $3,212 pivot point, it might challenge the $3,400 resistance zone. This could lead to a rise toward $4,000 and maybe even a retest of the all-time high of $4,950 set in August 2025.

- Bearish Case: If the price doesn’t stay above $3,100, it could drop much more, with analyst Tyrex setting initial downside targets in the $3,200–$3,220 region. If there is a further breakdown, ETH might go down to the next key support level near $3,000, which is about 6–7% lower than where it is now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account