USD Weakness Keeping EUR/USD Afloat, But the Dive Will Come Soon, As Inflation Remains Weak

EUR/USD is holding up due to the soft USD, despite the economic weakness in Europe

•

Last updated: Wednesday, October 14, 2020

[[EUR/USD]] increased around 13 cents since the middle of March, climbing above 1.20 for a moment on September 1. EUR/USD has been making lower highs since then and we saw a dip to 1.16. But the buying pressure has also been strong, keeping this pair afloat above 1.17.

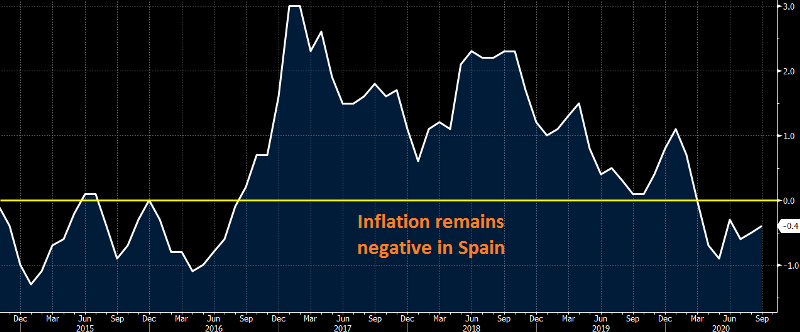

Although, that’s due to the USD weakness and the uncertainty surrounding the US elections. So, once the situation clears across the Atlantic, EUR/USD will head down, because there’s nothing to keep the Euro bullish. The economy has weakened again and inflation remains subdued, as the Spanish CPI report showed earlier today:

- CPI +0.2% vs +0.2% m/m prelim

- HICP -0.6% vs -0.6% y/y prelim

- HICP +0.4% vs 0.0% m/m prelim

No change to the annual estimates relative to the initial release, so there isn’t much to really digest here. This just reaffirms the narrative of softer inflation across the euro area last month.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

Related Articles

Sidebar rates

HFM

HFM rest

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals