Gold Price Reverses Down After Failing at MAs, As US Services Jump

Gold gained more than $20 today after the $100 late last week, but buyers couldn't break above MAs and the price is reversing lower now.

Gold gained more than $20 today after the $100 late last week, but buyers couldn’t break above MAs and the price is reversing lower now, being helped by the positive US services PMI reading, which showed a jump in December.

As traders awaited the U.S. Federal Reserve’s interest rate decision, with widespread anticipation of a 25 basis point cut, gold prices saw a notable rebound late last week after failing to breach the November resistance level near $2,725. Today, XAU showed modest gains during the Asian and European sessions.

While a quarter-point rate cut is widely expected at Wednesday’s meeting, uncertainty remains about whether the Fed will signal a “hawkish cut.” Such a move could imply rates staying unchanged until January to assess inflation trends and economic strength, which would likely strengthen the US dollar and pressure gold prices downward.

Gold Chart H4 – The 100 SMA Rejected the Price

From a technical perspective, the H4 chart reveals that XAU/USD has returned to trading within the range defined by two moving averages. Gold prices reversed lower after failing to break above the 100-day SMA, currently around $2,665, following strong US Services PMI data indicating continued growth in this sector. XAU dipped to $2,648.50, which now acts as immediate support. If this level is breached, further declines could target supports at $2,625 and $2,590, potentially accelerating the downward momentum.

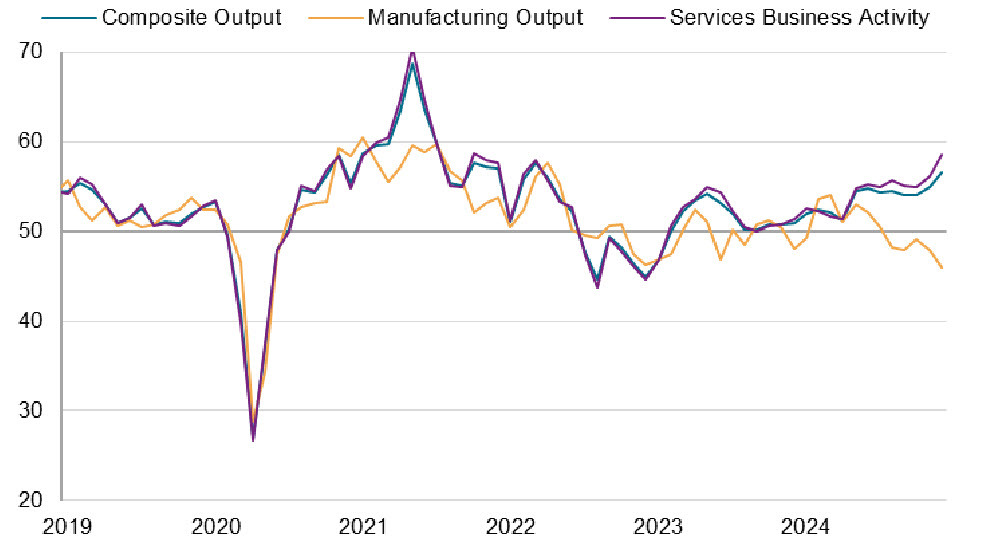

US Services and Manufacturing PMI Data for December![PMIs]()

- US S&P December Services PMI:

- Recorded at 58.5 points, above expectations of 55.7 (38-month high).

- November figure was 56.1 points.

- US Composite PMI for December:

- Rose to 56.6 points, surpassing November’s 54.9 (33-month high).

- US Manufacturing PMI:

- Declined to 48.3 points, down from 49.7 in November (3-month low).

- Inflation Insights:

- Overall Price Pressures: Continued to ease.

- Manufacturing Input Costs: Increased sharply to 2-year highs.

- Service Sector Inflation: Dropped to a 4.5-year low.

- Supplier Delivery Times: Started lengthening again.

Gold Chart Live

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM