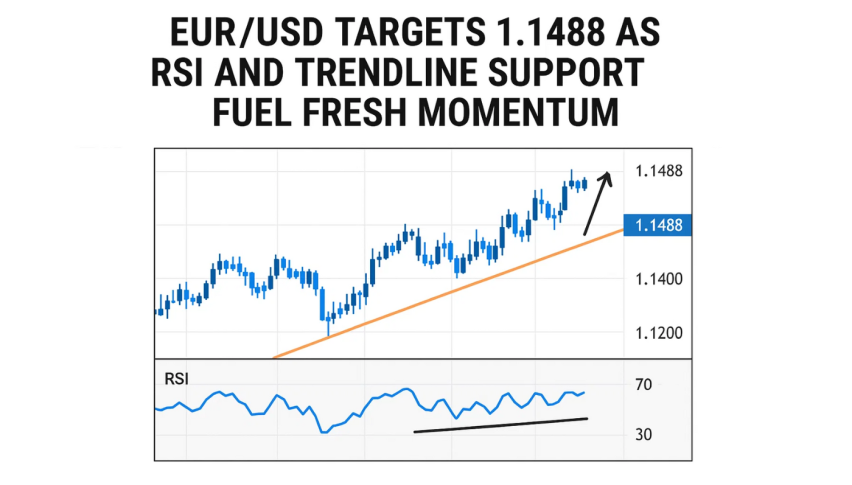

EUR/USD Targets 1.1488 as RSI and Trendline Support Fuel Fresh Momentum

The EUR/USD pair is quietly regaining strength after a clean bounce from its rising trendline support around the 1.1400 region.

Quick overview

- The EUR/USD pair is showing bullish momentum after bouncing off the 1.1400 trendline support.

- Current trading at 1.1426 indicates potential resistance at 1.1454, with a target of 1.1488 if broken.

- The RSI on the 1-hour chart supports this bullish outlook, sitting at 57 without overbought signals.

- Traders are advised to buy near 1.1420–1.1430, with a stop-loss below 1.1390 and take-profit levels at 1.1454 and 1.1488.

The EUR/USD pair is quietly regaining strength after a clean bounce from its rising trendline support around the 1.1400 region. On the 1-hour chart, price action shows a clear series of higher lows, suggesting bullish intent remains intact despite recent intraday volatility.

What’s notable is how the pair found buyers near the ascending support and reclaimed ground above 1.1425, pointing to a potential run toward the next resistance zones. The structure reflects growing market confidence in the euro as U.S. macro pressures ease, particularly ahead of the week’s policy data.

At the time of writing, EUR/USD is trading at 1.1426, just shy of the next key resistance at 1.1454. If that level breaks with volume, bulls will likely target 1.1488, a high not seen since earlier last week.

Key Levels and Bullish Signals on Chart

Technically, the pair is painting a bullish continuation pattern. Price remains comfortably above its trendline and is approaching horizontal resistance.

Here’s the short-term setup:

- Support zone: 1.1400 (trendline confluence)

- Resistance zones: 1.1454 and 1.1488

- Next breakout target: 1.1520 if momentum sustains

- Risk to the upside: Only if price drops below 1.1400

RSI on the 1-hour chart sits at 57, showing healthy bullish momentum without signaling overbought conditions. The RSI’s recent bullish crossover above the 50-line reinforces this view.

Trade Idea for Novice Traders

For those new to trading EUR/USD, here’s a straightforward plan based on trend and support confirmation:

- Entry: Consider buying near 1.1420–1.1430 on a pullback

- Stop-Loss: Below 1.1390, under trendline support

- Take-Profit: Scale out at 1.1454 and 1.1488

- Confirmation: Look for a strong bullish candle or continued RSI climb

As long as EUR/USD holds above its ascending trendline, the market bias leans bullish. But keep in mind: a break below 1.1400 would flip the structure and put 1.1365 and 1.1324 back in play for the bears.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM