BDSwiss Minimum Deposit Review

BDSwiss is a trusted broker known for its secure trading environment, competitive spreads, and educational support. The broker records an average monthly trading volume of $84 billion and holds a solid trust score of 74/100. It is fully regulated by the FSA, FSC, FSCA, and MISA.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

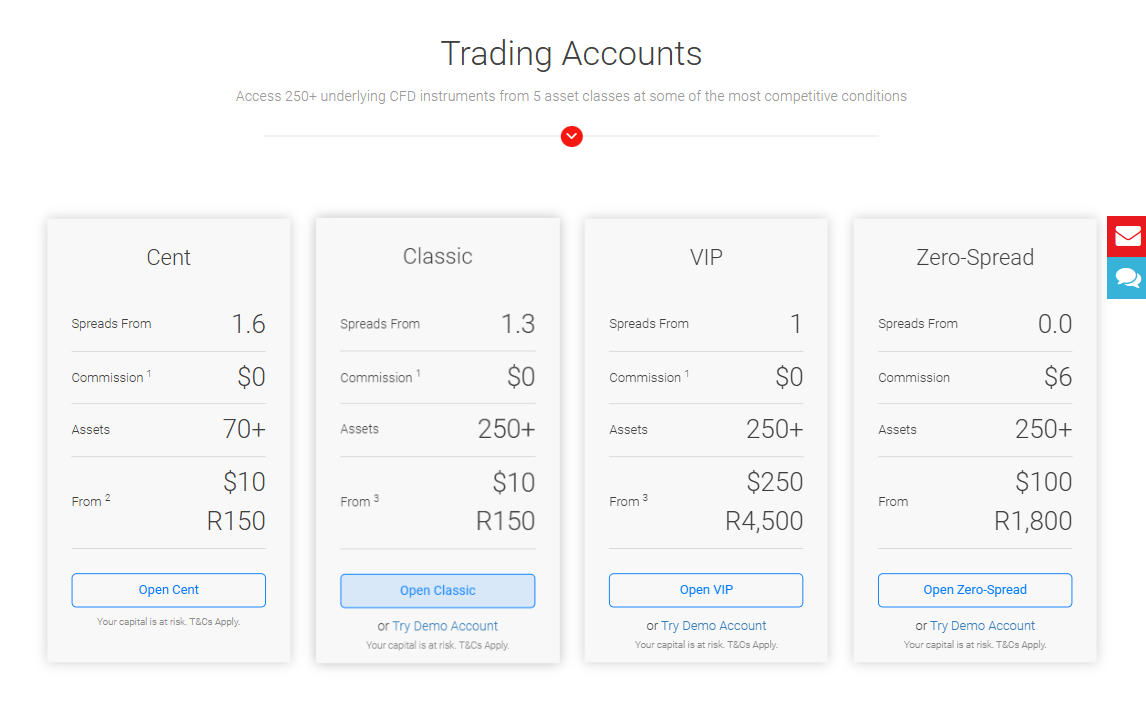

Minimum Deposit and Account Types

BDSwiss delivers an inclusive range of trading accounts designed for both newcomers and experienced traders. With minimum deposits starting at just $10 and dynamic leverage up to 1:2000, the broker empowers users with flexibility, asset variety, and tailored support options for every trading style.

Frequently Asked Questions

What is the minimum deposit for each account type at BDSwiss?

BDSwiss offers four account types with varying entry levels: $10 for the Cent and Classic accounts, $100 for the Zero-Spread account, and $250 for the VIP account. These options accommodate all traders, from casual beginners to serious professionals.

What is dynamic leverage, and how does it work?

Dynamic leverage automatically adapts to the size of your open positions. As position size increases, leverage decreases to manage risk effectively. This ensures traders can benefit from high leverage on smaller trades while reducing exposure on larger ones.

Our Insights

BDSwiss earns points for offering accessible account types with reasonable deposit thresholds. The flexible leverage and structured tier system support various trading goals. Additionally, the VIP account brings value-added features for serious traders seeking premium service and tools.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

How to Open a BDSwiss Account

BDSwiss delivers a swift digital onboarding experience that lets traders open accounts, verify identity, and start trading quickly. Account setup typically completes within one business day once documents are verified.

1. Step 1: Visit the BDSwiss website and click on the “Sign Up” or “Open Account” button.

Fill out the registration form with your name, email address, country of residence, phone number, date of birth, and select your preferred trading platform and leverage.

2. Step 2: Verify your email address by entering the six-digit code sent to your inbox.

Upload the required documents, including a valid government-issued ID and proof of address.

Wait for approval. Once verified, you’ll gain access to your dashboard and can fund your account to begin trading.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

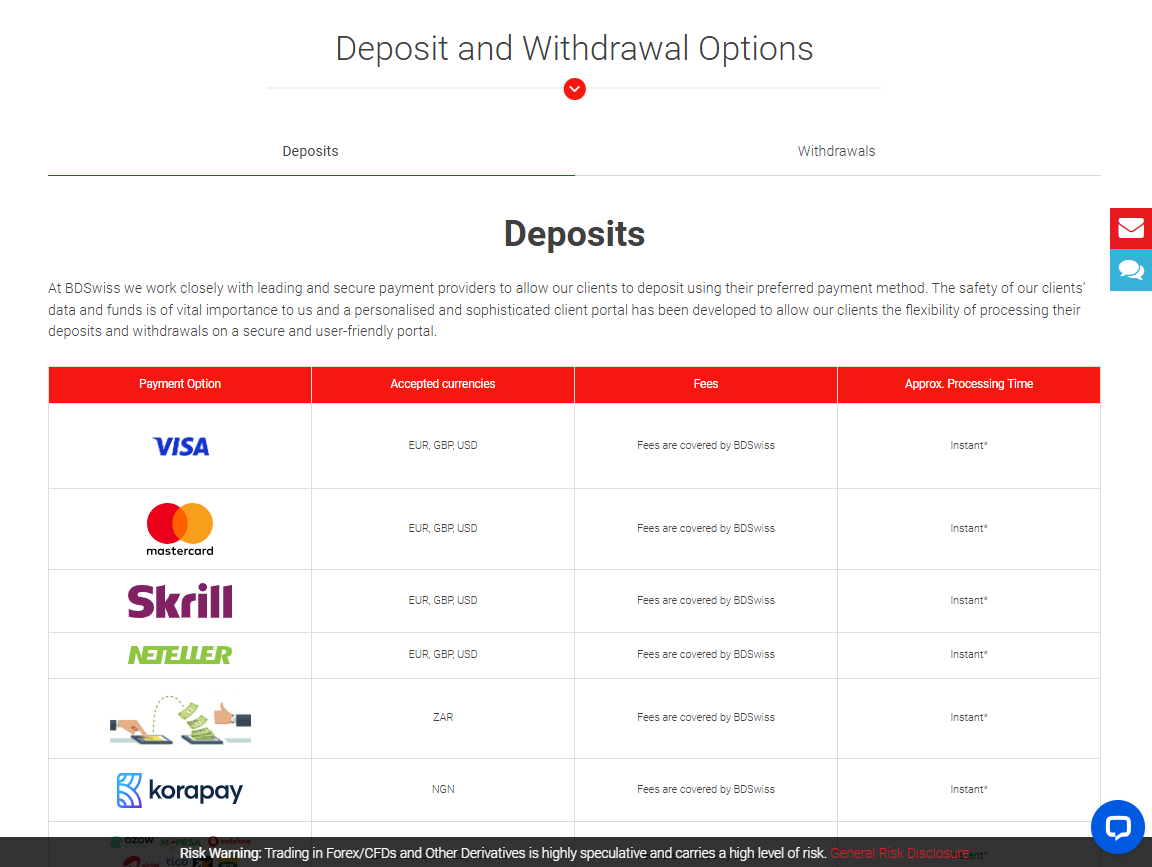

Deposit and Withdrawal

BDSwiss offers a wide range of secure deposit and withdrawal options for clients, including popular payment methods such as Visa, Mastercard, Skrill, Neteller, and various local payment systems like MPESA and PayPal. Deposits are processed instantly for most methods, while withdrawals are typically processed within 24 hours.

In addition, BDSwiss covers all receiving costs, and clients are advised to use the same method for withdrawals as for deposits. To ensure security and compliance, withdrawals are subject to full account verification.

Frequently Asked Questions

What deposit methods are available at BDSwiss?

BDSwiss supports various deposit options, including Visa, Mastercard, Skrill, Neteller, PayPal, and cryptocurrencies like Bitcoin, Ethereum, and others. Local payment systems such as MPESA and GCash are also available.

Are there any fees for depositing or withdrawing funds?

BDSwiss covers all deposit and receiving costs for most payment methods. However, there may be additional exchange or banking fees imposed by your payment provider.

Our Insights

BDSwiss offers a highly flexible and secure range of payment methods for both deposits and withdrawals, with most transactions processed instantly. The platform’s commitment to covering receiving costs and ensuring fast processing times enhances the overall user experience.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about BDSwiss’ minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open a BDSwiss account? – Elena, Spain

A: BDSwiss requires a minimum deposit of 100 USD (or equivalent in EUR, GBP). This makes it accessible for beginners while still offering a professional trading environment.

Q: How quickly can I withdraw funds from BDSwiss? – Daniel, South Africa

A: BDSwiss processes withdrawals within 24 business hours. Depending on the payment method, funds typically reach you within 1–5 business days for cards and e-wallets, and up to 7 days for bank transfers.

Q: Does BDSwiss charge fees for deposits or withdrawals? – Sophie, Germany

A: Deposits are generally free of charge. Withdrawals above the set minimum thresholds are also free, but smaller withdrawals or certain methods may include a fixed processing fee.

Q: Can I withdraw profits using a different method than my deposit method? – Arjun, India

A: In line with anti-money laundering policies, withdrawals are processed back to the original funding method up to the deposited amount. Any excess profits can be withdrawn via alternative methods registered in your name.

Q: What perks come with signing up at BDSwiss? – James, UK

A: BDSwiss offers free demo accounts, access to in-depth market analysis, trading tools, webinars, and competitive spreads. New clients can also benefit from multilingual customer support and a wide choice of trading platforms.

★★ | Minimum Deposit: $100 Regulated by: FSA, FSC, FSCA, MISA, SCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low minimum deposit from $10 | VIP account requires $250 |

| Regulated by multiple authorities | Small withdrawals may incur fees |

| Fast withdrawals within 24 hours | Bank transfers can take up to 7 days |

| Wide range of payment options | Different deposit thresholds per account |

| Dynamic leverage up to 1:2000 | Higher risk with high leverage |

You might also like:

In Conclusion

BDSwiss combines accessibility with reliability, offering minimum deposits starting from just $10 across account types. Backed by global regulation, secure payments, and dynamic leverage up to 1:2000, it caters to both beginners and professionals. Its competitive spreads, fast withdrawals, and educational tools make it a trusted broker choice.

Faq

The maximum deposit limit for e-wallets varies by provider and account status. BDSwiss may set its restrictions, which may be extended by contacting their support staff and completing further verification.

BDSwiss has many account options with variable minimum deposits, which commonly begin at $10 for basic accounts. Higher-tier accounts may need bigger initial deposits but often provide extra features and perks.

BDSwiss employs superior encryption and secure wallet technology to conduct cryptocurrency transactions.

When a deposit fails, BDSwiss normally reverses the transaction automatically. Manual reversals are normally processed within 1-3 business days; however, this varies based on the payment type.