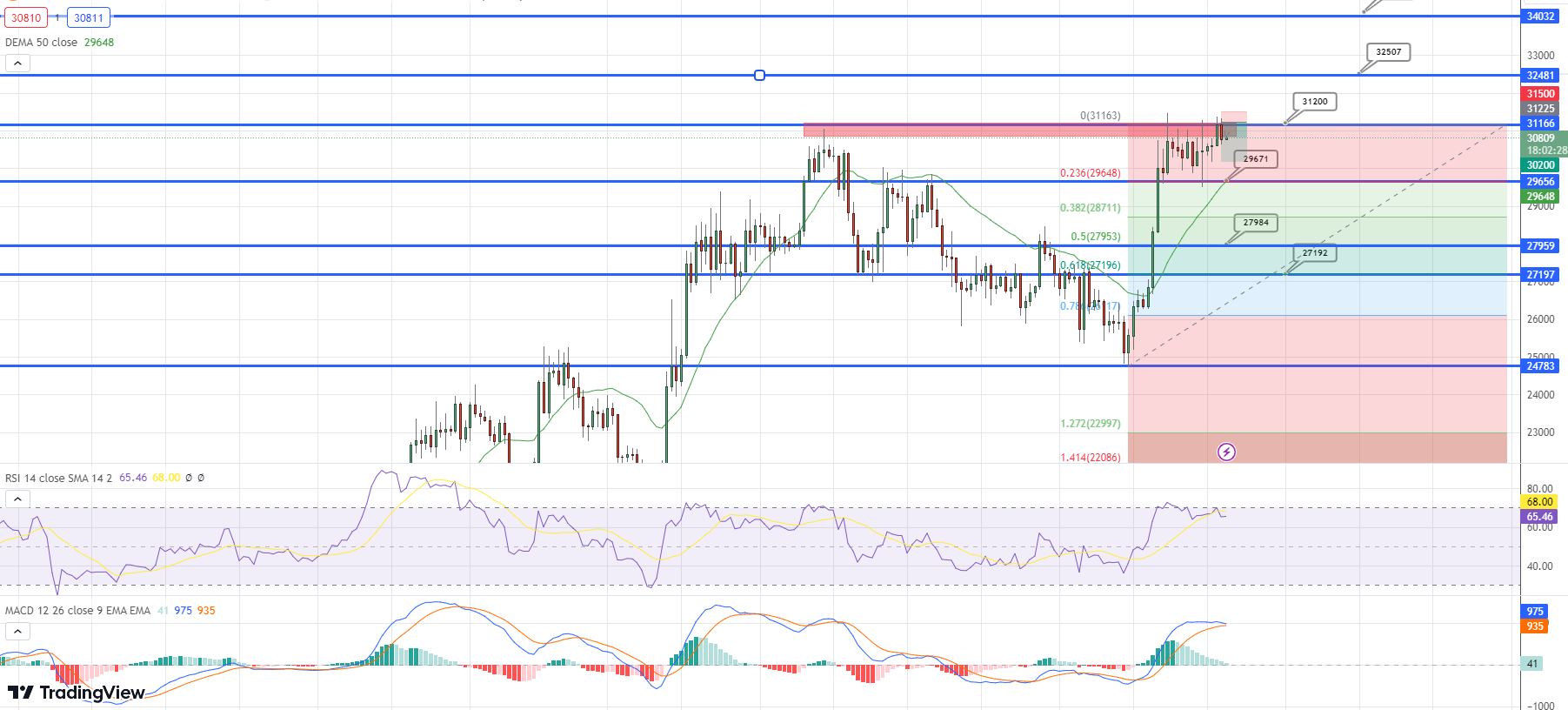

Bitcoin Price Analysis: BTC Tests Key Support and Faces Resistance at $31,050

Bitcoin experienced a correction in its price, leading to a retest of the $30,650 support level.

•

Last updated: Wednesday, July 5, 2023

BITCOIN experienced a correction in its price, leading to a retest of the $30,650 support level. The cryptocurrency’s future trajectory hinges on its ability to hold above the crucial $30,000 support zone.

Struggle to Surpass Resistance at $31,400

BITCOIN faced difficulties in surpassing the significant resistance zone at $31,400. As a result, it initiated a downside correction, breaching the $31,000 and $30,800 levels.

Bulls Defend Support Levels

During the correction, BITCOIN found support near the $30,650 level and the 100-hourly Simple Moving Average. The 61.8% Fibonacci retracement level of the upward move from the $30,192 swing low to the $31,372 high also witnessed bullish activity.

Bullish Trend Line and Immediate Resistance

Potential for Further Upside

A breakthrough above the $31,400 resistance level could trigger another strong upward move. The subsequent major resistance lies near $32,000, with additional gains potentially opening doors to the $32,500 resistance zone.

Possibility of Continued Downside

Possibility of Continued Downside

In the event that BITCOIN fails to surpass the $31,050 resistance, a continuation of the downward movement is plausible. Immediate support on the downside can be found near $30,650, along with the trend line and the 100-hourly Simple Moving Average.

Further support is expected around the $30,470 level, and a breach below it may lead to a drop toward $30,200. If selling pressure persists, the price might decline toward the critical $30,000 zone, potentially setting the stage for a larger downward move.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Sidebar rates

HFM

HFM rest

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals