Chainlink Surges 7% as Hong Kong CBDC Pilot Validates Real-World Utility

Chainlink (LINK) is experiencing a strong rally, trading above $14 and gaining around 7% in the last 24 hours. The rise follows a successful

Quick overview

- Chainlink (LINK) is rallying, trading above $14 with a 7% gain in the last 24 hours following a successful trial of its Cross-Chain Interoperability Protocol (CCIP).

- The Hong Kong Monetary Authority's pilot program demonstrated the effectiveness of Chainlink's infrastructure by enabling instant cross-border transactions between an Australian dollar stablecoin and Hong Kong's CBDC.

- Technical analysis indicates strong momentum for LINK, with indicators suggesting potential further price increases and a bullish sentiment among traders reflected in the long-to-short ratio.

- If the bullish trend continues, LINK could reach resistance levels of $16.19 and $18.81, while maintaining a critical support level at $12.59.

Chainlink LINK/USD is experiencing a strong rally, trading above $14 and gaining around 7% in the last 24 hours. The rise follows a successful trial program in which Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enabled a record cross-border transaction between an Australian dollar stablecoin and Hong Kong’s central bank digital currency (CBDC).

Hong Kong CBDC Pilot Demonstrates Chainlink’s Infrastructure Value

The Hong Kong Monetary Authority’s (HKMA) e-HKD+ Pilot Programme has reached a major milestone. Chainlink’s CCIP has successfully enabled the first real-world simulation of programmable money for cross-border investment in tokenized assets. The trial, which was done with Visa, ANZ, ChinaAMC, and Fidelity International, linked ANZ’s private blockchain DASChain to Ethereum’s public testnet.

In the test, an Australian investor used a AUD-backed stablecoin (A$DC) to buy a tokenized money market fund with Hong Kong’s digital currency (e-HKD). It usually takes two to three days for a transaction to settle, but it happened almost instantly, showing that blockchain might get rid of middlemen and lower the risks of cross-border transactions.

With CCIP now live on dozens of blockchains, including Ethereum and Solana Virtual Machine-compatible networks, this achievement makes Chainlink a key infrastructure supplier in the changing world of digital banking.

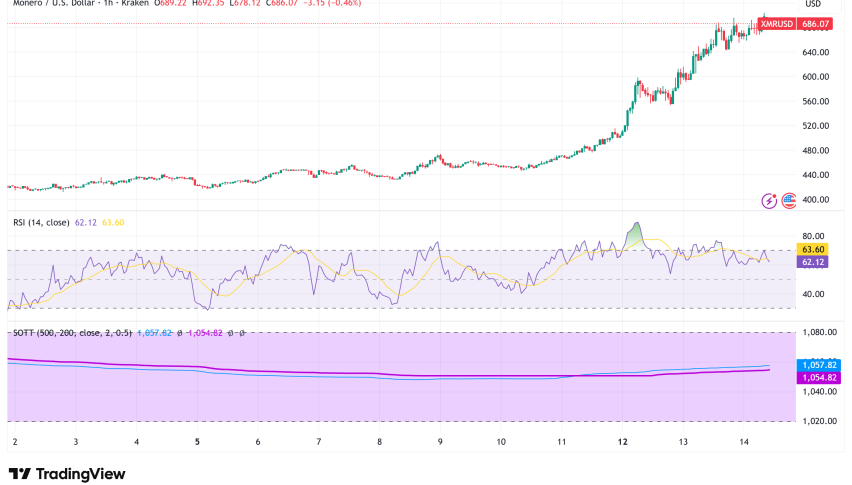

LINK/USD Technical Analysis Points to Continued Upside

From a technical point of view, LINK’s price action exhibits strong momentum signs that point to more rises. The coin has made a great comeback from its crucial support level of $12.59, rising 11.40% and staying that way through Tuesday’s trading session.

The Relative Strength Index (RSI) on the daily chart is 49 and is moving up toward the neutral 50 level. This means that negative momentum is receding. The Moving Average Convergence Divergence (MACD) indicator is very close to a bullish crossover on the daily chart, which is more crucial. This would be a strong buying signal and confirm the rising trend.

Volume analysis shows that there is a lot of purchasing demand, with more than 1 million LINK exchanged during the breakout session at 10:00 UTC. This confirms that both institutions and individuals are positive.

Derivatives Data Signals Bullish Sentiment

Coinglass data shows that LINK’s long-to-short ratio has reached 1.25, the highest level in more than a month. This supports the technical view. This ratio is above 1.0, which means that traders are quite bullish on the market. More traders are betting on prices going up than down.

The way futures are set up matches the way fundamentals are changing. Traders seem to be setting up for more upside because Chainlink’s real-world use in financial infrastructure is growing.

Chainlink Price Prediction

If the current bullish trend keeps up, LINK might reach its May 29 high of $16.19, which is about 11% higher than where it is now. If this resistance level is broken, it might lead to the weekly resistance level at $18.81, which could mean gains of about 30%.

Traders should keep an eye on the $12.59 support level, because any drop below this level could mean that bearish sentiment is coming back. The current trading range of $13.80 to $13.95 is a good place for prices to keep going up.

The present technical breakout is supported by the fact that tokenized asset markets are expected to be worth more than $2 trillion by 2030 and Chainlink is positioning itself as an important part of cross-border digital finance. The successful Hong Kong CBDC trial is simply the first step in Chainlink’s integration into existing traditional financial (TradFi) systems. This might lead to a steady demand for LINK tokens as the network’s utility grows around the world.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account