USD/CAD Retreating From the 200 SMA, After the Decline in Canadian Unemployment Rate

USD/CAD has been bullish for more than a month, but the 200 SMA is still holding as resistance

The USD/CAD was on a strong bearish trend from March last year until the end of May this year. The price declined more than 25 cents, as the USD/CAD fell to 1.20. But, that seems to have been the target for sellers, because after reaching that big round level, the USD/CAD reversed higher and has been bullish since.

The 20 SMA has turned into support for USD/CAD

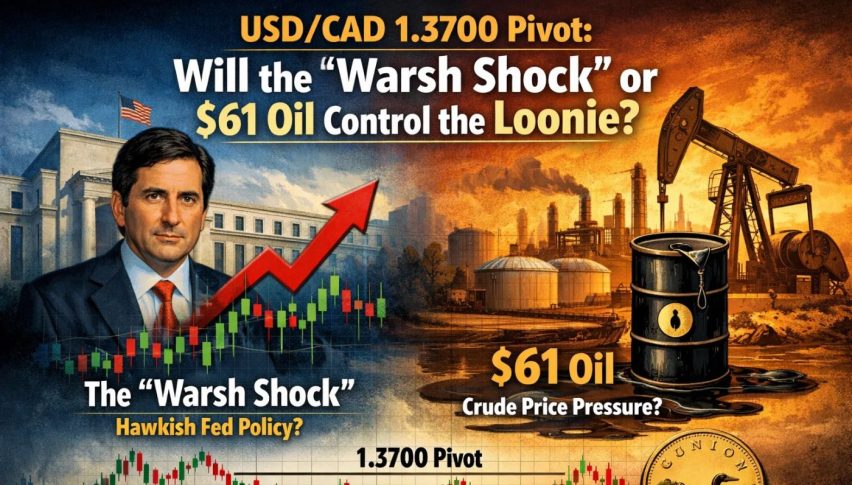

Moving averages were broken on the daily chart, and the 20 SMA (gray) turned into support. But, the 200 SMA (purple) seems to be holding as support now, especially after the decent decline in the Canadian employment rate today. Crude oil is also bullish today, which is helping the CAD. Although, CAD gains have been much smaller compared to the gains in crude oil, so I expect the bullish trend in the USD/CAD to resume soon.

USD/CAD Live Chart

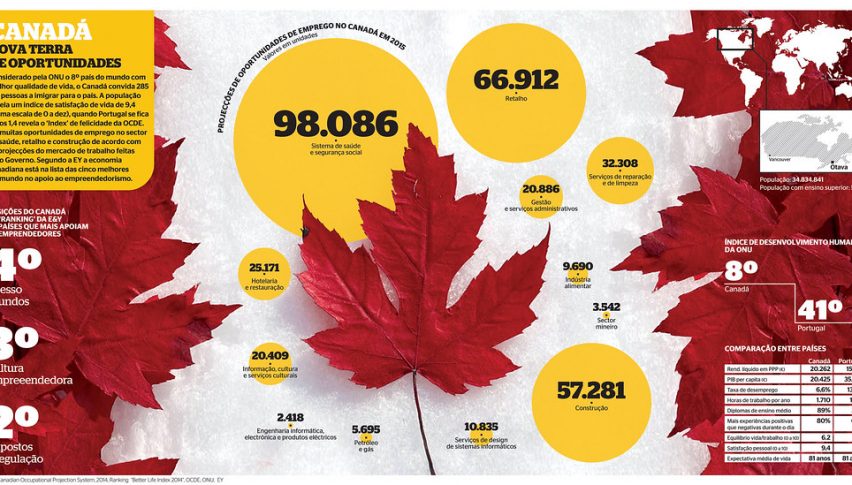

Highlights of Canada’s June 2021 employment report

- June employment 230.7K vs +195K expected

- May employment was -68K

- Full time -33.2K versus -13.8K last month

- Part-time 263.9K versus -54.2K last month

- Unemployment rate 7.8% versus 8.2% last month

- Participation rate 65.2% versus 64.6% prior

- Hourly wage rate for permanent employees -1.44% y/y prior

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM