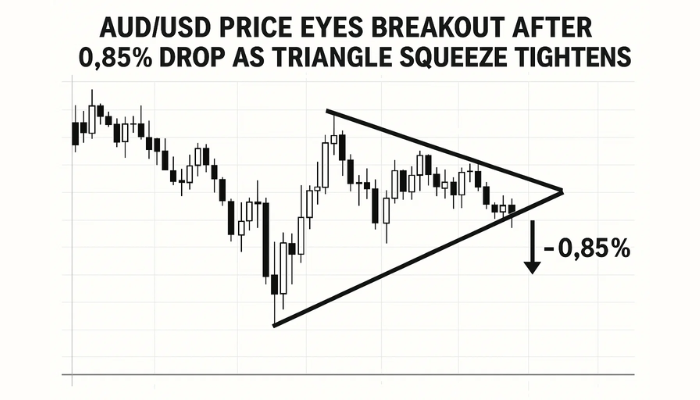

AUD/USD Price Eyes Breakout After 0.85% Drop as Triangle Squeeze Tightens

The Aussie Dollar fell 0.85% to 0.6496 during European hours on Monday. The decline was driven by investor nervousness over US tariffs...

Quick overview

- The Aussie Dollar fell 0.85% to 0.6496 amid concerns over potential US tariffs linked to comments from former President Trump.

- The RBA maintained interest rates at 3.85% but expressed a cautious outlook due to weakening demand and rising trade tensions.

- AUD/USD is currently at 0.6533, with a potential breakout setup as it approaches key resistance and support levels.

- Traders are advised to consider long positions above 0.6567 and short positions below 0.6513, with specific targets for profit.

The Aussie Dollar fell 0.85% to 0.6496 during European hours on Monday. The decline was driven by investor nervousness over US tariffs, reignited by former President Donald Trump’s “Liberation Day” comments. No country list has been confirmed but markets are speculating Australia is on the list.

Adding to the uncertainty, Treasury Secretary Bessent said the tariff decisions could be delayed until August 1. This fog of risk is weighing on global equities and commodity currencies. As a result, the US Dollar is in demand and the Aussie is under pressure as it’s tied to global trade.

RBA Holds Rates, But Dovish Tone Capped AUD

The RBA surprised no one by holding rates at 3.85% on Tuesday. But the dovish tone in the Rate Statement and Press Conference is getting more cautious. Weakening demand and rising trade tensions are the key downside risks according to the RBA. Another rate cut is on the table later this year.

Australia’s economy is slowing and inflation expectations are easing so the RBA has no choice but to wait and see how the external shocks (US tariffs) play out. Markets had partially priced in the rate pause but the dovish rhetoric has done nothing to support the Aussie in the short term.

AUD/USD Setup: Breakout Looms

AUD/USD is trading at 0.6533, coiled at the apex of a symmetrical triangle on the 2-hour chart. Price has respected the structure with clear resistance at 0.6567 and ascending support at 0.6513.

- 50-SMA (0.6546) is flat, neutral.

- RSI at 51.87 is neutral but stabilizing.

- Candlesticks are small bodies with wicks, hesitation at key levels.

If the pair breaks 0.6567, bulls may target 0.6591 and 0.6611 (late June highs). If it breaks 0.6513, AUD/USD may go to 0.6486 or 0.6457 if sentiment worsens.

Trade

- Long: Above 0.6567 with volume

- Short: Below 0.6513 on high volume

- Stop: 0.6530, inside the triangle

- Targets: 30-50 pips

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account