yearn.finance Price (YFI/USD) |

YFI/USD Signals

About yearn.finance

The Ethereum based yearn.finance is made up of a group of protocols that use blockchain to offer decentralized finance options. Yearn.finance offers a few different products that are designed to help people earn profit on their cryptocurrency, and its proprietary coin is the yearn.finance token (YFI).

The yearn.finance platform gives its users the ability to easily identify which interest rates are the highest and best for investing in. It also shows different rates among various lending protocols through a tool known as APY. The Zap tool from yearn.finance combines multiple trades in a single transaction, decreasing the amount of labor and fees involved. The other yearn.finance product is the Vault tool, which offers DeFi investment strategies.

So, the yearn.finance platform is an excellent way for investors to earn some money using the tools available, and all of this helps to lend some value to the YFI token. Users can take advantage of those tools to earn cryptocurrency, and they are given YFI tokens based on how much digital currency they have stored in the yearn.finance platform.

yearn.fiance works with other DeFi platforms, including Curve, UNI and Balancer to allow a wide variety of trading and lending among its users, giving them numerous ways to use their cryptocurrency and earn off of it.

YFI Breakdown

yearn.finance is ranked at #87 among cryptocurrencies,and it has a locked-in total value of $5,889,576,836. Its market cap is $1,284,688,256.95, and it has a market dominance of about 0.05%.

The interoperability of yearn.finance among different platforms helps to set it apart from other decentralized finance options. The YFI token is mainly used for trading and lending, though it can operate like a typical cryptocurrency coin and be traded between other cryptos.

Yield farming is a common crypto practice that involves securing digital assets into a decentralized finance protocol like yearn.finance and then earning additional crypto coins. That’s the concept behind this protocol as well, and earned assets increase at a rate based on how many assets are secured on the protocol.

The strength of the YFI token lies in its earning potential and the governing protocol’s ability to offer powerful lending tools. These tools are expanding and becoming more robust to incorporate data from other protocols as a way to make the YFI token more universal. The yearn.finance protocol takes repetitive processes, like checking on the earning potentials of various protocols and comparing them, and it automates them for faster, more efficient transactions.

YFI History

In 2020, an independent developer and coder named Andre Conje used his 20 years of development experience to create yearn.finance. Unlike most cryptocurrency launches, there was no funding provided for YFI. Cronje had to provide the resources on his own, and he did not reserve any personal tokens during that initial development and launch period.

The Rebrand

yearn.finance used to be known as iEarn, and it was rebranded in 2020 with a new set of tools available. Before introducing the YFI token, the protocol boasted about $8 million in assets. After the token’s launch, that skyrocketed to $400 million, all of which happened the first week the token went live. YFI tokens were given out to all those who invested in YFI Balancer and Curve yPool.

Vaults Introduced

In October of 2020, yearn.finance released Vaults to great acclaim. This new tool allowed for yield farming through advanced strategies. As liquidity is pushed into the Vaults, returns are maximized. Strategies were initially only offered by Conje, but now they can be suggested by anyone. The initial vault launch achieved more than $600 million in a matter of days. In response to the massive interest in Vaults, DAI increased its debt ceiling.

YFI Price Factors

As with any cryptocurrency, the yearn.finance price is affected by multiple factors. Identifying these and paying close attention to them will help you to invest at the right time or cash out before the price starts to plummet.

Strength of the Crypto Industry

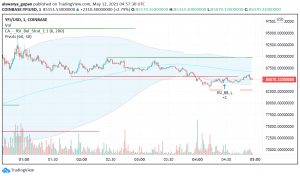

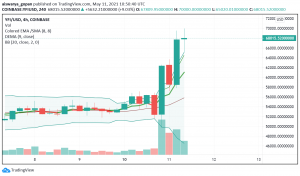

Watch the YFI price rise when the entire industry is doing well. We saw this in May when the YFI rate spiked from $54,024.71 to $82,745.19. This had nothing to do with yearn.finance and how the protocol was doing or how the YFI coin was being used. It was simply a matter of the economy doing well and people having extra money to spend (thanks partially to government stimulus checks) and then people investing that money into the cryptocurrency market in droves.

As Bitcoin, Ethereum, Dogecoin and other cryptos experienced bullish behavior, that rippled down to lower tier cryptos like yearn.finance. Then, when tons of investors sold off their digital assets shortly after, yearn.finance was hit by the ensuing market crash, as were all the rest of the cryptos.

Token Utility

The usefulness of the YFI token helps to determine the yearn.finance rate as well. We saw this with the introduction of Vaults, which helped to spur the price for a while, essentially giving the YFI rate a permanent boost. As the yearn.fiance protocol becomes more useful and adds more tools, and as the YFI coin becomes more widely used, the price will increase in response.

Trading YFI

When trading the YFI token, it is vital for investors to use analytical financial tools to help them make smart buying and selling decisions. The analysis tools available on FX Leaders, including live updates, YFI price predictions, and market insight, all help potential investors put their money in the right places.

Potential investors can purchase yearn.finance tokens on the official website and can be awarded tokens for investing in the yearn.finance protocol. They can also buy and sell this digital asset on a variety of crypto exchanges, including BInance, OKEx, CoinTiger, Mandala Exchange, and FTX, among others.

Trading cryptocurrency like yearn.finance can come with some serious risks. Investments can be lost quickly as the YFI price drops without warning. All cryptocurrencies are inherently unstable and volatile, with prices spiking and dropping sometimes erratically and drastically. Potential investors should be watching for indicators that the market is about to shift in order to buy or sell at the right time and maximize their profit and avoid loss.

yearn.finance may not be available in as many exchanges as some of the major cryptocurrencies, but it is still widely available and can be bought or traded in most countries around the world. Trades will always have a transaction fee of some kind, though that varies from one exchange to the next.

YFI/USD - FAQs

This decentralized protocol offers a digital coin called YFI, which is used to earn cryptocurrency, lend to others and trade between other cryptos. The protocol that the YFI token comes out of has proven to be very useful for investors looking to make money off their cryptocurrency, and it has become more useful over time, particularly as it automates processes that would be time consuming and repetitive without it.

The YFI coin can be traded on BInance, CoinTIger, OKEx, and other cryptocurrency exchanges. It also features interoperability between other protocols like UNI, DAI, Curve, Balancer, and more.

You can store YFI tokens on the yearn.finance site or on any exchange you bought them from. The price does not stay locked in just because the digital asset is being stored on is not in use, even if it is stored remotely offline. The price fluctuates based on market activity and other factors. Storage is typically in a digital wallet locked by a password and can even be done offline in a flash drive for extra security.

YFI tokens can be utilized to purchase other cryptocurrencies on crypto exchanges. They can be used to buy fiat currency as well on some platforms. YFI can also be used as an investment on yearn.finance, buying stakes in digital assets.

You can purchase the yearn.finace coin in most countries without any legal problem, but some countries limit or ban cryptocurrency trading outright. Cryptocurrency trading is not allowed at all in Algeria, Bolivia, Indonesia and others. Trading cryptocurrency like the YFI coin is restricted in Egypt, Russia, Iran and others.

Cryptocurrency has not been banned within the UK nor is there much regulation for using or trading cryptos there. However, all crypto exchanges must be registered. yearn.finance is not considered legal tender within the UK at this time.

As a cryptocurrency, the YFI coin is highly volatile. The price could vary greatly from day to day and even hour to hour, especially since this cryptocurrency is not backed by any fiat currency. The YFI price can change without any warning, so there is the risk that investors will lose many of their coins quickly without much opportunity to trade the crypto or cash it out before that happens.