10 Best ETF Forex Brokers

The 10 Best ETF Brokers revealed. We have explored and tested several prominent brokers to identify the Top 10.

10 Best ETF Forex Brokers (2026)

- AvaTrade – Overall, The Best ETF Forex Broker

- BDSwiss – Tight spreads, with commission-free accounts

- XTB – Award-winning xStation 5 trading platform

- Saxo Bank – Two professional trading platforms, SaxoTraderPRO & SaxoTraderGO

- Admirals – Fast execution, and a supportive customer service team

- FXCM – 87% of orders receiving zero or positive slippage

- City Index – Robust risk management tools

- Tickmill – ultra-tight spreads, and a choice of account types

- IG – Advanced trading platforms and apps

- CMC Markets – Ultra-fast, automated execution

Top 10 Forex Brokers (Globally)

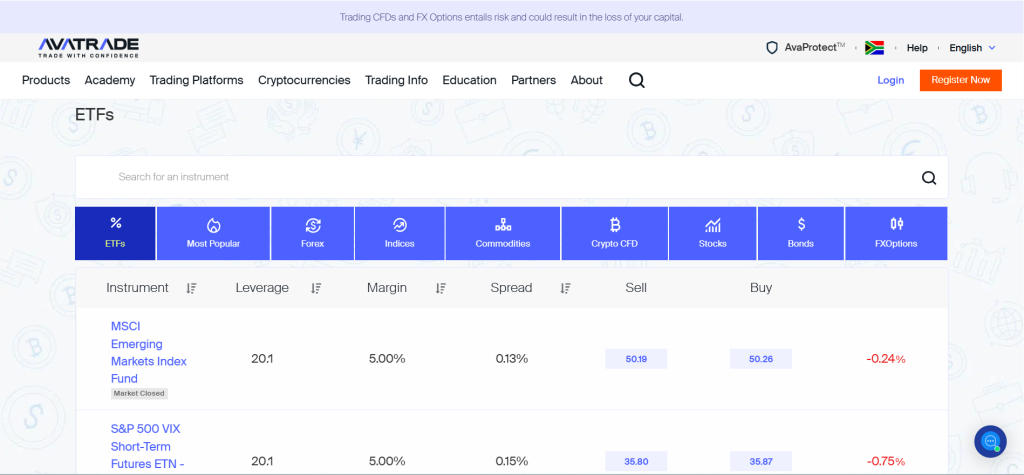

1. AvaTrade

AvaTrade allows clients to trade a wide range of ETFs, giving access to diversified investment opportunities in sectors, commodities, and global markets, without needing to own the underlying assets.

Frequently Asked Questions

Is AvaTrade authorized to offer ETF trading?

Yes, AvaTrade is an authorized broker regulated by multiple financial authorities. It offers ETF trading as Contracts for Difference (CFDs), allowing you to speculate on price movements of various funds without owning the underlying assets.

What ETFs can I trade on AvaTrade?

AvaTrade offers trading on a wide range of popular ETFs as CFDs. You can trade funds that track major indices like the S&P 500 (SPY), as well as those focused on specific sectors like gold miners or emerging markets.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated broker in multiple regions | Fixed spreads may be higher than variable spreads elsewhere |

| Wide variety of ETFs | Limited ETF educational resources compared to dedicated stock brokers |

| Commission-free ETF trading | No ownership of underlying ETF assets |

| User-friendly platforms | Inactivity fees |

| Negative balance protection for clients | Customer support not 24/7 in all languages |

Final Sore

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an authorized global broker offering secure ETF trading through CFDs. With commission-free access, strong regulation, and a wide market selection, it suits beginners and experienced traders, though spreads and limited ETF resources may be drawbacks.

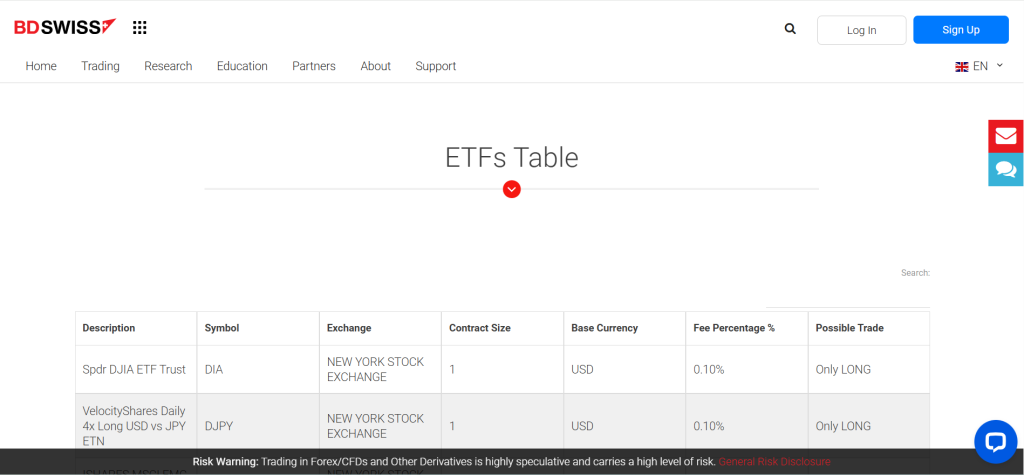

2. BDSwiss

BDSwiss is a regulated global broker offering access to ETFs through CFDs, alongside forex, stocks, commodities, and indices. The broker provides competitive spreads, flexible platforms, and investor protection measures for secure ETF trading.

Frequently Asked Questions

Does BDSwiss offer ETFs?

Yes, BDSwiss offers ETFs for trading. You can speculate on the price movements of a variety of Exchange Traded Funds through Contracts for Difference (CFDs) on their platform, allowing for portfolio diversification.

What trading platforms does BDSwiss support?

BDSwiss supports a range of platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5). It also offers its own proprietary platforms, the BDSwiss WebTrader and a mobile app, for seamless trading on any device.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and considered a legit broker across multiple jurisdictions | High spreads on Cent and Classic accounts |

| Wide range of over 250+ CFDs including ETFs | Raw account requires higher minimum deposit |

| Multiple account types | Limited leverage on certain assets |

| Leverage up to 1:2000 on forex majors | Investor compensation varies by jurisdiction |

| User-friendly platforms with advanced tools | Withdrawal fees on certain methods |

Final Score

| # | Criteria | BDSwiss |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

BDSwiss is a legit and regulated forex broker offering a broad range of CFDs, including ETFs, with user-friendly platforms. While it has varied account costs, its strong regulation, tools, and asset diversity make it appealing for beginners and experienced traders.

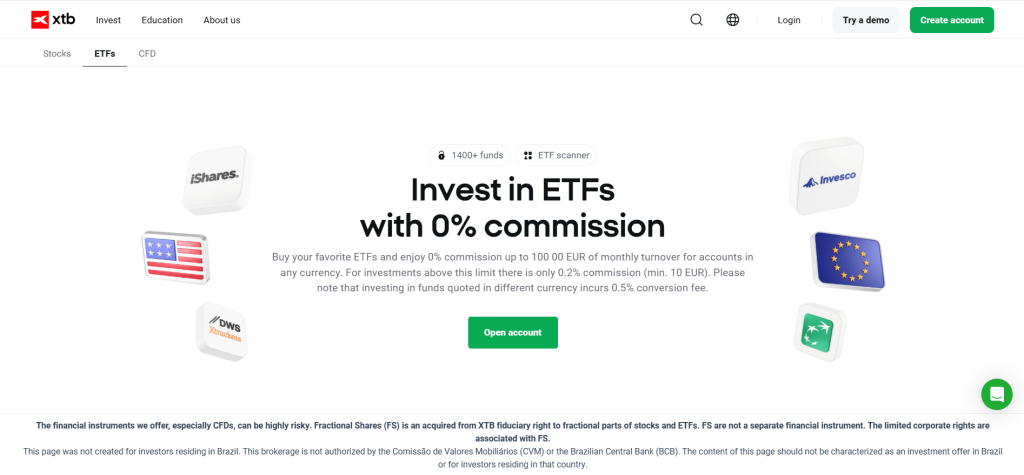

3. XTB

XTB is an established broker known for reliability, advanced trading tools, and access to ETFs, making it suitable for both beginners and experienced traders. With its award-winning xStation platform, XTB provides fast execution, competitive spreads, and a transparent trading environment.

Frequently Asked Questions

What trading platforms does XTB offer?

XTB primarily offers its own award-winning platform, xStation 5, which is available as a web-based platform and a mobile app. It also supports MetaTrader 4 (MT4) for desktop trading.

Does XTB offer ETFs?

Yes, XTB offers both real ETFs and ETF CFDs. You can invest in over 1,400 real ETFs with 0% commission up to a monthly turnover limit. It also provides leveraged trading on hundreds of ETF CFDs.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and well-regulated | Limited product availability in some regions |

| Competitive spreads with no hidden costs | ETF trading is via CFDs, not direct ownership |

| Access to ETF CFDs, forex, indices, commodities, and crypto | No support for MT5 platform |

| User-friendly xStation platform with strong research tools | Overnight swap fees apply |

| Educational resources ideal for beginners | Minimum deposit may vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XTB is a legal and regulated broker that provides access to forex, commodities, crypto, and ETF CFDs with a strong trading platform. Its transparency, education, and competitive costs make it a reliable choice for global traders.

Top 3 ETF Forex Brokers – AvaTrade vs BDSwiss vs XTB

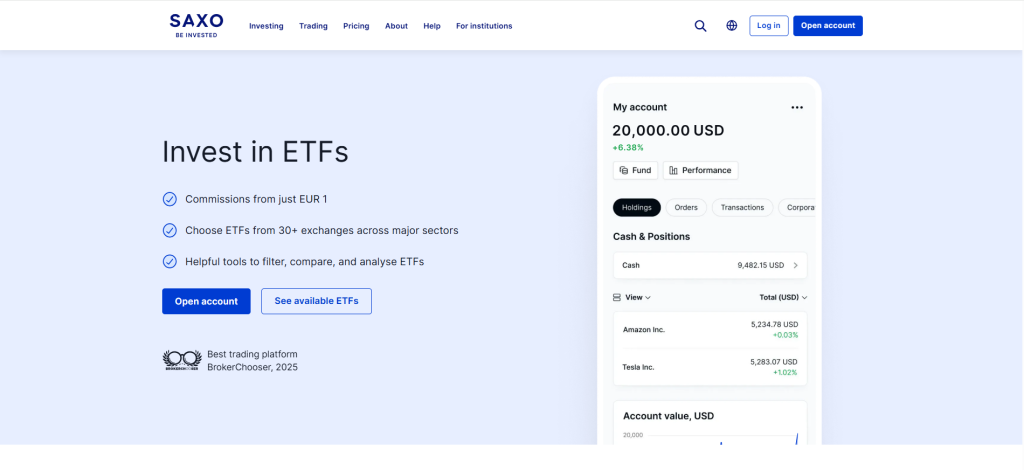

4. Saxo Bank

Saxo Bank is a legal multi-asset broker founded in 1992, authorized and regulated in multiple jurisdictions. It offers access to ETFs, forex, stocks, commodities, and bonds via advanced trading platforms with professional-grade tools.

Frequently Asked Questions

Is Saxo Bank an approved broker?

Yes, Saxo Bank is an approved and highly-regulated broker. It is a licensed Danish bank and holds licenses from multiple top-tier financial authorities globally, including the FCA (UK), MAS (Singapore), and ASIC (Australia).

What trading platforms does Saxo Bank offer?

Saxo Bank provides its own proprietary platforms, including SaxoTraderGO, a user-friendly platform for web and mobile, and SaxoTraderPRO, a professional-grade downloadable platform. They also support third-party platforms like TradingView.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and well regulated | Higher minimum deposits compared to many brokers |

| Access to ETFs, forex, stocks, commodities, and bonds | Platforms may feel complex for beginners |

| Professional-grade trading platforms | Limited leverage in some jurisdictions |

| Strong investor protection and account security | Inactivity fees |

| Wide range of research and educational resources | No support for MetaTrader 4 or 5 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Saxo Bank is an approved and trusted broker offering ETFs, forex, and multiple asset classes with advanced trading platforms. While it suits professionals best, its regulatory framework and strong protections make it a secure choice for serious traders.

5. Admirals

Admirals is a globally regulated forex and CFD broker that offers trading in ETFs, stocks, forex, and commodities. Known for transparency, Admirals provides competitive pricing, strong investor protections, and access to platforms like MetaTrader 4 and MetaTrader 5.

Frequently Asked Questions

Can I trade ETFs with Admirals?

Yes, Admirals allows you to trade ETFs. They offer both ETF CFDs, which are leveraged products, and the ability to directly invest in a wide selection of real ETFs on their Invest.MT5 account with low commission.

Does Admirals provide investor protection?

Yes, Admirals provides strong investor protection. It segregates client funds from company assets and is regulated by top-tier authorities like the FCA and CySEC, which offer compensation schemes in case of insolvency.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and well regulated | Limited product range |

| Wide access to ETFs | Higher fees for inactive accounts |

| Competitive spreads and transparent pricing | Professional account required for highest leverage |

| Advanced tools | Research tools may be basic for advanced traders |

| Strong client protection with segregated accounts | Limited educational resources |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Admirals is a registered and reliable broker offering ETF, forex, and CFD trading with strong regulatory oversight. With competitive pricing, investor protections, and access to MT4/MT5, it provides a secure environment for global traders.

6. FXCM

FXCM is a globally recognized online broker established in 1999, offering forex, CFDs, and ETFs. As a regulated and authorized broker, FXCM provides traders with access to competitive spreads, advanced platforms, and reliable execution.

Frequently Asked Questions

What platforms can I use with FXCM?

FXCM offers a variety of platforms to suit your needs. You can use their proprietary Trading Station, the popular MetaTrader 4 (MT4), or the advanced charting platform TradingView. They also support various specialized platforms.

Is FXCM an authorized broker?

Yes, FXCM is a highly authorized and regulated broker. It holds licenses from multiple top-tier financial authorities, including the FCA (UK), ASIC (Australia), and FSCA (South Africa), ensuring a secure trading environment.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited product range |

| Competitive spreads | Commissions apply on Raw accounts |

| Wide range of instruments including ETFs | Leverage restricted in EU/UK regions |

| Multiple trading platforms | Inactivity fees |

| Offers negative balance protection | Investor protection varies by jurisdiction |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXCM is an authorized global broker offering forex, CFDs, and ETFs with strong platforms and regulation. While it provides competitive trading conditions, traders should weigh commissions, regional leverage limits, and jurisdictional investor protection when choosing FXCM.

7. City Index

City Index is an established broker, authorized and regulated by the FCA, ASIC, and MAS. It offers trading in forex, indices, commodities, shares, and ETFs via CFDs. With advanced platforms, competitive spreads, and strong investor protection, City Index is a trusted choice for traders seeking access to global markets.

Frequently Asked Questions

Is City Index a legit broker?

Yes, City Index is a legitimate and well-established broker. It is a subsidiary of the NASDAQ-listed StoneX Group and is highly regulated by top-tier authorities like the FCA (UK) and ASIC (Australia).

Does City Index offer ETFs for trading?

Yes, City Index offers a variety of ETFs for trading. You can trade them as Contracts for Difference (CFDs) and spread bets, which allow you to speculate on price movements without owning the underlying fund.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong regulation | No Islamic swap-free account option |

| Wide range of 6,000+ CFD instruments including ETFs | Limited leverage for retail traders |

| User-friendly platforms with advanced tools | ETF trading only available via CFDs |

| Commission-free CFD trading with tight spreads | AT Pro platform is complex for beginners |

| Negative balance protection | Customer support not 24/7 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

City Index is a legit and well-regulated broker offering access to forex, CFDs, and ETFs. With robust platforms and investor protection, it’s ideal for traders seeking reliability, though limited leverage and no Islamic account may deter some.

8. Tickmill

Tickmill is a globally recognized forex and CFD broker that also offers ETFs for diversified trading. Its ETF CFDs allow clients to access global markets efficiently, making it suitable for both beginners and experienced traders seeking flexibility and reliability.

Frequently Asked Questions

Does Tickmill offer ETF trading?

Yes, Tickmill offers ETF trading via Contracts for Difference (CFDs). This allows you to trade on a wide range of popular funds from different sectors and countries without having to own the underlying asset.

What platforms can I use to trade ETFs on Tickmill?

You can trade ETFs on Tickmill using both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Tickmill also offers its proprietary platform, Tickmill Trader, available on mobile, which supports ETF trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and legal broker | No direct ETF ownership |

| Access to ETF CFDs | Limited educational content on ETF trading |

| Low spreads and competitive trading costs | Minimum deposit requirements may deter beginners |

| Multiple platforms | No proprietary trading platform |

| Negative balance protection | Limited ETF selection compared to larger brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a legal, regulated broker offering ETF CFDs alongside forex and other instruments. With low costs, reliable execution, and market access, it is well-suited for traders seeking secure and diversified opportunities in global financial markets.

9. IG

IG, founded in 1974, is a globally regulated broker offering 17,000+ markets including forex, shares, commodities, and thousands of ETFs. It provides market execution, low commissions from 0.02%, leverage up to 1:30 for retail clients, negative balance protection, and investor safeguards like the UK FSCS up to £85,000.

Frequently Asked Questions

Does IG offer ETFs?

Yes, IG offers an extensive range of ETFs. You can either trade them as CFDs and spread bets to speculate on price movements or, in certain regions, invest directly in over 6,000 real ETFs through a share dealing account.

Is IG a safe broker?

Yes, IG is considered a very safe broker. It is publicly traded and regulated by numerous top-tier authorities worldwide, including the FCA (UK) and ASIC (Australia). It also safeguards client funds through segregation.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated globally | Limited leverage for retail clients |

| Wide range of 17,000+ markets including ETF | Share/ETF commissions vary by region |

| Multiple platforms | Overnight swap fees apply |

| Negative balance protection | Higher minimum for card/PayPal deposits |

| Strong investor compensation schemes | Platform may be complex for beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is an approved global broker offering 17,000+ markets, including ETFs, with strong regulation, negative balance protection, and competitive pricing. While leverage is limited for retail traders, it remains a secure and reliable choice worldwide.

10. CMC Markets

CMC Markets provides market execution with no minimum deposit, competitive spreads from 0.3 pips, and commissions from 0.02% on shares and ETFs. Traders can access its award-winning Next Generation platform or MetaTrader 4, with retail leverage up to 1:30 (higher for professionals), negative balance protection, and investor safeguards such as FSCS in the UK.

Frequently Asked Questions

Does CMC Markets offer ETFs?

Yes, CMC Markets offers a wide range of ETFs. You can trade them as CFDs and spread bets, allowing you to speculate on price movements. They also offer direct investment in thousands of ETFs through their separate CMC Invest platform.

What is the minimum deposit at CMC Markets?

CMC Markets has no required minimum deposit to open an account. However, you will need to deposit enough funds to cover the margin for your first trade, which can vary depending on the instrument and leverage.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated globally | Leverage capped at 1:30 for retail traders |

| 12,000+ markets including thousands of ETFs | Overnight financing fees apply |

| No minimum deposit required | Platform can be complex for beginners |

| Award-winning Next Generation platform + MT4 | Share/ETF commissions vary by region |

| Negative balance protection | Limited crypto offerings compared to some brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

CMC Markets is a registered global broker providing 12,000+ instruments, including ETFs, with strong regulation, advanced platforms, and investor protection. While leverage is limited for retail clients, it remains a reliable and well-established trading choice.

What is an ETF Forex Broker?

An ETF Forex Broker is a broker that allows traders to access both forex (currency pairs) and ETFs (Exchange-Traded Funds) from the same trading account and platform.

-

Forex Trading – Buying and selling global currencies (e.g., EUR/USD).

-

ETFs – Investment funds traded on exchanges, which track baskets of assets like stocks, commodities, bonds, or indices (e.g., S&P 500 ETF, Gold ETF).

-

ETF Forex Broker – A broker that offers ETFs as CFDs (Contracts for Difference) or as direct investments, alongside traditional forex pairs.

Features of an ETF Forex Broker:

-

Multi-asset access – You can trade forex and invest/trade ETFs in one account.

-

Flexibility – ETFs can be used to diversify beyond currency trading.

-

Leverage – ETFs may be offered with leverage (usually lower than forex).

-

Trading platforms – Brokers like IG, CMC Markets, and Saxo Bank integrate ETFs with forex on platforms like MT4, MT5, or proprietary systems.

Overall, an ETF Forex Broker is simply a multi-asset broker that provides both forex trading and ETF investing/trading, giving traders more diversification in one place.

Criteria for Choosing an ETF Forex Broker

| Criteria | Description | Importance |

| Regulation & Licensing | Ensure the broker is registered and regulated by trusted authorities (e.g., FCA, ASIC, CySEC) for safety of funds. | ⭐⭐⭐⭐⭐ |

| Range of ETFs Offered | Look for a broker that provides access to a wide selection of ETFs (indices, commodities, sectors, bonds). | ⭐⭐⭐⭐☆ |

| Forex Pairs Available | A strong ETF forex broker should also offer a broad choice of currency pairs for diversification. | ⭐⭐⭐⭐☆ |

| Trading Costs | Compare spreads, commissions, and overnight financing fees as these directly affect profits. | ⭐⭐⭐⭐⭐ |

| Leverage Options | Check available leverage for forex and ETFs (retail vs. professional). Higher isn’t always better. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Platforms should be user-friendly, reliable, and offer ETF + forex tools (e.g., MT4, MT5, TradingView). | ⭐⭐⭐⭐⭐ |

| Minimum Deposit | Low deposit requirements make it easier for beginners to start without high capital. | ⭐⭐⭐⭐☆ |

| Investor Protection | Look for compensation schemes (e.g., FSCS, ICF) and negative balance protection. | ⭐⭐⭐⭐⭐ |

| Education & Research | Brokers with tutorials, market analysis, and ETF insights help beginners trade smarter. | ⭐⭐⭐⭐☆ |

| Customer Support | Responsive, multilingual support is essential for quick issue resolution. | ⭐⭐⭐⭐☆ |

Top 10 Best ETF Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From costs to which platforms to use, we provide straightforward answers to help you understand ETFs and choose the right broker confidently.

Q: Can I trade ETFs through forex brokers, or do I need a separate account? – Anna M.

A: Many forex brokers now offer ETFs, but usually as CFDs, which means you don’t own the underlying asset. For direct ownership of real ETFs, you may need to use a separate brokerage or a different account type.

Q: How do ETF trading costs compare with regular forex trading costs? – James W.

A: ETF trading costs typically include an annual expense ratio, commissions, and bid/ask spreads. In contrast, forex trading costs are almost exclusively based on the bid/ask spread, with some accounts also charging a commission per trade.

Q: What platforms are best for trading ETFs in forex brokers? – Michael L.

A: For trading ETFs with forex brokers, MetaTrader 5 (MT5) is generally the best platform. Unlike MT4, MT5 is designed for multi-asset trading and supports instruments like stocks and ETFs, providing more features for comprehensive analysis.

Q: Are ETFs a good choice for forex traders wanting more diversification? – Lisa R.

A: Yes, ETFs are an excellent choice for diversification. They allow forex traders to gain exposure to a basket of assets—such as stocks, bonds, or commodities—with a single trade, which helps to spread risk beyond currency pairs.

Q: Is leverage available when trading ETFs on forex platforms? – David P.

A: Yes, leverage is widely available when trading ETFs on forex platforms. This is because ETFs are typically offered as Contracts for Difference (CFDs), which are leveraged products that allow you to magnify your market exposure.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Diversification | Leverage Restrictions |

| Flexibility | Overnight Costs |

| Hedging Opportunities | Complexity |

| Leverage Options | Regional Limitations |

| Single Platform Access | Higher Costs on ETFs |

You Might also Like:

- AvaTrade Review

- BDSwiss Review

- XTB Review

- Saxo Bank Review

- Admirals Review

- FXCM Review

- City Index Review

- Tickmill Review

- IG Review

- CMC Markets Review

In Conclusion

ETF forex brokers provide traders with the flexibility to trade currencies and diversify into ETFs within one platform. While leverage and costs may differ, they remain a registered, secure, and convenient option for global investors.

Faq

An ETF forex broker is a multi-asset broker that offers trading on both forex pairs and ETFs, typically as Contracts for Difference (CFDs). This allows traders to diversify their portfolio by speculating on a basket of assets with a single trade.

Yes, authorized multi-asset brokers offering both forex and ETFs are legal and regulated. They must hold licenses from major financial authorities like the FCA (UK) or ASIC (Australia), which enforce strict rules on client fund protection and conduct.

Yes, many multi-asset brokers offer a single account for trading both ETFs and forex, along with other instruments like stocks and commodities. This streamlines your trading and portfolio management.

Verify a broker’s legitimacy by checking for licenses from top-tier financial authorities like the FCA (UK) or ASIC (Australia). Always cross-reference the license number on the regulator’s official website to ensure it’s valid and not a fake.

ETFs are generally considered safer due to their built-in diversification, spreading risk across a basket of assets. In contrast, forex trading is often more volatile and involves higher leverage, which can significantly amplify both profits and losses.