Lower GDP and Inflation Forecast Form the ECB

The ECB has lowered its inflation and GDP forecasts for this year

•

Last updated: Thursday, June 4, 2020

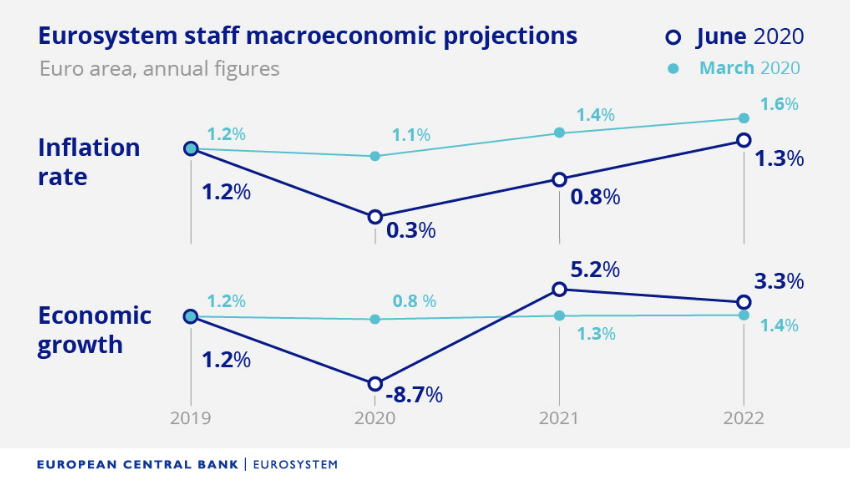

The European Central Bank (ECB) held its monthly meeting earlier today. They see the economy bottoming out after two three horrible months from March to May, as they commented on the statement. Although, they increased the PEPP programme by and additional 600 billion Euros and pledged to keep throwing money at the economy for as long as it’s needed. The baseline is -8.7% this year with a 5.2% rebound in 2021 and 3.3% in 2022. The March forecast was +0.8% for this year.

GDP Growth Forecast

- 2020 GDP forecast -8.7%

- 2021 +5.2% vs +1.3% prior

- 2022 +3.3% vs +1.4% prior

The basic outline here is that it will take until 2022 to recoup the growth lost this year. That’s not what the market wants to hear in terms of a quick rebound. The market was looking at something like an 8.0% GDP decline this year.

Inflation

- 2020 +0.3% vs +1.1% in March

- 2021 +0.8% vs +1.4% in March

- 2022 +1.3% vs +1.6% in March

Christine Lagarde Opening Statement

- Economy has showed signs of bottoming out

- Q2 contraction will be unprecedented

- Prices to continue to be depressed by economy

- ECB determined to ensure needed degree of stimulus

- ECB will do everything possible within its mandate

- ECB ready to adjust all instruments as needed

- Some bottoming out of economy seen in May

- Economy expected to rebound in Q3

- Recovery speed and scale remain highly uncertain

- Sees 202 GDP at -8.7%

Aside from these headlines, she’s reading the statement word-for-word. The euro has given back most of its gains and is up just 25 pips from pre-statement levels.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Sidebar rates

HFM

HFM rest

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals