Forex Signals US Session Brief, March 9 – Stocks and Crude Oil Crash

The sentiment took another hit today and crude Oil got a double smack

The outbreak of coronavirus has been hurting markets, as well as the global economy in the last month or so and continues to take center stage in forex. But, there was a bigger event today, or over the weekend, better I say. As we know, OPEC failed to convince Russia to join them in cutting production by 1.5 million barrels/day last Friday. Apparently, Saudis got upset about it and they are trying to bankrupt Russia I assume. They threatened to increase production instead over the weekend, while Russia replied earlier today that the Russian state energy company Rosneft can also increase production by 300k barrels/day. As a result, Crude Oil opened with a $10 gap lower last night and continued lower in the Asian session, but has recuperated a bit.

On the other hand, coronavirus keeps weighing on the stock markets, as well as the USD. The Sentix investor confidence made a strong move down today, falling into negative territory again, while governments around the globe and central banks are panicking. The FED is expected to deliver an ever bigger rate cut this month, of 0.75% and bring the range to 0.0%-0.25% by July, which has been the main factor for the big bearish move in the USD in the last two weeks.

The European Session

- France preparing for Fiscal Stimulus – It seems like everyone is panicking from the spread of coronavirus. More than the number of deaths, governments are worried about the effect on the economy, with many planning to start fiscal spending. French finance minister, Bruno Le Maire made some comments about this early this morning:

- This will be discussed at the 16 March Eurogroup meeting

- French GDP could fall below 1% this year

- Need more economic coordination in Europe against the coronavirus outbreak

- Virus outbreak will have severe impact on the French economy

- Eurozone Sentix Investor Confidence – The Eurozone economy has been weakening considerably during the last two years in the Eurozone, due to the trade war, but also partly because of the central banks hiking interest rates, when the global economy got used to being on life support. As a result, the consumer confidence turned negative, bottoming at -16.8 points in October last year. But, it started improving after the European Central Bank cut deposit rates in September last year and reintroduced QE in November. The trade deal between US and China in January, as well as the Brexit deal improved the sentiment further and in December, the Sentix consumer confidence indicator came out of the negative territory in December. In January, it improved further to 7.6 points, but cooled off in February to 5.2 points, as coronavirus broke out in China. This month the virus has come to Europe, particularly in Italy, and I was expecting this indicator to weaken further and probably fall into negative territory again. It turned negative indeed, and missed expectations of -11.4 points, coming at -17.1 points instead.

- FED Now Expected to Go Down to 0% – The FED cut interest rates three times in summer last year, as the global and the US economy weakened considerably due to the trade war between US and China. The economy started to improve at the end of last year and the beginning of this year, after the Phase One trade deal.But, the outbreak of coronavirus is hurting the global economy enormously. Parts of China and Italy are completely shut down, as they try to tackle the virus. The Chinese economy fell in deep contraction in February, as the data released last weekend showed. Central banks are panicking, delivering surprise rate cuts in recent weeks, with the FED cutting rates by 0.50%. But, markets don’t think that’s enough. They are expected to deliver an even bigger cut later this month, by 0.75%, which would take rates to 0.25%-0.50%. Then, another rate cut is priced in on the July meeting, which would take interest rates down to the bottom, at 0%-0.25%, which was where they kept rates until a few years ago.

- IMF Advising on Fighting Coronavirus’ Impact on the Economy – IMF chief economist Gopinath made some comments earlier, about how to fight the coronavirus effect on the economy.

- Virus stimulus should be targeted for cash transfers, wage subsidies and tax relief

- Governments need ‘substantial’ targeted measures to combat economic drag from virus

- Rate cuts and monetary stimulus may instill confidence but likely effective only after business conditions normalize

- Central banks should be ready to boost liquidity and other lending to small business

- Governments should consider temporary loan guarantees

US Session

- Canadian Building Permits and Housing Starts – The daylight saving time shift took place yesterday in North America and the release time for the economic data from that region has changed. For two weeks, the economic data will be released an hour earlier form Americas. Today, the housing starts and the building permits reports were released from Canada. They both bet expectations and revisions for the previous months were positive, bu the CAD is not benefiting from it. Below are the reports:

- Canada February housing starts 210.1K vs 206.5K expected

- January housing starts 213k, revised to 214k

- January building permits +4.0% vs -3.0% expected

- December building permits 7.4%, revised to 9.9%

- Russia Continues the Oil War with Saudis – Bloomberg reported that Russia’s Rosneft is planning to boost oil production as soon as April 1.

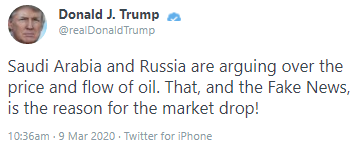

The person, who spoke on condition of anonymity, said that Rosneft had prepared for any scenario and would be able to withstand the current plunge in oil prices. Asked how rapidly Rosneft could increase production, the person said analysts who estimate the company could boost output by 300,000 barrels a day within a week or two are well informed.Russia’s finance ministry said earlier that the country’s oil-wealth reserves would be sufficient to cover lost revenue “for six to 10 years” at oil prices of $25 to $30 a barrel. - Trump Tweeting on the Market Crash – No one likes the market crash and the economic disaster from coronavirus, especially not Donald Trump. Elections are coming up in the US, so here’s Trump tweeting on it:

- Coronavirus Cases –

Country,

OtherTotal

CasesNew

CasesTotal

DeathsNew

DeathsTotal

RecoveredActive

CasesSerious,

CriticalTot Cases/

1M popChina 80,739 +44 3,120 +23 58,742 18,877 5,111 56.1 S. Korea 7,478 +165 53 +3 166 7,259 36 145.9 Italy 7,375 366 622 6,387 650 122.0 Iran 7,161 +595 237 +43 2,394 4,530 85.3 France 1,209 21 +2 12 1,176 45 18.5 Germany 1,164 +124 18 1,146 9 13.9 Spain 1,050 +376 26 +9 32 992 11 22.5 Diamond Princess 696 7 245 444 32 USA 566 +25 22 15 529 8 1.7 Japan 530 +28 9 +2 101 420 33 4.2 Switzerland 374 +42 2 3 369 43.2 Netherlands 321 +56 3 318 1 18.7 UK 321 +43 3 18 300 4.7 Sweden 248 +45 1 247 24.6 Belgium 239 +39 1 238 1 20.6 Norway 183 +7 1 182 33.8 Singapore 160 +10 93 67 10 27.3 Malaysia 117 +18 24 93 2 3.6 Hong Kong 115 3 59 53 6 15.3 Austria 112 +8 2 110 1 12.4 Bahrain 109 +24 14 95 64.1 Australia 93 +10 3 22 68 1 3.6 Greece 74 +1 74 1 7.1 Canada 67 +1 8 59 1 1.8 Iraq 65 6 1 58 1.6 Kuwait 65 +1 1 64 3 15.2 Iceland 60 +2 1 59 Denmark 59 +24 1 58 10.2 UAE 59 +14 12 47 2 6.0 Egypt 55 1 1 53 0.5 San Marino 51 +14 2 +1 49 5 Thailand 50 1 33 16 1 0.7 Taiwan 45 1 15 29 1.9 India 43 +3 4 39 Israel 39 4 35 1 4.5 Czechia 35 +3 35 3.3 Lebanon 32 1 31 3 4.7 Portugal 31 +1 31 3.0 Vietnam 31 +1 16 15 0.3

Trades in Sight

Bearish WTI Crude Oil

- The trend has turned bearish this year

- The pullback higher is complete

- The 20 SMA is acting as resistance

- Fundamentals point down

Buyers seem exhausted at the 20 SMA now

Crude Oil has been bearish since early this year, as the outbreak of coronavirus hurt the sentiment. Risk assets such as crude Oil turned bearish due to that and US WTI crude lost around $24 until markets closed last Friday. Today, they opened with a big massive bearish gap for crude Oil, worth around $11 for WTI. OPEC failed to convince Russia to join in on a 1./5 million barrels/day production cut, and it seems like Saudi Arabia got upset about it. They said to increase production instead, while Russia has replied in the same manner, which has killed any hopes of crude Oil turning bullish anytime soon.

US WTI crude Opened just above $30 last night and bounced a little, but sellers returned and sent it below that big round level. US Oil fell to $27.20 in the Asia session, but has retraced higher now and is trading around 1.35. Buyers look a bit exhausted from the retrace now and the 20 SMA is acting as resistance. So, we decided to go short on Oil and give this crash a go, perhaps we can make some big bucks.

In Conclusion

The sentiment turned even more negative today, as central banks and governments across the globe panic. Traders panicked even more and stock markets had another horrible day. But, not as horrible as crude Oil which opened with an $11 bearish gap.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account