Is The Trend Changing In AUD/USD?

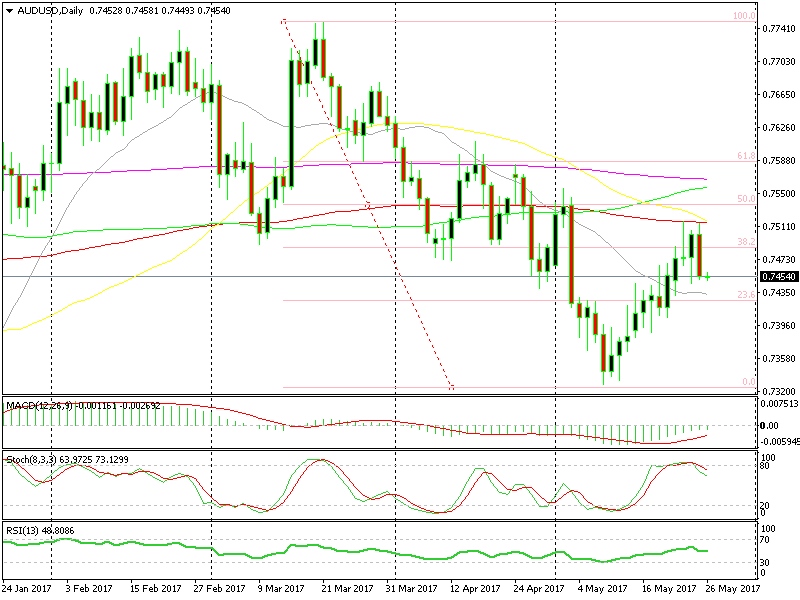

AUD/USD has been in an uptrend for more than two weeks now. That was partly due the recent USD weakness and partly due to the positive sentiment towards the commodity currencies.

We didn’t make much of this AUD uptrend, but we utilized the 200 pip climb in NZD/USD. We opened several buy forex signals there, all of which closed in profit.

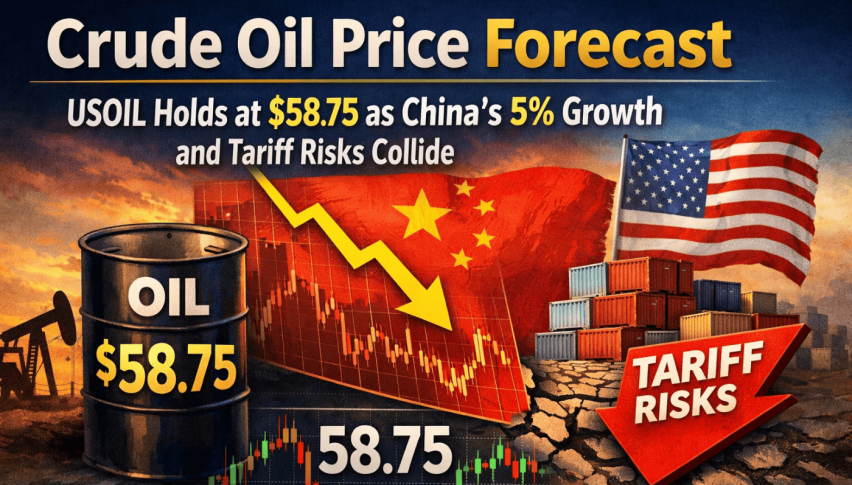

Anyhow, today the Buck has found some support and the commodity currencies have lost some of their shine, particularly AUD/USD, which has closed about 50 pips lower. Actually, the CAD was the biggest loser since it has lost nearly 100 pips, but that came from the three and a half cents crumble in oil prices.

Back to AUD/USD… I think that this climb has run its course. On the daily chart, the stochastic indicator is overbought which means that this forex pair is also overbought, so the uptrend must be over. Besides that, the 100 SMA (red) has been providing solid resistance, so this makes it two important indicators signaling a trend reversal.

Looking at the bigger picture, this is part of the larger downtrend. We see that the downtrend started back in March and has climbed the last two weeks and stopped just shy of the 50% Fibonacci retracement level.

The top seems to be in place

The top seems to be in place

Speaking of Fibonacci, this is not the best indicator out there and you see that moving averages are a lot more precise in providing support/resistance, but you get the idea that the recent uptrend – or better yet, the pullback of the bigger downtrend – is over.

We could have sold this pair today but the reverse happened during the night, so if we see it climb back above 0.75 we might open a long-term sell forex signal, aiming 150-200 pips as the first target, but with a much bigger potential.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account