Where Does the GBP Stand After the UK Employment Numbers?

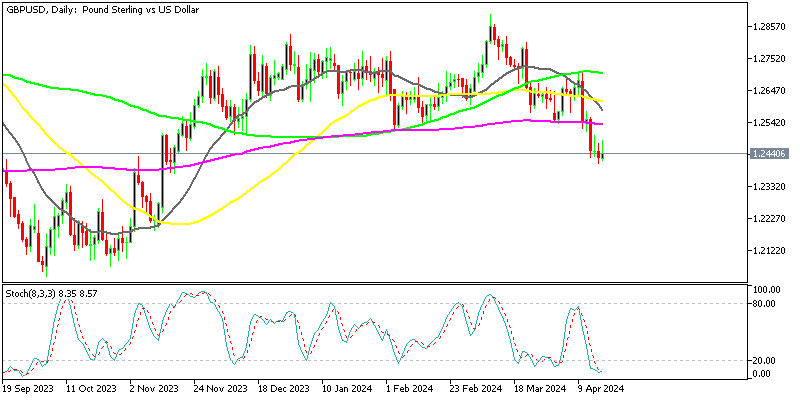

GBP/USD fell through an air pocket during summer and in September, as UK gilt yields surged higher, but reversed after the intervention by the Bank of England. Since then this pair has gained more than 20 cents, pushing above the resistance zone around $1.2450 and above 1.25 as well, reaching a high of 1.2550s.

But on Friday we saw a strong bearish reversal, after some USD strength following a decent round of data from the US. GBP/USD formed a triple top last week which caused it to drop and this pair closed below the resistance level, so it doesn’t count as broken.

This decline in GBP/USD was due to speculation that the FED would raise interest rates in May. The Empire State manufacturing index showed a sudden surge after being negative in the previous month, which helped improve the sentiment for the USD further. As a result, GBP/USD slipped to 1.2355 after reaching a high of 1.2438 yesterday.

This morning, the employment report fromm the UK showed a slowdown in average earnings.

UK March Employment Report

- March payrolls change 31k vs 98k prior

- Prior payrolls were 98k; revised to 39k

- February ILO unemployment rate 3.8% vs 3.7% expected

- Prior unemployment rate was 3.7%

- February employment change 169k vs 50k expected

- Prior employment change was 65k

- February average weekly earnings +5.9% vs +5.1% 3m/y expected

- Prior weekly earnings were +5.7%; revised to +5.9%

- February average weekly earnings (ex bonus) +6.6% vs +6.2% 3m/y expected

- Prior weekly earnings (ex bonus) were +6.5%; revised to +6.6%

The slight tick higher in the jobless rate sees it move to its highest since June last year but still keeping very much lower from a historical perspective. Payrolls are still continuing to print positively, although the pace is slowing down. However, the standout in this report is arguably the wage numbers, which continue to run hot.

Even if it might not translate to positive real wages, the figures above will certainly keep the BOE on their toes (perhaps needing to do more) when it comes to inflation and overall price pressures.