10 Best Forex Brokers Accepting Mobile Money

10 Best Forex Brokers Accepting Mobile Money Revealed. We have reviewed brokers and tested several prominent Forex brokers to identify the 10 best.

10 Best Forex Brokers Accepting Mobile Money (2026)

- Exness – Overall, The Best Forex Broker Accepting Mobile Money

- Axi – Pro account with tight spreads and ECN execution

- XM – Convenient and accessible payment options

- Pepperstone – Mobile Money transfers, enhancing accessibility and convenience

- HFM – Deposits and withdrawals via mobile money

- Tickmill – Fast execution and various account types

- FBS – Deposit and withdraw funds directly through the FBS app

- CM Trading – Integration of various mobile payment options

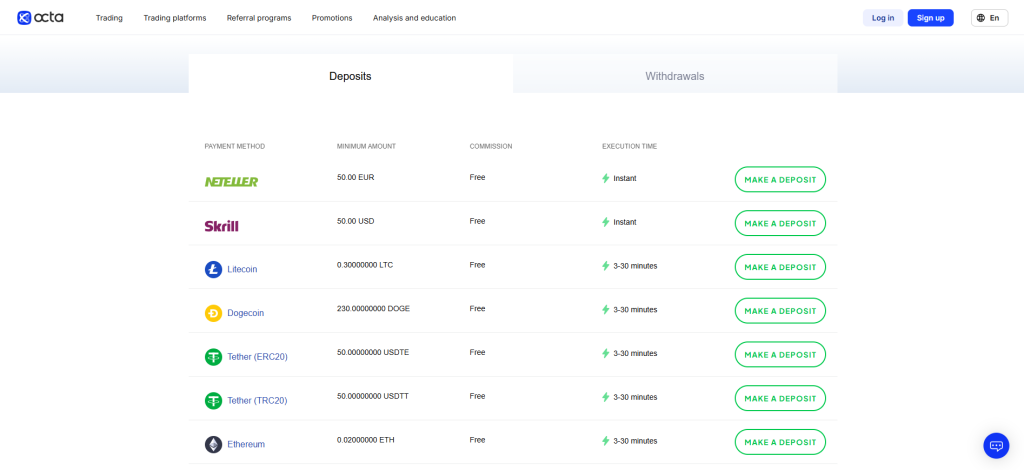

- Octa – User-friendly mobile app, copy trading, educational resources

- Swissquote – payment methods, including Apple Pay, Google Pay, Samsung Pay, and Twint.

Top 10 Forex Brokers (Globally)

1. Exness

Exness is a globally regulated forex and CFD broker that accepts mobile money deposits such as M-Pesa and MTN Mobile Money. It offers low minimum deposits, tight spreads starting from 0.0 pips, and leverage up to 1:2000.

With support for MetaTrader 4 and MetaTrader 5 platforms and fast withdrawal options, Exness is well-suited for traders in Africa and beyond.

Frequently Asked Questions

Does Exness accept mobile money?

Yes, Exness widely supports mobile money payment methods, especially in regions like Africa where it’s a popular choice. They integrate with various local mobile money services to facilitate convenient and often instant deposits and withdrawals.

Is leverage high at Exness?

Yes, Exness offers extremely high leverage. For eligible trading accounts with equity below $5,000, they provide “1:Unlimited” leverage. However, higher equity levels or specific regulatory entities have maximum caps, often up to 1:400 or 1:2000.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Regulation | Investor Protection Not Universal |

| Low Minimum Deposit | Limited Education Resources |

| Supports Mobile Money | Complex Leverage Conditions |

| High Leverage Available | No Bonuses or Promotions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is an authorized and globally recognized forex broker offering tight spreads, high leverage, and mobile money support. With reliable platforms and strong regulation, it provides a secure and accessible trading environment for all levels.

2. Axi

Axi is a globally regulated forex and CFD broker that accepts mobile money payments in select regions. It offers commission-free trading, spreads from 0.0 pips, and supports MetaTrader 4, making it ideal for beginners and advanced traders alike.

Frequently Asked Questions

Does Axi accept mobile money?

Axi supports various regional payment methods, which can include local banking transfers or specific payment services that operate similarly to mobile money in some countries (e.g., PIX in Brazil, PayNow in Singapore, 1-2-Pay in Thailand).

Which trading platforms does Axi offer?

Axi primarily offers the globally popular MetaTrader 4 platform across desktop, web, and mobile versions. They also support MetaTrader 5 in certain regions. Additionally, Axi provides its dedicated Axi Trading Platform (ATP) mobile app for convenient trading on the go.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Regulation | Fewer CFDs than competitors |

| No Minimum Deposit | Limited Bonuses/Promos |

| Mobile Money Support | Inactive Account Fee |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Axi is a legit forex broker regulated by top-tier authorities, offering low-cost trading, mobile money deposits, and MT4 access. It’s a solid choice for both beginners and experienced traders seeking a reliable platform.

3. XM

XM is a globally regulated forex and CFD broker that accepts mobile money payments like M-Pesa and MTN Mobile Money in supported regions. It offers low minimum deposits, zero commissions, and access to MetaTrader 4 and 5 platforms.

Frequently Asked Questions

Does XM accept mobile money?

Yes, XM accepts mobile money deposits, including popular providers like M-Pesa and Airtel Money. This allows traders to fund their accounts quickly and securely using their mobile phones, making XM especially convenient for clients in Africa and other regions.

Is XM suitable for beginners?

Yes, XM is suitable for beginners. It offers a low minimum deposit, user-friendly MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, and a Micro Account designed for new traders with small lot sizes to manage risk effectively.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-Regulated Broker | Limited Product Range |

| Low Minimum Deposit | Inactive Account Fee |

| Accepts Mobile Money | Not Available in Some Regions |

| Commission-Free Trading | Promotions Limited by Region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a legal and well-regulated forex broker offering low-cost trading, mobile money support, and powerful platforms like MT4 and MT5. It’s a solid choice for both beginner and experienced traders worldwide.

Top 3 Forex Brokers Accepting Mobile Money – Exness vs Axi vs XM

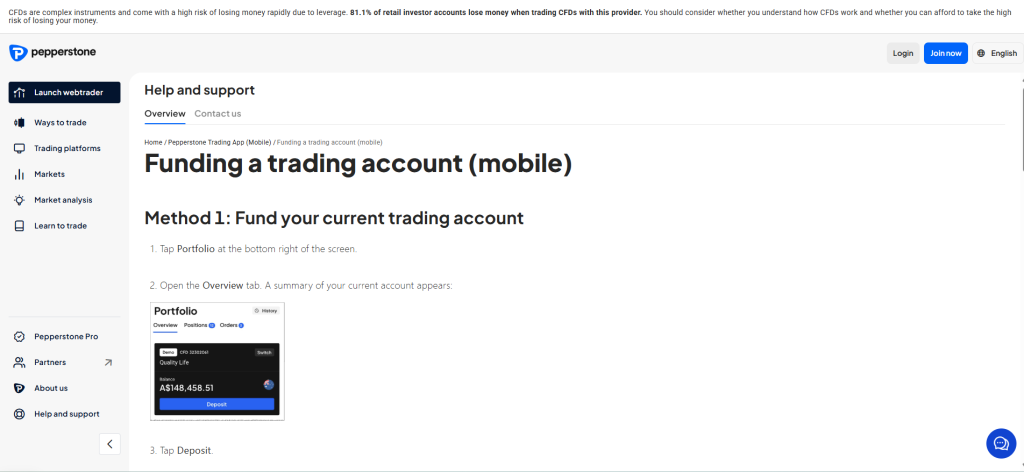

4. Pepperstone

Pepperstone is a globally regulated forex and CFD broker that accepts mobile money payments in supported regions. It offers low spreads from 0.0 pips, fast execution, and supports MetaTrader 4, MetaTrader 5, and cTrader platforms.

Frequently Asked Questions

Does Pepperstone offer MetaTrader platforms?

Yes, Pepperstone offers the MetaTrader platforms, including both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are available on desktop, web, and mobile devices, providing advanced charting, automated trading, and a wide range of trading instruments with fast execution and tight spreads.

Can I deposit using mobile money like M-Pesa?

Yes, Pepperstone accepts mobile money deposits like M-Pesa, allowing traders in Kenya, Tanzania, and Uganda to fund and withdraw from their accounts quickly and securely via their mobile phones. The process is simple with no broker fees.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strict Regulation | Limited Product Range |

| Tight Spreads | No Cent/Micro Accounts |

| Fast Execution | Inactivity Fee |

| Multiple Platforms | Mobile Money Region Restricted |

| Islamic Accounts Available | No Proprietary App |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is an approved and well-regulated broker offering tight spreads, fast execution, and strong platform support. It’s ideal for serious traders, though limited product options and region-specific features may not suit everyone.

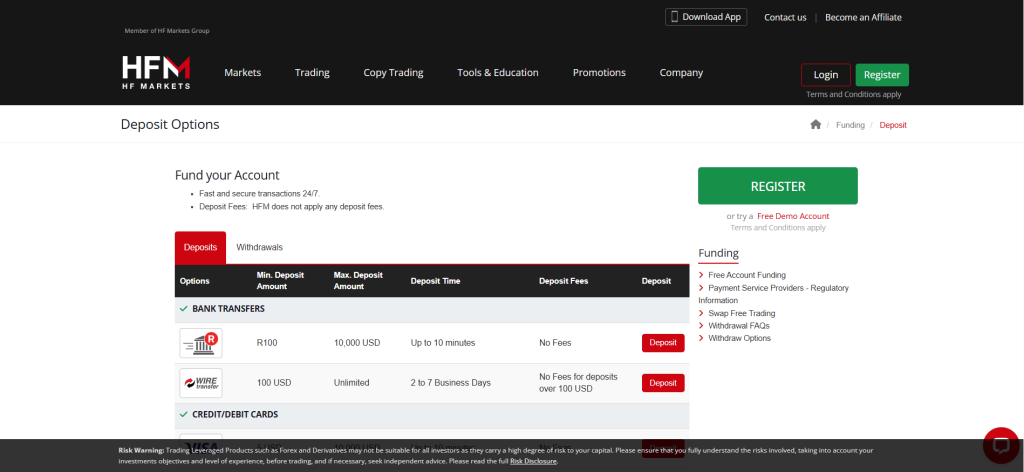

5. HFM

HFM accepts mobile money (M‑Pesa, Airtel Money, MTN Mobile Money) in Africa, with low minimums and no deposit fees.

Frequently Asked Questions

What trading platforms are offered?

HFM offers several trading platforms to suit different traders needs. These include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the HFM App for mobile trading. All platforms are available on desktop, web, and mobile devices, supporting a wide range of instruments.

Are Islamic (swap‑free) accounts available?

Yes, HFM offers Islamic (swap-free) accounts for clients who observe Sharia law. These accounts are available on multiple account types, including Cent, Premium, Zero, and Pro accounts, and do not incur interest charges on overnight positions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Global Regulation | Spread May Widen |

| Supports Mobile Money | Withdrawal Delays Possible |

| High Leverage Options | No Direct Stock/ETF Ownership |

| Multiple Account Types | Mobile Money Not Universal |

| No Deposit Fees | Inactivity Fee |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is an approved and well-regulated broker offering diverse account types, mobile money support, and access to over 1,200 CFDs. It’s ideal for global traders, though some features may vary by region.

6. Tickmill

Tickmill is a globally regulated FX & CFD broker with licenses from the FCA (UK), CySEC, FSCA (South Africa), DFSA, Seychelles FSA, Labuan FSA, CMA (Kenya), and SCB (Bahamas). The broker accepts mobile money in select regions, enabling seamless deposits and withdrawals via services like FasaPay, SticPay, UnionPay, and other e-wallets.

Frequently Asked Questions

What types of accounts are available at Tickmill?

Tickmill offers several account types to suit different traders. These include the Classic Account (commission-free with wider spreads) and the Raw Account (zero spreads on majors with commissions). They also provide Islamic (swap-free) account options and Demo Accounts for practice.

What trading platforms does Tickmill support?

Tickmill supports the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available as desktop, web, and mobile versions. They also offer integration with TradingView for advanced charting and their own dedicated Tickmill Trader mobile app, ensuring diverse trading options.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-Regulated Broker | Limited Product Range |

| Low Spreads | $100 Minimum Deposit |

| Low Commissions | No Proprietary Platform |

| Supports Mobile Money | Limited Crypto Selection |

| Advanced Platforms | Mobile Money Region Restricted |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a registered and trusted broker offering low spreads, fast execution, and strong regulation. It suits both beginners and professionals, though its product range and mobile money options may vary by region.

7. FBS

FBS accepts mobile money payments in supported regions, making it accessible for traders in countries like Kenya, Uganda, and Tanzania.

Frequently Asked Questions

What is the minimum deposit?

The minimum deposit at FBS depends on the account type, but it generally starts as low as $1 for the Cent and Micro accounts. Other account types, such as Standard or ECN, may require higher minimum deposits, from $5 upwards.

Can I open a Demo account?

Yes, you can open a demo account with FBS. Registration is free and simple—just provide your name and email, choose your desired platform and trading conditions, and start practicing with virtual funds in real market conditions without risking real money.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low Minimum Deposit | Limited Regulation for Global Clients |

| High Leverage | High Spreads on Some Accounts |

| Supports Mobile Money | Restrictions Based on Region |

| Wide Range of Accounts | Limited Educational Content |

| Multiple Trading Platforms | Crypto Trading Has Low Leverage |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FBS is a legit forex and CFD broker offering flexible account types, high leverage, and mobile money support. It’s suitable for beginners and experienced traders, though features and protections vary depending on your region.

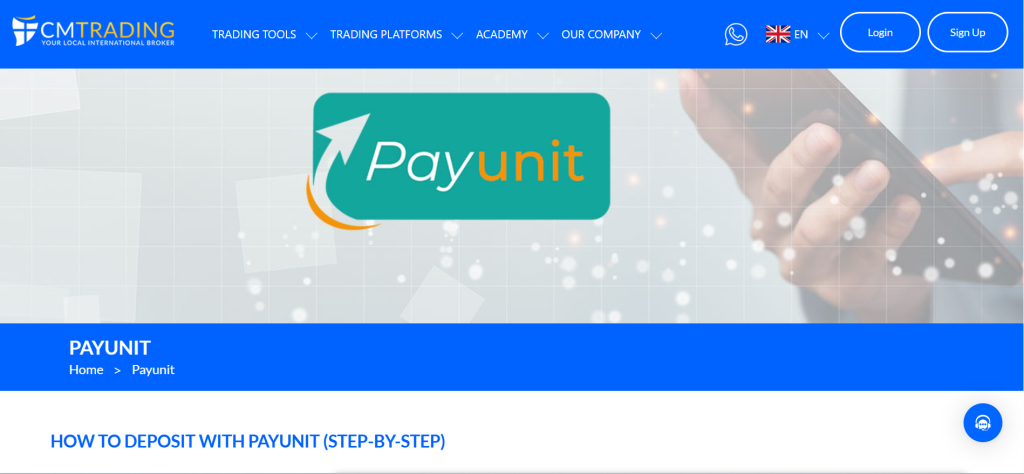

8. CM Trading

CM Trading supports mobile money payments such as M‑Pesa and Ozow, especially in African regions, with fast local processing. While it offers segregated client accounts, it does not officially guarantee negative balance protection.

Frequently Asked Questions

What’s the minimum deposit?

The minimum deposit at CM Trading starts from $100 for the entry-level (Bronze or Basic) account. Higher-tier accounts require larger deposits, but you can begin live trading with just $100, making it accessible for most new traders.

Can I use mobile money to deposit?

Yes, you can use mobile money to deposit with CM Trading. Supported options include M-Pesa, Airtel Money, Halopesa, and others, depending on your region. Deposits are processed quickly—typically within 20 minutes—for convenient and accessible funding of your trading account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong educational tools | Higher-than-average spreads |

| Social copy‑trading via CopyKat | Limited regulatory protection |

| Multiple account tiers | Customer support limited to 24/5 |

| MT4 platform availability | Withdrawal and inactivity fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐☆☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐☆☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐☆☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

CM Trading is a legal broker regulated by the FSCA and FSA, offering a solid platform with educational resources and mobile support. However, higher fees and limited regulation may affect trust for some traders.

9. Octa

Octa accepts mobile money for deposits and withdrawals in supported regions, making it convenient for users in Africa and Southeast Asia.

Frequently Asked Questions

What is the minimum deposit?

The minimum deposit with Octa is $25, depending on your region and payment method. This low entry requirement applies to all main account types, making Octa accessible for both new and experienced traders.

Which platforms can I trade on?

With Octa, you can trade on MetaTrader 4, MetaTrader 5, and OctaTrader platforms across web, desktop, and mobile. All three support forex, CFDs, indices, commodities, and cryptocurrencies, catering to both beginner and experienced traders with a $25 minimum deposit.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Competitive, ultra‑low spreads | Limited trading instrument |

| Low minimum deposit | No regulation from top-tier authorities |

| Supports MT4, MT5 and proprietary OctaTrader | Limited investor protection |

| Commission‑free & swap‑free trading | Delays on large withdrawals |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa is an affordable, user-friendly broker approved by multiple regulators, offering commission-free and swap-free trading. While ideal for beginners, limited asset variety and mixed user feedback may concern experienced traders seeking broader protections and features.

10. Swissquote

Swissquote supports Swiss TWINT payments via the Swissquote TWINT app for Swiss residents, enabling deposits and transfers via mobile wallet.

Frequently Asked Questions

Are mobile money deposits free?

Swissquote does not charge deposit fees for bank transfers, but deposits made with credit or debit cards incur a fee of 2.2%–2.5% depending on the currency. Mobile money solutions may depend on the payment provider used. Always check your funding channel before depositing.

Does Swissquote support automated trading or copy trading?

Swissquote fully supports both automated trading and copy trading. You can use MetaTrader 4/5 platforms for algorithmic trading via Expert Advisors, and access copy trading features to automatically replicate the strategies of successful traders directly on your account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly regulated | High minimum deposit |

| Strong reputation | Above-average spreads |

| Extensive asset range | Limited leverage |

| Mobile money accepted | Quarterly custody fees |

| Supports multiple platforms | Inactivity fee |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Swissquote is a well-established, registered broker offering secure multi-asset trading under top-tier regulation. While ideal for professionals, its higher minimum deposit and spreads may not suit beginners seeking low-cost entry.

What is Mobile Money?

Mobile Money is a digital payment service that allows users to store, send, and receive money using a mobile phone, without needing a traditional bank account.

Popular Mobile Money Services:

- M-Pesa (Kenya, Tanzania)

- MTN Mobile Money (Ghana, Uganda, Rwanda)

- Airtel Money (Zambia, Nigeria)

- Orange Money (West Africa)

- EcoCash (Zimbabwe)

Advantages:

- No bank account needed

- Fast and accessible

- Secure (PIN-based)

- Widely accepted in developing regions

Criteria for Choosing a Forex Broker that Accepts Mobile Money

| Criteria | Description | Importance |

| Mobile Money Compatibility | Broker supports deposits and withdrawals via services like M-Pesa, MTN, Airtel, etc. | ⭐⭐⭐⭐⭐ |

| Regulation & Licensing | Broker is registered with reputable regulatory bodies (e.g., FSCA, FCA, CySEC, etc.). | ⭐⭐⭐⭐⭐ |

| Minimum Deposit | The minimum amount required to start trading via mobile money. | ⭐⭐⭐⭐☆ |

| Withdrawal Speed | How quickly funds can be accessed after a withdrawal request using mobile money. | ⭐⭐⭐⭐☆ |

| Transaction Fees | Charges related to deposits/withdrawals through mobile money. | ⭐⭐⭐⭐☆ |

| Account Types Offered | Availability of standard, Islamic, demo, or micro accounts that support mobile money funding. | ⭐⭐⭐⭐☆ |

| Spreads & Trading Costs | Tightness of spreads and absence of hidden charges. | ⭐⭐⭐⭐⭐ |

| Platform Usability | Quality of mobile app and trading interface for mobile money users. | ⭐⭐⭐⭐☆ |

| Customer Support Availability | Access to responsive, multi-channel support (live chat, WhatsApp, local language, etc.). | ⭐⭐⭐⭐☆ |

| Security of Transactions | Use of encryption and protection for mobile money transfers. | ⭐⭐⭐⭐⭐ |

Top 10 Best Forex Brokers that Accept Mobile Money – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From security of funds to deposit fees, we provide straightforward answers to help you understand Mobile Money and choose the right broker confidently.

Q: Is it safe to deposit funds using mobile money on these platforms? – Victor M

A: Yes, with regulated brokers (like Exness, Pepperstone, and CM Trading), mobile money deposits are secure.

Q: What is the minimum deposit when using mobile money? – Moses T

A: The minimum ranges from $5 (FBS) to $1000 (Swissquote), depending on the broker and region.

Q: Are there any fees for depositing via mobile money? – Leah T

A: Most brokers offer free deposits, but some local payment channels might charge small transaction fees.

Q: How fast are mobile money deposits processed? – Kofi FX

A: Mobile money deposits are usually processed instantly or within minutes across most platforms.

Q: Which payment options other than mobile money are available with these brokers? – Susan F

A: Alternatives include bank transfers, credit/debit cards, Skrill, Neteller, and cryptocurrencies.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Convenient deposits & withdrawals | Limited availability |

| No need for a bank account | Lower transaction limits |

| Fast transaction processing | Potential service interruptions |

| Ideal for underbanked regions | Fees may apply |

| USSD-based access | Fewer top-tier regulated brokers |

| Increased financial inclusion | Fraud risk |

You Might also Like:

- Exness Review

- Axi Review

- XM Review

- Pepperstone Review

- HFM Review

- Tickmill Review

- FBS Review

- CM Trading Review

- Octa Review

- Swissquote Review

In Conclusion

Forex brokers that accept mobile money offer fast, accessible, and convenient funding options, especially for underbanked regions. While ideal for ease of use, it’s crucial to choose a regulated broker to ensure safety and transparency.

Faq

Yes, many trading platforms, especially those catering to African markets, offer mobile money as a withdrawal option. This is becoming increasingly common due to its convenience and widespread use. However, it always depends on the specific broker and their supported payment methods.

Yes, mobile money deposits often have limits. These vary depending on the mobile network operator, the specific mobile money service (e.g., Nedbank MobiMoney, MTN MoMo), and the user’s verification level. Daily and monthly limits are common to comply with anti-money laundering regulations.

Yes, some brokers, particularly those operating in regions where mobile money is prevalent, do offer deposit bonuses that can be claimed when funding your account via mobile money. These bonuses vary in type and size, but it’s important to check the specific terms and conditions.

Yes, it’s possible to open an Islamic account with a mobile money deposit option. Several brokers, particularly those catering to the African market, offer both Sharia-compliant “swap-free” Islamic accounts and mobile money as a funding method.

Some promotions might exclude certain deposit methods, including mobile money, or have specific minimum deposit requirements that mobile money transactions might not always meet due to transaction limits. Always check the specific terms and conditions of each bonus.