How Many Reasons Do We Need To Start Building EUR/USD Shorts?

•

Last updated: Friday, August 4, 2017

I have been mentioning quite often recently that the Dollar has been falling too deep for no major reason. It´s true that Trump is a liability for the Buck, but since when have politics been straightforward anywhere in the world?

- As I have also mentioned, the US economy is in the best place amongst the major economies. The FED is the only major central bank actually on a tightening path. So, fundamentally there´s no reason to sell the USD – that´s one reason to consider selling EUR/USD.

- Bond yield differentials don’t justify this move. The bond yield gap between the US and Europe tend to close by the currency exchange rate, which means EUR/USD should fall.

- The ECB and, specifically, President Draghi won´t be this calm once we thit 1.20 in EUR/USD. That´s the line in the sand for this pair and for the ECB.

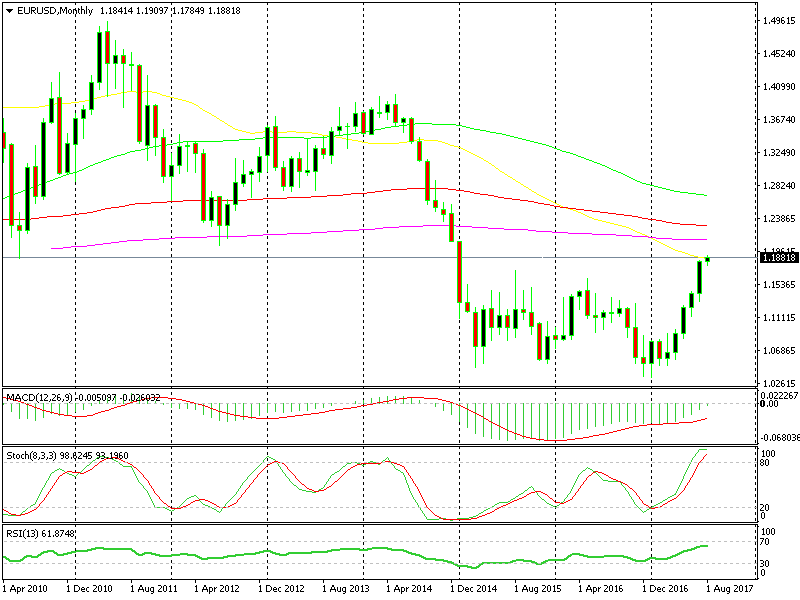

- EUR/USD is severely overbought and a number of moving averages on the monthly chart are crowded just above here, with the 50 simple MA (yellow) and the 200 smooth MA (purple) being the closest and most important as well. The 50 SMA is providing resistance at 1.1870, if we don’t close above it, then the buyers might get cold feet and call it a day, which would be the start of a decent pullback.

The 200 SMA has been providing support for years until it finally let go in 2014, so if the 50 SMA gets broken, then the 200 SMA should provide some solid resistance.

The monthly chart shows that the bullish run might have come to an end

The monthly chart shows that the bullish run might have come to an end

The stars are aligning for a long term sell position in this forex pair, but there are still some important events coming in the coming sessions, such as the US average hourly earnings. We will post another update about it later today so make sure to stay posted!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Sidebar rates

HFM

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals