10 Best Forex Brokers with Cent Accounts

The 10 Best Forex Brokers with Cent Accounts revealed. Our team has compiled a list of the top 11, focusing on their cent accounts to help traders select the broker that suits their trading style and financial goals.

Top 10 Forex Brokers with Cent Accounts – a Head-to-Head Comparison

10 Best Forex Brokers with Cent Accounts (2026)

- Exness – Overall, The Best Forex Broker with a Cent Account

- RoboForex – Sophisticated copy-trading system

- HFM – Varying leverage and spreads

- FBS – Low spreads and commission-free trading

- JustMarkets – Low-risk environment on Cent Account

- InsaForex – Wide array of trading instruments

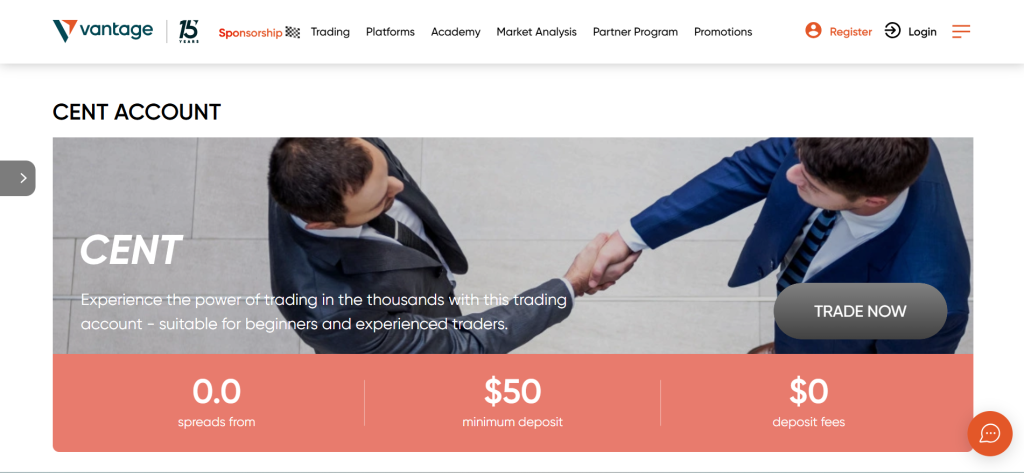

- Vantage Fx – Competitive pricing and advanced trading platforms

- FXTM – Trading platforms like MetaTrader and the FXTM Trader app

- FXOpen – Cost-effective for high-volume traders

- Forex4you – Multi-Platform Accessibility

- Alpari – Cent Account is perfect for Beginners

Top 10 Forex Brokers (Globally)

1. Exness

Exness is a globally regulated forex and CFD broker known for its low-cost trading and wide account variety. It offers a Cent Account, ideal for beginners, allowing trading with very small lot sizes using real money but with lower risk.

Frequently Asked Questions

What is the minimum deposit for Exness?

Exness offers varied minimum deposits. For Standard and Standard Cent accounts, it can be as low as USD 10, depending on the payment method. Professional accounts typically require a higher initial deposit, starting from USD 200.

Is Exness suitable for beginners?

Yes, Exness is generally considered suitable for beginners. They offer a Standard Cent account with a low minimum deposit (as little as $10), allowing new traders to start with minimal risk. Additionally, Exness provides a free demo account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low Minimum Deposit | Limited Education Content |

| Cent Account | No Bonus Offers |

| Tight Spreads | Limited Stock CFD Range |

| High Leverage | No Proprietary Desktop Platform |

| Multiple Regulations | Not Regulated in All Countries |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a reliable and well-regulated broker offering flexible account types, including a beginner-friendly Cent Account. With tight spreads, high leverage, and instant withdrawals, it suits both new and experienced traders globally.

2. RoboForex

RoboForex is a globally regulated forex and CFD broker known for its diverse account types and beginner-friendly features. It offers a Cent Account, allowing traders to start with very low capital and minimal risk while trading with real money.

Frequently Asked Questions

Does RoboForex offer a Cent Account?

Yes, RoboForex offers a “ProCent” account, which is their version of a Cent Account. It’s ideal for beginners or for testing new strategies, as trades are denominated in cents, significantly reducing the financial risk. It offers a low minimum deposit.

Does RoboForex offer negative balance protection?

Yes, RoboForex offers negative balance protection for its clients. This important feature ensures that your trading account balance cannot fall below zero, even during highly volatile market movements. If your account goes into a negative debit, RoboForex automatically resets it to zero.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Cent Account Available | IFSC Regulation Only |

| Low Minimum Deposit | Inactivity Fee |

| Multiple Trading Platforms | Complex Account Options |

| High Leverage | Limited Educational Content |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐☆☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

RoboForex is a versatile broker offering a wide range of assets, low entry barriers, and user-friendly platforms. With its Cent Account and high leverage, it suits both beginners and experienced traders seeking flexible trading conditions.

3. HFM

HFM is a globally regulated forex and CFD broker offering a variety of account types, including a Cent Account designed for beginners and low-risk trading.

Frequently Asked Questions

What trading platforms does HFM support?

HFM supports the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available on desktop, web, and mobile devices. Additionally, they offer their proprietary HFM Platform via their mobile app, providing a versatile trading experience for various trader preferences.

Can I open an Islamic (swap-free) account?

Yes, HFM (formerly HotForex) offers Islamic (swap-free) accounts specifically designed for clients who observe Sharia law. These accounts eliminate overnight swap charges on various instruments. It’s important to check their Rollover Policy, as some instruments may still incur “Carry Charges.”

Pros and Cons

| ✓ Pros | ✕ Cons |

| Cent Account Available | Offshore Regulation (FSC) |

| Low Minimum Deposit | High Leverage Risk |

| Multiple Regulations | Commissions on Zero Account |

| Negative Balance Protection | Limited Stock CFDs |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a reliable, beginner-friendly broker offering a Cent Account, low minimum deposit, and strong regulatory coverage. It’s well-suited for new and experienced traders seeking flexibility, diverse assets, and solid trading tools.

Top 3 Forex Brokers with Cent Accounts – Exness vs RoboForex vs HFM

4. FBS

FBS is a globally recognized forex and CFD broker regulated by CySEC and IFSC, offering low minimum deposits, tight spreads, and various account types. The FBS Cent Account is ideal for beginners, allowing trading with micro-lots and a minimum deposit of just $1.

Frequently Asked Questions

What trading platforms does FBS support?

FBS offers a variety of trading platforms to suit different needs. These include the globally popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for desktop, web, and mobile. Additionally, FBS provides its own proprietary FBS App for convenient mobile trading.

Does FBS offer Islamic (swap-free) accounts?

Yes, FBS offers Islamic accounts for Muslim clients, aligning with Sharia law. These accounts eliminate overnight interest charges on positions. While most instruments are swap-free, a weekly commission may apply to long-term positions on Forex Exotic instruments.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low Minimum Deposit | High Spreads on Some Accounts |

| Multiple Regulations | Limited Investor Protection Outside EU |

| High Leverage | High Commission on Zero Spread/ECN |

| Diverse Account Types | Complex Fee Structure |

| Bonus Offers | Offshore Regulation |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FBS is a versatile broker offering low entry barriers, high leverage, and various account types, including Cent and Islamic accounts. While spreads and commissions vary, it remains a strong choice for both beginners and experienced traders.

5. JustMarkets

JustMarkets provides a beginner-friendly Cent Account with only $10 deposit, micro‑lot trading in cents, 0.3 pips spreads, zero commissions, and up to 1:3000 leverage—ideal for cautious real‑money practice with real‑market conditions.

Frequently Asked Questions

Does JustMarkets offer a Cent account?

Yes, JustMarkets explicitly offers a “Standard Cent” account type. This account is specifically designed for beginners and allows trading with micro-lots (cent lots), meaning your balance and trades are denominated in cents. It has a low minimum deposit, typically USD 10.

What platforms can I use with JustMarkets?

JustMarkets provides traders with access to the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These are available as desktop applications, web-based terminals (WebTrader), and mobile apps for both Android and iOS devices.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Cent Account Available | Limited Investor Compensation |

| Multiple Regulations | Crypto Access Varies |

| High Leverage Options | Cent Account Only on MT4 |

| Low Spreads and Commission-Free Accounts | High Leverage Risk |

| Negative Balance Protection | Offshore Licenses Included |

Our Insights

JustMarkets is a well-regulated broker offering flexible account types, including a beginner-friendly Cent account. With high leverage, low-cost trading, and broad platform support, it suits both new and experienced traders globally.

6. InstaForex

InstaForex is a global forex and CFD broker offering a wide range of account types, including a Cent Standard Account designed for beginners. The Cent account allows trading with micro-lots using US cents as the base currency, enabling users to start with a minimum deposit of $1

Frequently Asked Questions

What is the minimum deposit to start trading with InstaForex?

InstaForex is known for its highly accessible entry point. For most of their account types, including Standard, Eurica, Cent.Standard, and Cent.Eurica accounts, the minimum deposit is typically just USD 1, depending on the chosen payment system.

What trading platforms are supported?

InstaForex supports the highly popular MetaTrader 4 and MetaTrader 5 platforms, available on desktop, web, and mobile devices. They also offer their proprietary WebTrader for browser-based trading and the MultiTerminal MT4 for managing multiple accounts, providing diverse options for traders

Pros and Cons

| ✓ Pros | ✕ Cons |

| Cent Accounts for Beginners | Wide Spreads on Standard Accounts |

| High Leverage | Complex Account Types |

| Multiple Platforms | Limited Regulation in Some Regions |

| Islamic (Swap-Free) Accounts | No Investor Compensation Fund (Offshore) |

| Bonus Offers | Bonus Restrictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

InstaForex is a versatile broker offering beginner-friendly Cent accounts, high leverage, and extensive trading tools. While it provides strong accessibility and platform support, its offshore regulation and wider spreads may concern more advanced traders.

7. Vantage

Vantage is a multi-regulated forex and CFD broker offering a Cent Account ideal for beginners. With a minimum deposit of $50, traders can access micro-lot trading in cents, ultra-tight spreads from 0.0 pips, and no commissions.

Frequently Asked Questions

Is there a demo account available?

Yes, Vantage (formerly Vantage FX) offers a free demo account with virtual funds (typically $100,000). This allows traders to practice strategies, explore their platforms (MT4, MT5, cTrader, Vantage App), and familiarize themselves with market conditions in a risk-free environment.

What is the maximum leverage at Vantage FX?

Vantage’s maximum leverage varies significantly by regulatory entity. For clients onboarded through their FSCA (South Africa), CIMA, or VFSC entities, leverage can go up to 1:500 for forex pairs. However, clients under stricter regulations are limited to 1:30.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-Regulated | Limited Product Range |

| Cent Account Available | Negative Balance Protection Not Universal |

| Low Spreads | Higher Minimum for ECN |

| No Commissions on Cent & STP | Bonuses/Promotions Not in All Regions |

| Advanced Trading Platforms | Education Tools Could Be Better |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Vantage FX is a well-regulated broker offering competitive spreads, a beginner-friendly Cent account, and powerful platforms. While its product range is moderate, it’s a strong choice for traders seeking flexibility, low costs, and ECN access.

8. FXTM

FXTM is a globally regulated broker (FCA, CySEC, FSCA, FSC Mauritius) offering a Cent Account (also called Micro) that starts from just $10 (or €50 in EEA), with spreads from 1.5 pips, zero commissions, and micro‑lot trading (0.01 = 0.0001 standard lots) via MT4 and WebTrader.

Frequently Asked Questions

Is FXTM good for beginners?

Yes, FXTM is generally considered good for beginners. They offer an accessible “Cent Account” (though a higher minimum deposit for other accounts exists), a free demo account, and extensive educational resources like guides and videos.

What is the maximum leverage at FXTM?

FXTM’s maximum leverage varies significantly by its regulating entity and the instrument traded. For clients under less strict regulations, leverage can reach up to 1:3000. However, for those under stricter regulations, maximum leverage is limited to 1:30.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Multi-Jurisdiction Regulation | Commission on ECN Accounts |

| Low Minimum Deposit | Variable Leverage by Region |

| Wide Range of Accounts | Inactivity Fees |

| High Leverage | No Proprietary Desktop Platform |

| Fast Execution & ECN Option | Investor Protection Not Global |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a well-regulated broker offering flexible account types, including a Cent account ideal for beginners. With low minimum deposits, high leverage, and strong platform support, it suits both novice and experienced traders alike.

9. FXOpen

FXOpen’s Micro (Cent) account allows trading with a $1 minimum deposit, micro-lots from 0.01, floating spreads, no commissions, leverage up to 1:500, and supports MT4/MT5/TickTrader. Designed for beginners to comfortably trade real money with minimal risk

Frequently Asked Questions

Does FXOpen offer negative balance protection?

Yes, FXOpen offers negative balance protection for its retail clients. This ensures that you cannot lose more money than you have deposited into your trading account, even during sudden and significant market movements. If your balance becomes negative, FXOpen will reset it to zero.

Is there a demo account available?

Yes, FXOpen provides demo accounts that allow you to practice trading in a risk-free environment. These accounts simulate real market conditions using virtual funds, enabling you to test strategies, learn the platforms, and familiarize yourself with forex trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong Global Regulation | Platform Can Be Complex for Beginners |

| Cent (Micro) Account Available | Leverage Varies by Region |

| Multiple Trading Platforms | Not All Features Available in All Regions |

| No Commissions on Micro/STP | Commission Fees on ECN Accounts |

| Tight ECN Spreads | Limited Proprietary Education Tools |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXOpen is a well-regulated broker offering flexible account types, including a 1 Cent account ideal for beginners. With competitive spreads, multiple platforms, and global reach, it suits both new and experienced traders.

10. Forex4you

Forex4you’s Cent variants allow traders to start with no minimum deposit, trade micro-lots with minimal risk, and test strategies using real money, making them ideal for beginners, EA testing, and cautious trading.

Frequently Asked Questions

What is the minimum deposit at Forex4you?

Forex4you is highly accessible, generally stating no minimum deposit requirement to open an account. While you can fund with any amount, they often suggest a recommended deposit ($50 for Cent accounts or $500 for Classic accounts) to facilitate effective trading.

What leverage is available?

Forex4you offers high leverage, typically up to 1:1000 for accounts with equity up to $10,000. For Cent and Classic Pro accounts, leverage can even go up to 1:4000. However, leverage decreases as your account equity grows.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Low or No Minimum Deposit | Limited Regulation |

| Multiple Account Types | Fixed Spreads on Cent Accounts |

| Wide Range of Instruments | Commission Fees on Some Accounts |

| Copy Trading Platform | Limited Educational Resources |

| High Leverage Options | Withdrawals May Have Fees |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐☆☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐☆☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Forex4you offers beginner-friendly Cent accounts with low deposits, a wide range of instruments, and reliable platforms. While regulated offshore with limited investor protection, it suits traders seeking flexible leverage and copy trading options.

What is a Cent Account?

A cent account is a type of trading account where balances and transactions are measured in cents instead of dollars. It allows beginners to trade with very small amounts, offering a low-risk way to practice real-market conditions using micro-lots.

Criteria for Choosing a Forex Broker with a Cent Account

| Criteria | Description | Importance |

| Regulation | Broker should be licensed by a reputable financial authority. | ⭐⭐⭐⭐⭐ |

| Minimum Deposit | Should offer a low deposit requirement (e.g., $1–$10) to accommodate beginners. | ⭐⭐⭐⭐☆ |

| Execution Speed | Fast order execution is essential to reduce slippage and improve trading. | ⭐⭐⭐⭐☆ |

| Spread & Commissions | Low spreads and no hidden fees make trading more cost effective. | ⭐⭐⭐⭐☆ |

| Leverage Options | Flexible leverage allows users to control larger positions with small capital. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Access to stable, user friendly platforms like MT4 or MT5 is important. | ⭐⭐⭐⭐⭐ |

| Account Types | Cent account should be clearly defined with real trading conditions. | ⭐⭐⭐⭐☆ |

| Customer Support | Prompt and helpful support is crucial, especially for new traders. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Methods | Should support fast, secure, and low-fee transactions. | ⭐⭐⭐⭐☆ |

| Educational Resources | Tutorials, guides, and demo access help beginners improve their skills. | ⭐⭐⭐⭐☆ |

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From account types and fees to benefits and Leverage, we provide straightforward answers to help you understand Cent Accounts and choose the right broker confidently.

Q: What exactly is a cent account, and how does it differ from a standard account? – Alex (Beginner Trader)

A: A cent account is a type of trading account where your balance and trades are denominated in cents instead of dollars. So, if you deposit $10, your account will show 1000 cents. The key difference is that it allows you to trade with much smaller lot sizes (micro-lots), making the financial risk significantly lower.

Q: Can I genuinely test new trading strategies on a cent account, or is it too different from real market conditions? – Ben (Experienced Trader, Strategy Testing)

A: Yes, you can genuinely test new trading strategies. While the capital involved is smaller, cent accounts operate under real market conditions, providing actual price movements, spreads, and execution speeds.

Q: What are the specific benefits of using a cent account for risk management? – Chloe (Risk-Averse Investor)

A: Cent accounts offer excellent risk management benefits due to their micro-lot trading. This means you can open positions with very small amounts of capital, minimizing your exposure to significant losses.

Q: What is the typical minimum deposit for a cent account? – David (New to Forex)

A: The minimum deposit for a cent account is typically very low, often starting from as little as $1 to $10. This low entry barrier makes it highly accessible for beginners or those with limited capital who want to dip their toes into live trading.

Q: Do cent accounts offer the same leverage as standard accounts, and how does that affect potential profits? – Emily (Seeking Higher Returns)

A: Cent accounts often offer high leverage, sometimes up to 1:500 or even 1:1000. While this can magnify potential profits, it’s important to remember that leverage also amplifies losses.

In Conclusion

Forex brokers with cent accounts offer a beginner-friendly way to start trading with minimal risk, using real market conditions but small amounts of capital. They’re ideal for learning, testing strategies, and gaining confidence before scaling up.

You Might also Like:

Faq

Yes, most brokers offering cent accounts ensure they are fully compatible with popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This allows traders to familiarize themselves with the platform’s features and tools in a real-trading environment.

While the range can be slightly more limited than standard accounts, cent accounts usually offer access to a good selection of popular trading instruments, including major and minor Forex currency pairs, and often metals like gold. Some brokers may also offer select commodities or indices.

Cent accounts generally boast zero commission on trades. However, some brokers may have slightly wider floating spreads on cent accounts compared to their ECN or raw spread standard accounts.

A cent account provides a crucial bridge between demo and live trading. It allows you to experience the psychological impact of real money (even small amounts) at stake, helping you manage emotions like fear and greed that are absent in demo trading.

The withdrawal process for a cent account is generally the same as for a standard account. You typically access your client area, select your preferred withdrawal method, specify the amount, and confirm. Most brokers aim for fast and secure withdrawals.