Solana Plunges 7.2% Amid Market Turmoil Despite Major Institutional Wins

Solana (SOL) is down 7.2% over the last day, trailing the 6% fall in the overall cryptocurrency market. It is currently trading around $114

Quick overview

- Solana is down 7.2% in the last day, reflecting a broader cryptocurrency market decline of 6%.

- The selloff was primarily driven by Bitcoin's 7% drop, leading to $1.75 billion in forced liquidations across the market.

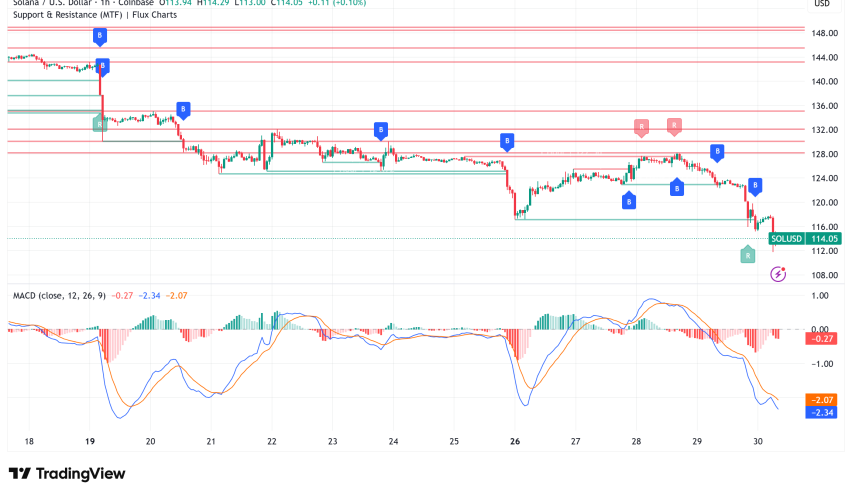

- Technically, Solana has breached critical support levels, indicating a negative short-term outlook despite recent institutional adoption developments.

- In the medium term, institutional validation may help Solana recover if macro selling pressure eases.

As of this writing, Solana SOL/USD is down 7.2% over the last day, trailing the 6% fall in the overall cryptocurrency market. It is currently trading at about $114. The precipitous decrease comes despite considerable positive developments on the institutional adoption front, showing how macro-driven selling pressure can overwhelm fundamental catalysts during periods of market stress.

Bitcoin-Led Liquidation Cascade Triggers Altcoin Selloff

The primary impetus for Solana’s loss is a broader market selloff spurred by Bitcoin, which plunged 7% to about $82,000 on January 30, 2026. Within a day, this led to a staggering $1.75 billion in forced cryptocurrency liquidations throughout the market, of which $70.34 million came from SOL.

This selloff’s mechanisms are typical of leveraged market corrections: traders with leveraged long holdings across altcoins face margin calls when Bitcoin BTC/USD breaks important support levels, which forces automated selling and generates a negative feedback loop. As risk-averse attitude predominated on trading tables, Solana, one of the larger-cap cryptocurrencies, faced increased selling pressure.

The question now is whether Bitcoin can stabilize over the $80,000 psychological level. Another wave of liquidations might be triggered with a breakdown below this mark, which could simultaneously pull SOL lower.

SOL/USD Critical Technical Support Levels Breached

Technically speaking, Solana has penetrated a number of crucial support zones. The asset went below its daily pivot point of $119.4 and critical Fibonacci support near $122.44, signaling a loss of buyer conviction at these levels.

Technical indicators present a negative picture in the short term. Strong negative trend is confirmed by the MACD histogram at -1.71, and SOL is firmly in oversold territory according to the 7-day RSI reading of 29.86. Analyst Larskooistra observes that SOL has completed a Model 2 accumulation schematic and acquired buy-side liquidity before breaking market structure back to bearish, creating supply pressure in the process.

The breach below pivot support often stimulates algorithmic selling and stop-loss orders, intensifying negative swings. While the oversold RSI shows selling pressure may be nearing exhaustion, technical indicators alone don’t guarantee a rapid reversal without a fundamental catalyst.

Institutional Adoption Provides Long-Term Foundation

This week, Solana earned significant institutional validation despite the negative pricing action. Regulated money market funds are now settling natively on the Solana blockchain thanks to WisdomTree’s $159 billion fund infrastructure deployment. The Government money market digital fund already owns around $730 million in on-chain assets, illustrating actual institutional capital moving onto Solana’s network.

Furthermore, 21Shares introduced the first Jito-staked Solana ETP in Europe, which is traded on Euronext Amsterdam and Paris under the ticker JSOL. By providing exposure to JitoSOL, which has a market capitalization of about $1.67 billion, the product enables investors to profit from staking yields on liquid tokens without having to handle validator activities personally.

By allowing millions of SOL-based tokens to trade utilizing on-chain liquidity rather than centralized order books, Coinbase’s connection with Jupiter Exchange enhances Solana’s infrastructure even more.

Solana Price Prediction and Outlook

Near-term (1-2 weeks): Bearish to neutral. Solana’s immediate price response rests greatly on Bitcoin’s ability to hold $80,000. SOL may try to retake the $119 pivot level if BTC stabilizes. If Bitcoin is unable to maintain support, SOL may move toward the $105–$110 level, where the next liquidity objective is equal lows.

Cautiously optimistic in the medium term (one to three months). Institutional adoption events, such as WisdomTree’s implementation and possible US clearance of JitoSOL ETFs, may assist SOL separate from more general market weakness once macro selling pressure has subsided. A daily close above $119.4 would signify the first step toward stabilization, with $130-$135 being early resistance levels.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM