What is a Pip?

Last Update: September 1st, 2025

In this article, we discuss what a pip is and its significance in financial trading. We have researched the topic thoroughly and provided a comprehensive guide on what a pip is.

- What is a Pip?

- The Importance of Pips in Forex Trading f

- How to Calculate the Value of a Pip

- Understanding the Relationship between Leverage and a Pip

- How Pips work in Cryptocurrency Trading

- Strategies for Managing Pips

- Advanced Pip Concepts

- Practical Tips for using Pips effectively in Forex Trading

- A Comprehensive List of the Top 10 Forex Brokers (Globally)

- Conclusion

Top 10 Forex Brokers (Globally)

10 BEST FOREX BROKERS

| MIN DEPOSIT $100 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $50 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $25 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $200 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $4 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $5 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $0 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $20 | SIGN-UP BONUS Yes | Visit Now |

| MIN DEPOSIT $10 | SIGN-UP BONUS No | Visit Now |

| MIN DEPOSIT $1 | SIGN-UP BONUS Yes | Visit Now |

What is a Pip?

Pips are the essential metric for tracking changes in foreign exchange rates and can be abbreviated as “price interest point” or “percentage in point.”

They represent the smallest possible price adjustment that a currency pair can undergo, often equivalent to one basis point at the fourth decimal place of the exchange rate. For example, if EUR/USD moves from 1.1050 to 1.1051, this would constitute a one-pip movement.

By simplifying fractional and decimal representations into easily digestible units like pips, traders gain greater clarity on minor currency value fluctuations, facilitating better strategic decision-making within an otherwise unstable forex market landscape.

The Importance of Pips in Forex Trading

Pips are essential for calculating profit and loss and making strategic decisions in forex trading. These tiny fluctuations in currency pair values reflect market activity and serve as the foundation for developing effective trading strategies.

In addition to measuring position size, pips are critical in determining transaction costs, so spreads are often quoted in terms of pip variance between purchase and sale prices.

To optimize their trades financially, traders must have an excellent grasp of decimals when managing expenses effectively.

Pips are crucial in managing risk; they help execute stop-loss and take-profit orders. While the former specifies the maximum loss acceptable to traders, the latter determines when profits should be locked in.

Such precision allows for more efficient management of risk and reward exposure by empowering traders with greater control over their strategies.

Their influence further exemplifies the significance of pips concerning leverage. Forex traders can handle significant positions using a small capital investment through leverage.

Thus, the value of a pip can substantially impact potential profit or loss from leveraged positions as it greatly amplifies both gains and losses.

It is, therefore, crucial for investors utilizing leveraged forex investments to grasp decimals and accurately comprehend their worth concerning specific currency combinations so they may make wise decisions when investing.

How to Calculate the Value

Forex traders need to have a solid understanding of how to calculate pip values to fully grasp the potential impact of market fluctuations on their trading positions.

Depending on whether the USD serves as the reference currency or not in a particular currency pair, slight variations in the straightforward formula used for determining pip value may exist.

The formula for calculating the Value

When the USD is the quote currency in a currency pair, calculating pip value usually involves using this formula: Pip Value = (One Pip / Exchange Rate) * Lot Size.

In most cases, “One Pip” represents 0.0001 for many pairings, while “Lot Size” refers to the amount of base currency units traded. For JPY quoted pairs, one pip equals 0.01 due to the yen’s decline against major currencies, including the dollar and others.

When the quote currency is not USD or when dealing with a non-USD account, an extra step is required according to the mentioned formula. The calculated pip value in the quote currency should be converted into the base currency of the respective account by utilizing current exchange rates.

This additional process ensures traders can accurately determine how pip fluctuations affect their domestic currencies’ values.

The formula for calculating the Value

When the USD is the quote currency in a currency pair, calculating pip value usually involves using this formula: Pip Value = (One Pip / Exchange Rate) * Lot Size.

In most cases, “One Pip” represents 0.0001 for many pairings, while “Lot Size” refers to the amount of base currency units traded. For JPY quoted pairs, one pip equals 0.01 due to the yen’s decline against major currencies, including the dollar and others.

When the quote currency is not USD or when dealing with a non-USD account, an extra step is required according to the mentioned formula. The calculated pip value in the quote currency should be converted into the base currency of the respective account by utilizing current exchange rates.

This additional process ensures traders can accurately determine how pip fluctuations affect their domestic currencies’ values.

Examples of Calculations in Major Currency Pairs

To exemplify, we can consider the EUR/USD pair with a lot size of 100,000 units and an exchange rate of 1.1050. The pip value can be calculated by dividing 0.0001 by 1.1050 and multiplying it by 100,000, resulting in around $9.05 per pip.

Therefore, for a position comprising this quantity (i.e., one hundred thousand), any movement made across one tick will result in approximately $9.05 as profit or loss on the trade outcome.

When the USD/JPY pair maintains a constant lot size and an exchange rate of 110.50, its calculation adjusts for the yen’s lower unit value.

This results in an estimated $9.05 per pip when multiplying (0.01 by 110.50) by 100,000 – comparable to EUR/USD but factoring in unique currency dynamics and pip magnitude specific to this pairing.

To handle currency pairs other than USD (e.g., GBP/JPY), traders must convert the decimal value into their account currency.

For instance, in a lot size of 100,000 and an exchange rate of 140.00 JPY per GBP, we derive the pip value as approximately 714.29 JPY by calculating (0.01 / 140) * 100,000).

If the trader’s account denomination is USD instead of JPY, then they must use the USD/JPY exchange rate for converting this amount into its corresponding dollar worth efficiently understanding all financial consequences involved hereafter.

Understanding the Relationship Between Pips and Leverage

In the intricate world of forex trading, leverage and decimals are inextricably linked concepts that significantly impact trading strategies and outcomes.

Therefore, to effectively navigate the market and capitalize on their positions, traders must thoroughly understand this crucial correlation.

The Concept of Leverage in Forex Trading

Leverage in forex trading allows traders to control a large position with minimal capital. The leverage ratio, such as 50:1 or 100:1, indicates how much capital the trader can use beyond their initial investment.

For instance, using 100:1 leverage lets a trader hold $100,000 worth of assets for just $1,000 of their funds.

This increases profit potential from even minor market movements but raises the risk factor and demands thorough knowledge about leveraging before entering foreign exchange trade deals.

How Pips Affect Your Trading With Leverage

Engaging in leveraged trading significantly amplifies the value of a penny. Despite being insignificant, even slight fluctuations in currency values – pips – can greatly affect the overall worth of a leveraged position.

Within this high-risk context, small favorable movements for traders can result in significant profits, while minor losses inflicted by unfavourable market conditions are debilitating.

Therefore, it is critical to accurately calculate and understand the implications of pennies within these ventures due to their magnified impact on outcomes.

How Pips Work in Cryptocurrency Trading

Although originating in the foreign exchange market, the concept of pips can also be applied to cryptocurrency trading; however, noteworthy differences and specific considerations must be taken into account.

Traders transitioning from forex to crypto markets or managing a diverse portfolio across both domains need an extensive understanding of these nuances and the process used for calculating pip value in cryptocurrencies. This knowledge is vital for success in crypto trading.

Differences Between Forex and Crypto Pips

Foreign exchange trading follows the market convention of using pips to measure the smallest price movement within a given exchange rate. Typically, this value is 0.0001 for most currency pairings and signifies one basis point shift in the fourth decimal place.

In contrast, cryptocurrency trading experiences more varied pip values due to digital currencies’ inherent volatility and vast worth range.

Pairs can change to either the second-to-last decimal place (0.01) or by single units from a denomination as small as Satoshi in Bitcoin trades, where each unit accounts for 0.00000001 of its parent coin’s overall value.

These fluctuations result from wider ranges of prices present among cryptocurrencies and an increased necessity for precision when attentively tracking their shifts over time.

The ever-changing nature and unstable market of cryptocurrencies give significant weight to pip fluctuations. Cryptocurrency variations may stem from news updates, speculation, or substantial transactions.

However, in the forex market, these changes typically indicate responses to economic events or sustained trends. This discrepancy underscores the cryptocurrency industry’s early stages as less regulated than traditional markets like forex trading.

Calculating Pip Value in Cryptocurrency

To determine pip value in cryptocurrency trading, you need to consider the denomination of a pip for the particular cryptocurrency being traded and the transaction’s quantity. This differs from forex market practices, where standardization of pip values is observed across most pairings.

In cryptocurrencies, computation requires factoring in each variant’s precise price point and volatility level when determining its appropriate pip value.

To better understand, imagine a trader making a Bitcoin deal at $40,000. If they define one pip as a movement of $1 (due to the high value of Bitcoin), then each pip represents a change in trade worth half of that amount – or 50 cents for every 0.5 BTC traded.

Traders must adapt their understanding of pips from traditional forex markets and account for factors like volatility and price range when dealing with cryptocurrencies. This means considering trade size and predetermined pip values unique to the digital currency being traded.

Strategies for Managing Pips

To succeed in foreign exchange trading, it is crucial to manage pips efficiently. This involves implementing methods that aim to increase profits while reducing losses.

Two key aspects of pip management are placing stop loss and take profit orders and utilizing risk management strategies based on pips. Traders who want greater precision and control when dealing with the unpredictable forex market need these techniques for optimal results.

Setting Stop Loss and Take Profit

Traders establish automated directives known as stop loss and take profit orders to terminate positions at specific value thresholds, either securing profits or restricting losses.

In the volatile forex market, where conditions can swiftly shift, traders must establish a stop loss order that specifies the distance in decimals from the entry price at which an open position shall be closed mechanically to prevent additional losses.

For example, a trader entering a long position on EUR/USD at 1.1200 could set a stop loss of 20 pips below 1.1180 to limit potential loss.

Similarly, establishing a take-profit order automatically terminates trades upon reaching predetermined quantities of pips above the entry price, safeguarding any accumulated profits before encountering possible reversal direction within the market space.

A trader anticipating increments might establish their take-profit rates some fifty pips higher than initial projections, such that one expecting gains over time would do so accordingly.

Effective stop-loss and take-profit decisions require traders to thoroughly understand market analysis, volatility, and personal risk tolerance.

This entails carefully assessing the past trends of the currency pair, current market conditions, and overall trading strategy and objectives.

Risk Management Techniques

To ensure adequate protection of a trading portfolio, it is essential to employ robust risk management strategies, including fractions and setting up stop-loss and take-profit orders.

One effective technique involves position sizing, which determines the trade volume based on the allowable percentage of potential losses on total capital and units at risk.

This approach enables investors to manage risks effectively by avoiding overexposure from any one transaction, thereby maintaining balance and diversity in their portfolios.

Another approach involves utilizing trailing stops, which protect profits by allowing a trade to stay active and gather more earnings if the price remains advantageous for traders.

Trailing stops adjust the stop loss level based on market direction, enabling traders to maximize gains while minimizing potential losses through predetermined decimal adjustments.

Advanced Pip Concepts

Exploring sophisticated principles in foreign exchange trading, like pipettes and the impact of economic events on pip values, can provide traders with a deeper understanding of market dynamics and improve the effectiveness of their trading strategies.

Understanding their Role

Pipettes offer greater precision in portraying currency fluctuations, providing added accuracy beyond pips. Equivalent to one-tenth of a pip, they are located at the fifth decimal place for most currency pairs and the third decimal place when involving Japanese yen.

Incorporating pipettes into foreign exchange trading platforms enables more accurate measurements during high volatility environments, which is especially crucial for short-term strategies where tiny price changes can significantly impact traders’ decisions.

By enabling orders with narrower spreads and increased precision, pipettes allow traders to adjust their entry and exit positions precisely in the market.

The Impact of Economic Events on Pips

Major economic events significantly impact the fluctuations of foreign exchange rates, often resulting in substantial changes within short timeframes.

Such occurrences can include announcements from central banks, publication of economic data, unforeseen global crises/instability, and general political unpredictability.

Interest rate decisions, GDP figures as well and employment reports are some examples that can lead to volatility that significantly affects currency values across markets.

Traders rely heavily on such information, regularly keeping up-to-date through consultation with various Economic Calendars available. Hence, they stay up-to-date about trends and potential turning points for market movements.

Economic events have a twofold impact on pips. Firstly, they can trigger immediate reactions that cause significant increases in trade volume and rapid changes in pip values. While this environment presents opportunities for traders to make quick profits, it also exposes them to greater risk.

Secondly, anticipating these occurrences may influence market trends, allowing traders to plan their positions strategically.

Understanding how economic events affect currency pairs is crucial for developing strategies that withstand volatility and take advantage of fluctuations for financial gain.

Practical Tips for Using Pips Effectively in Trading

In forex trading, proficiency in working with decimals is an indispensable skill for traders at all levels. To steer through this market successfully, it is imperative to optimize pip utilization by employing specialized tools and resources that monitor pips closely.

Additionally, seeking guidance on effective pip management from experienced trading experts can prove invaluable in mastering this critical aspect of forex trading.

Tools and Resources for Monitoring Pips

Sophisticated tools and resources are at the fingertips of traders, allowing them to monitor and evaluate changes in pip values. The primary tool for forex trading is the platform that offers real-time updates on currency pair prices with precision down to fractional measurements.

These platforms often include technical analysis tools such as charts and indicators, which assist traders in identifying trends along with potential entry or exit points based on fluctuations in price.

In addition, mobile applications tailored specifically for forex trading allow users to track decimals while on the go, ensuring they never miss a crucial market movement.

Economic calendars are essential and provide traders with a schedule of upcoming economic events that could influence pip fluctuations.

By anticipating these occurrences, traders can be well-prepared for potential market volatility. Real-time news channels covering global political and economic affairs also aid speculators in understanding the broader factors affecting point price changes.

For thorough analyses, traders can resort to software offering back-testing settings, automated trading tactics, and advanced charting features.

Through scrutinizing previous data with these tools’ support, traders are better equipped to anticipate possible price shifts and ultimately elevate their decision-making capacity.

Advice from Trading Experts

Trading experts often emphasize the importance of using a systematic approach to manage pip levels. One crucial recommendation is to continually monitor the currency’s value linked with every trade to reduce risk effectively.

This involves determining how much of your account balance is at stake with each penny movement and adjusting transaction sizes accordingly, staying within an established threshold for acceptable risk exposure.

Another crucial strategy is the tactical use of stop-loss orders in trading. These orders are placed a predetermined number of pips away from the entry point and serve as a tool to limit potential losses, protecting against volatile market swings that could erode capital.

Experts also advocate for implementing take-profit orders, which allow traders to lock in profits by automatically closing out positions once they reach a specific pip gain threshold.

This ensures lucrative trades translate into tangible earnings – shielding investments from unforeseen risks or fluctuations in value over time.

It is advisable to diversify transactions across various currency pairs and markets. This can help traders prevent a single decimal movement from significantly impacting their portfolio, reducing potential negative effects.

Top 10 Forex Brokers, Globally (2026)

- AvaTrade – Overall, The Best Forex Broker Globally

- Exness – Ultra-tight spreads and flexible leverage options

- Octa – Zero-fee policy (no deposit, withdrawal, swap, or inactivity fees)

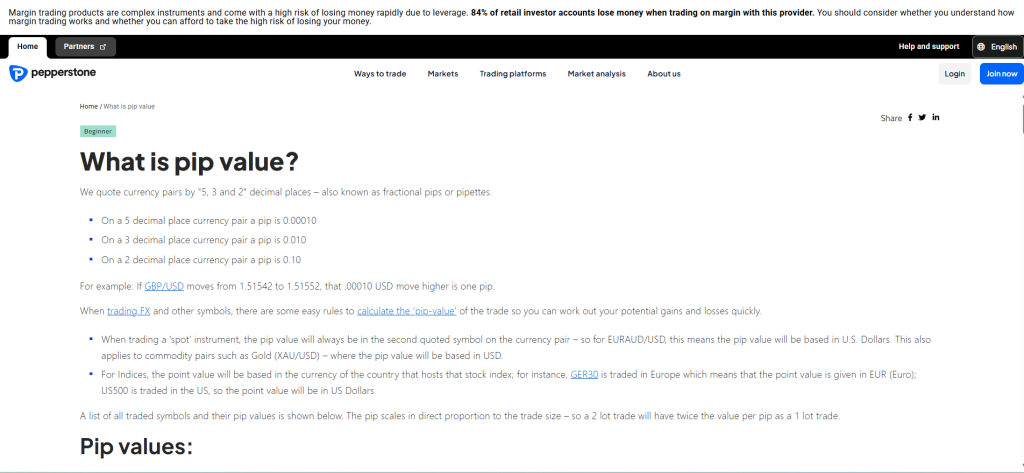

- Pepperstone – Powerful trading platforms like MetaTrader 4, 5, and cTrader

- Eightcap – Robust client support and educational resources

- FXTM – Options for commission-free trading or zero-spread accounts

- FinPros – Social trading and negative balance protection

- PU Prime – High leverage options up to 1:1000

- FP Markets – Multi-regulated entity, authorized by top financial bodies

- FBS – Highly competitive trading conditions

1. AvaTrade

AvaTrade is a globally regulated and legit forex and CFD broker established in 2006, offering trading on forex, stocks, commodities, indices, ETFs, bonds, and cryptocurrencies. The broker provides competitive spreads starting from 0.9 pips with no hidden commissions.

Frequently Asked Questions

Is AvaTrade an authorized broker?

Yes, AvaTrade is a highly authorized and multi-regulated broker. It is regulated by several top-tier financial authorities globally, including the Central Bank of Ireland, ASIC (Australia), and the FSA (Japan), ensuring a safe trading environment.

What are AvaTrade’s spreads?

AvaTrade’s spreads are typically wider than ECN brokers because they are a commission-free, spread-only broker. The spread on major forex pairs like EUR/USD starts from 0.9 pips, while spreads on other assets vary depending on the instrument.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and globally regulated | Inactivity fees after three months |

| Competitive spreads from 0.9 pips | Limited product range in some regions |

| Wide range of assets | No direct access to raw spread accounts |

| Supports MT4, MT5, WebTrader, and mobile apps | Withdrawals can be slow compared to some brokers |

| Offers negative balance protection and segregated accounts | No U.S. clients accepted |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an authorized broker offering competitive spreads, strong regulation, and diverse markets, including crypto. While inactivity fees and regional restrictions apply, it remains a trusted choice for traders seeking secure and flexible trading conditions.

2. Exness

Exness is a globally regulated and legal forex and CFD broker established in 2008, offering trading on forex, stocks, indices, commodities, and cryptocurrencies. The broker provides ultra-tight spreads starting from 0.0 pips on Raw Spread accounts, making it highly competitive for active traders.

Frequently Asked Questions

What are Exness spreads?

Exness offers a variety of spreads depending on the account type. Their Standard account has spreads from 0.2 pips with no commission. Their Raw Spread and Zero accounts offer spreads from 0.0 pips but charge a commission.

Does Exness allow cryptocurrency trading?

Yes, Exness allows cryptocurrency trading. It offers a wide range of popular digital currencies like Bitcoin, Ethereum, and Litecoin as Contracts for Difference (CFDs). Trading is available 24/7, with few exceptions for maintenance.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and legit global broker | Very high leverage may pose risk for beginners |

| Ultra-tight spreads from 0.0 pips | Not available to U.S. traders |

| Instant deposits and withdrawals | Limited research and educational resources |

| Supports MT4 and MT5 platforms | Some account types may have higher costs |

| Wide range of trading instruments | Limited investor protection in certain jurisdictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legit broker offering tight spreads, flexible leverage, and crypto trading options. While some regions face restrictions and fewer research tools, its regulation, instant withdrawals, and advanced platforms make it highly appealing to global traders.

3. Octa

Octa is a globally regulated and authorized forex and CFD broker established in 2011, offering trading in forex, indices, commodities, shares, and cryptocurrencies. The broker provides competitive spreads starting from 0.6 pips with zero commissions on most accounts.

Frequently Asked Questions

What are the spreads offered by Octa?

Octa offers highly competitive spreads, starting from as low as 0.6 pips on its Standard account. The spreads are floating and vary depending on the asset and market conditions, with no commissions charged on most account types.

Is Octa a legit forex broker?

Yes, Octa is a legitimate broker. It is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa. This oversight ensures it operates within established financial guidelines.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and legit broker | Limited investor protection outside the EU |

| Low spreads | Leverage capped in some regions |

| Zero commissions on most accounts | No fixed spread account option |

| Multiple platforms | Limited range of CFDs |

| Swap-free accounts available | No phone support in some regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa is a legit forex and CFD broker offering low spreads, zero commissions, and cryptocurrency trading. CySEC regulation, account segregation, and negative balance protection provide a secure environment suitable for both beginners and experienced traders.

Top 3 Forex Brokers – AvaTrade vs Exness vs Octa

4. Pepperstone

Pepperstone offers tight spreads starting from 0.0 pips on major pairs, with low commissions on Razor accounts. Traders can access forex, cryptocurrencies, indices, shares, and commodities through MetaTrader 4, MetaTrader 5, and cTrader platforms.

Frequently Asked Questions

Is Pepperstone a registered broker?

Yes, Pepperstone is a highly registered and authorized broker. It is regulated by multiple top-tier financial authorities globally, including the ASIC (Australia), FCA (UK), and CySEC (Cyprus), ensuring a secure trading environment.

What is the minimum spread offered by Pepperstone?

Pepperstone’s minimum spread is 0.0 pips on its Razor account, which is a popular choice for high-volume traders and scalpers. This account operates on a commission-based model to compensate for the raw spreads.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | No investor protection scheme in some regions |

| Ultra-low spreads | Inactivity fee |

| Wide range of assets | Limited research tools |

| Supports MT4, MT5, and cTrader platforms | No fixed spread accounts |

| Fast execution with no dealing desk | Customer support not available 24/7 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is a registered and highly trusted broker offering tight spreads, strong execution, and diverse assets including cryptocurrencies. While it lacks some regional protections, its platforms, low costs, and regulatory compliance make it a legit choice.

5. Eightcap

Eightcap is a regulated forex and CFD broker founded in 2009, offering ultra-tight spreads starting from 0.0 pips on major currency pairs. The broker supports MT4 and MT5 platforms, with fast execution and transparent pricing, making it a legit choice for both beginner and professional traders.

Frequently Asked Questions

What are Eightcap’s spreads in pips?

Eightcap offers spreads from 1.0 pips on its Standard account and competitive raw spreads from 0.0 pips on its Raw account, with an added commission. The spreads vary by asset and market conditions.

Is Eightcap an approved forex broker?

Yes, Eightcap is an approved and well-regulated broker. It holds licenses from multiple top-tier financial authorities, including the ASIC (Australia) and the FCA (UK), ensuring a secure trading environment.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated and approved | Limited investor protection compared to EU brokers |

| Ultra-tight spreads | Swap fees may apply |

| Supports both MT4 and MT5 platforms | No proprietary trading platform |

| Wide range of instruments | Lower educational resources for beginners |

| Fast execution and transparent pricing | Not available in certain jurisdictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Eightcap is an approved forex and CFD broker known for 0.0 pip spreads, strong regulation, and extensive crypto offering. While it lacks some protections and beginner tools, it remains a legit option for cost-conscious traders.

6. FXTM

FXTM is a legit forex and CFD broker founded in 2011, regulated by multiple authorities, including CySEC and FCA. It offers spreads from 0.0 pips on major forex pairs, fast execution, and supports trading on MT4 and MT5 platforms.

Frequently Asked Questions

Is FXTM a legal broker?

Yes, FXTM is a legal and globally regulated broker. It holds licenses from multiple reputable authorities, including the FCA (UK), CySEC (Cyprus), and FSCA (South Africa), ensuring client fund safety and operational transparency.

What are FXTM’s spreads?

FXTM’s spreads vary by account type. The Advantage Account offers spreads from 0.0 pips with commissions, while the Advantage Plus Account offers commission-free trading but with wider spreads starting from 1.5 pips.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and well-regulated | Inactivity fees may apply |

| Spreads from 0.0 pips on ECN accounts | Higher spreads on Standard accounts |

| Supports MT4 and MT5 platforms | Limited product range in some regions |

| Wide range of forex, crypto, and CFD instruments | Withdrawal fees on certain methods |

| Negative balance protection available | Educational resources could be broader for advanced traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a legal, regulated broker offering competitive spreads from 0.0 pips, access to forex, CFDs, and crypto trading. With strong platform support and solid protections, it’s a reliable choice for both new and experienced traders.

7. FinPros

FinPros is an international online forex and CFD broker that offers spreads starting from 0.0 pips on major currency pairs. The broker provides access to forex, commodities, indices, shares, and cryptocurrencies through advanced platforms like MT4 and MT5.

Frequently Asked Questions

Is FinPros a legit forex broker?

Yes, FinPros is a legit broker. It is regulated by the Cyprus Securities and Exchange Commission (CySEC), a Tier 2 EU regulator. It is also regulated by the FSA in Seychelles, which is an offshore authority.

Does FinPros offer cryptocurrency trading?

Yes, FinPros offers cryptocurrency trading as Contracts for Difference (CFDs). This allows you to trade on a variety of digital assets like Bitcoin, Ethereum, and Litecoin against the US Dollar without needing a crypto wallet.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight spreads | Regulated offshore |

| Low minimum deposit | No investor compensation scheme |

| Supports both MT4 and MT5 platforms | Limited educational resources |

| Offers 5,000+ CFDs | Customer support availability can vary |

| Negative balance protection provided | Limited local payment options in some regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐☆☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

FinPros is a legit forex and CFD broker with low-cost trading, advanced platforms, and broad asset coverage. While offshore regulation limits investor protection, its tight spreads, crypto options, and low deposits make it attractive for cost-conscious traders.

8. PU Prime

PU Prime is a regulated forex and CFD broker established in 2015, offering competitive spreads starting from 0.0 pips on major currency pairs. The broker supports advanced trading platforms like MetaTrader 4 and MetaTrader 5, ensuring fast execution and robust tools.

Frequently Asked Questions

Is PU Prime approved and regulated?

Yes, PU Prime is an approved and regulated broker. It holds licenses from several financial authorities, including the ASIC (Australia), FSCA (South Africa), and FSA (Seychelles), ensuring a secure and transparent trading environment.

What is the minimum deposit to start with PU Prime?

The minimum deposit for PU Prime varies by account type. The Cent account has the lowest entry point at $20, while the Standard account requires a $50 deposit. More advanced accounts have higher minimums.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Limited investor compensation scheme |

| Tight spreads | Regulation not as strong as Tier-1 authorities |

| Supports MT4, MT5, and social trading platforms | Swap fees apply |

| Wide range of CFDs | Educational resources are not as extensive as top brokers |

| Negative balance protection for client safety | Limited availability in some jurisdictions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and, Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆ |

Our Insights

PU Prime is an approved Forex and CFD broker offering competitive spreads, advanced platforms, and crypto trading. While it has some regulatory limitations, it remains a legit choice for traders seeking reliability, flexibility, and innovative trading options.

9. FP Markets

FP Markets is a globally regulated forex and CFD broker, offering tight spreads from 0.0 pips on major pairs. Founded in 2005, the broker provides MetaTrader 4, MetaTrader 5, and cTrader platforms, with competitive commissions, fast execution, and a wide range of trading instruments, including forex, commodities, indices, shares, and cryptocurrencies.

Frequently Asked Questions

What is the minimum deposit for FP Markets?

The minimum deposit to open a live trading account with FP Markets is $100 USD or its equivalent in another currency. This applies to both their Standard and Raw account types on the MetaTrader platforms.

Is FP Markets a registered broker?

Yes, FP Markets is a highly registered broker. It is regulated by multiple top-tier financial authorities globally, including the ASIC (Australia), CySEC (Cyprus), and FSCA (South Africa), ensuring a secure trading environment.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight spreads | Limited bonus or promotional offers |

| Regulated and registered | Higher commission structure on raw spread accounts |

| Supports MT4, MT5, and cTrader platforms | Restricted availability in some countries |

| Wide range of trading instruments | Cryptocurrency CFDs not available to all regions |

| Excellent customer support and educational resources | Beginners may find advanced tools overwhelming |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a registered and regulated broker offering competitive spreads, advanced platforms, and diverse trading instruments. While ideal for professional traders, beginners may face challenges with advanced tools, but its transparency ensures reliable trading conditions.

10. FBS

FBS is a global forex and CFD broker regulated by IFSC and CySEC, offering competitive trading conditions. Spreads start from 0.0 pips on ECN accounts, with leverage up to 1:3000 and access to forex, commodities, indices, metals, and cryptocurrency CFDs.

Frequently Asked Questions

Is FBS a legal broker?

Yes, FBS is a legal and globally regulated broker. It holds licenses from multiple authorities, including ASIC (Australia) and CySEC (Cyprus). These reputable licenses ensure it adheres to strict financial and operational standards.

What is the minimum deposit to start with FBS?

The minimum deposit for FBS is $5, though this can vary depending on the account type and payment method you choose. However, they recommend a minimum deposit of $100 for a smoother trading experience.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Very low minimum deposit requirement | Limited investor protection outside the EU |

| High leverage available | High leverage may increase risk for beginners |

| Multiple account types | Commissions apply on some accounts |

| Access to MT4, MT5, and mobile FBS Trader app | Global regulation is not as strong as top tier brokers |

| Offers both swap-free (Islamic) accounts and negative balance protection | Range of CFDs is smaller compared to some competitors |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FBS is a legal broker offering flexible trading options with low entry requirements and high leverage. While it provides popular platforms like MT4/MT5 and solid features, traders outside the EU should note limited investor protection.

Criteria for Choosing a Forex Broker

| Criteria | Description | Importance |

| Regulation & Licensing | Ensure the broker is licensed by top-tier regulators (e.g., FCA, ASIC, CySEC). | ⭐⭐⭐⭐⭐ |

| Trading Costs | Includes spreads, commissions, and hidden fees. Lower costs = higher profits. | ⭐⭐⭐⭐⭐ |

| Deposit & Withdrawal Options | Look for fast, secure, and low-fee methods that suit your needs. | ⭐⭐⭐⭐☆ |

| Leverage Options | Flexible leverage can enhance trading opportunities, but should be used wisely. | ⭐⭐⭐⭐☆ |

| Trading Platforms | A stable, user-friendly platform like MetaTrader 4/5 is essential for success. | ⭐⭐⭐⭐☆ |

| Asset Variety | A wider range of forex pairs, CFDs, and crypto gives more trading flexibility. | ⭐⭐⭐☆☆ |

| Customer Support | Accessible, fast, and multilingual support builds trust and reduces downtime. | ⭐⭐⭐⭐☆ |

| Educational Resources | Useful for beginners; look for webinars, guides, and market analysis. | ⭐⭐⭐☆☆ |

| Account Types | Different accounts for various trader levels (e.g., demo, standard, ECN, etc.). | ⭐⭐⭐☆☆ |

| Reputation & Reviews | Check trader feedback and watchdog warnings to avoid scams. | ⭐⭐⭐⭐⭐ |

Top 10 Best Forex Brokers (Globally) – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From what a forex pip is, to how to calculate them, we provide straightforward answers to help you understand forex pips and choose the right broker confidently.

Q: What exactly is a pip in forex trading? – John T.

A: A pip, or “percentage in point,” is the smallest unit of price movement in a currency pair. For most pairs, it’s the fourth decimal place (0.0001), but for Japanese Yen pairs, it is the second (0.01).

Q: How do I calculate the value of a pip in my trades? – Emily R.

A: To calculate a pip’s value, divide one pip (0.0001 for most pairs, or 0.01 for JPY pairs) by the current exchange rate and multiply that by your lot size (number of units being traded).

Q: Why are pips important for risk management? – Alex M.

A: Pips are essential for risk management because they allow traders to precisely quantify potential losses and gains. They are used to set exact stop-loss and take-profit levels, helping to enforce discipline and maintain a balanced risk-to-reward ratio.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Standardized Measurement | Value Varies by Lot Size |

| Clarity in Profit/Loss | Confusing for Beginners |

| Risk Management Tool | Not Always Equal Across Pairs |

| Strategy Development | Doesn’t Show True Costs |

| Cross-Broker Consistency | Overemphasis Risk |

You Might also Like:

In Conclusion

A pip is the smallest standardized unit of movement in forex trading, helping traders measure price changes, profits, and losses. It provides clarity, consistency, and precision in analyzing currency fluctuations across different trading strategies and pairs.