10 Best Scalping Forex Brokers

We have listed the 10 Best Scalping Forex Brokers known for their lightning-fast execution speeds, tight spreads, and low latency. These brokers offer advanced trading platforms, strong regulation, and optimal trading conditions, ensuring that scalpers can enter and exit trades quickly, efficiently, and with maximum precision.

10 Best Scalping Forex Brokers (2026)

- FP Markets – Overall, The Best Scalping Forex Brokers

- Pepperstone – Low-cost Razor account

- XM – Stable and high leverage up to 1000:1

- AvaTrade – Competitive, commission-free pricing

- Axi – Competitive pricing through tight spreads

- ActiTrades – Proprietary “Progressive Trailing Stop” tool

- BlackBull Markets – High-tech trading environment

- IC Markets – Raw spreads starting from 0.0 pips

- FXTM – Versatile range of account types

- Eightcap – Robust security and offers a suite of advanced trading tools

Top 10 Forex Brokers (Globally)

1. FP Markets

FP Markets is a top-tier forex broker that fully supports scalping strategies. Traders benefit from ultra-fast execution, raw spreads starting from 0.0 pips, and deep liquidity. Its ECN pricing model ensures minimal slippage, making FP Markets ideal for scalpers seeking precise and rapid trade entries and exits.

Frequently Asked Questions

Is FP Markets authorized for forex trading?

Yes, FP Markets is authorized for forex trading by several regulators globally. Key licenses include the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa.

Does FP Markets allow scalping strategies?

Yes, FP Markets allows scalping strategies and high-frequency trading. They facilitate this by offering tight spreads from 0.0 pips and fast execution on platforms like MT4, MT5, and cTrader, which are essential for successful scalping.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | VPS hosting may require a minimum deposit |

| ECN pricing with spreads from 0.0 pips | Limited educational tools for beginner scalpers |

| High-speed execution suitable for rapid trades | Higher leverage may increase trading risks |

| No trading restrictions on scalping or hedging | Inactivity fees may apply over time |

| Advanced trading platforms like MetaTrader 4, 5, and cTrader | Platform customization can be complex for new users |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is an authorized and trusted broker that supports scalping with ECN pricing, tight spreads, and lightning-fast execution. It’s ideal for traders seeking efficient, transparent, and regulated conditions for short-term forex strategies.

2. Pepperstone

Pepperstone is an authorized forex broker that fully supports scalping strategies. With ultra-low spreads, lightning-fast execution, and advanced platforms like MetaTrader and cTrader, Pepperstone provides optimal trading conditions for scalpers seeking precision, speed, and reliability.

Frequently Asked Questions

Does Pepperstone allow scalping strategies?

Yes, Pepperstone is considered highly suitable for scalping strategies.1 They offer the Razor Account with raw spreads from 0.0 pips, fast execution (average – 30ms), and no dealer intervention, which are crucial features for high-frequency trading.

Which platforms can scalpers use with Pepperstone?

Pepperstone supports scalping with platforms such as MetaTrader 4, MetaTrader 5, and cTrader. These platforms offer fast execution, low spreads, and various advanced trading features tailored for scalpers.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and highly regulated | VPS hosting may require additional setup or fees |

| Ultra-low spreads starting from 0.0 pips | Limited proprietary trading platform |

| Excellent execution speed ideal for scalpers | Educational content could be expanded for beginners |

| Supports automated and algorithmic trading systems | No fixed spread accounts available |

| No restrictions on scalping or hedging strategies | High leverage may increase trading risk |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a legit forex broker trusted worldwide for its low spreads, fast execution, and scalping-friendly environment. It’s ideal for traders who value regulation, transparency, and efficiency in short-term forex strategies.

3. XM

XM is a legit and authorized forex broker that supports scalping strategies. With fast trade execution, tight spreads, and advanced platforms like MetaTrader 4 and 5, XM provides ideal trading conditions for scalpers seeking speed and precision.

Frequently Asked Questions

Is XM a legal forex broker?

Yes, XM is a legal forex broker with multiple licenses from reputable financial authorities. Its affiliated entities are regulated by bodies like the FSCA (South Africa), FSC (Belize), and FSA (Seychelles), depending on the client’s jurisdiction.

Does XM allow scalping?

Yes, XM explicitly allows scalping strategies across all their account types. They cater to this by offering features like fast trade execution with no re-quotes, which are vital for a successful, high-frequency scalping approach.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Some account types have higher spreads |

| Tight spreads starting from 0.0 pips | Limited availability of ECN-style trading |

| Fast execution suitable for high-frequency trades | VPS service may require minimum deposit |

| No restrictions on scalping or hedging. | High leverage increases potential risk |

| Offers negative balance protection for safety | Restricted in certain regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XM is a legal and regulated broker that supports scalping with tight spreads, fast execution, and flexible trading options. It’s ideal for traders seeking a safe and efficient environment for short-term forex strategies.

Top 3 Scalping Forex Brokers – FP Markets vs Pepperstone vs XM

4. AvaTrade

AvaTrade is a legal and regulated forex broker that allows limited scalping under specific conditions. With reliable execution, competitive spreads, and advanced platforms like MetaTrader and AvaTradeGO, it offers a stable environment for short-term trading strategies.

Frequently Asked Questions

Does AvaTrade allow scalping?

Yes, AvaTrade allows all trading strategies, which includes scalping, hedging, and automated trading. They explicitly state there are no restrictions on scalping, providing fast execution and tight spreads that are essential for this high-frequency method.

Which platforms are available for scalping with AvaTrade?

You can scalp on several AvaTrade platforms, with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) being the most popular due to their advanced charting and Expert Advisor (algorithmic) support. You can also use the proprietary WebTrader and AvaTrade App.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Strict limits on high frequency scalping |

| Reliable and stable trade execution | No ECN account option |

| Competitive spreads across major forex pairs | Higher spreads compared to ECN brokers |

| Supports MetaTrader 4 and 5 platforms | Limited leverage depending on region |

| Offers negative balance protection | VPS hosting not directly provided |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an approved and trusted broker offering limited scalping opportunities with solid execution and competitive spreads. It suits traders seeking a regulated, secure, and steady platform for moderate short-term trading strategies.

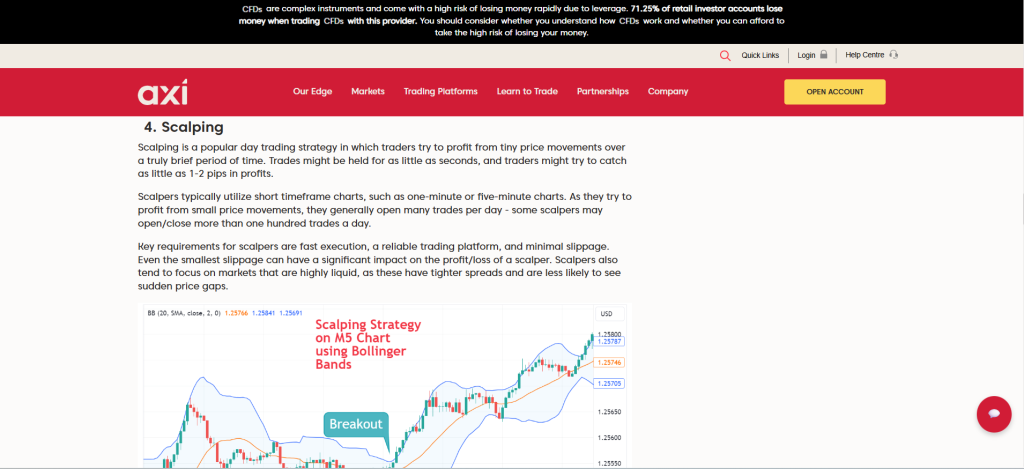

5. Axi

Axi is an approved and regulated forex broker that fully supports scalping strategies. With ultra-fast execution, raw spreads from 0.0 pips, and advanced platforms like MetaTrader 4, Axi provides ideal conditions for active scalpers seeking precision and speed.

Frequently Asked Questions

Is Axi a registered forex broker?

Yes, Axi is a registered forex broker. It holds licenses from regulators such as the Australian Securities and Investment Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, and the Financial Markets Authority (FMA) in New Zealand, ensuring its compliance with international financial regulations.

Does Axi allow scalping?

Yes, Axi allows scalping on its standard trading accounts, as it is a recognized short-term strategy. However, scalping is strictly prohibited in the specific Axi Select Program for funded accounts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Limited to MetaTrader 4 platform only |

| Raw spreads starting from 0.0 pips | No proprietary trading platform |

| Lightning-fast trade execution | VPS service may require minimum trading volume |

| No restrictions on scalping or hedging | Educational resources could be expanded |

| Supports automated trading systems (EAs) | Limited product range compared to larger brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Axi is a registered and trusted forex broker ideal for scalping. With tight spreads, fast execution, and unrestricted trading strategies, it offers professional traders a reliable and efficient environment for short-term forex trading.

6. ActivTrades

ActivTrades is a regulated forex broker that supports scalping, offering fast execution and tools suited for rapid trading strategies.

Frequently Asked Questions

Does ActivTrades allow scalping strategies?

Yes, ActivTrades allows scalping and actively welcomes it on their platforms. They provide the necessary conditions, like fast execution and tight spreads, to support traders employing rapid-fire, short-term strategies.

Which platforms can scalpers use with ActivTrades?

ActivTrades supports scalping on MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary ActivTrader platform. These platforms offer fast execution, advanced charting, customizable tools, and mobile compatibility, suitable for scalpers of all levels.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited availability of ECN-style accounts |

| Fast and reliable trade execution | No raw spread account option |

| Supports scalping and short-term trading | VPS hosting not standard |

| Competitive spreads across forex pairs | Higher minimum deposit than some brokers |

| Advanced platforms with professional grade tools | Limited leverage in regulated regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

ActivTrades is an authorized and regulated broker that supports scalping with fast execution, tight spreads, and advanced platforms. It’s suitable for traders seeking a secure and efficient environment for short-term forex trading strategies.

7. BlackBull Markets

BlackBull Markets welcomes scalping strategies, offering a true ECN environment with spreads from 0.1 pips. This setup provides the efficient execution needed for high-frequency entries and exits.

Frequently Asked Questions

Is BlackBull Markets a legit forex broker?

Yes, BlackBull Markets is a legitimate and regulated broker. It is overseen by the Financial Markets Authority (FMA) of New Zealand and the Financial Services Authority (FSA) of Seychelles, and segregates client funds for security.

Which platforms does BlackBull Markets offer for scalping?

BlackBull Markets supports scalping on MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. These platforms offer the fast execution and advanced charting necessary for high-frequency trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | VPS hosting may require a higher account balance |

| True ECN environment with raw spreads | Limited educational materials for beginners |

| High-speed execution ideal for scalpers | Customer support not 24/7 in all regions |

| No restrictions on scalping or hedging | No fixed spread account options |

| Supports multiple platforms including MT4, MT5, and TradingView | Regional restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

BlackBull Markets is a legit forex broker ideal for scalping, offering ECN pricing, tight spreads, and fast execution. It’s well-suited for professional traders seeking flexibility, transparency, and superior trade performance.

8. IC Markets

IC Markets is a regulated and legal forex broker that supports scalping. They offer ultra-low latency execution, raw ECN spreads from 0.0 pips, and no minimum order distance, making it ideal for high-frequency and automated trading.

Frequently Asked Questions

Does IC Markets allow scalping strategies?

Yes, IC Markets explicitly allows scalping strategies. They are highly favored by scalpers due to their ultra-low latency execution, no minimum order distance, and raw spreads on their ECN-style accounts.

Which platforms are best for scalping with IC Markets?

cTrader and MetaTrader 4/5 (MT4/MT5) are the best platforms. cTrader is often preferred for its clear depth of market (DOM) and one-click order functionality, while MT4/MT5 are excellent for automated scalping via Expert Advisors (EAs).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | VPS may require specific account conditions |

| True ECN environment with raw spreads | Limited proprietary tools for manual scalpers |

| No restrictions on scalping or hedging | Educational content could be broader |

| Ultra-fast execution speeds ideal for scalpers | High leverage increases trading risk |

| Supports automated trading and VPS hosting | Regional restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is an excellent, approved broker for scalping. It provides ECN pricing with raw spreads and lightning-fast execution, delivering the precision, speed, and flexibility required for high-frequency and short-term trading strategies.

9. FXTM

FXTM is a regulated forex broker that permits scalping, especially on its ECN accounts. It provides competitive spreads and quick execution via MetaTrader 4 and MetaTrader 5, making it well-suited for short-term traders who need rapid trade entries and exits.

Frequently Asked Questions

Is FXTM a registered forex broker?

Yes, FXTM is a registered forex broker. It holds licenses from regulatory authorities such as the Financial Services Commission (FSC) of Mauritius and the UK’s Financial Conduct Authority (FCA), ensuring compliance with international standards.

Does FXTM allow scalping?

Yes, FXTM allows scalping. Scalping is permitted on FXTM accounts, including the Advantage account, enabling traders to use short-term strategies to profit from small price movements with fast order execution and flexible trading conditions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Commission fees apply on ECN accounts |

| Tight spreads on ECN accounts | Scalping performance may vary by account type |

| Fast and reliable order execution | VPS hosting not free for all traders |

| Supports automated and manual scalping strategies | Leverage restrictions based on region |

| User-friendly MetaTrader platforms | Limited proprietary platform tools |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a registered and reputable broker that supports scalping with ECN accounts, tight spreads, and fast execution. It’s ideal for traders seeking reliable, regulated conditions for short-term and high-frequency forex trading.

10. Eightcap

Eightcap fully permits scalping strategies across all its account types, allowing traders to execute the rapid entries and exits necessary for short-term, high-frequency trading.

Frequently Asked Questions

Does Eightcap allow scalping strategies?

Yes, Eightcap explicitly allows all scalping strategies, supporting rapid trade entries and exits. This policy is consistent across all their account types, making it suitable for high-frequency short-term traders.

Which platforms can scalpers use with Eightcap?

Eightcap supports scalpers on three popular platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a seamless TradingView integration. These platforms are preferred for their advanced charting, fast execution, and support for Expert Advisors (EAs).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | VPS hosting requires minimum account conditions |

| Supports ECN accounts with tight spreads | Limited educational content for scalpers |

| Fast and reliable trade execution | Smaller product range compared to larger brokers |

| No restrictions on scalping or hedging | No proprietary trading platform |

| Compatible with MT4 and MT5 platforms. | Regional restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Eightcap is a legit forex broker ideal for scalping, offering tight spreads, fast execution, and ECN accounts. It provides a reliable and efficient environment for traders seeking high-speed, short-term trading opportunities.

What is Scalping in Forex Trading?

Scalping in Forex Trading refers to a strategy where traders aim to make small profits from very short-term price movements in the market. This is achieved by opening and closing multiple trades in quick succession, typically within a few seconds to minutes. The goal is to exploit small fluctuations in currency prices, often targeting a few pips of profit per trade.

Key Characteristics of Scalping:

-

Short Holding Period: Positions are held for a very brief time, ranging from seconds to a few minutes.

-

High Trade Frequency: Scalpers may place dozens or even hundreds of trades in a single day.

-

Small Profit Margins: Each trade typically targets a small number of pips, but cumulative profits can be significant with high-frequency trading.

-

Fast Execution: Scalping requires a broker that provides fast order execution, low spreads, and minimal slippage to ensure profitability.

Tools and Conditions for Successful Scalping:

-

Low Spreads: Scalpers need brokers that offer tight spreads (preferably 0.0–1.0 pips).

-

High Leverage: High leverage allows traders to maximize profits from small price movements.

-

Advanced Platforms: Platforms like MetaTrader 4/5 and cTrader are popular among scalpers due to their fast execution capabilities and advanced charting tools.

Scalping is often favored by traders who are looking for high-speed trading and are capable of maintaining sharp focus and discipline, as it can be demanding and requires significant market knowledge.

Criteria for Choosing a Scalping Forex Broker

| Criteria | Description | Importance |

| Low Spreads | Tight spreads (preferably from 0.0 pips) ensure minimal cost per trade, crucial for scalping success. | ⭐⭐⭐⭐⭐ |

| Fast Execution | Scalpers need brokers with low latency and quick order execution to capitalize on small price movements. | ⭐⭐⭐⭐⭐ |

| Reputable Regulation | Choose brokers regulated by top-tier authorities like ASIC or FCA to ensure transparency and safety of funds. | ⭐⭐⭐⭐⭐ |

| High Leverage | High leverage allows traders to maximize small price movements, which is essential for scalping. | ⭐⭐⭐⭐☆ |

| Advanced Platforms | Scalping requires powerful platforms like MetaTrader 4/5 or cTrader that offer rapid execution and advanced charting tools. | ⭐⭐⭐⭐⭐ |

Top 10 Best Scalping Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From commissions to brokers that restrict scalping, we provide straightforward answers to help you understand scalping and choose the right broker confidently.

Q: Are commissions a big concern when choosing scalping brokers? – Amy F.

A: Yes, commissions are a major concern for scalpers. Since scalping involves numerous trades for small profits, the fixed cost of a commission can quickly accumulate, significantly reducing or even eliminating your overall gains.

Q: Can scalping be done effectively on MetaTrader platforms? – Tyler T.

A: Yes, scalping can be effectively done on MetaTrader (MT4/MT5) platforms, provided you use an ECN/Raw Spread broker account and prioritize low latency, often achieved via a Virtual Private Server (VPS).

Q: Should I avoid brokers that restrict scalping or automate trades? – John G.

A: Yes, you should generally avoid brokers that strictly restrict scalping. Such restrictions often signal a conflict of interest where the broker may be taking the opposite side of your trades (market maker model).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Quick Profits | High Transaction Costs |

| Low Market Exposure | Requires High Focus and Discipline |

| High Trade Frequency | Broker Restrictions |

| Leverage | Potential for High Losses |

| Low Impact from News | Not Suitable for Beginners |

You Might also Like:

- FP Markets Review

- Pepperstone Review

- XM Review

- AvaTrade Review

- Axi Review

- ActivTrades Review

- BlackBull Markets Review

- IC Markets Review

- FXTM Review

- Eightcap Review

In Conclusion

Scalping forex brokers offer traders fast execution, tight spreads, and the ideal environment for short-term strategies. They suit experienced traders seeking quick profits, though high focus, discipline, and reliable technology are essential for consistent success.

Faq

Scalping is generally legal in forex trading, but its allowance depends on the broker’s policy. Many brokers, especially those not using an ECN/STP model, restrict or prohibit it due to the high volume of quick trades.

The ECN (Electronic Communication Network) or STP (Straight Through Processing) broker model is best for scalping. They offer tight, often raw spreads and fast, non-dealing desk execution, which is crucial for the high volume of quick trades scalpers perform.

No, not all brokers allow scalping. Many Market Maker (dealing desk) brokers restrict or prohibit it because the high volume of quick trades is unprofitable for their business model. ECN/STP brokers usually permit it.

Fast execution is vital because scalpers aim to profit from minimal price fluctuations over very short periods. Slow execution causes slippage, which can quickly eliminate the small gains that a scalping strategy relies on.

Yes, you can scalp on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms support the quick execution, low timeframes (like M1 and M5), and technical indicators essential for scalping.

A VPS is highly recommended for scalpers, especially for automated trading. It ensures ultra-low latency and 24/7 uptime, which are crucial for minimizing slippage and executing high-frequency trades precisely, even during home internet or power outages.

A moderate-to-high leverage (e.g., 1:100 to 1:500) is often used by experienced scalpers to maximize returns on small price moves. Crucially, this must be paired with extremely tight risk management (small position sizing and tight stop-losses) to mitigate the exponential risk of high leverage.

Scalping is generally not recommended for absolute beginners. It requires intense focus, rapid decision-making, strict discipline, and excellent risk management due to the high frequency and tiny profit targets. Start with slower styles like swing or trend trading.

Key risks include high transaction costs due to frequent trades, magnified losses from using high leverage, and significant emotional stress from quick, constant decision-making. One large loss can easily wipe out many small gains.