Admirals Review

- Overview

- Admirals Visual, Video Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an Admirals Account

- Islamic Forex Account

- Demo Account

- Safety and Security

- Trading Platforms

- The Admirals Mobile App

- Markets Available for Trade

- Deposit and Withdrawal

- Admirals Wallet

- Admirals Cashback

- Partnership Programmes

- Education and Resources

- Customer Reviews and Trust Score

- Discussions and Forums - What Traders Are Saying

- Employee Insights - Working at Admirals

- Axi vs Octa vs OANDA - A Comparison

- Pros and Cons

- In Conclusion

Admiral Markets (Admirals) is considered a low-risk broker, recognized for its reliability and trustworthiness in Forex and CFD copy trading. Admirals provides fast online support and quick trading execution, with an average trust score of 84 out of 100.

★★★ | Minimum Deposit: $25 Regulated by: FCA, ASIC, CySEC Crypto: Yes |

Overview

Admirals stand out as a multi-functional broker that merges trading, investing, and financial education under one global platform. With its powerful tools, strong security measures, and award-winning service, it aims to empower all levels of traders.

Frequently Asked Questions

Is Admirals a safe and regulated broker?

Yes, Admirals is globally regulated and operates under multiple entities. Client funds are kept in segregated Tier 1 bank accounts with insurance coverage up to $100,000, ensuring high financial security.

Can I trade and invest through the same Admirals account?

Absolutely. Admirals allows users to trade CFDs and invest in real stocks and ETFs from one unified account, offering flexibility and convenience through both MetaTrader platforms and a mobile app.

Our Insights

Admirals is a well-rounded platform that blends education, trading, and investing. Its low-cost structure, strong security, and advanced technology make it a compelling option for anyone seeking long-term financial empowerment.

★★★ | Minimum Deposit: $25 Regulated by: FCA, ASIC, CySEC Crypto: Yes |

Admirals Visual, Video Overview

Get a quick, engaging look at what Admirals has to offer through this visual and video overview. Discover the key features, trading platforms, account types, and tools available, all presented in an easy-to-understand format for traders of every experience level.

★★★ | Minimum Deposit: $25 Regulated by: FCA, ASIC, CySEC Crypto: Yes |

Fees, Spreads, and Commissions

Admirals delivers a competitive and transparent pricing structure across its account offerings. With spreads starting from 0.0 pips and low commissions, traders benefit from affordable trading without compromising platform quality or execution speed.

| Account Type | Spreads From | Commission | Leverage (Forex) |

| Trade.MT5 | 0.5 pips | From $0.02/share (stocks, ETFs) | 1:100 – 1:10 |

| Invest.MT5 | N/A | From $0.02/share (stocks, ETFs) | No leverage |

| Zero.MT5 | 0.0 pips | From $1.8–$3.0 per lot (Forex) | 1:100 – 1:10 |

Frequently Asked Questions

What is the difference in spread and commission between the Trade.MT5 and Zero.MT5 accounts?

Trade.MT5 offers spreads from 0.5 pips with no commission on most assets, while Zero.MT5 offers raw spreads from 0.0 pips with commission fees starting from $1.8 per lot on Forex and Metals.

Does Admirals charge commissions on stock and ETF trades?

Yes, both Invest.MT5 and Trade.MT5 accounts apply commissions starting from $0.02 per share when trading stocks or ETFs. This is charged per transaction and varies depending on the specific asset and market.

Our Insights

Admirals’ fee model provides flexibility, clarity, and affordability. With options for commission-free trading or raw spreads, the broker empowers both beginners and professionals to trade under conditions that align with their strategies and goals.

★★★ | Minimum Deposit: $25 Regulated by: FCA, ASIC, CySEC Crypto: Yes |

Minimum Deposit and Account Types

Admirals offers three core account types: Trade.MT5, Invest.MT5 and Zero.MT5, each tailored to specific trading and investing needs. With ultra-low spreads, flexible leverage, and clear commission structures, Admirals ensures pricing that suits traders of all levels.

| Account Type | Open an Account | Spreads From | Leverage (Forex) |

| Trade.MT5 | 0.5 pips | 1:100 – 1:10 | |

| Invest.MT5 | N/A | No leverage | |

| Zero.MT5 | 0.0 pips | 1:100 – 1:10 |

Frequently Asked Questions

What is the difference in spread and commission between the Trade.MT5 and Zero.MT5 accounts?

Trade.MT5 offers spreads from 0.5 pips with no commission on most assets, while Zero.MT5 offers raw spreads from 0.0 pips with commission fees starting from $1.8 per lot on Forex and Metals.

Does Admirals charge commissions on stock and ETF trades?

Yes, both Invest.MT5 and Trade.MT5 accounts apply commissions starting from $0.02 per share when trading stocks or ETFs. This is charged per transaction and varies depending on the specific asset and market.

Our Insights

Admirals’ fee model provides flexibility, clarity, and affordability. With options for commission-free trading or raw spreads, the broker empowers both beginners and professionals to trade under conditions that align with their strategies and goals.

★★★ | Minimum Deposit: $25 Regulated by: FCA, ASIC, CySEC Crypto: Yes |

How to Open an Admirals Account

Opening an account with Admirals is a simple process. Follow these steps:

1. Step 1: Visit the Admiral website.

Go to the official Admirals website.

2. Step 2: Choose Your Account Type

Select the type of account you wish to open. Admirals offer various account types, including Trade.MT5, Invest.MT5, and Zero.MT5. Each account type has its features, so choose the one that best suits your trading needs.

3. Step 3: Click on ‘Open Account‘ or ‘Register‘

On the homepage or account section, you will find an option to open an account. Click on the button to begin the registration process.

4. Step 4: Fill in Your Details

Provide your personal information, including your name, email, phone number, address, and nationality. You may also be asked to create a password for your account.

5. Step 5: Verify Your Identity

To comply with regulatory requirements, you will need to verify your identity. This typically involves submitting a copy of your ID (passport, driver’s license) and proof of address (such as a utility bill or bank statement).

6. Step 6: Deposit Funds

After your account is verified, fund your account with the minimum deposit amount (usually starting from 1 USD or equivalent). You can deposit via several methods, including bank transfer, credit/debit card, or e-wallet.

7. Step 7: Download the Trading Platform

Once your account is set up and funded, download the preferred trading platform (MetaTrader 4 or MetaTrader 5) on your computer or mobile device.

After completing the setup, you can log into your account, explore the platform, and begin trading.

Islamic Forex Account

Admirals’ Islamic Forex Account is designed for Muslim traders who wish to trade without earning or paying interest. Built on the Trade.MT5 platform delivers tight spreads, fast execution, and zero swap adjustments across multiple CFD instruments.

Frequently Asked Questions

Are there any interest charges on Admirals’ Islamic Account?

No. The Islamic Forex Account ensures that no interest is paid or received on overnight positions. This makes it fully compliant with Sharia law, eliminating swaps across major asset classes including currencies, indices, and commodities.

Why is there an administration fee on Islamic Accounts?

To maintain compliance while covering operational costs, Admirals applies a flat administration fee on trades held beyond three days (or one day for exotic pairs). This replaces traditional swap charges in a transparent, fixed manner.

Our Insights

Admirals provides a Sharia-compliant solution through its Islamic Forex Account, preserving ethical values without compromising performance. With no interest, competitive pricing, and full trading functionality, it’s a trusted option for faith-conscious traders.

Demo Account

The Admirals Demo Account replicates live market conditions using virtual funds. It’s ideal for both beginners and experienced traders who want to practise, learn, or test strategies, risk-free, on the world-class MetaTrader 5 platform, from any device.

| Account | Demo |

| Cost | Free |

| Platform | MetaTrader 5 |

| Access | PC Mac iOS Android Web |

| Expiration | 30 days (extendable by logging in regularly) |

| Open an Account |

Frequently Asked Questions

Does it cost anything to use Admirals’ Demo Account?

No. The Admirals Demo Account is completely free to use. You can open an account without making a deposit and start practising instantly with virtual funds under simulated real-market conditions.

How long can I use my Admirals Demo Account?

You can use the Demo account for up to 30 days unless you log in regularly. To keep the Demo account active beyond this period, simply log in at least once every 30 days.

Our Insights

The Admirals Demo Account is a smart choice for traders at any level. With zero cost, real-time data, and full access to advanced trading tools, it provides a safe space to learn and grow trading skills effectively.

Safety and Security

Admirals prioritize client fund safety through strict regulatory adherence, segregated accounts, and insurance coverage. With transparent security measures and ongoing fraud protection initiatives, traders can operate with peace of mind and confidence in their broker.

| Regulation | Jordan Securities Commission (JSC) |

| Client Fund Segregation | Held in trust accounts at leading Jordanian banks |

| Insurance Coverage | Up to $100,000 for eligible clients |

| External Audits | Regular operational and accounting audits |

Frequently Asked Questions

Is my money safe with Admirals?

Yes. Admirals keeps all client funds in segregated trust accounts held with top-tier Jordanian banks. The broker also provides additional security through external audits and a $100,000 insurance policy per eligible client.

What does the Admirals insurance cover?

The insurance policy covers eligible clients’ cash and securities in case of insolvency. It does not cover losses from trading performance or leveraged products. Most retail clients are automatically covered at no extra cost.

Our Insights

Admirals go beyond standard practices to ensure financial security. With regulation from the JSC, insured client accounts, and transparent fund segregation, it offers a reliable trading environment backed by robust investor protection policies.

Trading Platforms

Admirals provides access to MetaTrader 4 and MetaTrader 5, two of the most trusted platforms in the trading world. Whether you’re a beginner seeking simplicity or a seasoned trader needing advanced features, there’s a platform tailored to your needs.

| Platform | MetaTrader 4 | MetaTrader 5 |

| Asset Coverage | Forex CFDs | Forex CFDs Stocks ETFs Futures |

| Interface | Simple beginner-friendly | Advanced with extended features |

| Charting Tools | Standard charting indicators | Enhanced charting and analysis options |

| Mobile Access | Android iOS | Android iOS |

Frequently Asked Questions

What’s the main difference between MetaTrader 4 and MetaTrader 5?

MetaTrader 4 is ideal for Forex trading with a simple, user-friendly interface. MetaTrader 5 offers more advanced charting, supports additional assets, and is better suited for traders needing multi-market functionality.

Can I trade on MetaTrader platforms from my phone?

Yes. Both MetaTrader 4 and MetaTrader 5 are available as mobile apps for Android and iOS, letting you trade from anywhere with full access to charts, orders, and account management tools.

Our Insights

Admirals offers both MetaTrader 4 and MetaTrader 5, giving traders the choice between classic simplicity and cutting-edge functionality. With free access and multi-device compatibility, these platforms serve all skill levels and strategies.

The Admirals Mobile App

Developed in-house by Admirals, the mobile app is a fully equipped trading platform offering real-time execution, secure account management, and seamless switching between demo and live modes. It enables traders to act instantly, anytime, anywhere.

| Feature | Details |

| Trade Execution | Real-time fast execution |

| Account Management | Switch between demo/live, deposit/verify |

| Platform Security | Advanced encryption and secure login |

| Compatibility | iOS and Android |

Frequently Asked Questions

What features does the Admirals Mobile App offer?

The app includes fast trade execution, real-time data, account funding, verification, and full portfolio control. It also supports switching between demo and live accounts, ensuring a comprehensive trading experience on the go.

Can I trade global markets using the Admirals app?

Yes. The app provides direct access to global markets, including Forex, CFDs, stocks, and more. It offers professional-grade trading tools in a simplified mobile format for full flexibility and convenience.

Our Insights

The Admirals Mobile App is a modern, secure, and fully functional trading platform for mobile users. Whether you’re testing strategies or managing live trades, it delivers real-time market access and control in a streamlined, intuitive interface.

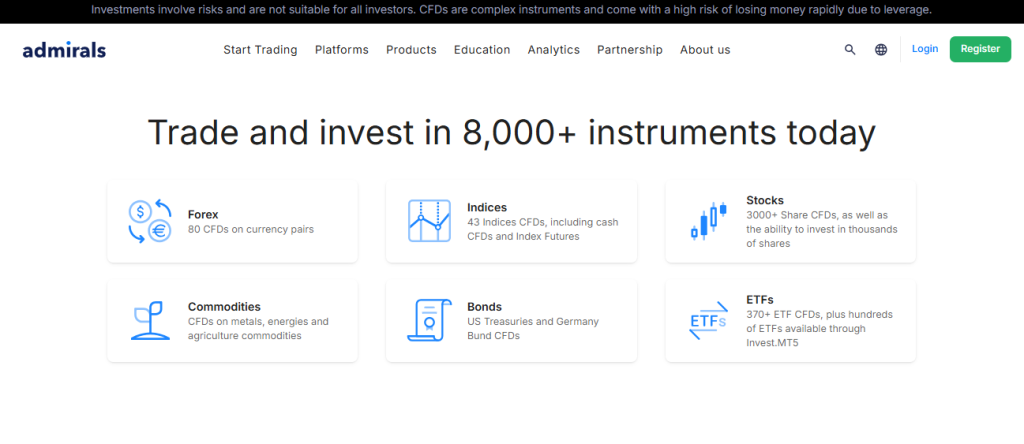

Markets Available for Trade

Admirals give traders access to a broad spectrum of global financial markets. From popular Forex pairs to stock CFDs, indices, commodities, and bonds, it’s a versatile trading environment ideal for building a well-rounded investment portfolio.

| Market Type | Examples |

| Forex Pairs | EUR/USD GBP/USD USD/JPY |

| Stock CFDs | Apple Tesla Meta Microsoft |

| Index CFDs | S&P 500 DAX 40 FTSE 100 |

| Commodity CFDs | Gold Oil Natural Gas |

Frequently Asked Questions

What markets can I access through Admirals?

Admirals allow you to trade across several markets, including major and minor Forex pairs, global stock CFDs, leading indices, government bond CFDs, and commodity CFDs like gold and oil, all in one place.

Can I trade well-known stocks like Apple or Tesla?

Yes. Admirals provide Share CFDs on a wide range of popular companies such as Apple, Tesla, Google, Microsoft, and Meta, allowing traders to speculate on price movements without owning the underlying shares.

Our Insights

Admirals stand out with its extensive market coverage and accessible trading conditions. From Forex to shares and commodities, it offers the flexibility and tools needed to diversify and explore global trading opportunities with confidence.

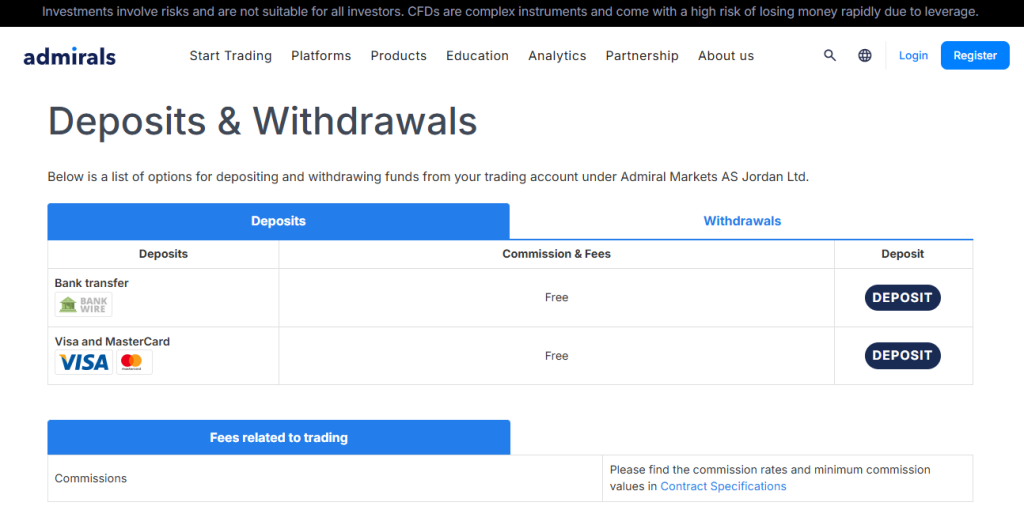

Deposit and Withdrawal

Admirals provides a user-friendly and cost-effective system for funding and withdrawing from trading accounts. With zero deposit fees and several supported methods, traders can manage their funds with clarity and confidence.

| Feature | Details |

| Deposit Methods | Bank transfer Visa/MasterCard |

| Deposit Fees | None |

| Withdrawal Fees | Generally free fees may apply for conversions |

| Inactivity Fee | $10/month after 24 months of no trading activity |

Frequently Asked Questions

What deposit methods do Admirals offer?

Admirals accept deposits via bank transfers and Visa/MasterCard, both of which are processed without any deposit fees. Traders can also perform internal transfers between accounts with the same base currency at no cost.

Are there fees for withdrawing funds?

Withdrawals are generally free. However, if the receiving account has a different base currency, a 1% conversion fee may apply. Additionally, third-party bank fees could be deducted during processing.

Our Insights

Admirals delivers a smooth and transparent deposit and withdrawal experience. With fee-free deposits and a clear structure for currency conversions or inactivity, it’s a trader-friendly system that balances convenience with accountability.

Admirals Wallet

Admirals Wallet provides a centralized solution for storing, exchanging, and managing trading funds. Supporting up to 20 currencies, instant exchanges, and even gold investing, this tool empowers traders with full control across all Admirals platforms.

| Feature | Functionality |

| Multi-Currency Support | Hold up to 20 different currencies (region dependent) |

| Instant Exchange | Convert currencies at market rates with minimal fees |

| Gold Investing | Invest in gold directly - no trading account required |

| Risk Control | Fund accounts strategically to manage margin exposure |

Frequently Asked Questions

What can I do with the Admirals Wallet?

With the Admirals Wallet, you can hold multiple currencies, instantly exchange them, manage risk, and even invest in gold—all from one secure dashboard linked to all your trading accounts.

Are there any fees associated with using the Admirals Wallet?

Currency exchanges are free for the first five transactions per month. After that, a 1% fee applies (minimum 1 EUR). Holding and transferring funds within the Wallet itself comes with no additional charges.

Our Insights

Admirals Wallet is a flexible and secure solution that enhances how traders manage funds. From risk control to multi-currency support and easy account transfers, it’s an intuitive and powerful tool for today’s global traders.

Admirals Cashback

The Admirals’ Cashback program rewards traders monthly, based on trading volume. Available for all account types, this incentive allows you to trade and receive automatic cashback payments, making your trading experience more valuable.

| Step | Action |

| 1. Register | Open your Admirals account |

| 2. Deposit | Fund your account with 0% deposit fees |

| 3. Trade & Earn | Earn cashback automatically monthly |

Frequently Asked Questions

How does Admirals Cashback work?

Admirals calculate your trading volume and automatically credits your trading account with a cashback reward each month. No manual requests or forms, just trade and get rewarded.

Can I use any Admirals account for cashback?

Yes, the cashback program applies to all Admirals account types, including Trade.MT5, Invest.MT5, and Zero.MT5. You need to register, make a deposit, and start trading.

Our Insights

Admirals Cashback is a trader-friendly program that enhances your trading activity with monthly rewards. With automatic payouts and compatibility across all accounts, it’s a practical way to benefit more from every trade.

Partnership Programmes

Admirals offers three robust partnership options: Introducing Business Partner, Affiliate Program, and White Label, designed to support growth and earnings. With transparency, multilingual support, and powerful marketing tools, it’s a top-tier choice for financial collaboration.

| Program | Ideal For | Key Features | Offered By |

| Introducing Business Partner | Agents Entrepreneurs | Flexible commissions Partner’s Room access | UK Jordan Entities |

| Affiliate Program | Affiliates Content Creators | CPA plans, marketing tools, 24/7 portal access | UK Jordan Entities |

| White Label | Financial Institutions | Full product suite back-office solutions | Admiral Markets AS |

Frequently Asked Questions

What types of partnerships does Admirals offer?

Admirals offers Introducing Business Partner, Affiliate Program, and White Label partnerships—each designed for agents, publishers, influencers, and institutions seeking to refer traders or expand service portfolios.

What are the benefits of becoming an Admirals partner?

Partners benefit from high commissions, flexible payouts, advanced marketing tools, real-time reporting, and global support in 24 languages—all backed by a highly regulated and award-winning broker.

Our Insights

Whether you’re a financial professional or digital marketer, Admirals’ partnership programs provide a scalable, transparent, and rewarding path to long-term earnings. Backed by strong regulation and tech, it’s ideal for growing your network and income.

Education and Resources

Admirals provides an exceptional suite of beginner-focused educational content. With free access to on-demand articles, live webinars, and interactive learning tools, it’s a great resource for traders starting from zero and looking to build confidence and skills.

| Content Type | Topics Covered | Access Format | Availability |

| Articles | Forex basics MT5 setup trading tips | Written guides | On-demand 24/7 |

| Webinars | Live Q&A trading concepts | Live sessions | Scheduled archived |

| Platform Guides | How to use MetaTrader | Interactive walkthroughs | Web mobile friendly |

Frequently Asked Questions

What can beginners learn from Admirals’ resources?

Beginners can learn everything from trading fundamentals to opening MetaTrader accounts and executing trades. Articles cover Forex basics, platform usage, common strategies, and risk management—all in a simple, beginner-friendly format.

Are the educational materials free?

Yes. Admirals offers all beginner-level content, including articles, webinars, and courses, at no cost. Traders can study on their own time and schedule, without needing to pay for access or materials.

Our Insights

For new traders, Admirals’ beginner education hub is a valuable launchpad. With clear, practical, and free content covering all the basics, it’s an ideal resource to start learning trading in a structured, confidence-building way.

Customer Reviews and Trust Score

Admirals (also known as Admiral Markets) generally receive favorable feedback across major review platforms. Users frequently praise the platform’s regulatory standing and fast trade execution, while some express concerns about withdrawals or account issues.

| Platform | Trust Score | Highlights |

| Trustpilot | 4 | Fast withdrawals, some payout complaints |

| ForexBrokers.com | 4.65 | Highly regulated, strong reputation |

Insights from Real Traders

🥇Great Trading Experience!

I’ve been trading with Admirals for over six months, and the experience has been fantastic. The platform is user-friendly, and I love the range of trading instruments available. Withdrawals are fast, and customer support is always helpful. A trusted broker! – Sarah

⭐⭐⭐⭐

🥈Reliable and Efficient Service.

Admirals has been a great partner in my trading journey. The deposit and withdrawal process is smooth, and I appreciate the detailed resources they provide. The low fees make it easy to keep my costs down while maximizing opportunities. – Lucy

⭐⭐⭐⭐⭐

🥉 Excellent Platform and Support.

As someone new to trading, I’ve found Admirals’ platform incredibly easy to use. The customer service team is always ready to help, and I appreciate the educational resources available to improve my skills. I’m happy with my choice to trade with them! – James

⭐⭐⭐⭐

Discussions and Forums – What Traders Are Saying

Trader opinions across forums are mixed. While Admirals is acknowledged for regulation and platform stability, some users have raised red flags over specific disputes, such as denied withdrawals or account terminations.

| Forum | Positive Feedback | Critical Feedback |

| Forex Peace Army | Prompt execution, transparent tools | Allegations of withheld funds, account closures |

| BabyPips | FCA-regulated, supportive experience | Some minor fee complaints |

| Balanced reviews on support and tools | Technical glitches, mixed service experiences |

Employee Insights – Working at Admirals

Employee feedback is generally positive, especially around global exposure, company culture, and team support. Areas of improvement include management transparency and the speed of internal promotions.

| Source | Rating (5) | Pros | Cons |

| Indeed AmbitionBox | 3.8 | Supportive teams flexible culture | Management issues limited growth paths |

| JobStreet | N/A | Global presence fintech exposure | Limited detailed feedback available |

Axi vs Octa vs OANDA – A Comparison

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated in multiple jurisdictions | High inactivity fees |

| Wide range of financial instruments | Limited proprietary research tools |

| Competitive spreads and low commissions | Fees for withdrawals in some cases |

| Advanced trading platforms (MetaTrader 4/5) | Complex fee structure for certain instruments |

| Educational resources available | Limited cryptocurrency offerings |

References:

In Conclusion

Admirals is a well-rounded broker that caters to a wide range of traders, from beginners to professionals. The platform is regulated by top-tier financial authorities, offering high levels of security and investor protection.

With a variety of account types, low minimum deposit, excellent customer support, and advanced trading tools, Admirals is a solid choice for anyone looking to engage in Forex and CFD trading. Admirals (formerly Admiral Markets) has local offices and offers customer support in the following countries:

- 🇬🇧 United Kingdom

- 🇨🇾 Cyprus

- 🇦🇺 Australia

- 🇯🇴 Jordan

- 🇪🇪 Estonia

- 🇸🇨 Seychelles

- 🇿🇦 South Africa

- 🇰🇪 Kenya

These countries represent the Admirals’ regional hubs for localized service, regulatory support, and multilingual customer assistance.

Faq

Yes, Admirals offers educational resources and user-friendly account options, making it an ideal choice for beginners.

There are no fees for deposits with Admirals.

The minimum deposit is 25 USD.

Admirals offers demo accounts for those looking to practice before committing real capital.

- Overview

- Admirals Visual, Video Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an Admirals Account

- Islamic Forex Account

- Demo Account

- Safety and Security

- Trading Platforms

- The Admirals Mobile App

- Markets Available for Trade

- Deposit and Withdrawal

- Admirals Wallet

- Admirals Cashback

- Partnership Programmes

- Education and Resources

- Customer Reviews and Trust Score

- Discussions and Forums - What Traders Are Saying

- Employee Insights - Working at Admirals

- Axi vs Octa vs OANDA - A Comparison

- Pros and Cons

- In Conclusion