XRP Price Prediction: $2.38 Breakout in Play as Bulls Defend Key Trendline

Ripple has taken a bold step that’s caught Wall Street’s attention—it’s officially applied for a national banking license...

Quick overview

- Ripple has applied for a national banking license from the OCC, signaling its strategic intent to enhance trust in its RLUSD stablecoin.

- Grayscale's Digital Large Cap Fund has added XRP to its portfolio, marking a significant step towards broader institutional acceptance of the token.

- XRP's technical outlook shows bullish potential with key support and resistance levels, indicating a possible price increase in the near future.

- The rising open interest in XRP suggests growing momentum, making it a critical asset to watch in the current market.

Ripple has taken a bold step that’s caught Wall Street’s attention—it’s officially applied for a national banking license from the U.S. Office of the Comptroller of the Currency (OCC). As someone who’s been watching markets for over a decade, I can tell you: moves like this aren’t just headlines. They’re a sign of deep strategic intent.

If approved, Ripple would join an exclusive group, right now, Anchorage Digital is the only crypto-native firm with a national charter. The license would place Ripple under both state and federal oversight, enhancing trust in its RLUSD stablecoin, which currently has a modest market cap of $469 million. Ripple is also seeking a Federal Reserve Master Account, which would allow it to hold reserves directly with the Fed—a serious signal of long-term positioning.

It’s a playbook that mirrors Circle’s strategy, and the timing couldn’t be more relevant. With regulators watching closely, institutional players want to see infrastructure that feels familiar and secure. Ripple’s moves could ease that transition.

Grayscale ETF Adds XRP to Institutional Menu

Adding fuel to the fire, Grayscale’s Digital Large Cap Fund (GDLC) just got the green light to convert into a spot ETF—and yes, XRP is in the basket. That’s big. While BTC dominates the fund at 80%, XRP shares space with Ethereum, Solana, and Cardano, opening doors for institutions to gain regulated exposure.

Grayscale’s CEO called it a “historic step,” and I agree. This type of exposure used to be off-limits for traditional investors. Now, it’s part of a growing trend that points to broader acceptance. The fact that XRP made it in tells us something: this token isn’t fading—it’s aligning with regulated finance.

With spot ETFs now live for Bitcoin and Ethereum, the possibility of a standalone XRP ETF is no longer far-fetched. From my experience, when institutions start parking serious capital behind a token, the retail crowd usually follows.

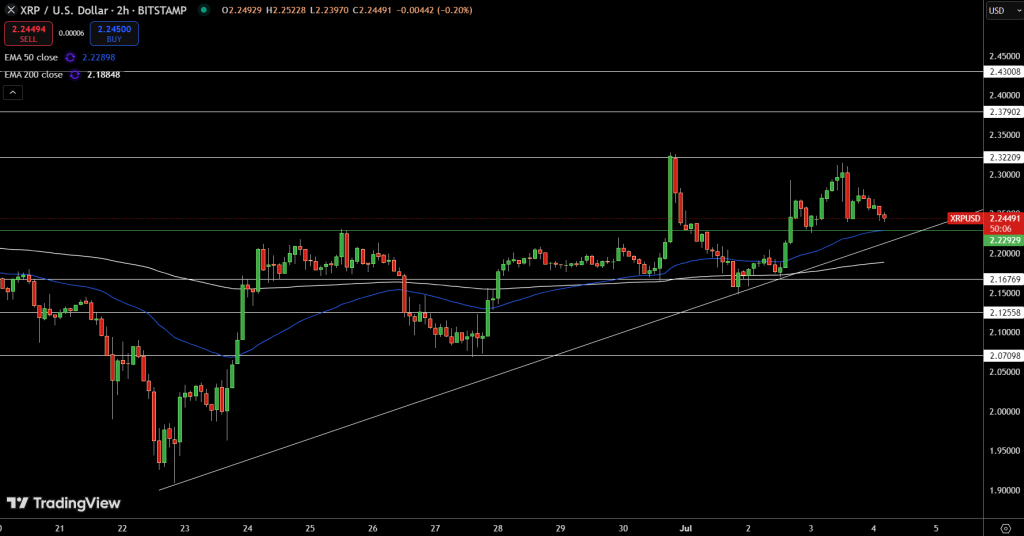

XRP Technical Outlook: Trendline Bounce in Focus

Let’s talk charts.

XRP/USD is trading around $2.24 and holding firm above a key ascending trendline that’s been in play since June 21. The price action has been forming consistent higher lows, and just this week, we saw a bullish engulfing candle followed by a spinning top, signaling indecision—but not weakness.

The 50 EMA has crossed above the 200 EMA, creating a golden cross, which historically hints at bullish continuation. RSI sits mid-range, suggesting we’re not overheated.

But here’s where it gets interesting:

- Support to watch: $2.22 (EMA + trendline)

- Immediate resistance: $2.32, then $2.38

- Breakdown zone: $2.17, with $2.12 as next support

We’re also seeing a rising wedge, a pattern that often leads to a breakout or shakeout. If XRP prints a bullish reversal (e.g., hammer or engulfing) off $2.22, the setup points to a swing trade toward $2.38. A close below $2.20 invalidates it.

In my view, this is a high-probability area worth watching. With open interest rising (up 3% to $4.6 billion), momentum is building.

If this trendline holds, I wouldn’t be surprised to see XRP test $2.38 in the coming days. But like always, wait for confirmation—and respect your stop.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account