Nvidia NVDA Stock Heads to $150 After Failing at Key Area on $100B OpenAI Deal Uncertainty

Because of transaction concerns, geopolitical threats, and insider selling, investors have become more cautious, making it difficult Nvidia

Quick overview

- Nvidia's stock has fallen approximately 3.5% as uncertainty surrounding its investment in OpenAI and geopolitical risks weigh on investor sentiment.

- The company's exposure to China remains a significant concern, with regulatory complexities and delays in chip deliveries complicating revenue visibility.

- Insider selling and the inability to reclaim key technical levels have contributed to a perception that Nvidia's growth story may be losing momentum.

- Despite strong quarterly revenue, investors are wary of shrinking gross margins and the potential for a more capital-intensive business environment.

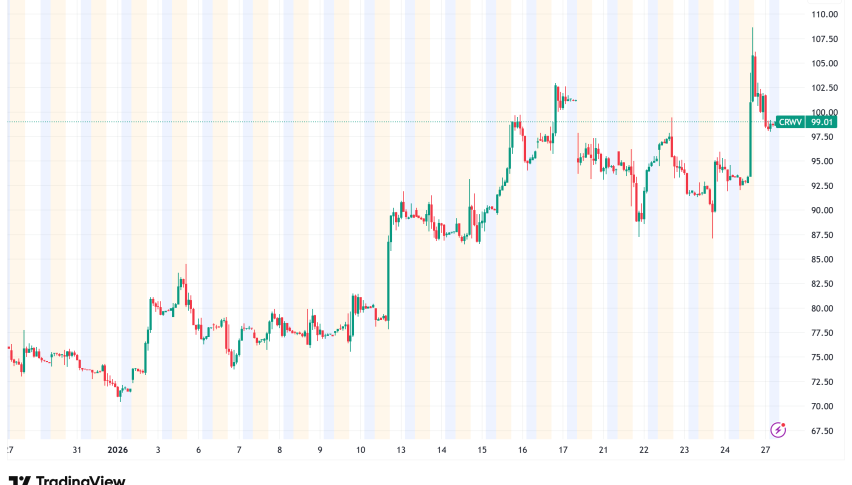

Live NVDA Chart

[[NVDA-graph]]Because of transaction concerns, geopolitical threats, and insider selling, investors have become more cautious, making it difficult for Nvidia to restore its upward momentum.

Nvidia’s Uptrend Fails to Restart

Nvidia entered the new week on the back foot once again, reinforcing concerns that the stock’s powerful multi-year rally may be losing steam. Shares fell roughly 3.5% on Monday, extending recent weakness after reports suggested Nvidia’s highly publicized investment in OpenAI may not proceed as originally outlined.

The inability to reestablish an uptrend has taken on added significance. After repeated failures to reclaim key technical levels, the market is beginning to treat Nvidia less as an untouchable growth story and more as a stock vulnerable to disappointment. In an environment where expectations were once relentlessly optimistic, sentiment is now far more conditional.

OpenAI Deal Uncertainty Undermines Confidence

According to reports citing people familiar with the matter, discussions between Nvidia and OpenAI have slowed materially. Nvidia had previously indicated it could invest up to $100 billion in the artificial intelligence firm and support the construction of massive computing infrastructure.

Subsequent comments from CEO Jensen Huang complicated the picture. Huang reportedly told industry contacts that the proposed investment was non-binding and far from finalized, while also expressing reservations about OpenAI’s business model and intensifying competition from rivals such as Google and Anthropic.

Over the weekend, Huang dismissed claims of dissatisfaction with OpenAI as “nonsense,” but reiterated that Nvidia’s investment would not exceed $100 billion. While he confirmed Nvidia’s participation in the funding round led by OpenAI CEO Sam Altman, the shifting tone around deal size and commitment unsettled investors rather than reassured them.

Market participants appear increasingly uneasy with ambiguity at this scale. As Cleo Capital’s Sarah Kunst noted, uncertainty around the ultimate size and structure of the deal is likely contributing to investor caution.

China Exposure Remains the Core Risk

Beneath the OpenAI headlines lies a deeper and more persistent concern: Nvidia’s exposure to China. While recent regulatory updates offered partial relief, they stopped well short of delivering clarity.

The U.S. Commerce Department confirmed that exports of Nvidia’s H200 AI chips to China may continue, but only under significantly tighter oversight. Each shipment must now be independently tested to ensure compliance with U.S. restrictions on AI performance thresholds.

This is not a clean reopening of a crucial market. Instead, it introduces layers of friction that complicate revenue visibility. Testing delays, approval bottlenecks, and uncertainty around shipment volumes all make forecasting increasingly difficult. For investors, conditional access is a far cry from regulatory stability.

Logistics and Enforcement Risks Intensify

Those concerns were amplified by reports that Chinese customs authorities delayed deliveries of Nvidia’s H200 chips. Industry sources indicated that some suppliers paused production after shipments were held at ports, highlighting how enforcement risk persists even when exports are technically permitted.

The episode rattled chip and technology stocks broadly, reinforcing how sensitive the AI hardware trade has become to incremental regulatory and logistical disruptions. Strong demand alone is no longer sufficient; execution timing now plays an outsized role in determining realized revenue.

For Nvidia, that represents a meaningful shift. The market is increasingly focused not on how many chips could be sold, but on how many can actually be delivered.

Restrictive Sales Terms Signal Unease

Further underscoring the fragility of the situation are reports that Nvidia now requires Chinese customers to pay fully upfront for H200 orders. These sales are reportedly non-refundable, non-cancelable, and not subject to reconfiguration.

While such terms protect Nvidia from sudden policy reversals, they also signal a lack of confidence in regulatory durability. If approvals were secure and predictable, such restrictive conditions would likely be unnecessary. Their existence reinforces the idea that Nvidia is operating in a narrow corridor of conditional acceptance rather than a stable commercial framework.

Geopolitics Re-Enter the Equation

Geopolitical tension has added another layer of uncertainty. Renewed trade rhetoric from President Trump, including disputes involving Greenland and broader tariff threats, has put policy risk back into sharp focus.

Although Nvidia is not directly targeted, the company’s reliance on global supply chains makes it particularly sensitive to deteriorating trade relations. Even indirect escalation can weigh on sentiment, especially when combined with already elevated regulatory scrutiny.

Valuation Pressure Begins to Surface

Nvidia’s underperformance relative to other mega-cap technology stocks is becoming more noticeable. The stock’s repeated failure to reclaim the $200 level has taken on psychological importance, reinforcing the perception that near-term upside may be capped.

At current valuation levels, Nvidia no longer benefits from the benefit of the doubt. Investors are no longer questioning the company’s technological leadership; they are questioning how much of that leadership is already priced in.

Insider Selling Adds to the Cautious Narrative

Finally, confidence took another hit after a Form 144 filing revealed that Nvidia officer Donald F. Robertson Jr. plans to sell up to 80,000 shares, worth approximately $15 million.

While insider sales are common and not inherently bearish, timing matters. With momentum fading and valuations stretched, such disclosures can reinforce perceptions that near-term upside is limited.

On its own, the filing was not market-moving. In context, however, it added weight to a growing sense that Nvidia’s rally is no longer one-directional—and that risks are beginning to command more attention than rewards.

Technical Picture Reflects Waning Momentum

Nvidia’s technical setup mirrors the shifting sentiment. The stock has slipped below its 20-week simple moving average (gray), a level that previously provided reliable support. That average has now turned into resistance, rejecting recent rebound attempts.

NVDA Chart Weekly – The 20 SMA Has Turned Into Resistance

Momentum indicators have weakened, and market participants are increasingly discussing the possibility of a deeper pullback toward the 50-week moving average (yellow). While the long-term uptrend remains intact, short-term control has shifted toward sellers.

Fundamentals Remain Exceptional—but Investment Costs Are Massive

From a business standpoint, Nvidia remains a powerhouse. The company recently reported quarterly revenue of $39.3 billion, far exceeding expectations, reaffirming its central role in the AI boom.

However, the market reaction was muted after management guided toward shrinking gross margins. Investors interpreted this as a sign that the AI “gold rush” phase—characterized by effortless margin expansion—may be giving way to a more capital-intensive reality.

In today’s environment, strong results are assumed. The question is whether Nvidia can continue to exceed already-elevated expectations.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM