Trading The NFP (Non-Farm Payrolls): What is NFP and How to Trade It In Forex?

The US non-farm payroll report is arguably the most important and volatile release in any given month. Traditionally, markets respond with huge moves on the release of the data.

For that reason, understanding how to trade the NFP in forex markets is both a vital skill for traders and one that can be very lucrative.

WHAT IS NFP?

NFP is the abbreviation for non-farm payrolls. It forms part of the monthly US employment report from the U.S. Bureau of Labor Statistics.

The NFP report shows the total number of paid workers in America not including seasonal farm workers, government workers, private household employees and employees of nonprofit organizations.

The point of the NFP report is to show how many new jobs were created in the prior month not including seasonal related jobs like farming. This gives us a metric that can be easily compared, month over month and year over year, to help better understand that state of the US economy.

As a part of the broader employment data release from the U.S. Bureau of Labor Statistics, we also get data on the US unemployment rate and growth in wages as well as a breakdown of different employment sectors.

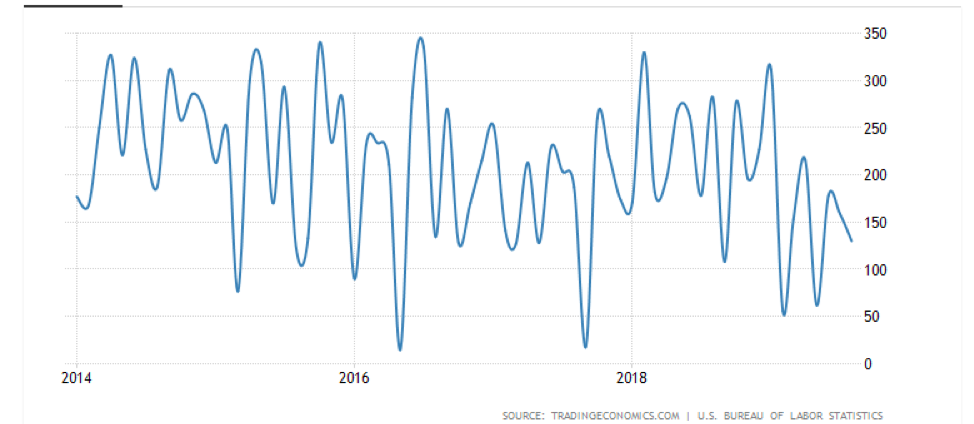

Monthly Non-Farm Payroll Data

Source: Trading Economics

HOW DOES THE NFP AFFECT FOREX?

The NFP report is a key measure of the state of the US economy. Jobs are the lifeblood of any economy and if more jobs are being created, it is a sign of a healthy and strong economy.

When jobs are created, that helps put pressure on employers to raise wages which in turn, gives workers more money to spend. That leads to growth in spending which lifts both GDP and inflation.

As a result, the NFP report is closely watched, particularly in forex markets, as there is a direct relationship between the level of job creation and interest rates. If jobs are strong and the economy is strong, interest rates will likely be rising. Conversely, weak jobs and low wages will cause the US Federal Reserve to cut official rates to help stimulate growth.

For those reasons that we will often see significant moves in forex markets, after the release of the NFP report.

NON-FARM PAYROLL RELEASE DATES

The NFP report is released on the first Friday of every month and 8:30 am US EST.

TRADING THE NFP DATA RELEASES: TOP TIPS & FURTHER READING

The NFP report is arguably the most important fundamental data point for the US economy. So while interest rates changes also have a big impact on forex, it is important to note that they change as a result of the NFP report. Effectively, interest rates are lagging indicators of what is going on in the economy. The NFP report is more of a leading indicator of how healthy the US economy is.

Given the power of the NFP report in forex markets, it is important to firstly understand the best way to trade the release.

Like anything in trading, that absolute value of the NFP report isn’t as important as the expectation.

For example, just because there are 200,000 new jobs created in the prior month, isn’t necessarily going to be enough information for us to trade-off. That’s because the moves that occur based on the NFP report are based on what the market was expecting.

Before every release on the economic calendar, analysts and economists get surveyed about their expectations and a consensus number is formed.

So in our prior example, if the expectation or consensus was for 100K new jobs to have been created, and the actual result is 200K, then that is a positive result and markets such as the SPX and USD, would likely rise.

Conversely, if the expectation going into the NFP report was for 300K new jobs to have been created in the last month and the actual result was 200K, then that would be seen as a negative.

That would likely send the risk assets like the SPX falling and safe-havens or risk-off type assets such as GOLD higher.

There is also the need to factor in what the report will mean for underlying interest rates in the US. For example, if the FOMC is looking to cut interest rates and is maintaining a dovish stance on monetary policy, a poor NFP report, one where the headline number falls below expectation, could be seen as a positive outcome as that would lead to a cut in interest rates.

So before trading the NFP report, it is important to clearly gauge the underlying sentiment of the overall market.

NFP FOREX TRADING STRATEGIES

NFP Forex trading strategies are a good fit for the more advanced trader. That’s because the NFP report brings with it increased volatility. We also see a significant reduction in liquidity in the lead-up, which makes spreads wider and risk higher.

So as a general rule, it is advisable not to trade off the release itself and even holding trades into the release is not something new traders should be doing.

The most effective strategy for trading the NFP report is to combine a combination of both technicals and fundamentals.

Firstly, you need to identify the forex pair that might be most impacted by the result. Clearly the USD will be heavily impacted.

A good choice would be the EUR/USD or GBP/USD based on strong liquidy.

Remember that a result that sees the NFP report beat expectations, will likely be a positive for the USD.

So that would mean that the EUR/USD or GBP/USD would likely trade inversely to the announcement.

As mentioned, we want to try and combine both technicals and fundamentals.

It’s very important that we don’t trade around the actual release itself. You don’t want to have an open position going into the NFP report and you don’t want to trade in the minutes following it.

You will often see price trading in wide ranges and whipsawing back and forth. That is oftentimes simply just traders executing market orders and stops getting hit. There is no real follow-through and not much to be gained by being involved.

However, in the 30-60 minutes following the release, the price will start to move and ideally trend in one direction.

Remember, the NFP report is a key fundamental catalyst. It will drive the price. From here we use technicals to build out a strategy.

We don’t care about the result of the NFP report, we are simply looking to go with the momentum.

Prior to the release, you should identify key support and resistance levels on a 30-60 minute chart. Then when price breaks through these levels, you’re able to use them as your entry signal.

That way you are buying strong pairs above key resistance and shorting weak pairs below support, with a fundamental catalyst behind them.

NFP FOREX TRADING EXAMPLE

EUR/USD – 5min.

In this example, the market expectation was for 160K new jobs to be created in the prior month. The actual result came in below expectations, which was, therefore, negative for the USD.

That would give us an upside bias here in the EUR/USD as we expect the Greenback to weaken.

As you can see on the chart, there was a bit of whip back and forth on the bar when the NFP report was released. As mentioned, we need to avoid the minutes after the release.

We can also see that there was a round number resistance level at 1.040 that was a good level to key off, post the NFP report.

Once price breaks through the 1.040 resistance level on a 5 min chart we are then looking at a possible long entry. As we have our fundamental driver (NFP report) and a key technical level.

As you can see, price first breaks through and then pulls back, tests that support and holds.

When prices closes above 1.040 on the pullback, that is a good long entry signal.

At FX Leaders, we like to look for 30 pips of upside and risk the same sort of amount to the downside. As you can see, price moved cleanly into the next round number resistance level at 1.0450, giving us a quick and easy profit on the trade.

Remember, trading around data releases is a more advanced skill particularly big ones like the NFP report. NFP forex trading is a skill that you can build over time, but always be cautious given the lack of liquidity and potential for big moves in either direction.