Ethereum Slides Below $2,000 as “Final Capitulation” Fears Mount: Will ETH Bottom at $1,400?

With a 5.4% decline over the past day, Ethereum (ETH) has reached a high-volatility "danger zone," holding shakily at $1,900. There is more

Quick overview

- Ethereum has experienced a 5.4% decline, struggling to maintain its position above the critical $2,000 resistance level.

- Standard Chartered predicts Ethereum could drop to $1,400 before a potential recovery, maintaining a year-end target of $4,000.

- Technical indicators show a negative trend for Ethereum, with immediate resistance at $1,980 and primary support at $1,930.

- Despite current selling pressure, on-chain data reveals significant accumulation by 'whales,' suggesting potential for a future rebound.

With a 5.4% decline over the past day, Ethereum ETH/USD has reached a high-volatility “danger zone,” holding shakily at $1,900. There is more selling pressure on the second-largest cryptocurrency by market capitalization as it was unable to hold above the key $2,000 resistance line. The current structure, according to analysts, points to a shift from a correction to a more widespread phase of capitulation.

Targets Slashed by Standard Chartered: A Challenging Path to $4,000

On February 12, Standard Chartered published a research updating its short- and long-term predictions for the cryptocurrency industry, indicating a dramatic change in institutional sentiment. A “final capitulation period” is anticipated in the upcoming months, according to Geoffrey Kendrick, the bank’s Global Head of Digital Assets Research, who cautioned that the macroenvironment is still difficult.

Before the market reaches a real bottom, the bank now projects that Ethereum may drop as low as $1,400. Accelerated ETF withdrawals and a “risk-off” attitude among investors as they await a change in the Fed’s leadership in May are the causes of this updated prognosis. Kendrick maintains a year-end target of $4,000 for ETH, calling the $1,400 level a generational “buy-the-dip” opportunity, but the long-term perspective is still bullish.

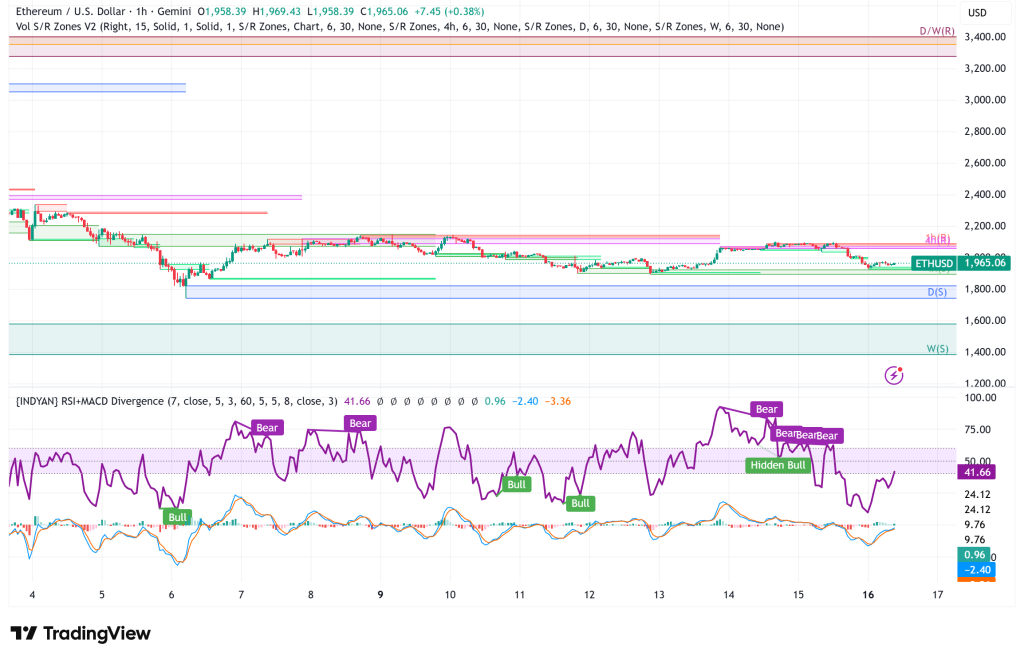

ETH/USD Technical Analysis: Bulls Retreat to the $1,800 Line

Ethereum’s technical structure has become resolutely negative. ETH failed to recover the 100-hourly Simple Moving Average (SMA) after breaking below a positive trend line around $2,035, indicating that the bears are still in complete control.

- Immediate Resistance ($1,980 – $2,000): Currently acting as a Bearish Rejection Zone, preventing a move back into positive territory.

- Primary Support ($1,930): Aligns with the 83.2% Fibonacci Retracement Level, serving as a critical floor for bulls.

- RSI (1-Hour): Currently Below 50, indicating Fading Momentum and a lack of buying pressure.

- MACD: Hovering in Negative Territory, signaling Increasing Bearish Momentum and the potential for further downside.

Ethereum Price Prediction: Short-Term Pain, Long-Term Gain?

In the middle of February, Ethereum finds itself in a technical “no-man’s land.”

- Bearish Scenario: If there is persistent pressure below $1,930, the lower consolidation zone of $1,747 will probably be retested. A decline to $1,400 would be consistent with the “CME gap” and institutional accumulation zones in a larger market wash-out.

- Bullish Scenario: Bulls must first clear $2,025 with high volume in order for a recovery thesis to hold. The first indication that the trend is turning around and heading back toward the $2,400 resistance would be the recovery of the upper consolidation level at $2,149.

On-chain data indicates that “whales” (wallets holding 10K–100K ETH) amassed over 520,000 ETH during the early February slump, despite the fact that retail selling pressure is still significant. This covert accumulation implies that even though the price is currently down, the structural groundwork for a late-2026 rebound is being subtly established.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM