GBP/USD Declines on Dollar Strength and Weaker Inflation Forecast

Cable continued its decline today as the forex market’s perception of higher for longer US rates takes a foot hold.

Cable continued its decline today as the forex market’s perception of higher for longer US rates takes a foot hold.

After yesterday’s small rally for sterling, the market continued in the bear that started last Thursday. Over the past weeks the cable market has been dealing with the divergence in sentiment between monetary policy in the US and the UK.

But last week’s comments by Fed officials outlined that the central bank would need to see data showing a more significant decline in inflation to take action. These statements fueled a rally for the dollar against most currencies.

The British pound was also a victim, as we may be getting closer to a rate cut in the UK before we see one in the US. Lower interest rates in the UK would help the dollar rally against the pound as the interest rate differential favors the greenback.

All eyes are on inflation data from the UK tomorrow, where forecasts are for a significant decline. YoY Inflation is expected to drop to 2% from 2.3%, while Core Inflation is forecast to decline to 3.5% from 3.9% last month.

Technical View

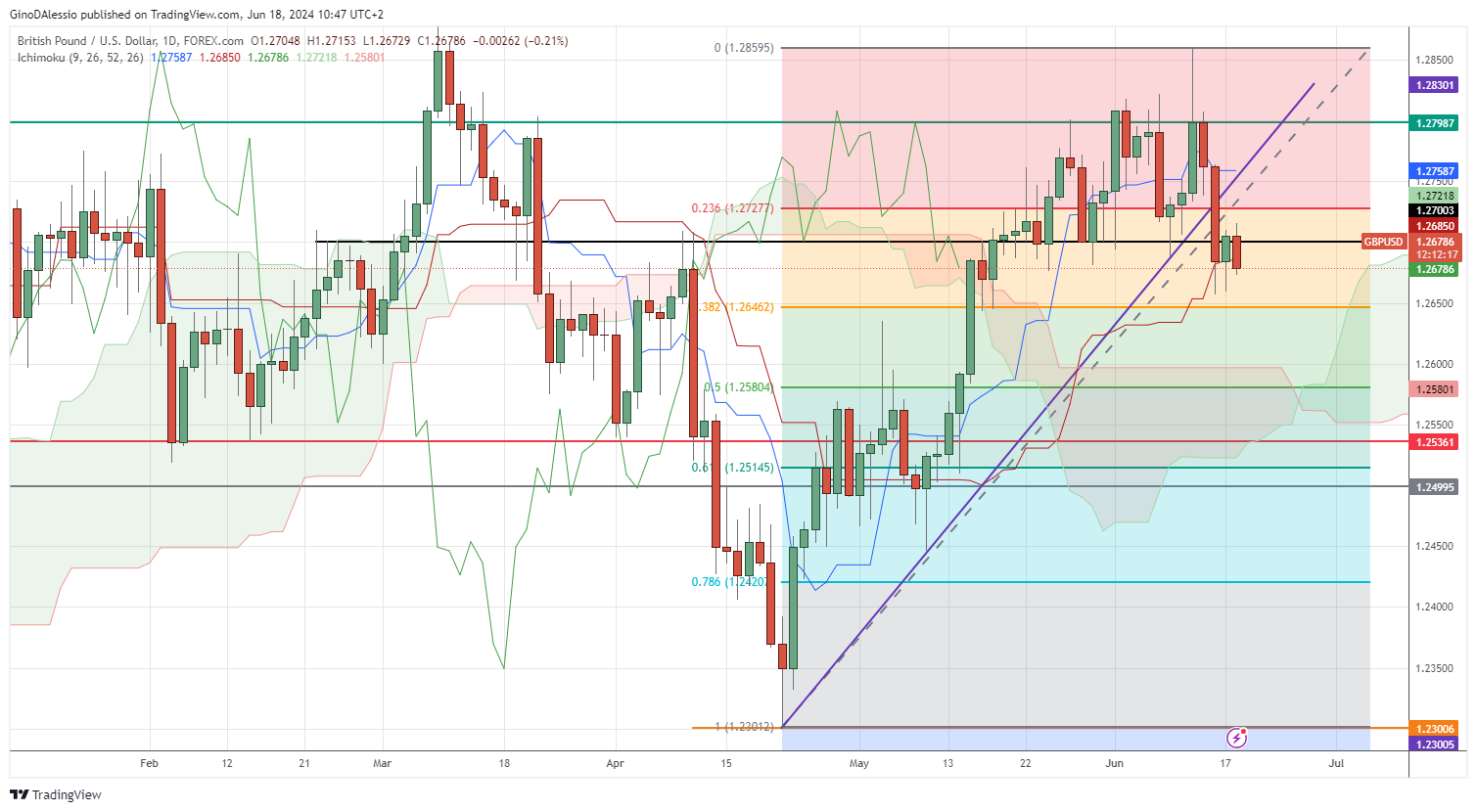

The day chart below for GBP/USD shows a market that is still technically in a bull trend. However, the recent retracement from the recent high on June 12 at 1.2860 is showing signs of more downward price action.

The break below the rising trend line (purple) indicates lower prices are likely to precede. Today’s candle looks set to close below the support of 1.2700 (black line), which is a big figure number, and has been touched on several occasions.

The next support would be the 0.382 Fibonacci retracement level of 1.2646 (orange line). The market will find further support on the 50% retracement level at 1.2580, which also coincides with the Ichimoku cloud.

To the upside, the initial resistance would be at 1.2700, if that breaks we have resistance at the 0.236 Fibo level of 1.2727, and then the 1.2800 big figure which coincides with a previous high in December 2023.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM