10 Best Forex Brokers Accepting PayPal

10 Best Forex Brokers Accepting PayPal Revealed. We have reviewed brokers and tested several prominent Forex brokers to identify the 10 best.

10 Best Forex Brokers Accepting PayPal (2026)

- AvaTrade – Overall, The Best Forex Broker Accepting PayPal

- IC Markets – Tight spreads and fast execution speeds

- Pepperstone – User-friendly platforms with advanced tools

- OANDA – Outstanding PayPal integration

- FxPro – Multiple platform options

- XTB – Competitive pricing with commission-free trading

- Octa – Leverage up to 1:500, and access to the MetaTrader 4 and 5 platforms

- JustMarkets – Supports PayPal for deposits and withdrawals.

- Plus500 – User-friendly interface and diverse range of trading instruments

- Doo Prime – Robust trading infrastructure

Top 10 Forex Brokers (Globally)

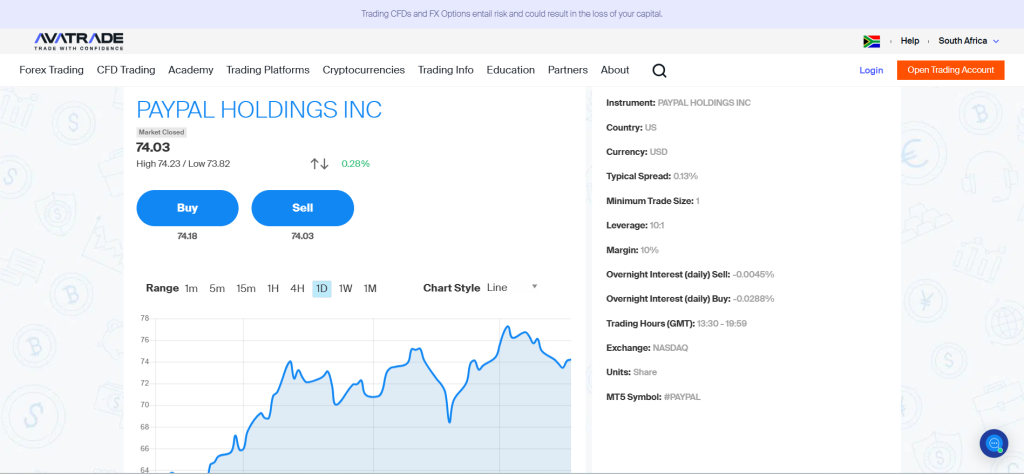

1. AvaTrade

AvaTrade accepts PayPal for deposits and withdrawals in supported regions, offering added convenience and security. With competitive spreads, negative balance protection, and a variety of account types, AvaTrade caters to both beginner and experienced traders.

Frequently Asked Questions

Can I use PayPal with AvaTrade?

Yes, AvaTrade does offer PayPal as a payment method for deposits and withdrawals in some countries. However, the availability of PayPal and other e-payment options like Skrill and Neteller can vary depending on your specific region due to regulatory requirements.

Does AvaTrade offer Islamic (swap-free) accounts?

Yes, AvaTrade offers Islamic (swap-free) accounts, which are designed to comply with Sharia law. These accounts typically do not incur overnight swap fees. However, it’s important to note that for positions held longer than 5 days, an administrative fee may apply.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated in multiple top-tier jurisdictions | Limited product range |

| Accepts PayPal and other e-wallets | No raw spread or ECN account |

| Commission-free trading | Inactivity fees |

| Islamic (swap-free) accounts | Limited leverage |

| Variety of trading platforms | No US clients accepted |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an authorised and trusted broker offering commission-free trading, solid platform choices, and PayPal support. Its strong regulatory backing and beginner-friendly features make it a reliable choice for global traders.

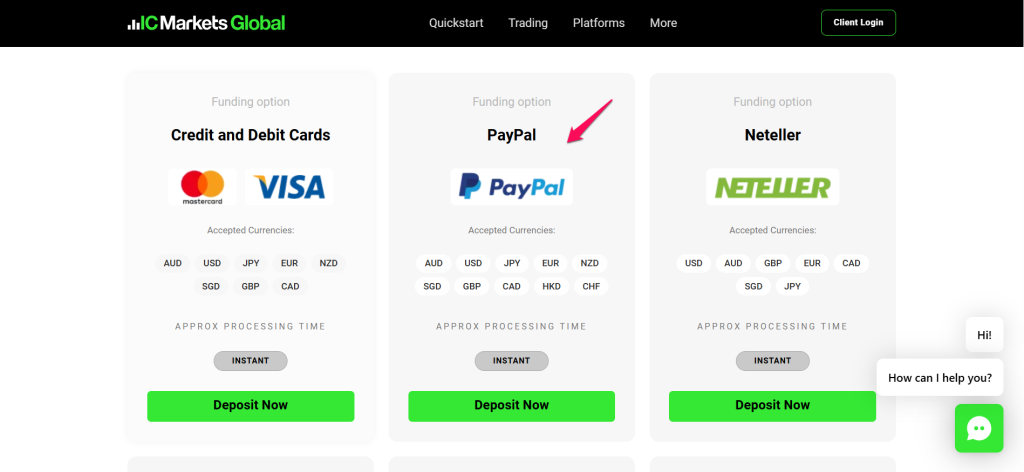

2. IC Markets

IC Markets accepts PayPal for both deposits and withdrawals, offering secure and fast transactions. With regulation from ASIC, CySEC, and FSA Seychelles, it caters to both beginner and professional traders.

Frequently Asked Questions

What platforms does IC Markets support?

IC Markets provides a comprehensive suite of trading platforms to suit diverse trader needs. These include the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their robust charting and automated trading capabilities. Additionally, they support cTrader.

Can I use PayPal for deposits and withdrawals?

Yes, IC Markets generally supports PayPal for both deposits and withdrawals. This is a common e-wallet option for many international brokers due to its speed and security. Deposits are often instant, and withdrawals are typically processed quickly once approved.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by ASIC, CySEC, and FSA | High Minimum Deposit |

| Very low spreads | No investor protection scheme outside the EU |

| Accepts PayPal, Skrill, and other e-wallets | No proprietary trading platform |

| High leverage | No guaranteed stop loss feature |

| Offers VPS hosting and copy trading options | No bonuses or promotions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a legit and highly trusted forex and CFD broker, offering ultra-tight spreads, fast execution, and PayPal support. It’s ideal for both retail and professional traders seeking secure, regulated, and transparent trading conditions.

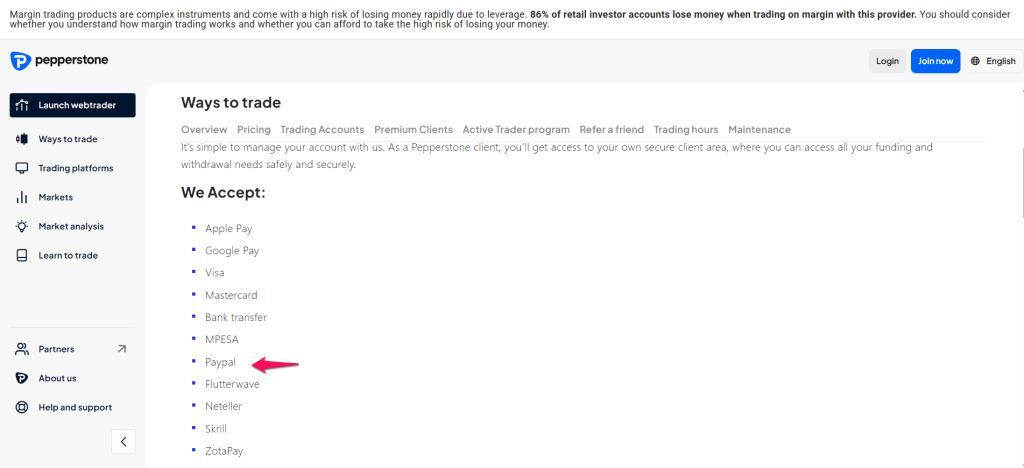

3. Pepperstone

Pepperstone accepts PayPal for deposits and withdrawals in most regions, providing a convenient and secure payment option. With razor-thin spreads, strong client protection measures, and award-winning service, Pepperstone is a trusted choice for both beginner and professional traders.

Frequently Asked Questions

Does Pepperstone accept PayPal?

Yes, Pepperstone does accept PayPal for both deposits and withdrawals. However, for your first PayPal deposit, verification might take 1-2 business days to ensure no third-party funding. Subsequent deposits from the same account are usually instant.

Can I open a demo account with Pepperstone?

Yes, Pepperstone allows you to open a free demo account. This is a great way to practice trading with virtual funds in a realistic market environment. You can choose from platforms like MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated Globally | No Proprietary Research Tools |

| Low Spreads | Limited Asset Classes |

| Multiple Platforms | No Bonuses or Promotions |

| Fast Execution | Crypto Trading Not Available in All Jurisdictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a legal, well-regulated broker offering fast execution, low spreads, and reliable platforms. It’s a strong choice for traders seeking secure access to global markets through a trusted and transparent provider.

Top 3 Forex Brokers Accepting PayPal – AvaTrade vs IC Markets vs Pepperstone

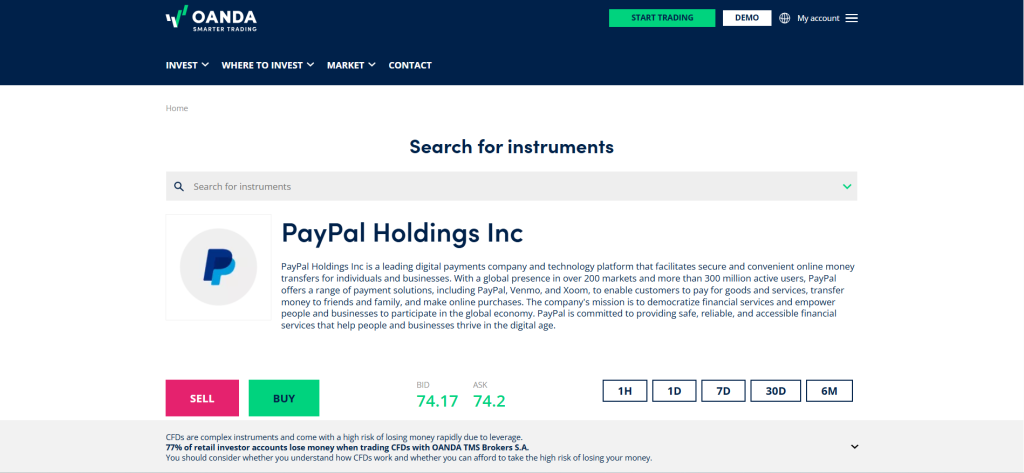

4. OANDA

OANDA supports PayPal for deposits and withdrawals in most regions, making funding fast and convenient. With negative balance protection, segregated client funds, and investor protection schemes where applicable, OANDA is a secure and flexible choice for traders worldwide.

Frequently Asked Questions

Is PayPal accepted by OANDA?

Yes, OANDA generally accepts PayPal for both deposits and withdrawals. However, it’s worth noting that processing times for PayPal deposits can sometimes take a few business days to reflect in your OANDA account.

Is OANDA a good broker for beginners?

OANDA is often considered a good option for beginners due to its strong regulation, user-friendly platforms (including their proprietary OANDA Trade, MetaTrader 4, and TradingView integration), and competitive pricing. They also offer a demo account, allowing new traders to practice without risk.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Highly Regulated | Limited Cryptocurrency Offering |

| No Minimum Deposit | No Guaranteed Stop Loss |

| Low Spreads | No Bonus or Promotions |

| Multiple Trading Platforms | Higher Commissions on Core Accounts |

| PayPal Accepted | U.S. Negative Balance Protection Limited |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is an approved, well-regulated broker offering low spreads, multiple platforms, and convenient PayPal funding. It’s ideal for both beginners and experienced traders seeking a secure and reliable trading environment worldwide.

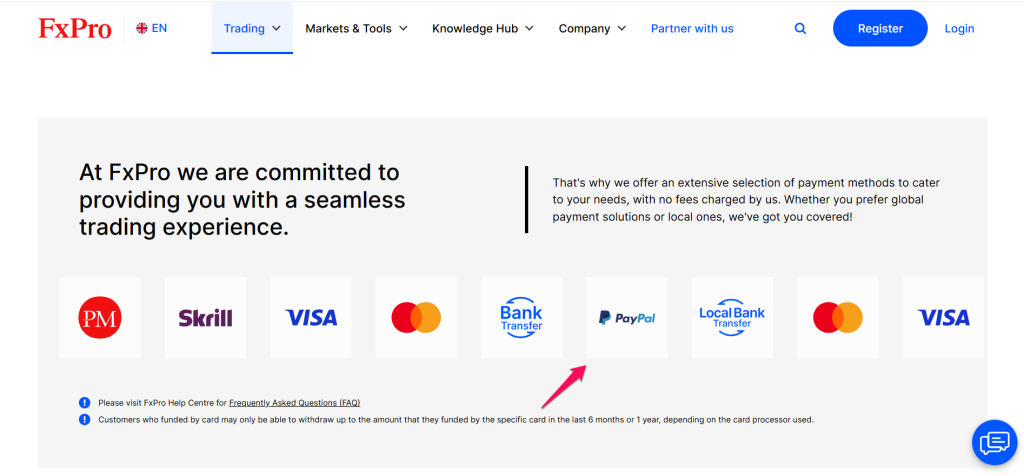

5. FxPro

FxPro is a well‑regulated, FCA‑approved broker with transparent pricing and multiple trading platforms. It supports PayPal funding, provides strong client protections like segregated accounts and negative balance protection, and offers diverse CFD access with competitive spreads.

Frequently Asked Questions

Can I fund my FxPro account with PayPal?

Yes, FxPro does accept PayPal for both deposits and withdrawals. It’s listed as one of their convenient payment methods, and FxPro states that all deposits and withdrawals are processed with no commissions from their side.

What leverage does FxPro provide?

FxPro offers leverage that varies based on the instrument and trading volume. For retail clients, leverage on Forex majors can go up to 1:200. However, for professional clients, FxPro can provide significantly higher leverage, potentially reaching 1:10,000.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Well-Regulated Broker | Complex Account Types |

| Multiple Platforms | Higher Minimum Deposit for Premium Accounts |

| Commission-Free Options | No Bonuses or Promotions |

| Accepts PayPal | Swap Fees on Standard Accounts |

| High Leverage | Crypto Availability Limited by Region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro is a registered and highly trusted broker offering diverse CFD trading, multiple platforms, and strong client protection. With PayPal support and competitive pricing, it’s a reliable choice for both new and experienced traders.

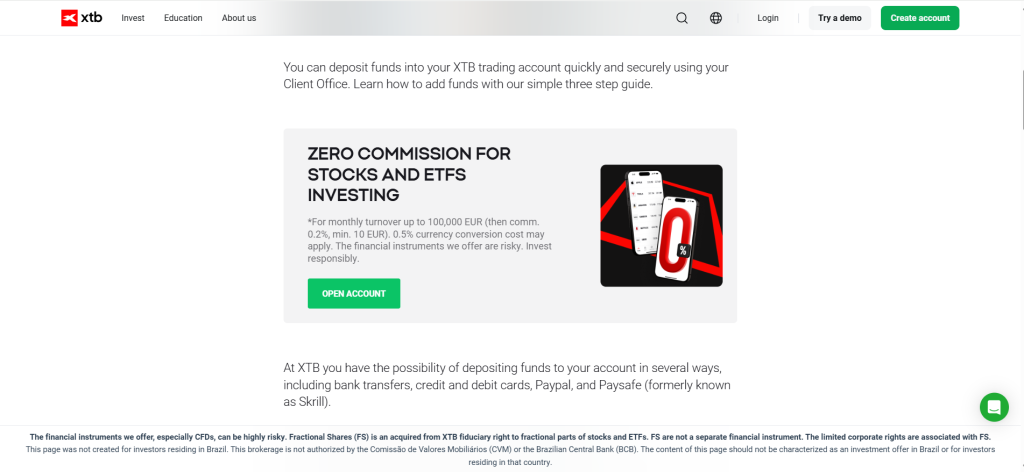

6. XTB

XTB is a regulated, FCA-approved broker offering competitive pricing, a modern trading platform, a wide range of instruments, and PayPal funding for eligible clients.

Frequently Asked Questions

Does XTB accept PayPal?

Yes, XTB does accept PayPal for both deposits and withdrawals. However, it’s important to note that the availability of PayPal and associated fees can vary based on your region. For EU residents, PayPal deposits are often fee-free, but for non-UK/EU residents.

What platforms does XTB offer?

XTB primarily offers its award-winning proprietary trading platform, xStation 5. This platform is available as a web app, a desktop application, and a mobile app for both iOS and Android devices. They also offer the popular MetaTrader 4.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Well-Regulated Broker | No MetaTrader 5 (MT5) |

| No Minimum Deposit | High Overnight Swap Fees |

| Commission-Free Trading Option | Leverage Restrictions in EU/UK |

| Accepts PayPal | Limited Protection Under IFSC |

| Modern Trading Platform | No Bonuses or Promotions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XTB is an authorized and reliable broker offering commission-free trading, a powerful proprietary platform, and PayPal support. With solid regulation and a wide range of instruments, it suits both beginner and experienced traders globally.

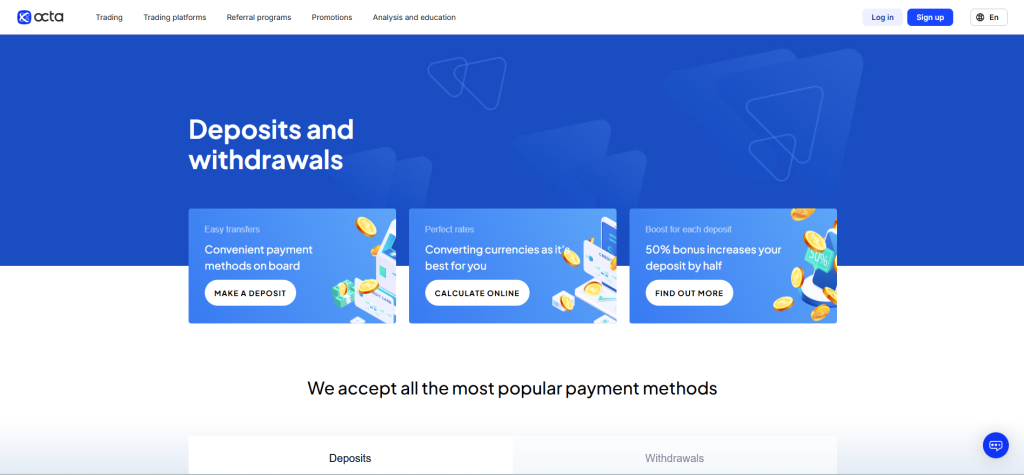

7. Octa

Octa is a regulated and competitively priced broker offering advanced platforms, high leverage, and PayPal funding. While it delivers global CFD access and client protections, leverage and rules vary by entity and location.

Frequently Asked Questions

Does Octa offer an Islamic account?

Yes, Octa offers Islamic (swap-free) accounts. In fact, all of Octa’s trading accounts are designed to be swap-free by default, making them compliant with Sharia law. This means you won’t incur or receive overnight interest charges.

What leverage does Octa provide?

Octa offers competitive leverage that varies by instrument. For Forex pairs, clients can access leverage up to 1:1000. Other instruments have different limits, such as 1:400 for metals, energies, and indices, 1:200 for cryptocurrencies, and 1:40 for stocks.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated Broker | Limited Investor Protection |

| Low Minimum Deposit | No MT5 on Some Account Types |

| Commission-Free Trading | Fewer CFDs Than Top Competitors |

| Accepts PayPal | Restricted Promotions in Some Regions |

| High Leverage | Offshore Licensing for Many Clients |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa is a legit forex and CFD broker offering low-cost, commission-free trading, multiple platforms, and PayPal support. With global regulation and strong features, it suits both beginners and experienced traders seeking flexible account options.

8. JustMarkets

JustMarkets supports PayPal deposits and withdrawals through its CySEC-regulated entity. Deposits are usually instant and free of broker fees, while withdrawals are handled within 24 hours, in addition to PayPal’s own processing time.

Frequently Asked Questions

What trading platforms does JustMarkets offer?

JustMarkets primarily offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These are available across various modalities, including desktop (Windows, Mac), web-based (WebTrader), and mobile applications for both iOS and Android devices.

What is the minimum deposit at JustMarkets?

JustMarkets has varying minimum deposit requirements depending on the account type. For their Standard and Standard Cent accounts, the minimum deposit is typically USD 10. However, their Pro and Raw Spread accounts require a higher minimum deposit of USD 200.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated Broker | Limited Investor Protection |

| Low Minimum Deposit | Commission on Raw Accounts |

| Accepts PayPal | Offshore Regulation for Most Clients |

| High Leverage | No Proprietary Desktop Platform |

| Multiple Account Types | Limited Educational Resources |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

JustMarkets is a legit broker offering low minimum deposits, PayPal funding, and high leverage. With strong regulation in key regions and multiple account options, it provides flexible trading conditions suitable for both beginners and experienced traders.

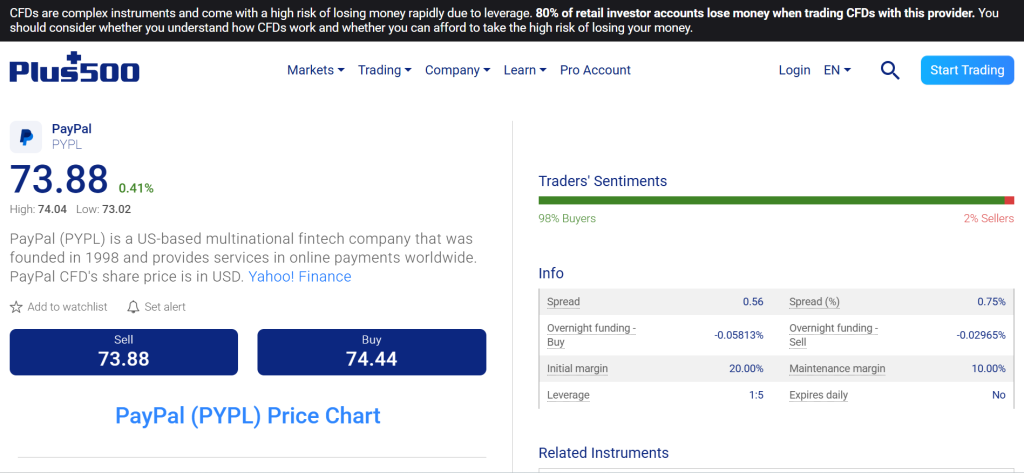

9. Plus500

Plus500 accepts PayPal for deposits and withdrawals in supported regions. Transactions are typically processed promptly, providing a convenient funding option for traders.

Frequently Asked Questions

Does Plus500 accept PayPal?

Yes, Plus500 generally accepts PayPal for both deposits and withdrawals. It’s listed as one of their electronic wallet options. However, availability can vary by your region due to local regulations. Always check the deposit section within your Plus500 trading platform.

Does Plus500 offer leverage?

Yes, Plus500 offers leverage, which varies based on the instrument and your regulatory jurisdiction. For retail clients, leverage on major forex pairs is typically capped at 1:30. However, for other instruments like shares or cryptocurrencies, it can be lower.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by Top Authorities | No MetaTrader Support |

| Wide Range of CFDs | Higher Minimum Deposit |

| User-Friendly Platform | Limited Educational Resources |

| Accepts PayPal | Swap Fees on Overnight Positions |

| No Commissions | Investor Protection Varies by Region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐☆☆☆ |

Our Insights

Plus500 is a legal, well-regulated broker offering a vast range of CFDs with a user-friendly platform and PayPal support. Its competitive spreads and strong client protections make it suitable for traders seeking reliable and straightforward trading.

10. Doo Prime

Doo Prime is a regulated, multi-jurisdiction broker offering vast instrument choice, tight spreads, high leverage, and flexible platforms. While PayPal funding may be available in some cases, it’s not guaranteed upon signup.

Frequently Asked Questions

What platforms does Doo Prime offer?

Doo Prime offers a variety of trading platforms. These include the widely popular MetaTrader 4 and MetaTrader 5. Additionally, they provide their proprietary Doo Prime InTrade mobile app, TradingView for advanced charting, and FIX API 4.4 for direct market access.

Is Islamic (swap-free) trading available?

Yes, Doo Prime offers Islamic (swap-free) accounts. You can convert your live trading account to an Islamic account through their client area. While no overnight interest charges are applied, be aware that administrative fees or holding fees might apply.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-Region Regulation | Inconsistent Investor Protection |

| Extensive Asset Coverage | PayPal Access Limited |

| Multiple Platforms | High ECN Minimum Deposit |

| Tight Spreads | Limited Educational Content |

| High Leverage | Offshore Entities |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Doo Prime is an approved multi-regulated broker offering diverse assets, advanced platforms, and strong safety features. Its competitive spreads and user-friendly tools make it a solid choice for both new and experienced traders.

What is PayPal?

PayPal is a widely used online payment system that allows individuals and businesses to send and receive money electronically. It acts as a digital wallet, securely linking to your bank account, credit card, or debit card.

Criteria for Choosing a Forex Broker that Accepts PayPal

| Criteria | Description | Importance |

| Regulation & Licensing | Broker should be licensed by reputable regulators (e.g. FCA, ASIC, CySEC). | ⭐⭐⭐⭐⭐ |

| PayPal Support | Broker must fully support PayPal for both deposits and withdrawals. | ⭐⭐⭐⭐⭐ |

| Security of Funds | Funds should be kept in segregated accounts with encryption and fraud protection. | ⭐⭐⭐⭐⭐ |

| Trading Fees & Commissions | Low spreads and transparent fee structures are essential. | ⭐⭐⭐⭐☆ |

| Minimum Deposit Requirements | Look for a broker with reasonable minimum deposits for PayPal transactions. | ⭐⭐⭐⭐☆ |

| Platform & Tools Availability | Availability of MT4/MT5 or proprietary platforms with advanced tools and analytics. | ⭐⭐⭐⭐☆ |

| Withdrawal Speed via PayPal | Fast and smooth withdrawal processing through PayPal (within 24–48 hours preferred). | ⭐⭐⭐⭐☆ |

| Range of Tradable Instruments | A wide selection of forex pairs, CFDs, stocks, indices, and crypto for diversified trading. | ⭐⭐⭐⭐☆ |

| Customer Support | Reliable support, especially for resolving PayPal transaction issues quickly. | ⭐⭐⭐⭐☆ |

| User Reviews & Reputation | Positive feedback from real traders, especially regarding PayPal usage and fund withdrawals. | ⭐⭐⭐⭐☆ |

Top 10 Best Forex Brokers Accepting PayPal – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From minimum deposits to withdrawal speed, we provide straightforward answers to help you understand PayPal and choose the right broker confidently.

Q: Is there a fee for using PayPal with forex brokers? – Clara_TraDe

A: Typically, forex brokers themselves do not charge fees for using PayPal for deposits and withdrawals. However, PayPal may impose its own fees for certain transactions, such as currency conversion or international transfers.

Q: How fast are deposits and withdrawals via PayPal? – ZuluSignals

A: PayPal deposits are usually instant or completed within 30 minutes. Withdrawals typically take 1–2 business days.

Q: Do I need to verify my account to use PayPal with a forex broker? – Olaf_Markets

A: Yes, you absolutely need to verify both your forex trading account and your PayPal account to use PayPal for deposits and withdrawals with a forex broker. This is a crucial part of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, ensuring secure and legitimate transactions.

Q: Is PayPal safer than other e-wallets for forex trading? – Dani_XAU

A: PayPal is widely regarded as one of the safer e-wallets for online transactions, including forex trading. It employs robust security measures like end-to-end encryption, 24/7 fraud monitoring, and buyer/seller protection policies.

Q: What’s the minimum deposit for forex trading using PayPal? – FxKenya

A: The minimum deposit for forex trading using PayPal varies significantly by broker. While some brokers like XTB and OANDA have no official minimum deposit, others can range from $10 to $100 or more. Always check the specific broker’s website.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fast Transactions | May charge transaction or currency conversion fees |

| Security | Limited Broker Choice |

| Convenience | Country Restrictions |

| Global Availability | Funding Limitations |

| Low Deposit Requirements | No Anonymous Transactions |

You Might also Like:

- AvaTrade Review

- IC Markets Review

- Pepperstone Review

- OANDA Review

- FxPro Review

- XTB Review

- Octa Review

- JustMarkets Review

- Plus500 Review

- Doo Prime Review

In Conclusion

Forex brokers that accept PayPal offer fast, secure, and convenient transactions, making them ideal for beginners. However, limited broker availability and potential fees are drawbacks to consider when choosing a PayPal-friendly broker.

Faq

Generally, no. Due to strict Anti-Money Laundering (AML) regulations, forex brokers typically enforce a “back to source” policy. This means you can only withdraw funds back to the original method used for deposit, and often up to the amount initially deposited by that method.

While PayPal operates in over 200 countries, its availability for forex trading can be restricted. This depends on both PayPal’s internal policies for specific regions and the regulatory environment governing forex brokers in those countries.

PayPal’s own limits vary based on account verification status and transaction type. For verified personal accounts, you can send up to $60,000 in a single transaction, though PayPal might cap it at $10,000.

Yes, generally you can claim bonuses and participate in promotions when depositing via PayPal. Many brokers that accept PayPal include it as an eligible funding method for their promotional offers, such as welcome bonuses or deposit matches.

While generally safe and fast, using PayPal with forex brokers can have some disadvantages. Potential fees for currency conversion or international transfers are common, which can eat into profits. Also, PayPal’s strict regulations and occasional account freezes can be frustrating.