The 10 best Forex brokers in Qatar revealed.

This is a complete guide to the Ten best Forex brokers in Qatar.

In this in-depth guide, you’ll learn:

- Who are the 10 best Forex brokers in Qatar

- The main features of the 10 best Forex brokers in Qatar

- The pros and cons of trading in the UAE

- How to choose a Forex broker

- Frequently Asked Questions about Trading in Qatar

And lots more…

Let’s dive right in…

🏆 10 Best Forex Brokers

10 Best Forex Brokers in Qatar (2024*)

- ☑️FP Markets – Overall, Best Forex Broker in Qatar.

- ☑️Pepperstone – Low Spread Swap Free Broker.

- ☑️ AvaTrade – Award-winning QFC-regulated trading platform.

- ☑️Plus500 – Best Low Spread Islamic Broker.

- ☑️HFM – Multi-asset regulated Broker.

- ☑️eToro – Best Trading App in Qatar.

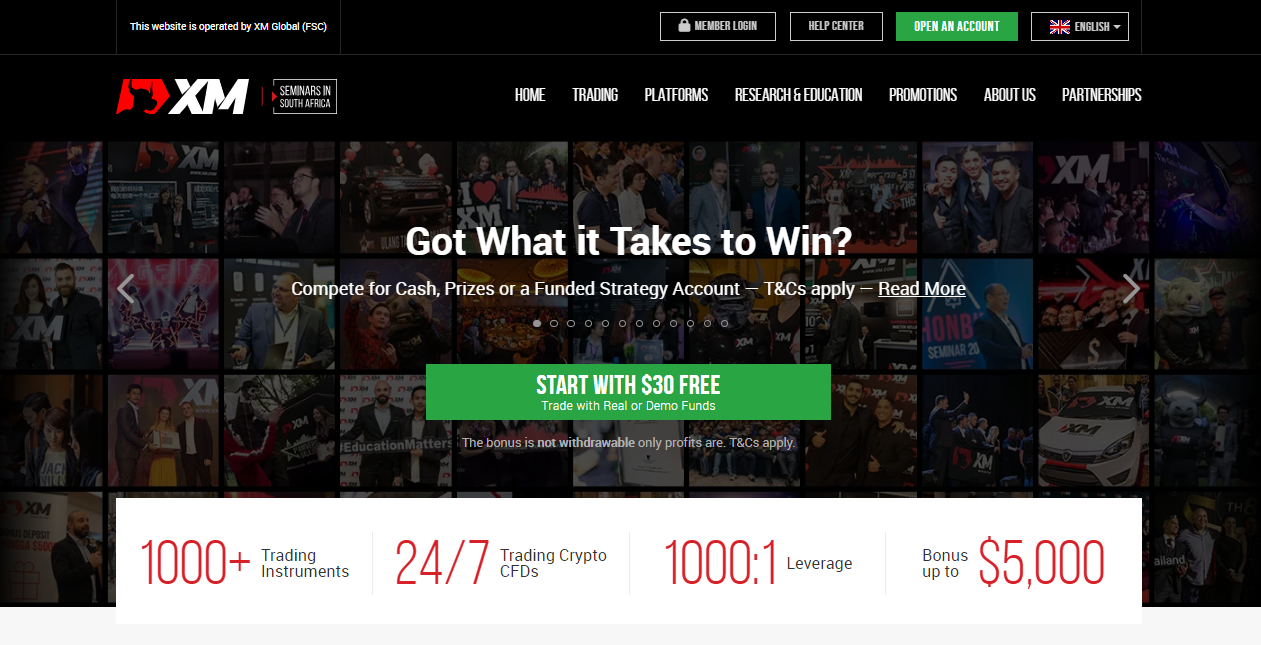

- ☑️XM – Offers multiple trading account types.

- ☑️IC Markets – Low Spread Islamic Broker.

- ☑️Interactive Brokers – Multi-asset trading platform in UAE.

- ☑️Oanda – Best mobile trading app in Qatar.

Best Forex Brokers in Qatar

10 Best Forex Brokers in Qatar

FP Markets

Who should use FP Markets?

Qatari Forex traders seeking a reputable broker with advanced trading tools and tight spreads should consider FP Markets.

What does FP Markets do best?

FP Markets excels in providing Qatari traders with advanced trading platforms, competitive spreads, diverse asset offerings, and exceptional customer support services.

Where can FP Markets improve?

FP Markets could improve in enhancing their social trading or copy trading features for better client engagement.

FP Markets Pros and Cons

Pepperstone

Who should use Pepperstone?

Qatari Forex traders seeking low spreads, fast execution, advanced technology, and a wide range of markets should consider trading with Pepperstone.

What does Pepperstone do best?

Pepperstone offers Qatari traders access to low spreads, lightning-fast execution, advanced trading technology, diverse market offerings, and exceptional customer service.

Where can Pepperstone improve?

Pepperstone could improve by expanding its educational resources and providing more comprehensive learning materials for traders of all levels.

Pepperstone Pros and Cons

AvaTrade

Who should use AvaTrade?

Qatari traders seeking a comprehensive range of educational resources to enhance their trading skills should consider AvaTrade’s extensive educational materials.

What does AvaTrade do best?

AvaTrade excels in providing Qatari traders with a user-friendly and intuitive trading platform, catering to both novice and experienced traders alike.

Where can AvaTrade improve?

One area where AvaTrade could improve is by enhancing its customer support services to provide faster response times and more personalized assistance to traders.

AvaTrade Pros and Cons

Plus500

Who should use Plus500?

Qatari traders seeking a straightforward and intuitive trading experience should consider Plus500‘s user-friendly platform, which offers easy access to a wide range of markets and instruments.

What does Plus500 do best?

Plus500 stands out for its extensive range of tradable assets, including Forex pairs, stocks, commodities, cryptocurrencies, and indices, providing Qatari traders with diverse investment opportunities.

Where can Plus500 improve?

One area where Plus500 can improve is by expanding its range of educational resources and providing more in-depth tutorials, webinars, and analysis tools tailored to the needs of Qatari traders.

Plus500 Pros and Cons

HFM

Who should use HFM?

Qatari Forex traders seeking diversified trading opportunities should consider HFM’s extensive range of financial instruments, spanning Forex, commodities, indices, cryptocurrencies, and shares.

What does HFM do best?

HFM excels in providing Qatari traders with ultra-low spreads, offering competitive pricing and cost-effective trading conditions compared to many other brokers.

Where can HFM improve?

HFM could improve its platform stability and uptime by investing in robust infrastructure and technology upgrades, ensuring uninterrupted access to the trading platform for Qatari traders, especially during high-volume trading periods.

HFM Pros and Cons

eToro

Who should use eToro?

Forex traders in Qatar seeking a social trading platform with a user-friendly interface and access to a diverse range of markets should consider using eToro.

What does eToro do best?

eToro excels in providing Qatari traders with a unique social trading experience, allowing them to connect with and replicate the strategies of successful traders, while also offering a wide range of markets and innovative trading features.

Where can eToro improve?

eToro could improve by enhancing its customer support services to provide faster response times and more comprehensive assistance to Qatari traders, ensuring a smoother and more satisfactory trading experience.

eToro Pros and Cons

XM

Who should use XM?

XM is particularly suitable for Qatari Forex traders who prioritize tight spreads and fast execution. The broker offers competitive pricing and reliable order execution, ensuring optimal trading conditions.

What does XM do best?

XM excels in providing Qatari traders with an extensive range of educational resources, including webinars, seminars, and video tutorials, designed to enhance traders’ knowledge and skills in the Forex market.

Where can XM improve?

One area where XM could improve is by enhancing its social trading features to offer a more robust and interactive social trading experience, allowing traders in Qatar to easily connect with and follow successful traders on the platform.

XM Pros and Cons

IC Markets

Who should use IC Markets?

The specific feature that would appeal to Forex traders in Qatar, considering IC Markets, is its renowned reputation for offering extremely low spreads, which is ideal for traders seeking cost-efficient trading conditions.

What does IC Markets do best?

IC Markets stands out for its robust ECN (Electronic Communication Network) pricing model, offering Qatari traders direct access to interbank liquidity and tight spreads, facilitating transparent and fair trading environments even during volatile market conditions.

Where can IC Markets improve?

One area where IC Markets could improve is by introducing guaranteed stop-loss orders, providing Qatari traders with enhanced risk management tools and greater peace of mind during volatile market conditions.

IC Markets Pros and Cons

Interactive Brokers

Who should use Interactive Brokers?

Forex traders in Qatar seeking direct market access to global exchanges and a vast array of financial instruments, including Forex, stocks, options, futures, and bonds, would greatly benefit from trading with Interactive Brokers.

What do Interactive Brokers do best?

Interactive Brokers excels in providing Qatari traders with access to direct market access (DMA) and a vast array of financial instruments, facilitating transparent and efficient trading across global markets.

Where can Interactive Brokers improve?

One area where Interactive Brokers could improve is simplifying its fee structure to make it more transparent and easier for traders to understand, thus reducing confusion and ensuring a smoother trading experience for Qatari traders.

Interactive Broker’s Pros and Cons

Oanda

Who should use Oanda?

Forex traders in Qatar seeking cutting-edge trading technology that offers advanced charting tools, customizable indicators, and seamless execution should leverage OANDA‘s innovative platform for optimal trading experiences.

What does Oanda do best?

OANDA excels in providing Qatari traders with unparalleled transparency and reliability in pricing. It offers real-time access to market rates and fair execution, ensuring a trustworthy trading environment.

Where can Oanda improve?

One area where OANDA could improve is by expanding its integration with third-party trading platforms and tools, providing Qatari traders with more options for customization and enhancing their trading experience.

Oanda Pros and Cons

How to Choose a Forex Broker in Qatar

When selecting a Forex broker in Qatar, traders should prioritize several factors.

- First, consider regulations and ensure that the broker is licensed by reputable authorities.

- Next, assess trading conditions, including spreads, commissions, and available trading platforms.

- It’s crucial to choose a broker offering suitable account types and deposit/withdrawal options. Traders should also evaluate customer support quality and available educational resources. Additionally, transparency, reliability, and a strong track record are essential.

- Finally, consider any unique needs or preferences, such as specific trading tools or markets, to find a broker aligned with your trading style and objectives.

Conclusion

These brokers offer a diverse range of features tailored to meet the needs of Bahraini traders, including competitive spreads, advanced trading platforms, regulatory compliance with authorities such as the Central Bank of Bahrain (CBB), and robust customer support services. Additionally, they prioritize security and transparency, ensuring that traders have access to secure trading environments and transparent pricing.