Dukascopy Review

- Overview

- Trading Fees

- Minimum Deposit and Account Types

- How to Open a Dukascopy Trading Account

- Safety and Security

- Trading Platforms and Tools

- Deposits and Withdrawals

- Customer Reviews and Trust Scores

- Discussions and Forums about Dukascopy

- Employee Overview of Working for Dukascopy

- Pros and Cons

- In Conclusion

Dukascopy is a Swiss-based Forex and CFD broker known for its strong regulatory framework, advanced trading technology, and competitive pricing. Catering to both retail and institutional traders, it has a reputation for transparency and reliability, standing out as a broker that blends innovation with the security of Swiss banking standards.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Overview

Dukascopy Bank, founded in 2004 in 🇨🇭 Switzerland, delivers advanced online and mobile trading services with a strong reputation for transparency and innovation. Regulated by FINMA, it offers Forex, CFDs, bullion, and binary trading through its proprietary JForex platform and the ECN-powered Swiss FX Marketplace.

Frequently Asked Questions

Is Dukascopy a safe broker to trade with?

Yes, Dukascopy is considered highly secure because it is regulated by 🇨🇭 Switzerland’s FINMA as both a bank and a securities firm. Additionally, it operates licensed subsidiaries in 🇱🇻 Latvia and 🇯🇵 Japan, ensuring compliance across multiple financial jurisdictions and reinforcing its global trustworthiness.

What makes Dukascopy different from other brokers?

Dukascopy stands out with its Swiss FX Marketplace, an ECN trading environment that connects clients directly with liquidity providers. This means no dealing desk, no requotes, and consistently tight spreads. Moreover, its JForex platform offers advanced tools, automation, and a robust environment suited to both retail and institutional traders.

Our Insights

Dukascopy combines Swiss banking standards with cutting-edge trading technology. Traders benefit from tight spreads, fast ECN execution, and advanced tools through JForex. With strong global regulation, secure banking solutions, and innovative platforms, Dukascopy remains a reliable choice for traders seeking transparency and performance.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Trading Fees

Dukascopy offers a competitive, commission-based pricing structure with volume discounts that reward active traders. Traders using the proprietary JForex platform enjoy slightly lower costs than MT4/MT5 users. While fees for Forex, commodities, metals, indices, and cryptocurrencies are transparent, additional service fees such as inactivity and conversion charges, may apply.

| Instrument | Average Spread | Commission per Lot | Total Cost (1 Lot) |

| EUR/USD (JForex) | 0.2 pips | $7.00 | $9.00 |

| EUR/USD (MT4/MT5) | 0.2 pips | $8.00 | $10.00 |

| GBP/USD | 0.8 pips | $8.00 | $16.00 |

| WTI Crude Oil | N/A | $0.05 | $0.05 |

Frequently Asked Questions

How much does it cost to trade major Forex pairs at Dukascopy?

Trading EUR/USD costs around 0.2 pips with a $7.00 commission per standard lot on JForex, totaling approximately $9.00. MT4/MT5 users pay slightly higher fees at 0.2 pips and $8.00 commission per lot. GBP/USD costs average 0.8 pips or $8.00 per lot.

Are there extra fees for commodities, metals, or Islamic accounts?

Yes, commodities and metals start at $10.50 per $100,000 and decrease with trading volume. Swap-free Islamic accounts incur fixed fees: $0.50 per 100,000 units for Forex and $0.75 for precious metals. Additional fees include maintenance, bank guarantees, and currency conversion charges.

Our Insights

Dukascopy provides transparent and competitive trading costs for retail traders, especially on its JForex platform. While MT4/MT5 traders face slightly higher fees, volume discounts and positive swap rates for certain assets enhance overall cost efficiency. Traders should review all service fees before committing.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Minimum Deposit and Account Types

Dukascopy provides six main account types for retail and managed trading: JForex (ECN), MT4, MT5, Managed, LP PAMM, and binary options. Each account type supports different base currencies and trading conditions, while demo accounts and swap-free Islamic options give traders flexibility to learn and trade responsibly.

| Account Type | Base Currencies | Min Deposit | Demo Available |

| JForex (ECN) | 25 currencies including USD, EUR, CHF, GBP | 1000 USD | Yes |

| MT4 | 5 currencies including USD, EUR, CHF, GBP | 1000 USD | Yes |

| MT5 | 24 currencies including USD, EUR, CHF, GBP | 1000 USD | Yes |

| Binary Managed LP PAMM | 21 currencies including USD, EUR, CHF, GBP | 1000 USD | Only Managed and Binaries |

Frequently Asked Questions

What account types does Dukascopy offer for retail traders?

Dukascopy supports JForex (ECN), MT4, MT5, binary options, Managed, and LP PAMM accounts. Each account type has specific base currencies, deposit requirements, and trading conditions. Retail traders can also access demo accounts for all platforms except LP PAMM to practice risk-free.

Can traders open a demo or Islamic account at Dukascopy?

Yes, demo accounts are available for JForex, MT4, MT5, binaries, and managed accounts. Swap-free Islamic accounts are offered across account types. Demo accounts allow traders to set base currency, balance, and leverage up to 1:200 without verification, providing an educational experience.

Our Insights

Dukascopy excels in offering versatile account types for retail and passive traders. With multi-currency support, demo accounts, and Islamic options, traders can tailor their experience to skill level and trading style. However, demo trading does not replicate real trading psychology, so beginners should use it cautiously.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

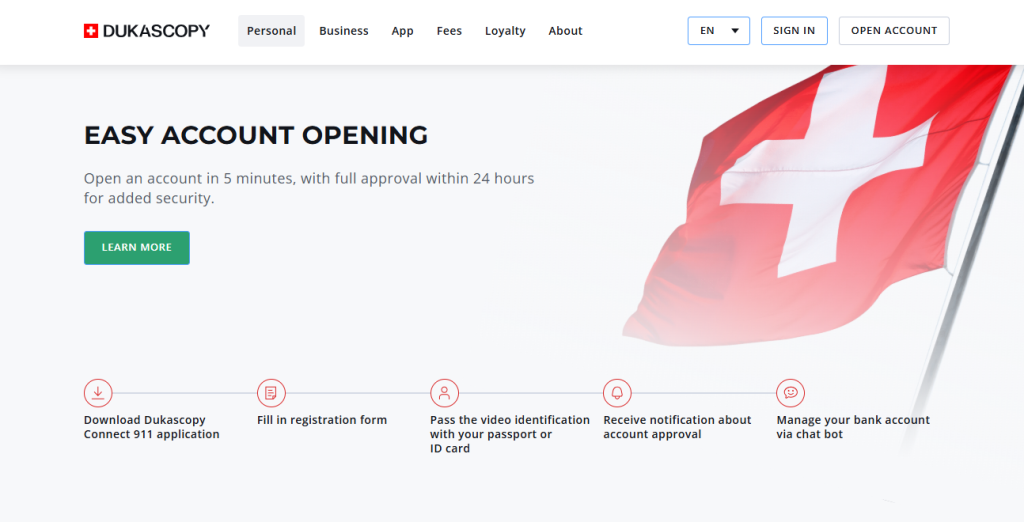

How to Open a Dukascopy Trading Account

Opening a Dukascopy live trading account is straightforward and efficient. Follow these steps to get started:

1. Step 1: Begin Registration

Visit the Dukascopy site and click “Open Live Account.” Complete the online registration form with your personal details and accept the terms.

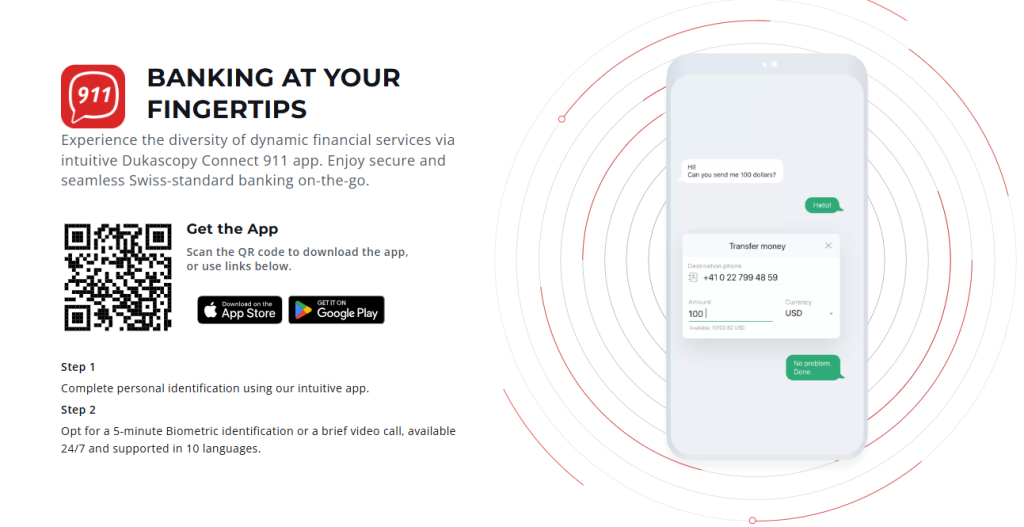

2. Step 2: Complete Identity Verification

After registration, you will undergo a short video identification using the Dukascopy Connect 911 app. Be ready to show your passport or ID during the call.

3. Step 3: Submit Documents

Upload a copy of your government-issued ID or passport along with a utility bill not older than three months for address verification.

4. Step 4: Fund Your Account

Once confirmed, you’ll receive transfer instructions. Fund your account via your preferred method, commonly a card or wire transfer.

5. Step 5: Access and Trade

After your deposit is received, Dukascopy sends your login credentials. Then download your preferred platform, JForex, MT4, or MT5, and start trading.

With everything verified and funded, you’re all set to begin trading.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Safety and Security

Dukascopy is a fully regulated broker with a Swiss banking license and a clean track record. Its operations in 🇨🇭Switzerland, 🇯🇵Japan, and 🇱🇻Latvia are supervised by top-tier regulators, ensuring client fund segregation, negative balance protection, and deposit safeguards. Audits and compliance measures reinforce its credibility for retail and institutional traders.

| Country | Regulator | Regulatory Tier | Key Protections |

| 🇨🇭Switzerland | FINMA | 1 | Segregated funds, deposit protection |

| 🇯🇵Japan | JFSA | 1 | Regulated capital, compliance oversight |

| 🇱🇻Latvia | Bank of Latvia | 1 | Negative balance protection, audits |

Frequently Asked Questions

Is Dukascopy a safe and legitimate broker?

Yes, Dukascopy has operated since 2004 without verifiable misconduct. It is regulated in 🇨🇭Switzerland (FINMA), 🇯🇵Japan (JFSA), and 🇱🇻Latvia, with capital requirements, negative balance protection, and segregated client funds, making it a safe option for retail and professional traders.

What security measures does Dukascopy implement for clients?

Dukascopy segregates client deposits from corporate funds, offers deposit protection up to CHF 100,000, and maintains regulated capital of approximately CHF 40,000,000. Regular external audits by KPMG and compliance with strict Swiss banking laws ensure strong protection against fraud and malpractice.

Our Insights

Dukascopy ranks among the safest brokers for retail traders, thanks to its robust regulation, Swiss banking license, and comprehensive client protection measures. With negative balance protection, segregated funds, and external audits, it provides a secure trading environment suitable for both new and experienced traders.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Trading Platforms and Tools

Dukascopy offers a range of trading platforms, including JForex, MT4, MT5, and mobile apps. Its proprietary JForex platform provides advanced tools for algorithmic trading, back-testing, and charting. While MT4 and MT5 are supported, trading fees are slightly higher, encouraging traders to use JForex for full functionality and lower costs.

| Platform | Key Features | Trading Fees Impact | Mobile Support |

| JForex | Algorithmic trading, 1,200+ assets, back-testing, 10+ order types | Base fees | Yes |

| MT4 | Custom indicators, EAs, templates | +$0.50 per lot | Yes |

| MT5 | Advanced charting, 10,000+ indicators, EAs | +$0.50 per lot | Yes |

| Mobile Apps | Lightweight, full account access, one-click trading | Base fees | iOS Android |

Frequently Asked Questions

Which trading platforms are available at Dukascopy?

Dukascopy supports its proprietary JForex platform, MT4, MT5, and mobile apps for iOS and Android. JForex offers algorithmic trading, back-testing, advanced charting, and multi-asset support, while MT4 and MT5 allow customization with indicators, templates, and expert advisors.

What unique features does JForex offer?

JForex supports 1,200+ assets across eight classes, real-time Level 2 quotes, algorithmic trading via Visual Strategy Builder, 10+ order types, tick-by-tick price history, and chart trading. It also offers gold-denominated accounts and cryptocurrency collateral borrowing for BTC and ETH, providing additional flexibility for traders.

Our Insights

Dukascopy provides professional-grade trading platforms with extensive tools for retail and algorithmic traders. JForex stands out for its low fees, comprehensive asset coverage, and advanced order types. MT4 and MT5 offer familiar interfaces but come with slightly higher trading costs.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Deposits and Withdrawals

Dukascopy provides a secure trader’s cabinet for all deposits and withdrawals. Verified clients benefit from transparent processes with minimal fees. While internal transfers, wire deposits, and crypto deposits are free, currency conversions and third-party processing may incur charges. Processing times are fast, typically within 48 hours.

| Feature | Details |

| Minimum Deposit | 100 USD |

| Deposit Currencies | AUD, USD, CHF, EUR, GBP, CAD, CZK, HKD, HUF, JPY, MXN, NOK, NZD, PLN, RON, CNH, SEK, SGD, TRY, AED, SAR, DKK, ZAR |

| Processing Time | Withdrawals within 48 hours |

| Fees | Internal, wire, and crypto deposits free; conversion 0.05%-1.00%; third party fees may apply |

Frequently Asked Questions

What are the minimum deposit requirements at Dukascopy?

The minimum deposit is $100. Dukascopy accepts multiple currencies, including AUD, USD, CHF, EUR, GBP, CAD, JPY, and more. SEPA transfers are in EUR only, and credit or debit card deposits have a single transaction limit of $18,000.

How long do withdrawals take at Dukascopy, and are there any fees?

Withdrawals are processed within 48 hours by Dukascopy’s finance department. While most internal transfers, wire transfers, and crypto deposits are free, currency conversion fees range from 0.05% to 1.00%, and third-party processing fees may apply depending on the payment method and location.

Our Insights

Dukascopy provides a fast and secure deposit and withdrawal system for retail traders. With a $100 minimum deposit, multi-currency support, and 48-hour processing, it caters well to active traders, although currency conversion and third-party fees should be considered.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Customer Reviews and Trust Scores

Dukascopy Bank has received mixed reviews across various platforms. While some clients praise its trading tools and platform stability, others have raised concerns about customer support responsiveness and withdrawal processes. The bank is regulated by the Swiss Financial Market Supervisory Authority (FINMA), which adds a layer of credibility.

| Platform | Rating (5) | Highlights |

| Trustpilot | 3.9 | Mixed feedback some praise some complaints |

| Reviews.io | 3.8 | Positive comments on platform features |

| Varied | Discussions on account setup and services |

While Dukascopy offers a robust platform, potential clients should be aware of the mixed reviews and consider their individual needs before engaging.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Discussions and Forums about Dukascopy

Online forums like Reddit and Forex Factory feature discussions about Dukascopy. Users often highlight the bank’s Swiss regulation and multicurrency IBAN offerings. However, some express concerns about transaction limits and currency exchange rates.

| Forum | Positive Aspects | Concerns Raised |

| Non-resident account access, Swiss regulation | Transaction limits, exchange rates |

|

| Forex Factory | Good broker, no problems reported | Average trading fees |

Engaging with these forums can provide a broader perspective on Dukascopy’s services and help potential clients make informed decisions.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Employee Overview of Working for Dukascopy

Employee reviews suggest a dynamic work environment at Dukascopy. While some appreciate the innovative culture, others point out areas for improvement in management and work-life balance.

| Aspect | Positive Feedback | Areas for Improvement |

| Work Culture | Innovative, supportive | Need for clearer communication |

| Management | Open to feedback | Decision-making processes |

| Career Growth | Opportunities for advancement | Limited training programs |

| Compensation | Competitive salaries | Inconsistent bonus structures |

| Work-Life Balance | Flexible hours | High workload during peak times |

Prospective employees should weigh the positive aspects against the areas for improvement to determine if Dukascopy aligns with their career aspirations.

★★★ | Minimum Deposit: $100 Regulated by: FINMA, FCMC, JFSA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by FINMA | Mixed customer support feedback |

| Multicurrency IBAN offered | Transaction limits may apply |

| Innovative trading platform | Currency exchange rates may vary |

| Opportunities for career growth | Limited training programs |

| Competitive salaries | Inconsistent bonus structures |

References:

In Conclusion

Dukascopy maintains a global presence with both full-fledged offices and representative locations:

- 🇨🇭 Switzerland (Geneva)

- 🇱🇻 Latvia (Riga)

- 🇭🇰 Hong Kong

- 🇯🇵 Japan (Tokyo)

- 🇦🇪 United Arab Emirates (Dubai)

- 🇷🇺 Russia (Moscow)

- 🇺🇦 Ukraine

- 🇲🇾 Malaysia (Kuala Lumpur)

- 🇨🇳 China (Shanghai)

Dukascopy provides multilingual customer support available 24/7 through live chat, email, phone, and callback requests. Their support is designed to serve clients globally, backed by their international office network and online infrastructure.

Faq

Yes, Dukascopy offers demo accounts to test platforms and strategies in a risk-free, simulated environment.

Dukascopy normally processes withdrawals within one to two business days, depending on the method used.

The minimum deposit to start a trading account with Dukascopy is $100.

Dukascopy is considered a safe broker, regulated by prominent authorities such as FCMC, FINMA, and the JFSA, ensuring high standards of security and client fund protection.

You can start the account opening procedure online using the Dukascopy website. Typically, requirements include identification verification (such as a passport or ID scan) and confirmation of domicile.

- Overview

- Trading Fees

- Minimum Deposit and Account Types

- How to Open a Dukascopy Trading Account

- Safety and Security

- Trading Platforms and Tools

- Deposits and Withdrawals

- Customer Reviews and Trust Scores

- Discussions and Forums about Dukascopy

- Employee Overview of Working for Dukascopy

- Pros and Cons

- In Conclusion