Bullwaves Review

- Overview

- Fees, Spreads, and Commission

- Minimum Deposit and Account Types

- How to Open a Bullwaves Account

- Safety and Security

- Trading Platforms and Tools

- Market Analysis and Tools

- Markets available for Trade

- Prime Funded Trader Program

- Bullwaves Partner (CPA and IB)

- Bonus Offers and Promotions

- Deposits and Withdrawals

- Education and Resources

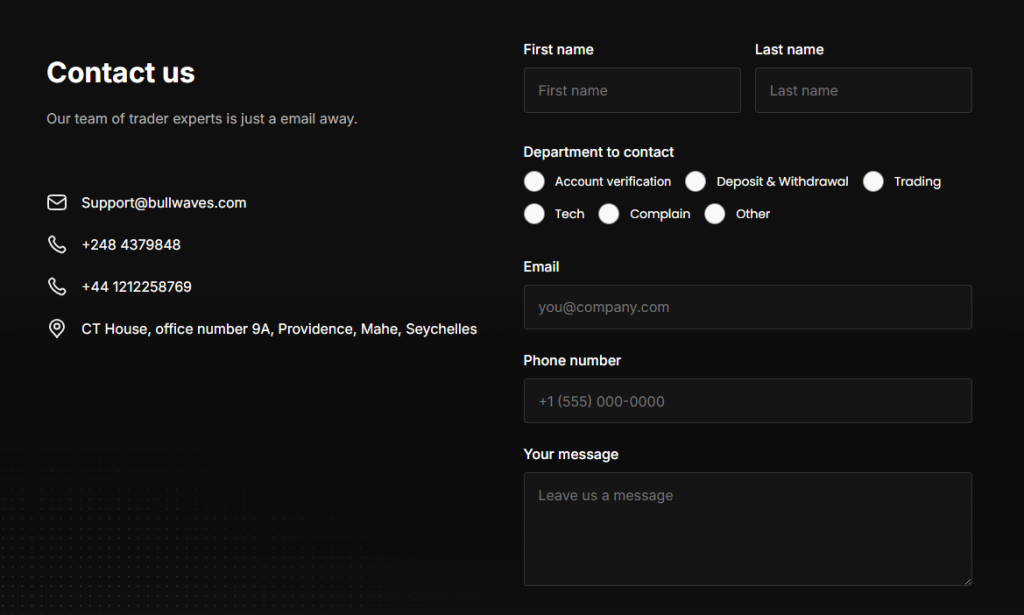

- Customer Support

- Bullwaves vs Trade247 vs Exness - A Comparison

- Customer Reviews and Trust Scores

- Discussions and Forums about Bullwaves

- Pros and Cons

- In Conclusion

Bullwaves is a multi-asset trading platform that gives individual traders access to forex, indices, commodities, metals, shares, and ETFs through MetaTrader 5. It operates under Equitex Capital Ltd in Seychelles, and it serves more than ten thousand traders worldwide.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Overview

Bullwaves stands out as a dynamic multi-asset broker operating under 🇸🇨 Equitex Capital Ltd in Seychelles. It offers access to forex, indices, commodities, metals, shares, and ETFs via MetaTrader 5. The platform attracts over ten thousand traders worldwide who value its balance of flexibility, education, and community-driven trading.

Frequently Asked Questions

What account types does Bullwaves offer?

Bullwaves provides three main account options: Classic, VIP, and ECN. Each suits different trading experience levels. The ECN account starts from 0.1 pips, while leverage can reach up to 1:500. Traders can also explore a demo account before moving to live trading.

Does Bullwaves support trader education?

Yes. Bullwaves emphasizes education through beginner-friendly lessons covering registration, KYC, and trading fundamentals. More advanced topics like technical analysis and risk management are being developed, ensuring traders have the tools to enhance their skills and confidence.

Our Insights

Bullwaves effectively combines powerful MetaTrader 5 technology with a strong educational approach. With its tiered accounts, competitive trading conditions, and focus on learning, it offers both new and experienced traders a well-rounded and supportive environment to grow.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Fees, Spreads, and Commission

Bullwaves maintains a transparent pricing structure across its Classic, VIP, and ECN accounts, ensuring traders understand spreads, commissions, and overnight costs before entering the markets. By clearly outlining its trading fees, Bullwaves empowers traders to make informed decisions and manage their strategies effectively.

| Account Type | Typical Spread (EUR/USD) | Commission | Inactivity Fee |

| Classic | 1.6 pips | None | Up to 10 USD/year |

| VIP | 0.8 pips | None | Up to 10 USD/year |

| ECN | 0.1 pips | May apply on CFDs/Futures | Up to 10 USD/year |

Frequently Asked Questions

Does Bullwaves charge any hidden fees?

Bullwaves is upfront about its costs. While deposits are free from internal fees, external processors may charge their own. The broker also applies a €10 withdrawal fee for bank transfers under €100 and an inactivity fee of up to $10 after 12 months of no activity.

How competitive are Bullwaves spreads?

Bullwaves offers tight spreads across all account types. The Classic Account starts at 1.6 pips, VIP at 0.8 pips, and ECN at just 0.1 pips. Popular forex pairs like EUR/USD can even reach 0.0 pips, making trading costs highly competitive for active traders.

Our Insights

Bullwaves’ fee model blends transparency with value. Its low spreads, minimal hidden costs, and clear structure cater to traders who prioritize cost efficiency. Combined with flexible account options, the platform delivers a balanced pricing approach suitable for both new and professional traders.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Minimum Deposit and Account Types

Bullwaves provides a structured account lineup designed to suit traders at all levels. From the accessible Classic Account to the advanced ECN option, each offers unique pricing, margin levels, and flexibility. This approach allows traders to grow within the Bullwaves ecosystem as their skills and strategies evolve.

| Feature | Classic | VIP | ECN |

| Ideal For | Beginner traders | Intermediate traders | Advanced traders |

| Minimum Deposit | 100 USD | 3,000 USD | 5,000 USD |

| Spread From | 1.6 pips | 0.8 pips | 0.1 pips |

| Stop-Out Level | 50% | 50% | 25% |

| Open an Account |

Frequently Asked Questions

Which Bullwaves account is best for beginners?

The Classic Account is ideal for beginners. With a $100 minimum deposit, 1:500 leverage, and manageable spreads starting from 1.6 pips, it offers a low-risk entry point into the markets. It also includes margin alerts and access to all Bullwaves tradable assets.

What makes the ECN Account different from others?

The ECN Account provides direct access to raw spreads and deep liquidity through the MT5 platform. With a lower 25% stop-out level, it is best suited for experienced or high-volume traders who rely on algorithmic strategies or precision execution.

Our Insights

Bullwaves delivers flexibility through its Classic, VIP, and ECN accounts, each carefully structured to align with trader experience and strategy. Its uniform leverage, tiered spreads, and wide asset access make the platform a versatile choice for traders seeking scalable opportunities.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

How to Open a Bullwaves Account

Opening a Bullwaves account is quick and fully online. You can create your profile, verify your identity, fund your wallet, and start trading through MetaTrader 5 – all in just a few easy steps.

1. Step 1: Visit the Bullwaves website

Go to the official Bullwaves homepage and click “Get Started” to begin the registration process.

2. Step 2: Complete your personal details

Enter your full name, date of birth, contact information, and create a secure password. Confirm your address, postal code, and country, then accept the Terms and Conditions and Privacy Policy.

3. Step 3: Verify your email

Check your inbox for an activation email from Bullwaves. Click the link provided to confirm your account and gain access to the client area.

4. Step 4: Submit verification documents

Upload a valid government-issued ID and proof of address to pass the KYC process. You will also complete a brief economic questionnaire and appropriateness test.

Finally, deposit funds using your preferred payment method. Once your MT5 account is active, you can begin trading forex, indices, commodities, metals, shares, and ETFs.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Safety and Security

Bullwaves is a regulated broker operating under the 🇸🇨 Financial Services Authority (FSA) of Seychelles through Equitex Capital Ltd. It ensures client safety by maintaining segregated accounts, applying negative balance protection, and enforcing KYC verification before withdrawals to protect traders and maintain transparency.

| Category | Details |

| Licensed Entity | Equitex Capital Ltd |

| Regulator | 🇸🇨 Financial Services Authority (FSA), Seychelles |

| License Number | SD185 |

| EU Representative | ETX Services Ltd, Cyprus (Service Entity) |

Frequently Asked Questions

Is Bullwaves a legitimate and regulated broker?

Yes, Bullwaves operates legally under the 🇸🇨 Financial Services Authority (FSA) in Seychelles through Equitex Capital Ltd, registration number 8434948-1. It meets international safety standards by keeping client funds separate from its operational capital and implementing strict verification procedures.

Do Bullwaves protect traders’ funds?

Absolutely. Bullwaves uses segregated client accounts, ensuring traders’ money is not mixed with company funds. Additionally, it applies negative balance protection, preventing clients from losing more than their deposits and maintaining fair trading conditions under regulatory oversight.

Our Insights

Bullwaves demonstrates a strong regulatory foundation and a clear commitment to trader safety through the 🇸🇨 FSA of Seychelles. With secure fund segregation, negative balance protection, and strict verification measures, it provides a reliable and transparent trading environment suitable for global investors.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Trading Platforms and Tools

Bullwaves delivers a smooth and intuitive trading experience through MetaTrader 5, WebTrader, and its Copy Trading platform. Each option focuses on usability, quick execution, and accessible tools that meet both beginner and advanced traders’ needs while maintaining consistent performance across all devices.

| Platform | Type | Key Strength | Device Compatibility |

| MetaTrader 5 | Advanced Trading Platform | Customizable charts and instant execution | Web Desktop Mobile |

| WebTrader | Browser-Based | No installation, fast access | Any browser |

| Copy Trading | Automated Strategy Tool | Follow top-performing traders | Web, Dashboard |

Frequently Asked Questions

What trading platforms does Bullwaves offer?

Bullwaves provides access to MetaTrader 5, a WebTrader that runs on any browser, and a Copy Trading platform. Each is designed for seamless execution, real-time analysis, and full synchronization across devices, helping traders manage strategies effectively and trade efficiently.

How does Bullwaves Copy Trading work?

Bullwaves Copy Trading allows users to mirror trades from experienced traders automatically. You can review verified profiles, set investment limits, adjust risk levels, and diversify by copying multiple signal providers while maintaining full manual control at any time.

Our Insights

Bullwaves combines advanced technology with simplicity through MetaTrader 5, WebTrader, and Copy Trading. It balances flexibility, speed, and control, offering traders an efficient and engaging platform experience suitable for all trading styles and levels of expertise.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Market Analysis and Tools

Bullwaves empowers traders with real-time analytics, actionable insights, and integrated research tools. Through MetaTrader 5, social trading access, and continuous market commentary, it delivers the information and clarity traders need to make confident, data-driven decisions across multiple asset classes.

| Tool | Purpose | Main Features |

| MetaTrader 5 | Charting and Execution | Indicators order types real-time data |

| Copy and Social Trading | Strategy Replication | Integrated with MT5 platform |

| Market Commentary | Research and Insights | Technical and trend analysis |

| Economic Calendar | Global Event Tracking | Real-time macro updates |

Frequently Asked Questions

What market analysis tools does Bullwaves provide?

Bullwaves offers traders a full suite of research tools, including MetaTrader 5 charting, market commentary, and economic updates. It covers forex, crypto, and equities while combining real-time pricing, RSI readings, and trend insights to help traders refine their strategies.

Does Bullwaves offer research or trading insights?

Yes, Bullwaves provides frequent research briefs and commentary on key global assets. These include technical breakdowns, economic calendar updates, and trading signals designed to help traders identify market opportunities and manage timing with greater precision.

Our Insights

Bullwaves delivers a robust analytical edge through its MetaTrader 5 integration, expert commentary, and research tools. With real-time updates and practical market insights, it supports traders seeking to make informed decisions in fast-moving global markets.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Markets available for Trade

Bullwaves provides access to over 250 financial instruments across global markets, helping traders diversify portfolios with forex, shares, indices, commodities, metals, and ETFs. Its wide range of assets enables both short-term speculation and long-term investment opportunities in a user-friendly environment.

| Market | Example Instruments | Key Benefits |

| Forex | EUR/USD GBP/USD AUD/JPY USD/JPY | Tight spreads high liquidity 24-hour access |

| Indices | US30 DE40 UK100 S&P 500 | Global exposure diversification directional trading |

| Commodities | Oil Gold Coffee Natural Gas | Inflation hedge volatility opportunities |

| Shares | Apple Tesla Nvidia Microsoft | Direct access to major U.S. companies |

| Metals | Gold Silver Platinum Copper | Safe-haven stability portfolio balance |

| ETFs | SPDR S&P 500 Nasdaq 100 EEM, VTI | Broad exposure lower entry cost |

Frequently Asked Questions

What assets can traders access on Bullwaves?

Bullwaves offers more than 250 tradable instruments, including forex pairs, global indices, commodities, shares, metals, and ETFs. This broad selection allows traders to explore multiple markets and create balanced portfolios that align with various trading styles and goals.

Why is Bullwaves’ asset range beneficial for traders?

Its wide market coverage enables diversification and flexibility. Traders can hedge risks using commodities or metals, follow stock trends like Apple and Tesla, or take advantage of the forex market liquidity while maintaining control through advanced platform tools.

Our Insights

Bullwaves stands out for its diverse asset selection and seamless global access. With options ranging from forex to ETFs, it empowers traders to pursue different market opportunities and adapt quickly to changing economic conditions while managing risk effectively.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Prime Funded Trader Program

Bullwaves Prime allows traders to access live capital by completing a structured challenge that tests consistency and discipline. With account sizes ranging from $5,000 to $400,000, the program rewards controlled trading behavior while minimizing the risk to personal funds.

| Account Size | One-Step Fee (USD) | Two-Step Fee (USD) | Leverage |

| 5,000 USD | 150 | 120 | 1:50 |

| 25,000 USD | 350 | 300 | 1:50 |

| 100,000 USD | 700 | 600 | 1:50 |

| 200,000 USD | 1,200 | 1,000 | 1:50 |

| 400,000 USD | 1,800 | 1,500 | 1:50 |

Frequently Asked Questions

How does the Bullwaves Prime challenge work?

Traders choose between a One-Step or Two-Step challenge, each with specific profit targets and drawdown limits. The One-Step challenge is quicker with tighter limits, while the Two-Step challenge allows more flexibility but includes an additional evaluation round before accessing funded accounts.

What are the rules for funded accounts?

Leverage is capped at 1:50, and traders must complete a minimum of 10 trading days per phase. Strict risk management applies, and exceeding daily or total drawdown limits ends the challenge immediately, ensuring disciplined and consistent trading performance.

Our Insights

Bullwaves Prime provides a structured pathway to trade with live capital while emphasizing risk management and consistency. Its flexible challenge options, wide account sizes, and strict evaluation criteria make it ideal for disciplined traders seeking professional funding.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Bullwaves Partner (CPA and IB)

Bullwaves partners can generate income through CPA and Introducing Broker programs by referring active traders. With over $13 million paid globally, the platform rewards performance, trading activity, and client acquisition, offering both fixed commissions and ongoing volume-based rebates.

| Program | Type | Key Features | Payout Method |

| CPA Affiliate | Fixed commission | Up to $1,500 per client, real-time reporting, affiliate manager support | Bank transfer or crypto |

| Introducing Broker | Volume-based rebate | Tiered rates, monthly commissions, advanced IB tools | Bank transfer or crypto |

Frequently Asked Questions

What is the Bullwaves CPA Affiliate program?

The CPA program rewards partners with a fixed payout per verified and funded trader, up to $1,500 per client. Affiliates receive real-time reporting, multilingual support, and dedicated account management while earnings are linked to trading volume and deposits.

How does the Bullwaves Introducing Broker program work?

IB partners earn rebates based on the trading volume of referred clients. Payments are recurring, calculated per traded lot, and made monthly via bank transfer or crypto. Partners also access advanced management tools and tiered rates depending on performance.

Our Insights

Bullwaves’ partner programs provide attractive earning opportunities through CPA commissions and IB rebates. Transparent tracking, global support, and flexible payout options make it ideal for affiliates and brokers seeking recurring or performance-based income from active trading clients.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Bonus Offers and Promotions

Bullwaves offers time-limited bonuses designed to enhance trading capacity and reward referrals. The Deposit Bonus gives new clients extra capital to start trading, while the Referral Program incentivizes introducing new traders. Both require verification, adherence to trading rules, and compliance with eligibility criteria.

| Bonus Type | Eligibility | Key Features | Limitations |

| Deposit Bonus | New verified clients | Up to $5,000 bonus, expands trading capacity | Canceled if balance drops below deposit or withdrawn early |

| Referral Program | Verified clients | Earn $200 for referrer and $50 for referee | Limited to five referrals per client, 30-day redemption window |

Frequently Asked Questions

How does the Bullwaves Deposit Bonus work?

New traders who verify a live account and deposit a minimum of $100 USD can opt in to receive a bonus up to $5,000 USD. The bonus expands initial trading capacity, allowing strategy testing or position scaling, but is canceled if withdrawals reduce the balance below the initial deposit.

What is the Bullwaves Referral Program?

Verified clients can earn rewards by referring new traders. The referee must deposit at least $200 USD and complete five standard lots on eligible products. Referrers receive a $200 voucher, and the referee earns a $50 bonus, with all verification and trading conditions strictly enforced.

Our Insights

Bullwaves bonuses provide practical incentives for new and existing traders. The Deposit Bonus boosts starting capital, and the Referral Program rewards introductions, making both valuable tools when used responsibly and in combination with disciplined trading strategies.

Deposits and Withdrawals

Bullwaves provides flexible funding and withdrawal options, including cards, e-wallets, crypto, and bank transfers. Instant deposits, clear processing timelines, and a “refund first” withdrawal policy ensure compliance with AML standards while giving traders control and transparency over their funds.

| Category | Details |

| Deposit Methods | Card (Visa/Mastercard), Bank Transfer, E Wallets, Crypto |

| Deposit Currencies | All major currencies, converted if different from account base |

| Account Currencies | USD EUR GBP |

| Processing Time | Card/E-Wallet: Instant, Crypto: 90 minutes, Local Bank: 1 business day, International Bank: Up to 5 business days |

| Deposit Fees | No Bullwaves fee; external fees may apply |

| Withdrawal Methods | Crypto Bank Transfer |

| Withdrawal Time | Crypto: 24–48 hours, Bank Transfer: 3–5 business days |

| Withdrawal Fees | €10 for bank withdrawals ≤€100; external fees may apply |

| Minimum Withdrawal | None stated; withdrawals below €2 not processed |

Frequently Asked Questions

How can I deposit funds into my Bullwaves account?

Traders can fund their accounts via card, e-wallet, crypto, or bank transfer. Deposits are processed instantly for cards and e-wallets, about 90 minutes for crypto, and 1–5 business days for bank transfers, with major currencies converted to the account’s base currency if needed.

What is the Bullwaves withdrawal process?

Withdrawals follow a “refund first” process to the original funding source. Bank transfers take 3–5 business days, crypto transfers 24–48 hours, and ID verification is required. A €10 fee applies to bank withdrawals under €100, while minimum withdrawal limits are not strictly stated.

Our Insights

Bullwaves offers reliable and transparent deposit and withdrawal procedures. Multiple funding methods, prompt crypto transfers, and AML-compliant policies make it convenient for traders to manage capital while maintaining security and regulatory standards.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Education and Resources

Bullwaves’ Learning Hub guides traders through account setup and verification, providing clear, step-by-step lessons for beginners. While currently focused on registration and KYC, future courses will cover deposits, trading strategies, copy trading, and risk management to support skill development and confident market participation.

Frequently Asked Questions

What courses are currently available in the Bullwaves Learning Hub?

At present, the Learning Hub offers a course on account registration and KYC verification, lasting 3 minutes and 7 seconds. This ensures new traders can start safely and comply with verification requirements before funding or trading.

What courses are planned for the future?

Upcoming lessons will include deposits, starting trading, copy trading, forex basics, technical analysis, risk management, trading strategies, and leverage guidance. These aim to provide a comprehensive foundation for both beginner and intermediate traders.

Our Insights

Bullwaves Learning Hub provides a focused and practical introduction for new traders. Its current KYC course ensures compliance, while planned modules promise a complete educational pathway, making it a valuable resource for building confidence and trading skills.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Customer Support

Bullwaves offers responsive and accessible customer support 24/7, combining email, phone, and online resources. Traders can reach offices in 🇸🇨 Seychelles or the United Kingdom, or use the Help Centre for self-service, ensuring assistance is available for trading, account, or technical inquiries.

Frequently Asked Questions

What support channels are available at Bullwaves?

Traders can contact Bullwaves via email, phone, or the Help Centre. Phone support connects to offices in 🇸🇨 Seychelles or the United Kingdom, while the Help Centre provides FAQs for self-service solutions, ensuring multiple ways to resolve account or trading questions.

Are Bullwaves’ support services available all the time?

Yes, customer support operates 24/7. Whether by email, phone, or online Help Centre, traders can receive assistance at any time, ensuring timely solutions for issues ranging from account management to technical or trading inquiries.

Our Insights

Bullwaves provides highly accessible and reliable support through multiple channels. Around-the-clock assistance, combined with email, phone, and a comprehensive Help Centre, ensures traders can resolve questions or issues efficiently and with minimal disruption to trading.

★★★★ | Minimum Deposit: $100 (Classic) Regulated by: FSA Seychelles Crypto: Yes |

Bullwaves vs Trade247 vs Exness – A Comparison

Customer Reviews and Trust Scores

Bullwaves has garnered mixed reviews across various platforms. On Trustpilot, the broker holds a 4.5 out of 5 stars based on over 600 reviews, with many users praising the platform’s usability and customer support. Conversely, some users have expressed concerns about commission fees and withdrawal processes.

Customer Feedback Summary

| Platform | Rating | Highlights |

| Trustpilot | 4.5/5 | Positive feedback on usability and support |

| Slashdot | Mixed | Some complaints about commissions and withdrawals |

While Bullwaves receives commendations for its platform and support, potential users should consider both positive and negative reviews before engaging.

Discussions and Forums about Bullwaves

Online forums present a cautious approach among some traders regarding the broker’s reputation.

| Forum | Sentiment | Common Themes |

| Cautious | Concerns over authenticity of reviews and trustworthiness |

Engaging with community discussions can provide valuable insights into the experiences of other traders with Bullwaves.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Supports multiple asset classes | Limited global recognition |

| Offers MT5 trading platform | No mobile-exclusive platform |

| Educational resources for beginners | Lacks detailed fee transparency |

| Demo account available | Customer support details unclear |

| Tight spreads on ECN accounts | Regulatory details could be stronger |

References:

In Conclusion

Bullwaves has done well to balance accessibility and performance. The platform’s MT5 integration, copy trading, and Autochartist tools make market participation easy without overwhelming newer traders.

Spreads, leverage, and instrument diversity are impressive. Regulation under Seychelles’s FSA gives some reassurance, though it’s not on par with EU or UK oversight. The funded trader program is an interesting angle, though capped leverage and evaluation rules could limit risk-takers.

Bonuses, partner rewards, and educational expansion are available, even if there are a few essential educational materials pending. Overall, Bullwaves is perfect for active traders who value diversification and transparency.

Faq

Bullwaves uses MetaTrader 5 for all order execution types, allowing instant updates and real-time pricing. Stop-out levels vary by account: 50% for Classic and VIP, and 25% for ECN.

$100 for the Classic account, $3,000 for VIP, and $5,000 for ECN.

You must complete ID and proof-of-address checks before any withdrawal. Funds are sent back to the original payment method.

Yes, up to $10 per year after 12 months of no trading or funding activity.

Yes, Bullwaves blocks traders from several countries, including the US, Belgium, Israel, Iran, Russia, and others.

- Overview

- Fees, Spreads, and Commission

- Minimum Deposit and Account Types

- How to Open a Bullwaves Account

- Safety and Security

- Trading Platforms and Tools

- Market Analysis and Tools

- Markets available for Trade

- Prime Funded Trader Program

- Bullwaves Partner (CPA and IB)

- Bonus Offers and Promotions

- Deposits and Withdrawals

- Education and Resources

- Customer Support

- Bullwaves vs Trade247 vs Exness - A Comparison

- Customer Reviews and Trust Scores

- Discussions and Forums about Bullwaves

- Pros and Cons

- In Conclusion