- Home /

- Forex Brokers /

- Deriv

Deriv Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Deriv Account

- Safety and Security

- Partnership Options

- CFDs Trading

- Options Trading

- Trading Platforms and Tools

- Deposits and Withdrawals

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums About Deriv

- Employee Overview of Working for Deriv

- Pros and Cons

- In Conclusion

Deriv is a reputable and dependable broker, regulated by several trusted authorities. They offer leverage of up to 1:1,000 and pips starting at 0.5. The minimum deposit is as low as USD 5, and the broker boasts a high trust score of 85 out of 100.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Overview

Deriv has built a strong reputation over 25 years by offering traders a transparent, reliable, and commission-free alternative to traditional brokers. Serving over 2.5 million users worldwide, it provides diverse CFDs and derivatives across forex, stocks, indices, cryptocurrencies, and commodities with a customer-first approach.

Frequently Asked Questions

What makes Deriv different from other online brokers?

Deriv stands out by eliminating high commissions and providing a simple yet powerful trading platform. It emphasizes transparency, fairness, and innovation while catering to traders of all experience levels with a broad selection of trading instruments.

How many customers does the Broker serve?

Deriv serves more than 2.5 million traders globally, offering a comprehensive range of CFDs and derivatives. Its extensive user base reflects its appeal to both novice and professional traders.

Our Insights

Deriv 🇲🇹 consistently delivers an excellent trading experience focused on low costs and user trust. Its 25 years of industry presence and ongoing innovation make it a solid choice for traders seeking reliability and diverse market access.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Fees, Spreads, and Commissions

Deriv provides a clear and cost-effective trading environment with no hidden fees. Traders benefit from commission-free trading on Deriv and Deriv cTrader. Spreads remain competitive, with Zero Spread accounts offering rates as low as 0 pips, making it attractive for all trader types.

| Fee Aspect | Details | Highlights | Notes |

| Commissions | None on Deriv MT5 and cTrader | Transparent cost-efficient | Maximizes trader profits |

| Spreads | Starting from 0 pips on Zero Spread accounts | Competitive across assets | Supports tight trading costs |

| Swap Fees | Swap-free accounts available | No overnight fees | Good for long-term positions |

| Minimum Stake | From USD 0.35 on Deriv Trader | Accessible for small budgets | Ideal for new traders |

Frequently Asked Questions

Does Deriv charge commissions on its trading platforms?

Deriv does not charge commissions on popular platforms like Deriv MT5 and Deriv cTrader, allowing traders to maximize their returns with transparent costs.

What spreads can I expect when trading on Deriv?

Spreads are competitive across asset classes, with Zero Spread accounts offering spreads starting at 0 pips, ideal for tight cost control.

Our Insights

Deriv 🇲🇹 delivers a straightforward fee structure that appeals to both beginners and seasoned traders. With no commissions, competitive spreads, and swap-free accounts, it offers flexible, affordable trading for diverse strategies.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

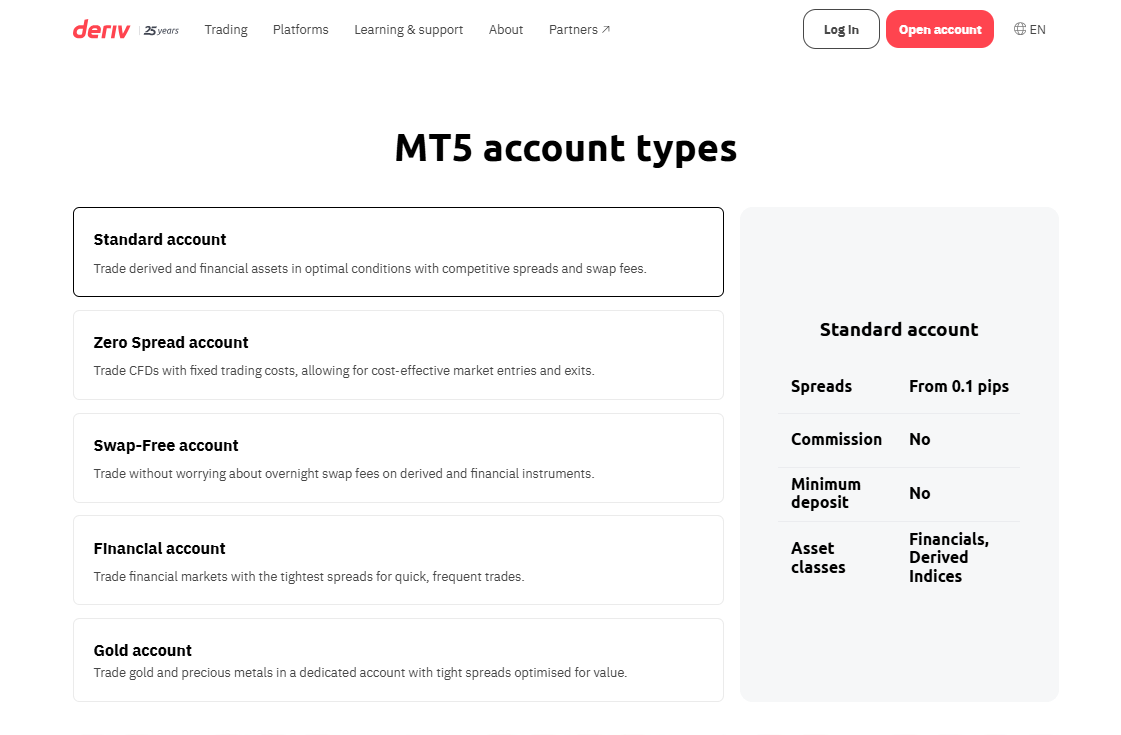

Minimum Deposit and Account Types

Deriv 🇲🇹 offers diverse account types tailored to different trader needs. With a minimum deposit of just 5 USD, the platform is accessible to both beginners and experienced traders. Features include swap-free trading, multiple indicators, and exclusive 24/7 access to Derived Indices.

| Feature | Details | Highlights | Notes |

| Minimum Deposit | 5 USD | Low barrier to entry | Suitable for all traders |

| Account Types | Multiple, including swap-free | Flexible trading options | Supports varied strategies |

| Assets Available | Forex Stocks Cryptocurrencies Derived Indices | Broad market coverage | 24/7 access on Derived Indices |

| Demo Account | Available | Risk-free practice | Helps new traders |

Frequently Asked Questions

What is the minimum deposit required to start trading on Deriv?

Deriv requires a minimum deposit of only 5 USD, making it easy for traders to start without a large upfront investment.

Can I trade CFDs with no commission on Deriv?

Yes, Deriv provides commission-free trading on all assets, helping traders maximize their capital and reduce costs.

Our Insights

Deriv delivers a user-friendly platform with low entry requirements and flexible account options. Its commission-free trading and swap-free accounts make it an attractive choice for traders seeking affordability and variety.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

How to Open a Deriv Account

Opening a Deriv account is straightforward and can be completed in just a few minutes. Whether you’re starting with a demo or a real account, follow these steps to get started:

1. Step 1: Visit the Official Deriv Website

Go to deriv.com and click on “Try Free Demo” to begin the registration process.

2. Step 2: Enter Your Email Address

Provide a valid email address and click “Create Account“.

3. Step 3: Verify Your Email

Check your inbox for a verification email from Deriv. Click on the link provided to confirm your email address.

4. Step 4: Set Up Your Account

After email verification, you’ll be prompted to:

- Select your country of residence.

- Choose your account currency (e.g., USD, EUR).

- Enter your full name, date of birth, and phone number.

Set a secure password for your account.

5. Step 5: Provide Additional Personal Information

Complete the following sections:

- Enter your residential address, including city, region, and postal code.

- Provide your tax identification number or ID card number.

- Select your current employment status.

- Agree to Terms and Conditions

Carefully read Deriv’s terms of service and privacy policy. Check the box to agree to these terms and proceed.

6. Step 6: Complete Registration

Click on “Create Account” to finalize your registration. You’ll be directed to your Trader’s Hub dashboard.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Safety and Security

Deriv emphasizes strong security and regulatory compliance, providing traders with a safe and transparent environment since 1999. Licensed by regulators such as the 🇲🇹 MFSA, 🇲🇾 LFSA, and 🇻🇺 Vanuatu FSC, it upholds high ethical standards while protecting user accounts with advanced security measures.

| Feature | Details | Highlights | Notes |

| Regulatory Licenses | 🇲🇹 MFSA 🇲🇾 LFSA 🇻🇬 BVI FSC 🇻🇺 Vanuatu FSC | Multiple jurisdictions | Ensures legal compliance |

| Security Measures | Two-factor authentication, antivirus, secure web browsing | Protects user accounts | Minimizes risk of breaches |

| Fair Trading Practices | Internal audits, risk management protocols | Transparent and ethical | Supports trader confidence |

| Responsible Trading | Self-exclusion, trading limits | Promotes responsible use | Helps prevent excessive losses |

Frequently Asked Questions

Is Deriv regulated?

Yes, Deriv is regulated by multiple authorities, including 🇲🇹 MFSA, 🇲🇾 LFSA, and 🇻🇬 BVI FSC. This ensures traders benefit from a high level of legal and financial security.

How does Deriv protect my account?

Deriv secures accounts with two-factor authentication, secure web browsing, and antivirus protection, preventing unauthorized access and enhancing user safety.

Our Insights

Deriv 🇲🇹 demonstrates a strong commitment to safety through broad regulatory compliance and advanced security features. Coupled with responsible trading tools, it offers a secure, fair, and reliable platform for traders worldwide.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Partnership Options

Deriv offers a range of partnership programs designed to help individuals and businesses earn additional revenue and expand their client base. These programs, which include options for affiliates, introducing brokers, payment agents, and API partners, provide ample opportunities for collaboration and financial growth.

Whether you are a marketer looking to monetize your network or a business aiming to offer payment services to traders, Deriv’s partnership initiatives are designed to be rewarding, with no hidden fees or setup costs.

With expert support, promotional materials, and the backing of Deriv’s trusted reputation, partners can build strong and profitable relationships with the platform.

Frequently Asked Questions

How do I become a Deriv partner?

You can apply to become a Deriv partner by signing up for any of the available partnership programs, such as affiliate, IB (Introducing Broker), or payment agent programs. Simply email Deriv to apply and start expanding your business.

Are there any fees associated with joining Deriv’s partnership programs?

No, Deriv’s partnership programs are completely free to join. There are no hidden fees or charges, making it a cost-effective way to earn additional income.

What types of partnerships does Deriv offer?

Deriv offers several partnership opportunities, including affiliates, introducing brokers (IBs), payment agents, API partners, and Deriv Prime, each designed to suit different business models and monetization strategies.

What support does Deriv provide to its partners?

Deriv offers expert support through dedicated affiliate managers, who provide guidance, promotional materials, and educational resources to help you succeed in the partnership program.

Our Insights

Deriv’s partnership programs offer a great opportunity for businesses and individuals to grow their client base and generate income without the burden of fees or hidden costs. With expert support, flexible programs, and a solid reputation in the industry, Deriv makes it easy for partners to succeed. Whether you’re a marketer, payment agent, or API partner, joining Deriv’s network is a smart and profitable choice.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

CFDs Trading

Trading Contracts for Difference (CFDs) on Deriv allows you to control larger positions with a smaller capital investment. With leverage of up to 1:1000, traders can go long or short across various markets, including Forex, Stocks, Commodities, and 24/7 Derived Indices. Deriv provides commission-free trading on popular platforms such as MT5, cTrader, and Deriv X, with tight spreads starting from 0 pips and negative balance protection to safeguard your funds.

Traders can access over 250 instruments and choose from different account types to suit their trading strategies. With an intuitive interface and advanced analytical tools, Deriv offers a supportive environment for both beginners and experienced traders.

Frequently Asked Questions

What are CFDs, and how do they work on Deriv?

CFDs are contracts that allow traders to speculate on the price movements of various assets without owning the underlying asset. On Deriv, you can trade CFDs with leverage, enabling you to manage larger positions with a smaller investment.

What leverage options does Deriv offer for CFD trading?

Deriv offers leverage of up to 1:1000, enabling traders to amplify their positions and maximize potential returns with lower capital investment.

Are there any fees for trading CFDs on Deriv?

Deriv offers commission-free CFD trading, allowing traders to benefit from tight spreads without additional fees or costs.

How many instruments can I trade as CFDs on Deriv?

Traders can access over 250 instruments across a variety of markets, including Forex, Stocks, Commodities, and Derived Indices when trading CFDs on Deriv.

Our Insights

Deriv’s CFD trading platform presents an attractive option for traders looking to leverage their capital effectively. With a wide range of instruments, high leverage, and a user-friendly interface, it supports both beginner and experienced traders, fostering a versatile environment for diverse trading strategies.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Options Trading

Deriv offers diverse options trading on over 50 assets, including Forex, Derived Indices, Cryptocurrencies, and Commodities. With entry costs from just USD 0.35, traders can choose from Digital, Vanilla, and Turbo Options, capping risk while aiming for fixed or variable payouts.

| Feature | Details | Highlights | Notes |

| Contract Types | Digital Vanilla Turbo Options | Variety of trading styles | Flexible for diverse strategies |

| Minimum Entry Cost | USD 0.35 | Low-cost access | Suitable for small budgets |

| Asset Classes | Forex Derived Indices Crypto Commodities | Wide market coverage | Enhances portfolio diversity |

| Payout Options | Fixed or variable returns | Adjustable to strategy | Tailored to market forecasts |

Frequently Asked Questions

What types of options contracts are available on Deriv?

Deriv provides Digital, Vanilla, and Turbo Options. Each contract suits different trading strategies, enabling traders to pick the best fit for their market approach.

What is the minimum cost to start trading options on Deriv?

Traders can begin options trading with just USD 0.35, making it affordable for beginners and those with limited capital.

Our Insights

Deriv delivers an accessible and flexible options trading platform. Its low entry costs and multiple contract types support both novice and experienced traders in managing risk and diversifying portfolios effectively.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Trading Platforms and Tools

Deriv delivers an impressive range of trading platforms tailored for different trader preferences. From MT5’s multi-asset access and zero commissions to cTrader’s advanced indicators, Deriv X’s precision tools, and Deriv Trader’s low entry stakes, every platform is designed to provide flexibility, efficiency, and cutting-edge trading capabilities for all experience levels.

| Platform | Key Feature | Asset Access | Special Tool or Benefit |

| MT5 | Commission-free multi-asset | Forex Stocks Crypto Derived Indices | No overnight charges on swap-free accounts |

| cTrader | 60+ custom indicators | 150+ instruments | Copy trading feature |

| Deriv X | Precision charting | 200+ assets | Extensive customization options |

| Deriv Trader | Low entry stake | Options | Minimum stake USD 0.35, payouts up to 200% |

Frequently Asked Questions

What assets can I trade on Deriv MT5?

On Deriv MT5, you can trade Forex, Stocks, Cryptocurrencies, and Derived Indices with commission-free execution. This wide selection allows traders to diversify their portfolios and explore various markets while benefiting from competitive conditions and a professional-grade trading environment.

Does Deriv cTrader charge commissions?

Deriv cTrader is a commission-free trading platform, enabling users to focus on growing their investments without additional costs. Furthermore, it includes advanced charting tools, 60+ custom indicators, and copy trading options to enhance the overall trading experience for both beginners and professionals.

Our Insights

Deriv’s suite of platforms provides something for every trader, from low-cost entry options to highly advanced, customizable interfaces. With commission-free trading, automated solutions, and robust mobile tools, Deriv empowers traders to operate with confidence, efficiency, and strategic precision in multiple markets.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Deposits and Withdrawals

Deriv provides traders with a broad selection of payment options for both deposits and withdrawals, ensuring flexibility and ease of use. From credit and debit cards to cryptocurrencies and its own P2P system, Deriv offers fast processing times and secure transactions to support seamless trading experiences.

| Payment Option | Minimum Deposit | Processing Time | Maximum Deposit |

| Credit/Debit Cards | $10 | Instant | $5,000 |

| E-wallets | $10 | Instant | $5,000 |

| Cryptocurrencies | $10 | Instant | $5,000 |

| Deriv P2P | $10 | Under 2 hours | $5,000 |

Frequently Asked Questions

What payment methods does Deriv accept?

Deriv supports a variety of payment options, including credit and debit cards, online banking, e-wallets, cryptocurrencies, vouchers, and its P2P system. This range ensures traders can choose the method that best suits their preferences and location.

What is the minimum deposit amount?

The minimum deposit required to start trading on Deriv is just $10. This low entry requirement makes it accessible to a wide range of traders, including beginners who want to start with a smaller investment.

Our Insights

Deriv’s deposit and withdrawal system combines speed, versatility, and security. With multiple payment methods, quick processing, and low deposit requirements, it enables traders to manage their funds with minimal hassle and maximum confidence.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Customer Support

Deriv maintains a strong global presence, offering multiple ways for clients to get in touch. From its help center and community forums to regional offices across continents, Deriv ensures that traders worldwide can access timely support and explore potential business partnerships with ease.

Frequently Asked Questions

How can I contact Deriv for support?

Traders can access Deriv’s help centre, connect with the Deriv community, or reach out directly to one of its global offices. These options ensure quick assistance, no matter the client’s location or time zone.

Does Deriv have offices worldwide?

Yes, Deriv operates offices across multiple continents, including 🇬🇧 United Kingdom, 🇫🇷 France, 🇲🇹 Malta, 🇨🇾 Cyprus, 🇲🇾 Malaysia, 🇸🇬 Singapore, 🇦🇪 UAE, 🇯🇴 Jordan, 🇷🇼 Rwanda, 🇸🇳 Senegal, 🇵🇾 Paraguay, 🇰🇾 Cayman Islands, 🇻🇬 British Virgin Islands, and 🇻🇺 Vanuatu.

Our Insights

Deriv’s worldwide network of offices and diverse support channels demonstrates its commitment to accessibility and client care. Whether through digital resources or in-person contact, Deriv ensures that traders receive reliable guidance and opportunities for business collaboration.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been trading with its Broker for over a year now, and I couldn’t be happier! The variety of platforms available makes it easy to find one that suits my style. I love the low spreads on the Standard Account, and the customer support has been responsive whenever I’ve had questions. Highly recommended! – Jessica

⭐⭐⭐⭐⭐

Deriv has simplified my trading journey. The deposit and withdrawal process is seamless, and I appreciate the range of payment options. The cTrader platform’s copy-trading feature is a game-changer for me. I’ve learned so much from replicating successful traders. Overall, a fantastic platform! – Michael

⭐⭐⭐⭐

As a beginner, I found the educational resources invaluable. The demo account helped me practice without any risk, and now I’m confidently trading on live accounts. The Swap Free Account is perfect for my long-term strategy. I feel secure knowing my funds are in good hands. Great job! – Jones

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Customer Reviews and Trust Scores

Deriv earns strong user trust thanks to its intuitive platform, responsive support, and fast transactions. These elements consistently appear in customer feedback and ratings.

| Metric | Details |

| Trustpilot Score | 4.4 out of 5 from over 66,000 reviews |

| Common Praise | User-friendly, fast deposits and withdrawals, helpful support |

Despite occasional critiques, Deriv generally maintains a solid reputation and dependable performance.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Discussions and Forums About Deriv

Online communities often highlight both the benefits and the controversies around Deriv’s unique offerings, especially its synthetic indices.

| Forum Topic | Overview |

| Synthetic Indices | Some appreciate 24/7 access and low-lot trading; others suspect manipulation |

| Reliability Withdrawals | Users report fast crypto payouts and legitimate withdrawals |

These discussions show a mix of appreciation for convenience and caution around proprietary instruments.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Employee Overview of Working for Deriv

Deriv employees describe a dynamic and supportive workplace with ample learning and growth, but also highlight inconsistent structure in some areas.

| Positive | Negative |

| Supportive team culture | Unclear career path in some roles |

| Flexible working hours and autonomy | Salary growth sometimes slow |

| Strong onboarding and development | Remote work restrictions strict |

Dynamic change and fast growth can create both opportunity and occasional uncertainty.

★★★★ | Minimum Deposit: $5 Regulated by: MFSA, LFSA, BVI FSC, FSC, FMA, FSC, SVG, TFC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| High trust score | Some products raise skepticism |

| Responsive customer support | Synthetic indices controversial |

| Fast payouts | Structured career path unclear |

| Team collaboration | Remote work restrictions |

| Employee development focus | Salary progression slow |

References:

In Conclusion

Deriv maintains a global footprint with physical offices across multiple continents, enabling strong local customer support and in-person assistance in many regions.

Countries with Deriv Offices and Support:

- 🇬🇧 United Kingdom

- 🇫🇷 France

- 🇲🇹 Malta

- 🇨🇾 Cyprus

- 🇯🇪 Channel Islands (Guernsey)

- 🇩🇪 Germany

- 🇲🇾 Malaysia

- 🇸🇬 Singapore

- 🇦🇪 United Arab Emirates

- 🇯🇴 Jordan

- 🇷🇼 Rwanda

- 🇸🇳 Senegal

- 🇵🇾 Paraguay

- 🇰🇾 Cayman Islands

- 🇻🇬 British Virgin Islands

- 🇻🇺 Vanuatu

This widespread presence reflects Deriv’s commitment to global accessibility and localised support, strengthening trust and convenience for traders worldwide.

Faq

Yes, Deriv is well-suited for beginner traders. The platform offers educational resources, including forex courses, tutorials, and webinars, making it easier for newcomers to get started. Additionally, the demo account allows beginners to practice without risking real money.

The minimum deposit required to start trading on Deriv is just $5, making it accessible for traders with a small starting budget.

Deriv offers various account types, including individual accounts, institutional accounts, managed accounts, and Islamic accounts. This diversity allows traders of all levels to choose an account that best suits their needs.

Withdrawals from Deriv typically take between 1-3 days, depending on the withdrawal method. There are no fees for withdrawals, which is a benefit for traders.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Deriv Account

- Safety and Security

- Partnership Options

- CFDs Trading

- Options Trading

- Trading Platforms and Tools

- Deposits and Withdrawals

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums About Deriv

- Employee Overview of Working for Deriv

- Pros and Cons

- In Conclusion