10 Best Forex Brokers Accepting Debit Cards

We have listed the 10 Best Forex Brokers accepting debit cards for secure and convenient deposits and withdrawals. These brokers offer competitive spreads, strong regulation, and user-friendly trading platforms, allowing both beginners and professional traders to fund their accounts and trade efficiently with ease.

10 Best Zero Spread Forex Brokers (2026)

- MultiBank Group – Overall, The Best Forex Broker Accepting Debit Cards

- AvaTrade – Comprehensive educational suite

- FP Markets – Competitive pricing with low-spread or zero-spread options

- IC Markets – Ultra-fast execution with an NDD (no dealing desk) model

- XM – Multi-regulated status for client safety

- Pepperstone – Selection of powerful trading platforms

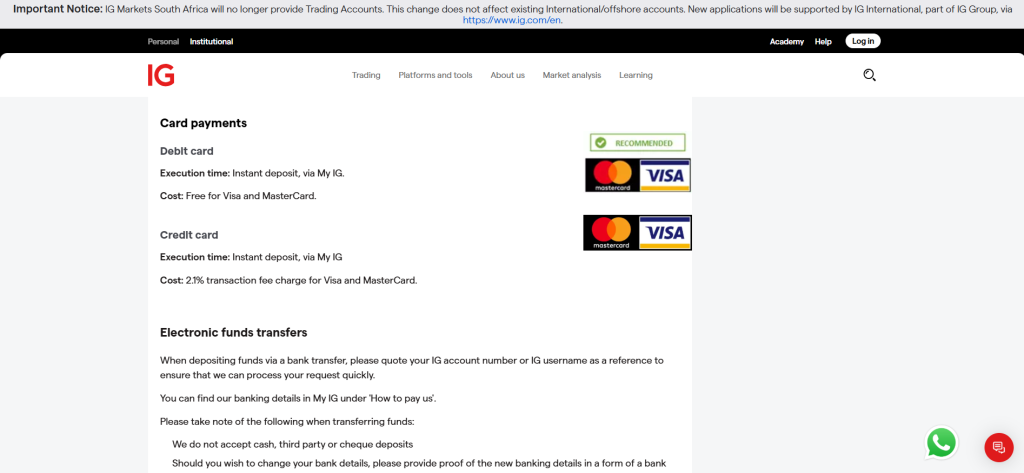

- IG – User-friendly platform suitable for both beginners and experienced traders

- Plus500 – Wide range of over 2,000 CFDs on instruments

- eToro – CopyTrader allows users to automatically copy other investors

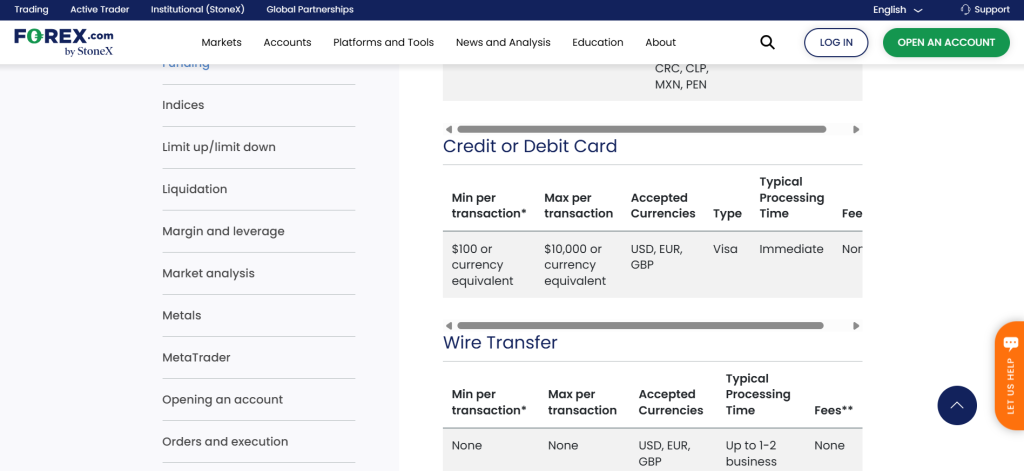

- Forex.com – Variety of trading platforms

Top 10 Forex Brokers (Globally)

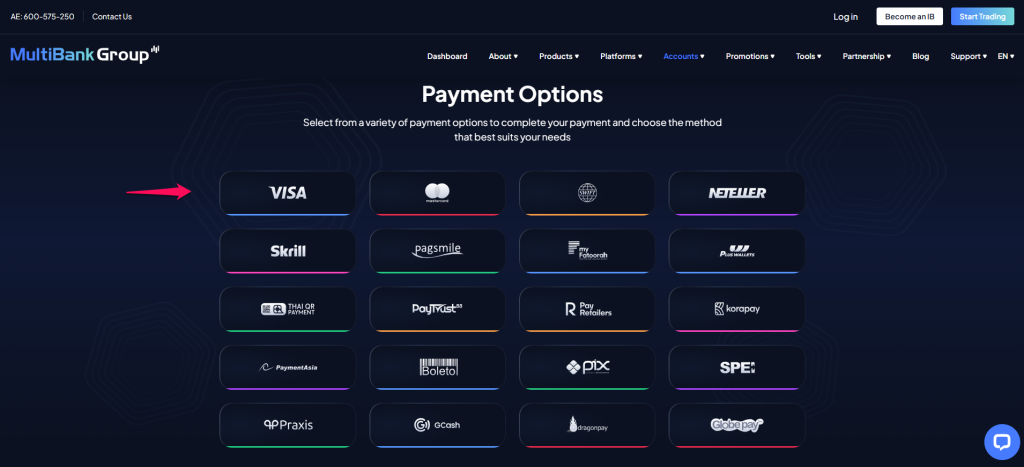

1. MultiBank Group

MultiBank Group is a legit and regulated forex broker that accepts debit cards for fast and secure deposits and withdrawals. It offers competitive spreads, advanced trading platforms, and strong financial transparency for traders worldwide.

Frequently Asked Questions

Does MultiBank Group accept debit cards?

Yes, MultiBank Group accepts debit cards for funding your trading account. It is one of their available deposit methods, typically offering instant processing for quick access to your funds.

What trading platforms does MultiBank Group offer?

MultiBank Group primarily offers the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. They also provide their own proprietary trading solution, the MultiBank-Plus platform, which includes social/copy trading features.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited educational resources for beginners |

| Accepts debit cards for easy funding and withdrawals | Some account types require higher minimum deposits |

| Offers tight spreads and low trading costs | Inactivity fees may apply |

| Provides access to MT4 and MT5 platforms | Not available in certain jurisdictions |

| Excellent customer support and multilingual service | Withdrawal times can vary by payment method |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized and reliable forex broker that accepts debit cards, offering secure transactions, advanced trading platforms, and competitive conditions, making it a strong choice for traders seeking a regulated and efficient broker.

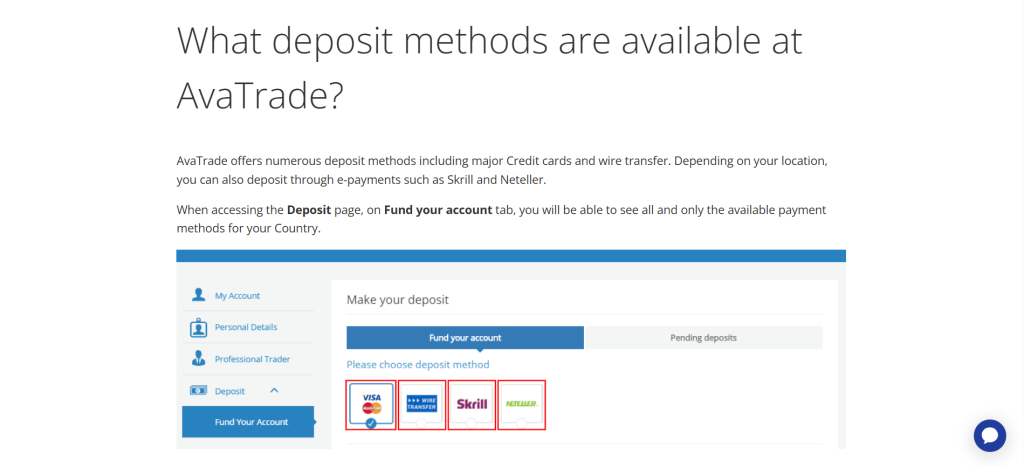

2. AvaTrade

AvaTrade is an authorized and regulated forex broker that accepts debit cards for secure and convenient deposits and withdrawals. It offers competitive spreads, advanced trading platforms, and reliable customer support for traders worldwide.

Frequently Asked Questions

Is AvaTrade a legit forex broker?

Yes, AvaTrade is a highly regulated and legitimate forex broker. It is licensed by multiple top-tier financial authorities across various jurisdictions, including the CBI, ASIC, and FSCA, ensuring a secure trading environment.

Does AvaTrade accept debit cards?

Yes, AvaTrade does accept debit cards for funding your trading account, typically including Visa and Mastercard. Deposits made with a debit card are usually credited instantly.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Inactivity fees apply after periods of non use |

| Accepts debit cards for easy transactions | Limited cryptocurrency trading options |

| Offers multiple trading platforms | No ECN account availability |

| Competitive spreads and low trading costs | Withdrawal processing can take several days |

| Excellent customer support and educational tools | Platform customization is somewhat limited |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a legit and well-regulated forex broker that accepts debit cards, offering secure transactions, advanced platforms, and competitive spreads, making it a trusted choice for both beginner and experienced traders worldwide.

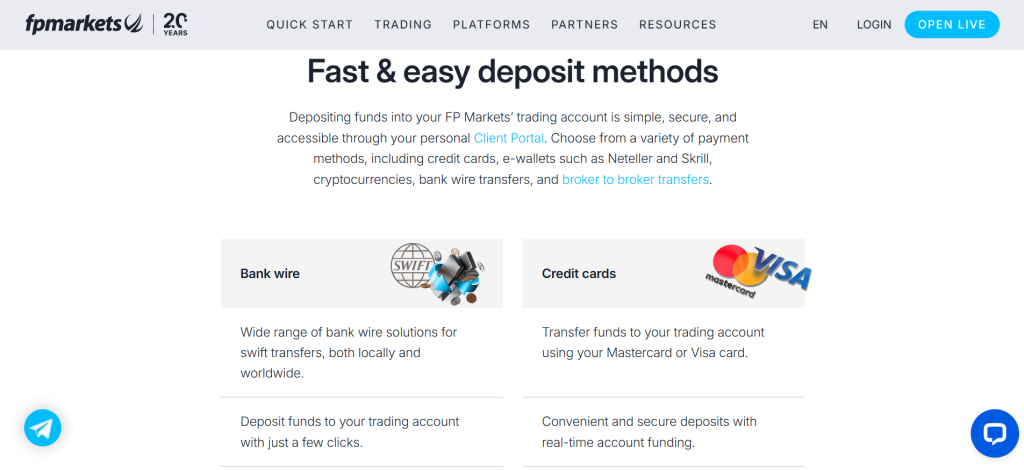

3. FP Markets

FP Markets is a legit and authorized forex broker that accepts debit cards for fast and secure deposits and withdrawals. It offers tight spreads, advanced trading platforms, and strong regulation, making it ideal for global traders.

Frequently Asked Questions

Does FP Markets accept debit cards?

Yes, FP Markets accepts major debit cards, including Visa and Mastercard, for funding your trading account. Card deposits are generally processed instantly and come with no deposit fees from the broker.

What trading platforms does FP Markets offer?

FP Markets offers several platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also provide cTrader, TradingView, the IRESS platform (for specific accounts), and a proprietary Mobile Trading App.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Inactivity fees may apply |

| Accepts debit cards for easy funding and withdrawals | Limited product range outside Forex and CFDs |

| Offers MT4, MT5, and cTrader platforms | No fixed spread accounts |

| Tight spreads and fast execution speeds | Some withdrawal methods may incur fees |

| Strong customer service and educational resources | The website can be complex for beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a legal and well-regulated forex broker that accepts debit cards, offering secure transactions, low spreads, and advanced platforms, making it a trusted choice for traders seeking transparency and performance.

Top 3 Forex Brokers Accepting Debit Cards – MultiBank Group vs AvaTrade vs FP Markets

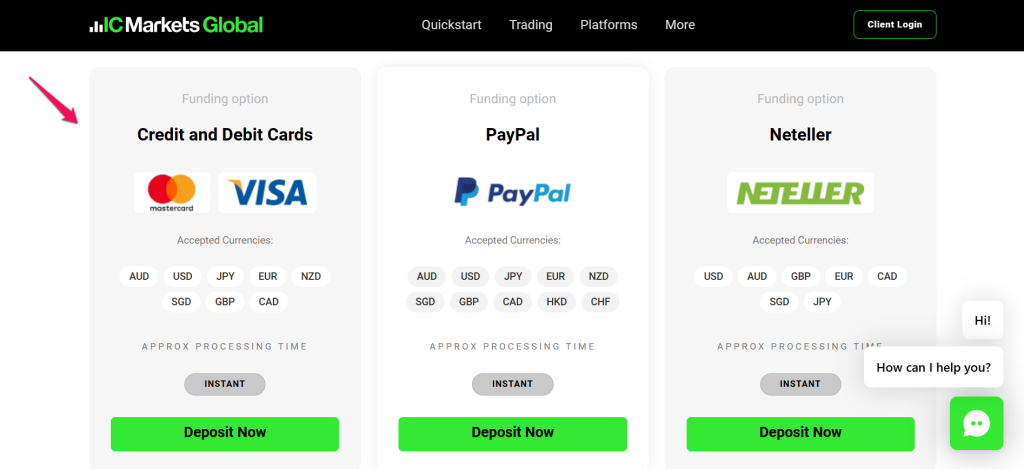

4. IC Markets

IC Markets is an approved and regulated forex broker that accepts debit cards for fast, secure deposits and withdrawals. It offers instant funding via major card networks and ensures client funds are held in segregated accounts for added security.

Frequently Asked Questions

Does IC Markets accept debit cards?

Yes, IC Markets accepts deposits and withdrawals using debit cards, specifically Visa and MasterCard. These transactions are typically processed instantly for deposits and without additional fees from the broker.

What trading platforms does IC Markets offer?

IC Markets offers the globally popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Additionally, they provide the advanced cTrader platform and offer integration with TradingView for charting and execution.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Inactivity fees may apply |

| Accepts debit cards for instant funding and withdrawals | Limited bonuses or promotional offers |

| Tight spreads with low trading costs | Platform may be complex for beginners |

| Supports MT4, MT5, and cTrader platforms | Some regional restrictions on service availability |

| Excellent customer support available 24/7 | Educational content could be more extensive |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is an approved and well-regulated forex broker that accepts debit cards, offering secure transactions, tight spreads, and advanced trading platforms, making it a top choice for both beginner and professional traders worldwide.

5. XM

XM is an authorized forex and CFD broker that supports debit and credit cards (Visa, MasterCard) for both deposits and withdrawals, offering instant funding and secure transactions to traders globally.

Frequently Asked Questions

Is XM a registered forex broker?

Yes, XM is a globally regulated forex broker. It operates through various entities licensed by several financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission of Belize (FSC).

Does XM accept debit cards?

Yes, XM accepts major debit cards for funding your trading account, including Visa and Mastercard. Deposits via debit card are typically processed instantly and are free of charge.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Inactivity fees after long periods of no trading |

| Accepts debit cards for instant deposits and withdrawals | Limited availability in some regions |

| Tight spreads and low trading costs | No cryptocurrency trading |

| Offers MT4 and MT5 trading platforms | Withdrawal times may vary by method |

| Strong educational resources and customer support | Some account types have higher spreads |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a registered and reliable forex broker that accepts debit cards, offering secure payments, low spreads, and user-friendly platforms, making it a trusted option for traders seeking transparency, regulation, and convenience.

6. Pepperstone

Pepperstone is a globally regulated forex broker that makes funding easy. They accept debit cards like Visa and MasterCard for deposits and withdrawals that process almost instantly, offering a fast and convenient way to manage your trading account.

Frequently Asked Questions

Does Pepperstone accept debit cards?

Yes, Pepperstone accepts debit cards, including Visa and Mastercard, for both deposits and withdrawals. This is a common, popular funding method, and deposits are typically processed immediately.

What trading platforms does Pepperstone offer?

Pepperstone offers a robust selection of popular platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. They also provide their own native Pepperstone trading platform and mobile app.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | No fixed spread accounts |

| Accepts debit cards for easy funding and withdrawals | Limited educational materials for beginners |

| Offers multiple professional-grade trading platforms | Inactivity fees after long periods |

| Tight spreads and fast execution speeds | Limited range of tradable cryptocurrencies |

| Excellent customer support and reliability | Some regional restrictions apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is an authorized and trusted forex broker that accepts debit cards, offering fast payments, tight spreads, and advanced trading platforms, ideal for traders seeking secure transactions and professional-level trading conditions.

7. IG

IG, a globally regulated CFD and forex broker, accepts Visa and MasterCard debit cards for instant, fee-free deposits. This allows traders worldwide to fund their accounts securely and efficiently.

Frequently Asked Questions

Does IG accept debit cards?

Yes, IG readily accepts debit cards, including Visa and Mastercard, for funding trading accounts. Deposits made using a debit card are typically instant and often fee-free (depending on the card and region), making it a very quick option.

What platforms does IG offer?

IG offers multiple platforms, including its proprietary online trading platform and mobile app. Additionally, they support specialist third-party platforms like MetaTrader 4 (MT4), ProRealTime for advanced charting, and L2 Dealer for direct market access.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Higher minimum deposit in some regions |

| Accepts debit cards for instant and secure transactions | Limited support for cryptocurrencies |

| Wide range of trading instruments across markets | Some advanced tools may have learning curves |

| Excellent research tools and market analysis | Inactivity fees after prolonged dormancy |

| Trusted brand with decades of industry experience | Spreads can widen during volatile market periods |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is a legit and highly trusted forex broker that accepts debit cards, offering secure funding, advanced platforms, and extensive market access, ideal for traders seeking reliability, transparency, and professional-grade trading conditions.

8. Plus500

Plus500 is a registered and regulated CFD broker that accepts debit cards for secure, instant deposits and withdrawals. It offers a user-friendly platform, competitive spreads, and strong financial oversight, making trading convenient for global users.

Frequently Asked Questions

Is Plus500 a legal forex broker?

Yes, Plus500 is a legal and heavily regulated broker. Its subsidiaries are licensed by multiple top-tier global financial authorities, including the FCA in the UK, ASIC in Australia, and CySEC in Cyprus, ensuring strict oversight for its forex and CFD offerings.

What trading platforms does Plus500 offer?

Plus500 primarily offers its own proprietary trading platforms: Plus500 WebTrader (accessible via web and mobile apps) for CFD trading, Plus500 Invest for share dealing, and Plus500 Futures for US-based futures trading. It does not support MetaTrader.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Limited range of advanced trading tools |

| Accepts debit cards for instant funding | No MetaTrader support |

| User-friendly platform suitable for beginners | Limited educational resources |

| Competitive spreads with zero commissions | Inactivity fees apply after three months |

| Available on desktop, web, and mobile devices | Limited range of asset types compared to other brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is a legal and regulated broker that accepts debit cards, offering secure transactions, a simple platform, and competitive spreads, making it an ideal choice for beginner and casual traders seeking a reliable trading experience.

9. eToro

eToro is a legit and authorized forex broker that accepts debit cards (Visa, MasterCard, Maestro) for secure and instant deposits, offering traders a convenient way to fund accounts and access global markets efficiently.

Frequently Asked Questions

Does eToro accept debit cards?

Yes, eToro accepts debit cards like Visa, Mastercard, and Maestro for instant deposits in many countries. However, restrictions apply in some regions, and the card must be in the eToro account holder’s name.

Can I withdraw funds to my debit card?

Yes, you can generally withdraw funds to a debit card, but it is often limited to the original amount you deposited with that specific card, due to “return to source” anti-money laundering regulations. Any additional profit usually requires a bank transfer.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Withdrawals are limited to the original debit card |

| Accepts debit cards for instant funding | Card issuer may charge fees |

| Secure and user friendly platform | Regional restrictions on debit card usage |

| Supports multiple debit card types | Deposit limits may apply |

| Available to traders globally | Additional verification may be required for new cards |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is an approved and trusted forex broker that accepts debit cards, offering secure, instant deposits and a user-friendly platform, making it a convenient choice for traders seeking reliability and regulatory assurance.

10. Forex.com

Forex.com is a legitimate, authorized forex broker that accepts Visa, MasterCard, and Maestro debit cards. This allows for secure, instant deposits, offering traders a quick and efficient way to fund their accounts and begin trading in global markets.

Frequently Asked Questions

Does Forex.com accept debit cards?

Yes, Forex.com accepts debit cards, including Visa and MasterCard, for funding trading accounts. Deposits are usually processed instantly, providing a secure and convenient way to access global forex markets efficiently.

Are there any fees for debit card deposits?

Forex.com itself does not charge fees for incoming debit card deposits. However, be aware that your card-issuing bank might impose a cash transaction, cross-border, or currency conversion fee for the transfer.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Instant Deposits | Bank Issuer Fees |

| Low Minimum Deposit | Withdrawal Limitations |

| No Internal Deposit Fees | Regional Restrictions |

| Multiple Card Support | Deposit Limits |

| Secure Transactions | Verification Requirements |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Forex.com is a legit and authorized forex broker that accepts debit cards, offering secure, instant deposits with no internal fees. While withdrawal options may be limited to the original debit card, the platform provides a user-friendly experience for traders.

Is it safe to use a Debit Card in Forex Trading?

Yes, it is generally safe when using a regulated broker that employs advanced security like encryption and PCI DSS compliance. Debit card deposits are also convenient and fast, but always ensure your broker is properly regulated.

Criteria for Choosing Forex Brokers Accepting Debit Cards

| Criteria | Description | Importance |

| Regulation & Authorization | Ensure the broker is fully regulated and authorized by reputable financial authorities to protect your funds and ensure compliance. | ⭐⭐⭐⭐⭐ |

| Debit Card Support | Check that the broker accepts debit cards (Visa, MasterCard, Maestro) for deposits and withdrawals, ensuring fast and convenient transactions. | ⭐⭐⭐⭐⭐ |

| Fees & Charges | Review deposit and withdrawal fees, including any charges from the broker or your card issuer, to minimize trading costs. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Assess the usability, reliability, and available features of platforms like MT4, MT5, cTrader, or proprietary platforms. | ⭐⭐⭐⭐☆ |

| Spreads & Commissions | Compare spreads and commission structures to ensure competitive trading costs for your strategy. | ⭐⭐⭐⭐☆ |

| Customer Support | Look for 24/5 or 24/7 support, preferably multilingual, to assist with account and transaction issues. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Speed | Evaluate how quickly deposits and withdrawals are processed using debit cards to ensure timely access to funds. | ⭐⭐⭐⭐⭐ |

| Minimum Deposit | Consider the minimum deposit requirement to ensure it aligns with your budget and trading goals. | ⭐⭐⭐⭐☆ |

| Account Types | Check if multiple account types are offered to suit beginners, intermediate, and professional traders. | ⭐⭐⭐☆☆ |

| Security & Fund Protection | Ensure client funds are held in segregated accounts and that the broker uses robust encryption for transactions. | ⭐⭐⭐⭐⭐ |

Top 10 Forex Brokers Accepting Debit Cards – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From which debit cards are commonly used to fees, we provide straightforward answers to help you understand debit cards in forex trading and choose the right broker confidently.

Q: Which debit cards are commonly accepted by Forex brokers? – Arron L.

A: The most commonly accepted cards by Forex brokers are those issued by Visa and Mastercard. Many regulated brokers accept them globally for instant, fee-free deposits, although availability can vary by region and specific broker.

Q: Are there fees for depositing funds with a debit card? – Aila V.

A: Forex brokers typically do not charge fees for debit card deposits. However, your own bank or card issuer might impose their own service fees, especially for currency conversion. Always check both the broker’s and your bank’s fee schedule.

Q: How long does it take for a debit card deposit to reflect in my account? – Tom H.

A: Debit card deposits in forex trading are typically instant or immediate with most brokers. However, a few brokers or a first-time card deposit for security verification might take up to one business day.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Instant Deposits | Withdrawal Delays |

| Convenience | Fees |

| Wide Acceptance | Deposit Limits |

| Security | Bank Restrictions |

| Direct Funding | Chargeback Risk |

| Easy Record-Keeping | Not Always Accepted |

| Flexibility | Currency Conversion |

You Might also Like:

- MultiBank Group Review

- AvaTrade Review

- FP Markets Review

- IC Markets Review

- XM Review

- Pepperstone Review

- IG Review

- Plus500 Review

- eToro Review

- Forex.com Review

In Conclusion

Forex brokers accepting debit cards offer fast, convenient, and secure deposits, making trading accessible for beginners. However, potential fees, withdrawal delays, and bank restrictions should be considered before choosing this payment method.

Faq

Yes, most forex brokers accept debit cards (Visa/Mastercard) for funding your trading account. It is one of the quickest deposit methods, often providing instant funding. Ensure the card is in your name.

In most cases, yes, debit card deposits in forex trading are instant and reflect immediately in your account. However, some brokers or a first-time deposit may take up to one business day for security checks.

No, generally you cannot withdraw profits directly to your debit card. Most brokers must first refund the original deposit amount to your card; any remaining profit is then withdrawn via bank wire or e-wallet.

Using a debit card with a regulated forex broker is generally safe, as they use encryption for transactions. However, debit cards access your main bank funds, so using a credit card or a separate bank account may offer better financial protection against platform risk.

Yes, most regulated forex brokers accept international Visa or Mastercard debit cards for funding trading accounts. Check for any transaction fees or country-specific restrictions your broker or bank may have.

Yes, forex brokers and your card issuer often set deposit limits, which can be daily, per transaction, or monthly. These limits vary significantly by broker and your card type.

Yes, generally, you can link multiple debit cards to a single forex trading account. However, all cards must be in your own name due to anti-money laundering regulations. Withdrawals are usually returned proportionally to each card used.

Yes, many forex brokers accept prepaid debit cards for deposits. They offer a secure and convenient funding method. However, withdrawals often require an alternative method like a bank transfer, as some prepaid cards cannot receive funds.

The method of deposit (debit card) doesn’t directly affect the maximum leverage offered by a broker. However, the amount deposited contributes to your account equity, which determines your available margin to utilize the offered leverage.

Many brokers offer general deposit bonuses, and since debit cards are a common funding method, these promotions often apply to funds deposited this way. You should check the specific terms.