Is Bitcoin Preparing For A Mega Run? These 2 Signals Point To Massive Pent-Up Demand

Bitcoin is stable when writing but in a bullish formation. A break above $68,000 is likely on the cards, boosted by falling GDP

Bitcoin fell early yesterday before refreshingly bouncing to spot rates. Even though the bear range of April 24 wasn’t reversed, the injection of capital on April 25 is a huge sentiment boost for buyers. As it is, the path of least resistance remains southwards in the short term but is bullish from a top-down preview. For buyers to turn this around, there should be a follow-through of yesterday’s gains, propelling the coin above $68,000. This upsurge should ideally be with rising volume.

For now, Bitcoin is stable in the past day and week of trading. At the same time, the average trading volume in the last 24 hours is at $33 billion, up nearly 20%. Engagement will likely expand should prices conquer $68,000, setting the coin for $72,000 and all-time highs if bulls push higher.

In the coming days, the following Bitcoin news events will impact price action:

- Going by recent events, it appears that whales are loading up on every dip. Yesterday, Lookonchain data showed that one whale bought 620 BTC, or nearly $40 million of the coin, pushing total holdings to 4,380 BTC. Parallel data reveals that whales are amassing BTC as prices range.

- Recent economic data shows that Bitcoin could benefit from the falling GDP in the United States amid raging inflation. Yesterday, Q1 2024 GDP data revealed that growth slowed year-to-date to 1.6%, down from 3.4% in Q1 2023.

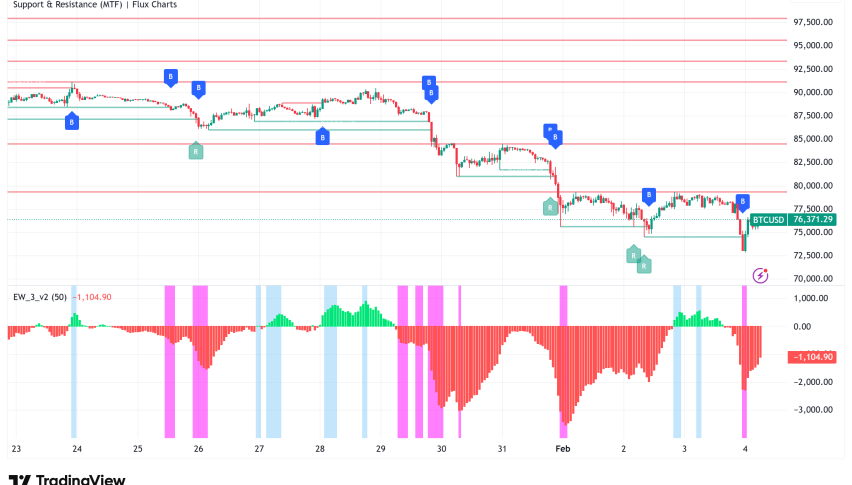

Bitcoin Price Analysis

BTC/USD is trading higher at spot rates.

From the daily chart, the April 25 bar closed with a long lower wick pointing to demand.

If whales continue accumulating, Bitcoin might break above $68,000.

Any upswing above this level, at the back of rising volume, might offer entries for optimistic traders. The first target would be all-time highs at $73,800.

Any dump below April lows invalidates this outlook.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM