- Home /

- Forex Brokers /

- BDSwiss

BDSwiss Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a BDSwiss Account

- Trading Platforms and Tools

- Markets Available for Trade

- Safety and Security

- Partnership Options

- Deposit and Withdrawal

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about BDSwiss

- Employee Overview of Working for BDSwiss

- Pros and Cons

- In Conclusion

BDSwiss is a reliable and secure broker offering competitive spreads and educational resources. It manages an average monthly trading volume of $84 billion and boasts a strong trust score of 74/100. The FSA, FSC, FSCA, and MISA fully regulate the broker.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Overview

BDSwiss has earned global recognition since 2012, now serving over 1 million traders. Regulated by 🇸🇨 FSA, 🇧🇿 FSC, 🇿🇦 FSCA, and 🇲🇿 MISA, the broker provides a secure environment, ultra-tight spreads from 0.0 pips, and flexible account types suited for both novice and seasoned traders.

Frequently Asked Questions

Can I open an Islamic (swap-free) account with BDSwiss?

Yes, BDSwiss offers Islamic (swap-free) accounts that fully comply with Sharia principles. These accounts are available upon request and exclude any overnight interest charges, making them ideal for traders who follow faith-based financial practices.

What is the maximum leverage available on BDSwiss?

BDSwiss provides traders with leverage of up to 1:500, depending on the account type and regulatory jurisdiction. This level of leverage enables experienced traders to amplify their trading potential while remaining mindful of associated risks.

Our Insights

BDSwiss delivers a secure and flexible trading experience supported by multiple platforms, including MT4 and MT5. With strong regulatory oversight, high leverage, and competitive spreads, it stands out as a solid broker for both entry-level and advanced traders alike.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

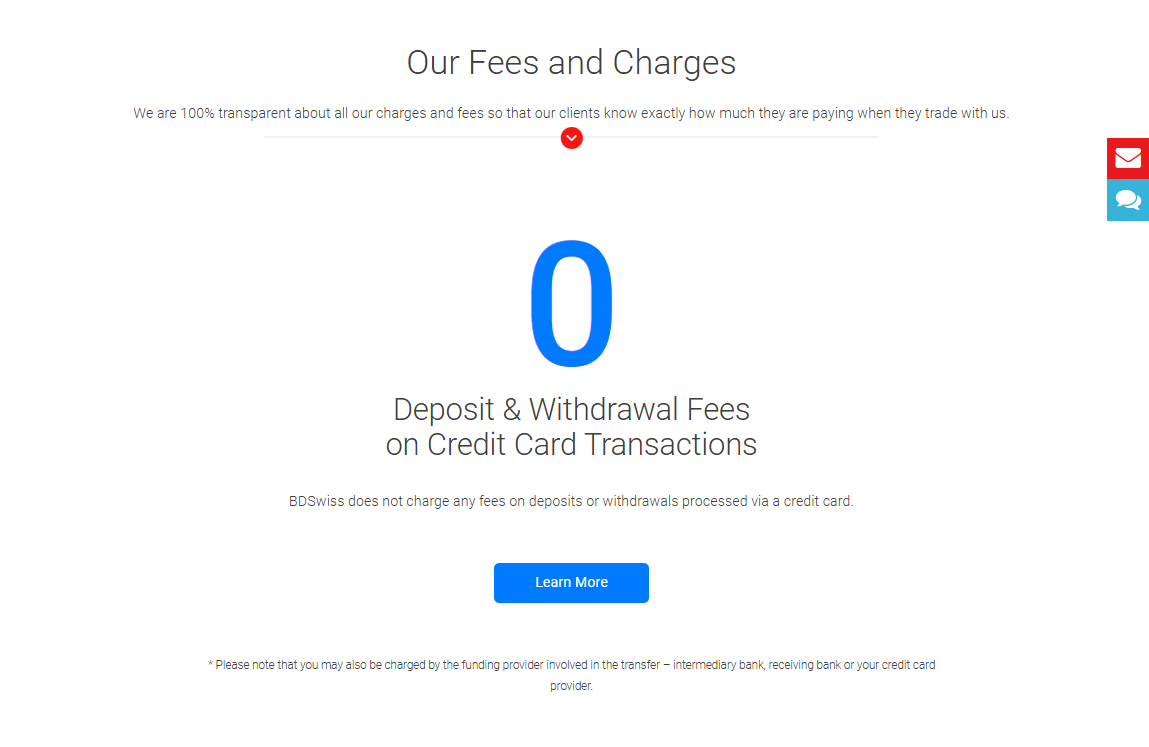

Fees, Spreads, and Commissions

BDSwiss stands out for its transparent fee structure, offering tight spreads from 0.0 pips on the Zero-Spread account and zero commissions on forex, crypto, and commodities. Although commissions apply to indices and shares, traders enjoy free deposits and credit card withdrawals, creating a cost-effective trading environment.

| Feature | Details |

| Spreads | From 1.6 pips (Cent) to 0.0 pips (Zero) |

| Forex Crypto Commodities | No commissions |

| Indices Commission | From $2 (varies by account) |

| Share Commission | From 0.15 percent |

Frequently Asked Questions

What are the spreads on BDSwiss accounts?

BDSwiss offers spreads starting at 1.6 pips on the Cent account and dropping to 0.0 pips on the Zero-Spread account. This flexible structure allows traders to choose the best fit for their strategy and risk tolerance.

Does BDSwiss charge commissions on all instruments?

No, BDSwiss does not charge commissions on forex, crypto, or commodity trading. However, it applies fixed commissions on indices and shares, which vary by account type, starting from $2 for indices and 0.15 percent for shares.

Our Insights

BDSwiss delivers competitive pricing with zero commission on major asset classes and minimal non-trading fees. Traders looking to manage costs will appreciate the free deposits, no hidden charges, and tight spreads, though share and index traders should factor in moderate commission costs.

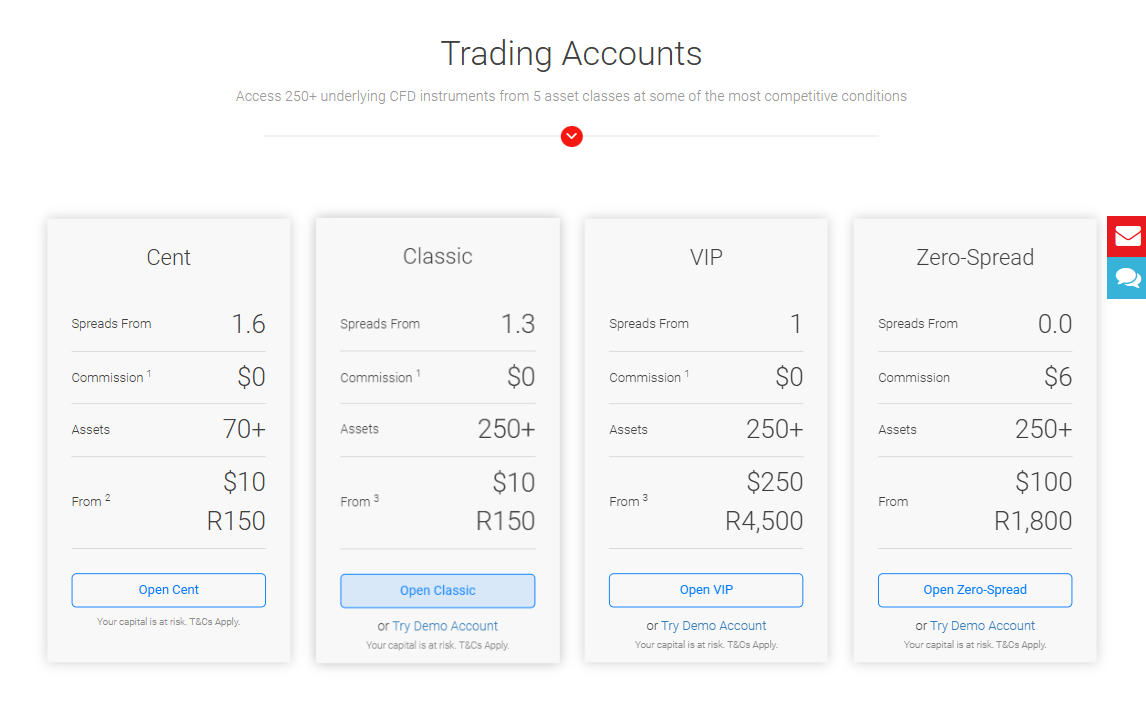

Minimum Deposit and Account Types

BDSwiss delivers an inclusive range of trading accounts designed for both newcomers and experienced traders. With minimum deposits starting at just $10 and dynamic leverage up to 1:2000, the broker empowers users with flexibility, asset variety, and tailored support options for every trading style.

Frequently Asked Questions

What is the minimum deposit for each account type at BDSwiss?

BDSwiss offers four account types with varying entry levels: $10 for the Cent and Classic accounts, $100 for the Zero-Spread account, and $250 for the VIP account. These options accommodate all traders, from casual beginners to serious professionals.

What is dynamic leverage, and how does it work?

Dynamic leverage automatically adapts to the size of your open positions. As position size increases, leverage decreases to manage risk effectively. This ensures traders can benefit from high leverage on smaller trades while reducing exposure on larger ones.

Our Insights

BDSwiss earns points for offering accessible account types with reasonable deposit thresholds. The flexible leverage and structured tier system support various trading goals. Additionally, the VIP account brings value-added features for serious traders seeking premium service and tools.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

How to Open a BDSwiss Account

BDSwiss delivers a swift digital onboarding experience that lets traders open accounts, verify identity, and start trading quickly. Account setup typically completes within one business day once documents are verified.

1. Step 1: Visit the BDSwiss website and click on the “Sign Up” or “Open Account” button.

Fill out the registration form with your name, email address, country of residence, phone number, date of birth, and select your preferred trading platform and leverage.

2. Step 2: Verify your email address by entering the six-digit code sent to your inbox.

Upload the required documents, including a valid government-issued ID and proof of address.

Wait for approval. Once verified, you’ll gain access to your dashboard and can fund your account to begin trading.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Trading Platforms and Tools

BDSwiss equips traders with a strong lineup of platforms – MT4, MT5, WebTrader, and a Mobile App – designed to meet diverse skill levels. Whether on desktop or mobile, users gain access to advanced charting, real-time data, and automated strategies, making it easier to trade confidently and efficiently.

| Platform | Device Compatibility | Key Features | Download Required |

| MetaTrader 4 | Desktop Mobile | Expert Advisors Indicators | Yes |

| MetaTrader 5 | Desktop Mobile | 80+ Indicators Strategy Tester | Yes |

| WebTrader | Web Browsers | Trend Analysis Tools | None |

| Mobile App | iOS Android | Real-Time Quotes Charting | Yes |

Frequently Asked Questions

What platforms does BDSwiss offer for trading?

BDSwiss provides MetaTrader 4 (MT4), MetaTrader 5 (MT5), its custom WebTrader, and a Mobile App available for both Android and iOS. Each platform caters to different trading preferences while offering fast execution and comprehensive features.

What are the key features of the MT5 platform?

MT5 offers more than 80 technical indicators, automated trading via Expert Advisors, multi-language support, and the ability to conduct in-depth chart overlays. It is ideal for traders seeking precision and analytical depth.

Our Insights

BDSwiss delivers a well-rounded platform suite that suits mobile traders, technical analysts, and automated strategy users alike. With powerful tools across MT5 and WebTrader, plus seamless mobile functionality, it enables flexible trading from nearly any device with intuitive features and responsive design.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

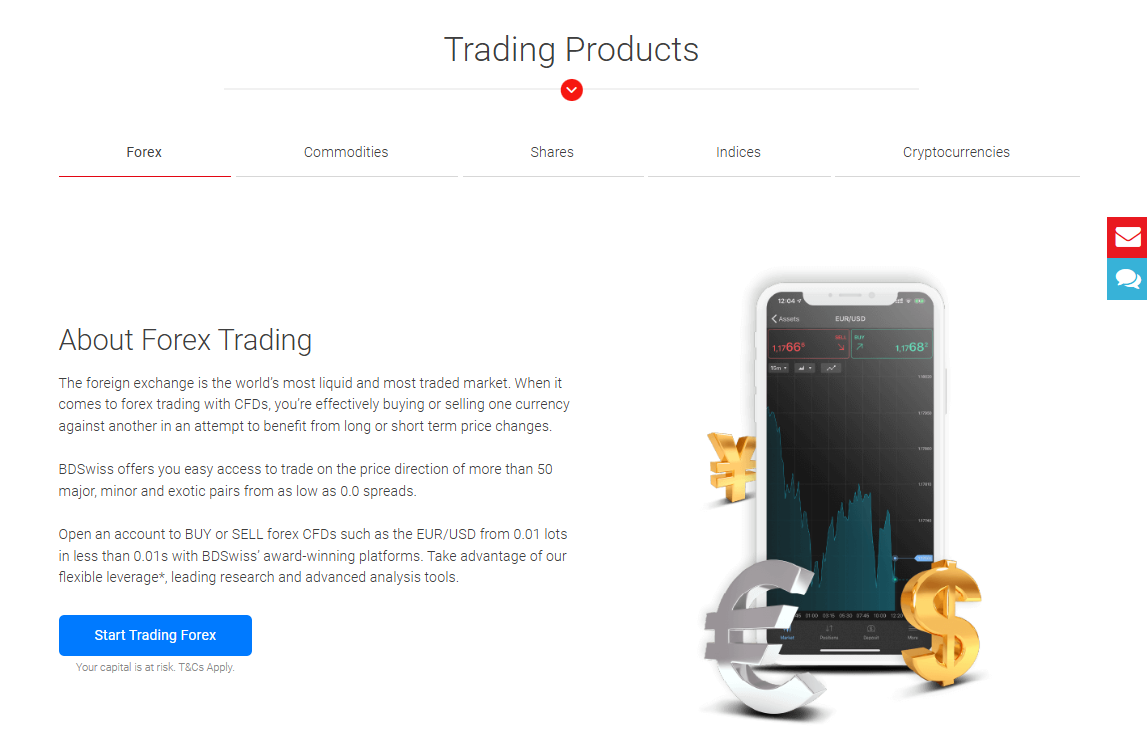

Markets Available for Trade

BDSwiss gives traders exposure to over 250 CFD instruments across Forex, Stocks, Indices, Commodities, and Cryptocurrencies. With tight spreads, dynamic leverage, and seamless platform integration, BDSwiss creates a versatile environment for both traditional investors and crypto-focused traders.

| Asset Class | CFD Instruments | Trading Hours | Crypto Access |

| Forex | 50+ | 24/5 | None |

| Stocks | 100+ | Market Hours | None |

| Indices | 10+ | Nearly 24/5 | None |

| Commodities | 20+ | Market Hours | None |

| Cryptocurrencies | 30+ | 24/7 | Yes |

Frequently Asked Questions

What types of markets can I trade on BDSwiss?

You can trade CFDs on five major asset classes: Forex, Stocks, Indices, Commodities, and Cryptocurrencies. This wide range ensures that traders can diversify and explore multiple global markets from one account.

How many instruments are available for trade on BDSwiss?

BDSwiss offers access to more than 250 CFD instruments. These are distributed across all key asset classes, giving traders ample opportunity to build diverse strategies in both stable and volatile markets.

Our Insights

BDSwiss provides a well-rounded market selection with competitive conditions. With access to over 250 instruments and support for crypto, the broker appeals to traders seeking portfolio variety. The platform’s mix of global assets and flexible leverage helps users tailor strategies to their risk appetite and goals.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Safety and Security

BDSwiss has earned the trust of over 1.7 million clients since 2012 by offering secure, transparent trading conditions. Regulated in multiple jurisdictions, the broker upholds high standards through fund segregation, data protection, and rigorous oversight – safeguarding both capital and personal information.

| Feature | Details |

| Regulatory Bodies | 🇸🇨 FSA 🇲🇺 FSC MISA 🇦🇪 SCA |

| Client Fund Protection | Segregated Accounts |

| Data Security | Encryption Secure Protocols |

| Global Reach | 1.7M+ Clients in Multiple Regions |

Frequently Asked Questions

Is BDSwiss regulated?

Yes, BDSwiss is regulated by multiple authorities, including 🇸🇨 FSA (Seychelles), 🇲🇺 FSC (Mauritius), MISA, and 🇦🇪 SCA (United Arab Emirates). These licenses contribute to the broker’s credibility and ensure compliance with international financial standards.

How does BDSwiss protect client funds?

Client funds are held in segregated accounts, completely separate from BDSwiss’s operational finances. This segregation helps protect client money in the event of broker insolvency or internal financial issues.

Our Insights

BDSwiss provides a secure trading environment backed by global regulation and industry-standard protections. From fund segregation to encrypted trading platforms, the broker shows a strong commitment to client safety. Traders can rely on BDSwiss for trustworthy and responsible brokerage services.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Partnership Options

BDSwiss offers a highly competitive Partnership Program that has attracted over 20,000 affiliates and introducing brokers (IBs) worldwide. With a global reach in over 180 countries, the program features flexible commission structures, free marketing materials, personalized support, and high conversion rates.

In addition, Partners can benefit from competitive remuneration, cutting-edge tools, and opportunities for significant payouts, with up to $2.7 million in partner payouts monthly.

Frequently Asked Questions

What types of partnerships does BDSwiss offer?

BDSwiss offers Affiliate and Introducing Broker (IB) partnership programs, each with competitive commission structures.

Are there any setup fees to join the BDSwiss Partnership Program?

No, there are no setup fees required to join the BDSwiss Partnership Program.

Our Insights

BDSwiss offers a robust and lucrative partnership program with excellent earning potential. With a wide range of tools, educational resources, and flexible commission structures, partners are set up for success. Moreover, the broker’s global presence and high conversion rates make it a compelling choice for anyone looking to monetize their influence in the financial industry.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

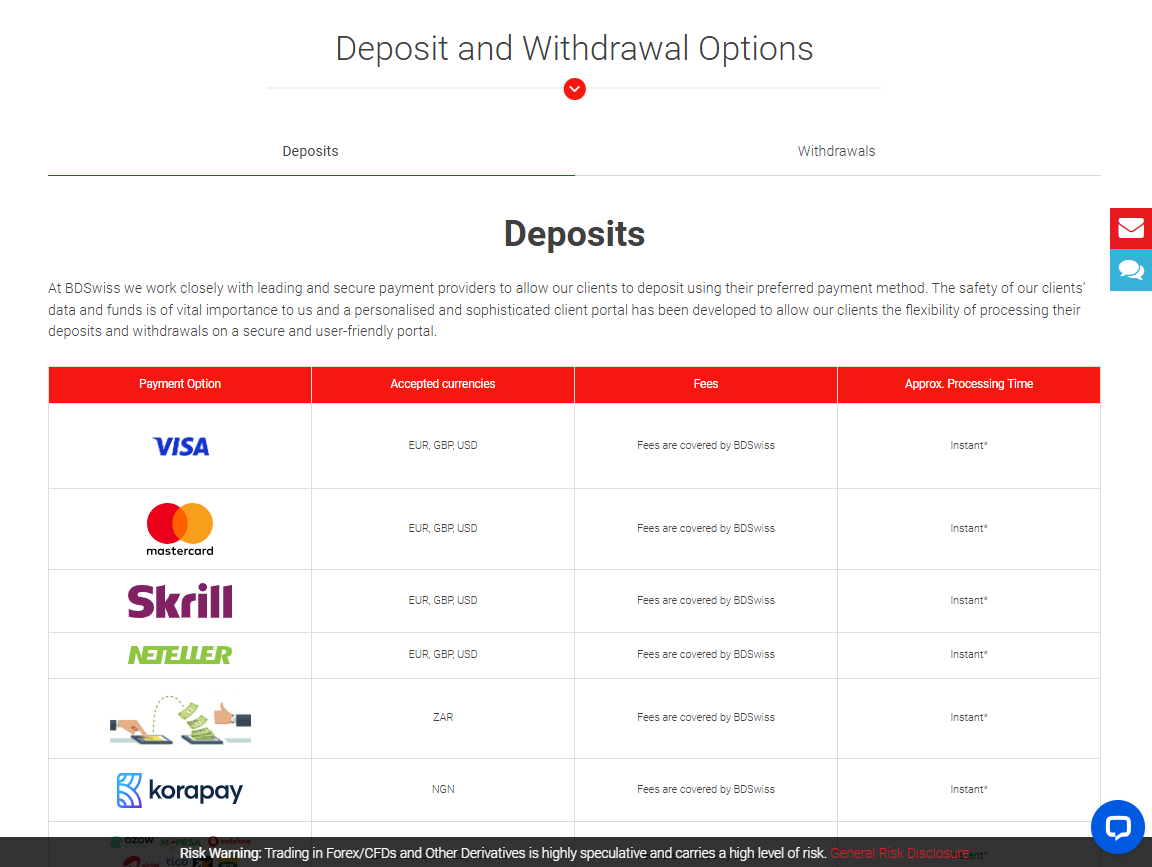

Deposit and Withdrawal

BDSwiss offers a wide range of secure deposit and withdrawal options for clients, including popular payment methods such as Visa, Mastercard, Skrill, Neteller, and various local payment systems like MPESA and PayPal. Deposits are processed instantly for most methods, while withdrawals are typically processed within 24 hours.

In addition, BDSwiss covers all receiving costs, and clients are advised to use the same method for withdrawals as for deposits. To ensure security and compliance, withdrawals are subject to full account verification.

Frequently Asked Questions

What deposit methods are available at BDSwiss?

BDSwiss supports various deposit options, including Visa, Mastercard, Skrill, Neteller, PayPal, and cryptocurrencies like Bitcoin, Ethereum, and others. Local payment systems such as MPESA and GCash are also available.

Are there any fees for depositing or withdrawing funds?

BDSwiss covers all deposit and receiving costs for most payment methods. However, there may be additional exchange or banking fees imposed by your payment provider.

Our Insights

BDSwiss offers a highly flexible and secure range of payment methods for both deposits and withdrawals, with most transactions processed instantly. The platform’s commitment to covering receiving costs and ensuring fast processing times enhances the overall user experience.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with BDSwiss for over a year, and I couldn’t be happier. The platform is easy to use, and the educational resources helped me improve my skills. The spreads are competitive, and the customer support is top-notch! – Alex

⭐⭐⭐⭐⭐

BDSwiss is a fantastic broker! I appreciate their fast execution times and the wide variety of trading instruments. The customer service is always quick to respond, and I love the range of educational tools available to help me stay informed. – Angela

🥉 Solid Choice for Traders.

⭐⭐⭐⭐

I switched to BDSwiss after trying a few other brokers, and I’m glad I did. The leverage options are great, and the platform is stable. The demo account was a perfect way to get started, and now I feel confident in my trading. – Mark

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Customer Reviews and Trust Scores

BDSwiss has received mixed reviews from customers. Many complaints focus on delayed or failed withdrawals, while some platforms offer high overall ratings.

| Source | Score/Feedback |

| Trustpilot | ~2.5 / 5 numerous complaints about withdrawal issues |

| Reviews.io | 2.1 / 5 overall only 24 percent recommend the broker |

| Tradelytic | 4.9 / 5 high marks for deposits, withdrawals, assets, and security |

These wide-ranging scores indicate polarized customer experiences, particularly around fund access.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Discussions and Forums about BDSwiss

Online forums reflect both skepticism and caution toward BDSwiss, especially regarding withdrawal reliability and regulatory concerns.

| Platform | Typical Forum Comments |

| BDSwiss is a known scam broker, many people can’t withdraw their money. |

|

| Withdrawal request … pending for over a month with no resolution. only mentioning delays.” |

Overall, community sentiment leans negative, with several users warning about unresolved withdrawal issues and regulatory instability.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Employee Overview of Working for BDSwiss

According to Glassdoor, the internal perspectives of BDSwiss are mixed, with some praise for company culture but consistent criticism of management and growth opportunities.

| Metric | Rating/Feedback |

| Glassdoor rating | 3.6 / 5 based on 53 reviews |

| Pros (employees say) | “Good environment to work,” “Flexible working hours,” “Amazing colleagues” |

| Cons (employees say) | “Toxic workplace,” “Poor communication,” “Senior management keeps changing,” “No growth” |

Employees report a friendly work environment but highlight concerns around leadership consistency and limited career progression.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple authorities | Withdrawal fees may apply |

| Competitive spreads from 0.0 pips | Limited public trading information |

| Leverage up to 1:500 | Not publicly traded |

| Over 250 CFDs available | Swap fees for certain accounts |

References:

In Conclusion

BDSwiss stands out as a trusted and secure broker in the forex and CFD markets. With a wide range of account types, impressive leverage options, and a solid regulatory framework, it offers an excellent platform for traders worldwide. The broker’s dedication to customer support and educational resources makes it an ideal choice for both newcomers and seasoned traders.

Faq

Yes, BDSwiss offers both an affiliate and an IB program.

Bank transfers, Credit/Debit Cards, and E-wallets are available.

Yes, BDSwiss offers articles, webinars, and trading tutorials.

Deposits and withdrawals typically take 1-3 business days.

Yes, BDSwiss offers a demo account.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a BDSwiss Account

- Trading Platforms and Tools

- Markets Available for Trade

- Safety and Security

- Partnership Options

- Deposit and Withdrawal

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about BDSwiss

- Employee Overview of Working for BDSwiss

- Pros and Cons

- In Conclusion